8 April 2022 Morning Session Analysis

US 10-year yield hit its highest level in three years, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies received significant bullish momentum following the US 10-year Treasury yield hit its highest level since March 2019 on Thursday as investors continued to speculated that latest hawkish tone from the Federal Reserve. The US 10-year treasury yield hitting 2.667%. According to the latest statistic, the CME FedWatch Tool was assigning a probability of 78.8% to a 50-basis point rate hike during the May FOMC meeting. In earlier, the meeting minutes released from the Fed’s March meeting suggested the Federal Reserve should reduce their liabilities in balance sheet next month while increasing the interest rate in order to combat the high inflation risk in future. As of writing, the Dollar Index appreciated by 0.15% to 99.75.

In the commodities market, the crude oil price depreciated by 0.45% to $96.70 per barrel as of writing. The oil market edged lower amid investors remained their doubts upon whether the European leaders will be able to effectively sanction Russian energy exports. On the other hand, the gold price surged 0.04% to $1932.45 per troy ounces as of writing as market participants concerned that the implementation of sanction on Russia would likely to trigger future inflation risk, prompting investors to shift their portfolio toward safe-haven gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (Mar) | 336.6K | 80.0K | – |

Technical Analysis

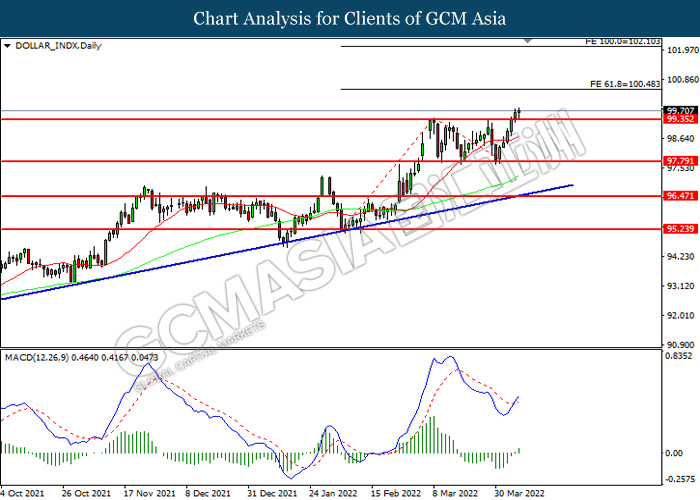

DOLLAR_INDX, Daily: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

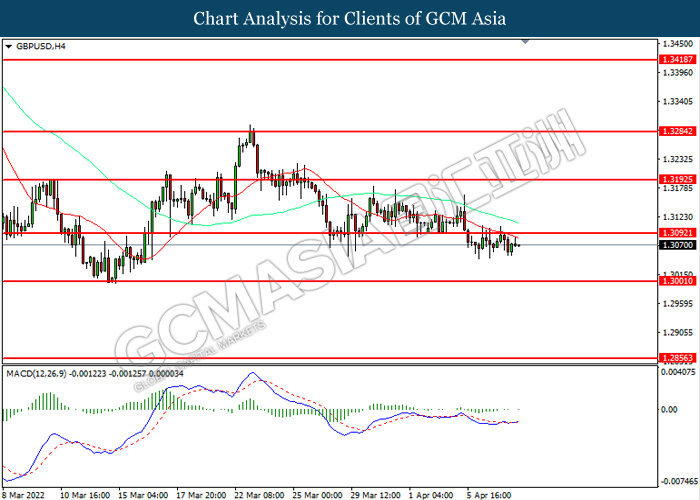

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

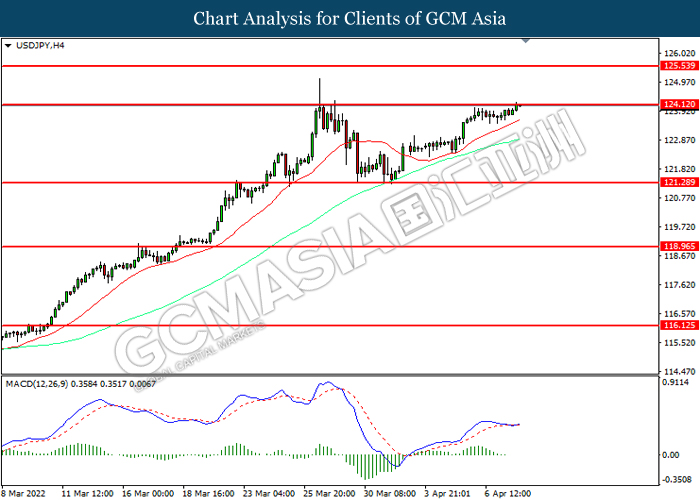

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACFD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 124.10, 125.55

