7 April 2022 Morning Session Analysis

FOMC meeting minutes signalled hawkish tone, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies extend its gains over the backdrop of hawkish expectation from Federal Reserve following the minutes of the previous Federal Reserve meeting reinforced the probability of multiple half percentage-point rate hike to combat the inflation rate. According to FOMC meeting minutes, the Fed officials viewed the 50-basis point of rate hike as appropriate during the next monetary policy meeting if the inflation pressures continue to intensify. Besides, the Monetary Policy Committee (MPC) also agreed to reduce the debt in balance sheet by $95 million per month with $60 billion of its Treasury holdings and $35 billion of mortgage-backed securities over the next three months. The contractionary monetary policy from Fed would likely to diminish the money circulation in the financial market, spurring bullish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.15% to 99.65.

In the commodities market, the crude oil price slumped 0.15% to $97.25 per barrel as of writing following the bearish inventory was released. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at 2.421M, exceeding the market forecast at -2.056M. On the other hand, the gold price depreciated by 0.11% to $1923.20 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 202K | 200K | – |

Technical Analysis

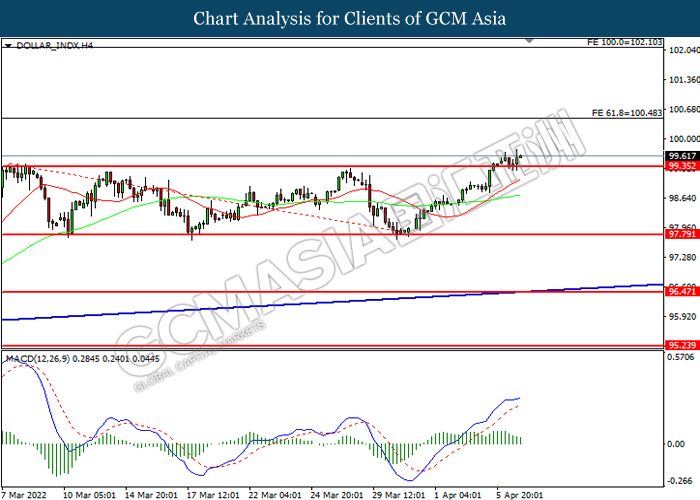

DOLLAR_INDX, H4: Dollar index was traded higher after its breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