Support level: 121.30, 118.95

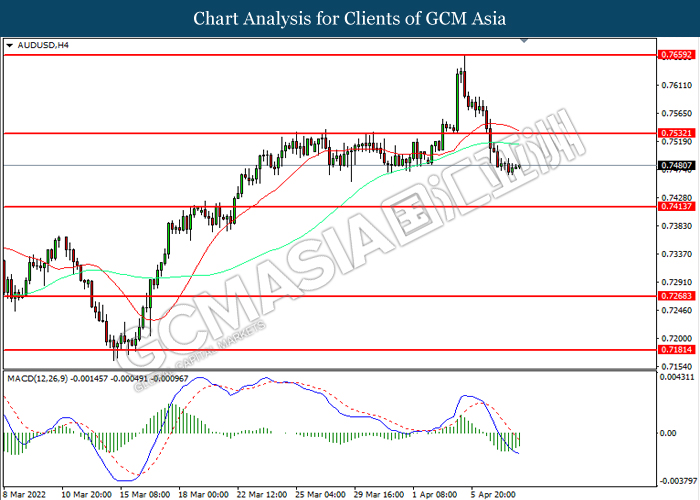

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level at 0.6880. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6975, 0.7045

Support level: 0.6880, 0.6800

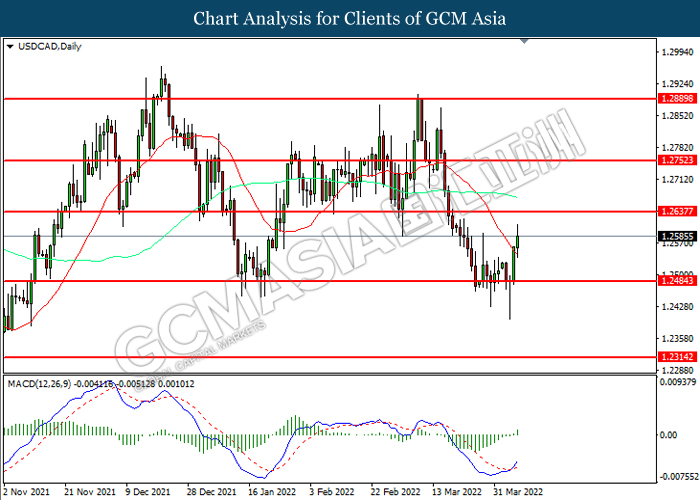

USDCAD, Daily: USDCAD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

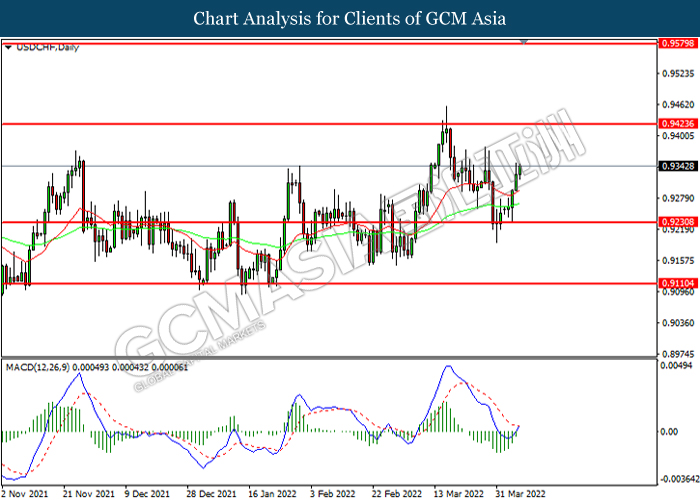

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

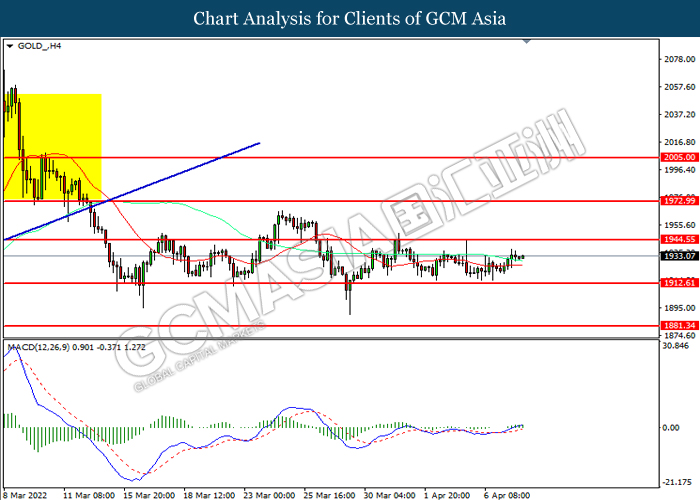

GOLD_, H4: Gold price was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35