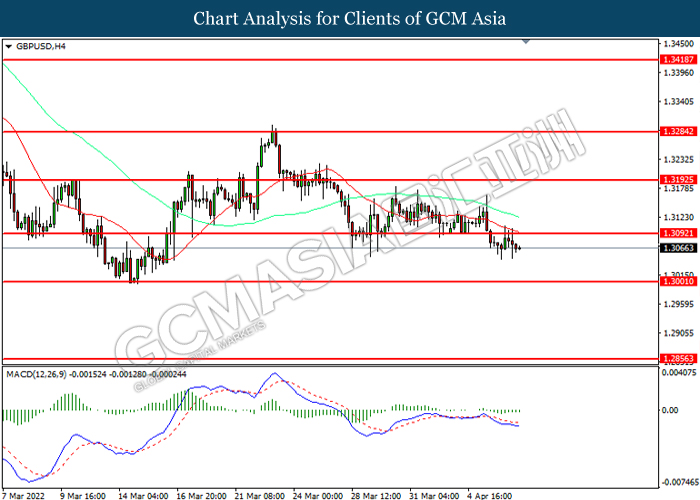

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

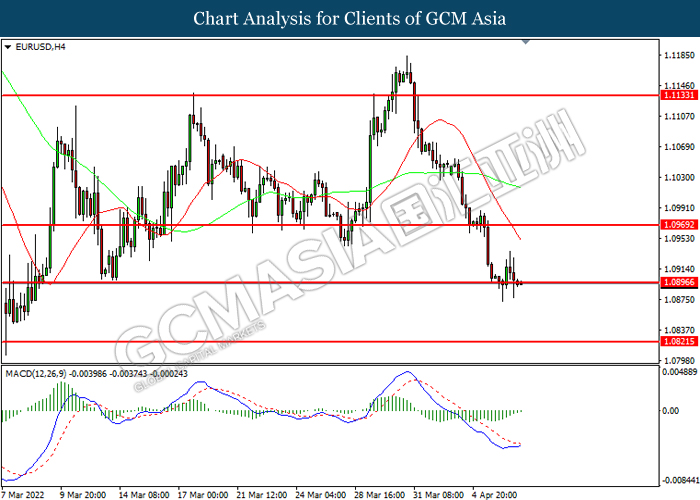

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0970, 1.1135

Support level: 1.0895, 1.0825

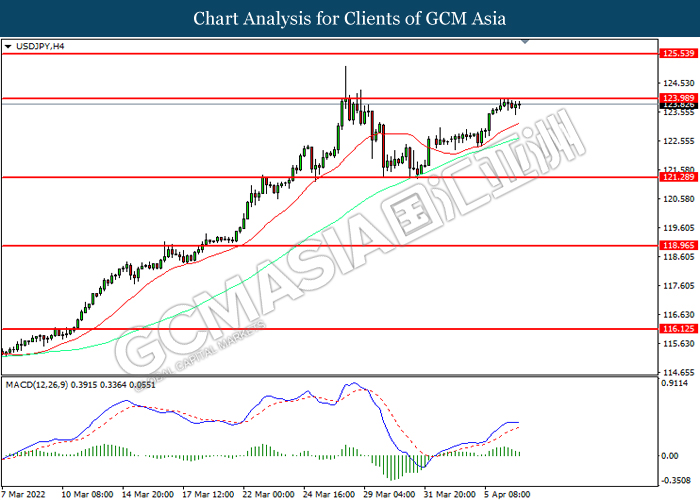

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACFD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.00, 125.55

Support level: 121.30, 118.95

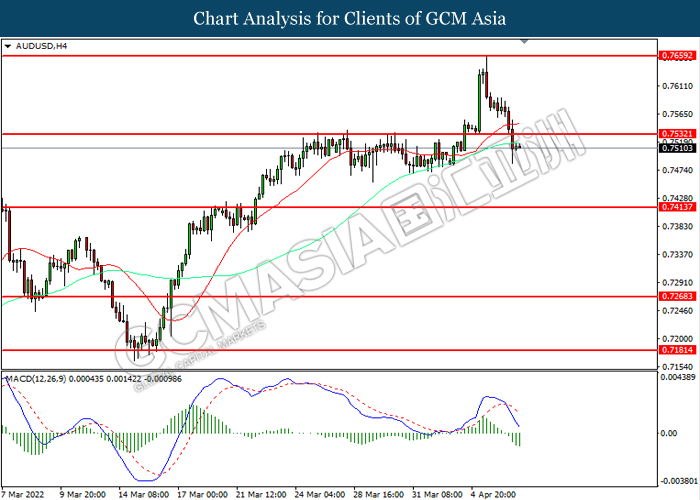

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

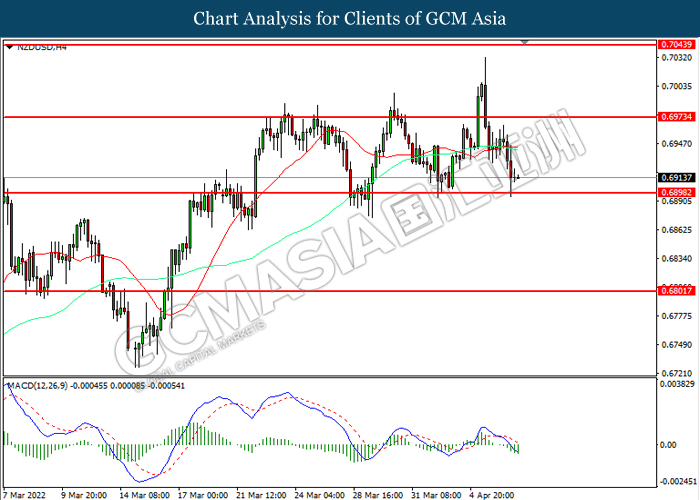

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6900. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6975, 0.7045

Support level: 0.6900, 0.6800

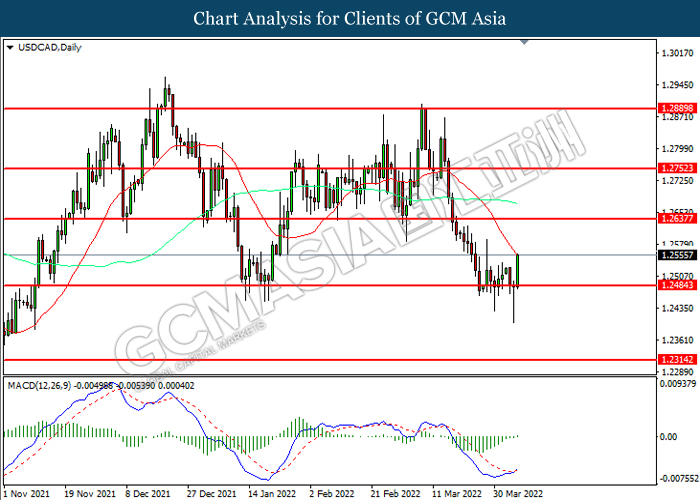

USDCAD, Daily: USDCAD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

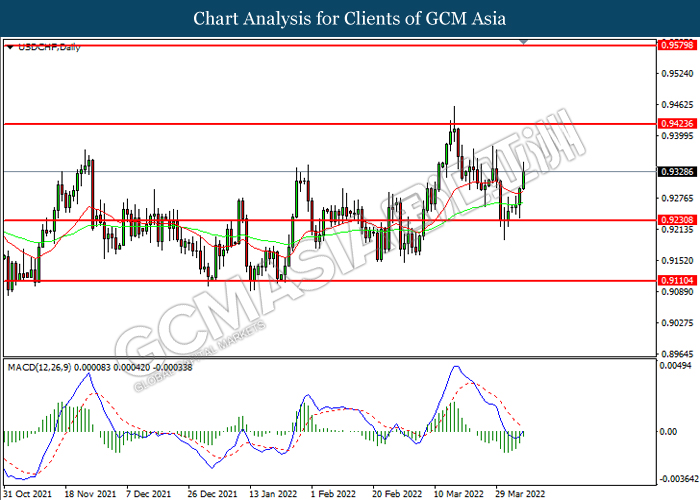

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

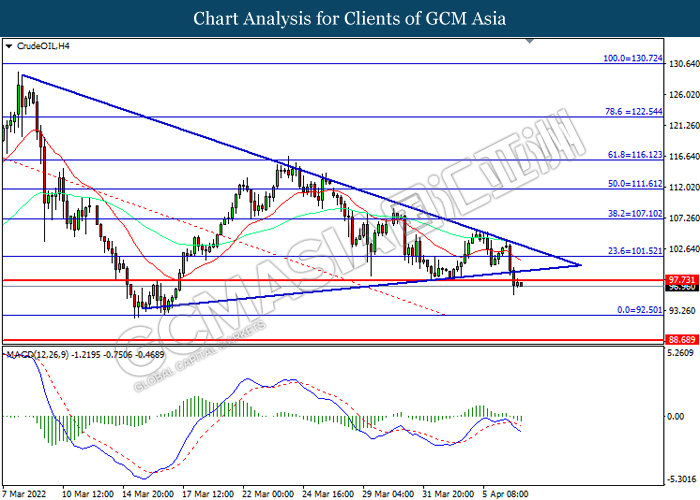

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

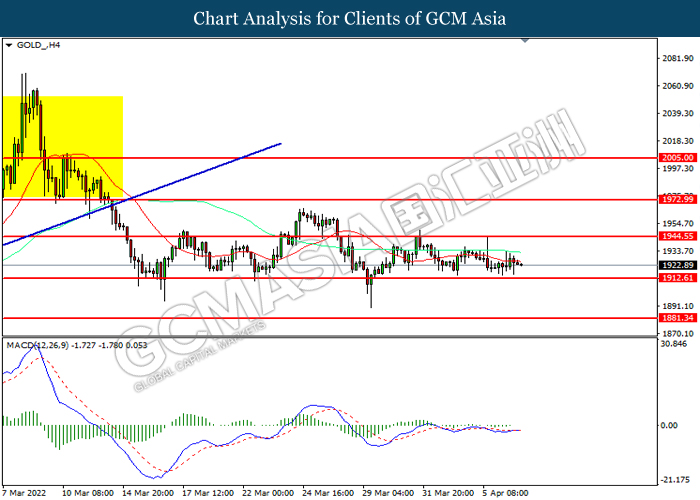

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35