11 April 2022 Afternoon Session Analysis

Australia Dollar slumped as bearish economic prospect in China.

The Chinese proxy currency such as Australia Dollar slumped significantly over the backdrop of bearish economic data from China. The China’s factory inflation slowed but exceed expectations in March as country still suffered with cost pressures following the rising tensions between Russia-Ukraine continue to affect the global supply chain issues. According to National Bureau of Statistics, China Producer Price Index (PPI) for last quarter notched down significantly from the previous reading of 8.8% to 8.3%, exceeding the market forecast at 7.9%. Besides, the overall economic prospect on China remained negative following the rising Covid-19 cases in the country. According to latest statistics, China reported almost more than 24,000 Covid-19 cases over the previous 24 hours. The implementation of lockdown policies would likely to trigger stagflation risk in future, dialling down the market optimism toward the Chinese’s major export countries such as Australia. As of writing, AUD/USD depreciated by 0.20% to 0.7440.

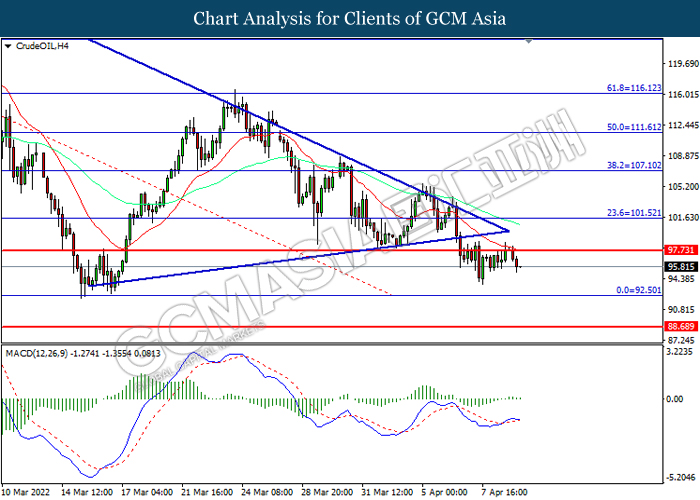

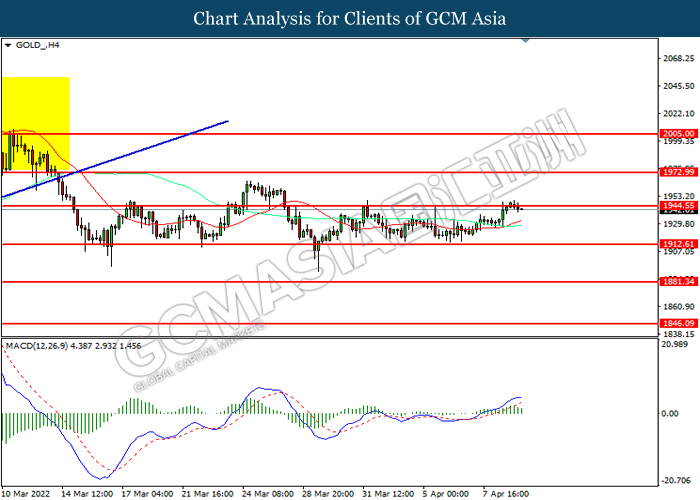

In the commodities market, the crude oil price slumped 2.13% to $96.55 per barrel as of writing. The oil price extends its losses amid the rising tensions between Russia-Ukraine as European countries would likely to discuss the implementation of oil sanction toward Russia. Investors would continue to scrutinize the latest updates with regards of the Russia-Ukraine tensions to receive further trading signal. On the other hand, the gold price appreciated by 0.04% to $1944.55 per troy ounces as of writing amid risk-off sentiment in the global financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (MoM) | 0.80% | – | – |

| 14:00 | GBP – GDP (YoY) | 6.60% | – | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Feb) | 0.80% | 0.30% | – |

| 14:00 | GBP – Monthly GDP 3M/3M Change | 1.10% | – | – |

Technical Analysis

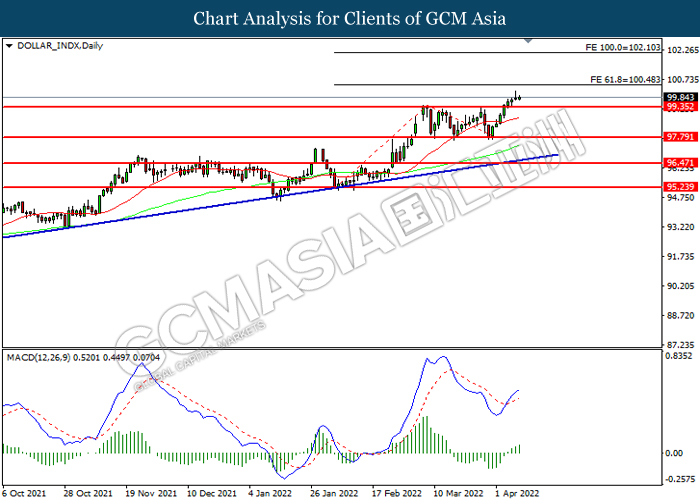

DOLLAR_INDX, Daily: Dollar index was traded higher after its breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

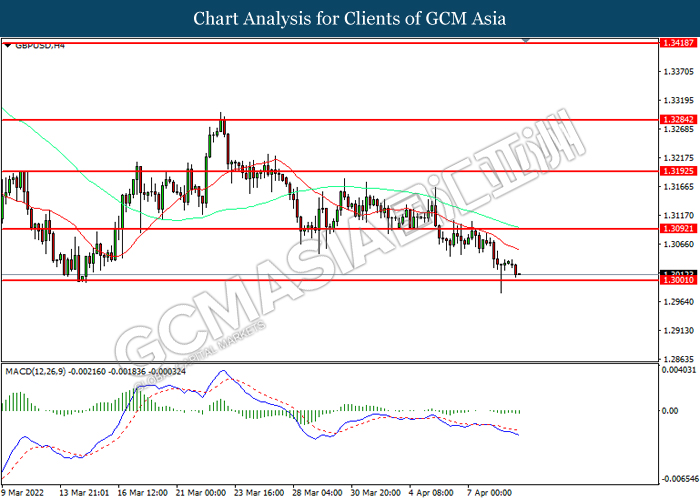

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3000, 1.2855

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0895, 1.0970

Support level: 1.0805, 1.0690

USDJPY, H1: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 125.05, 126.15

Support level: 124.35, 123.25

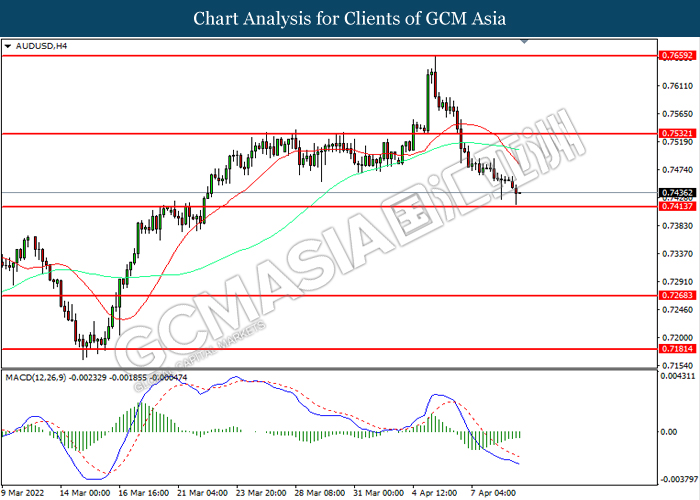

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

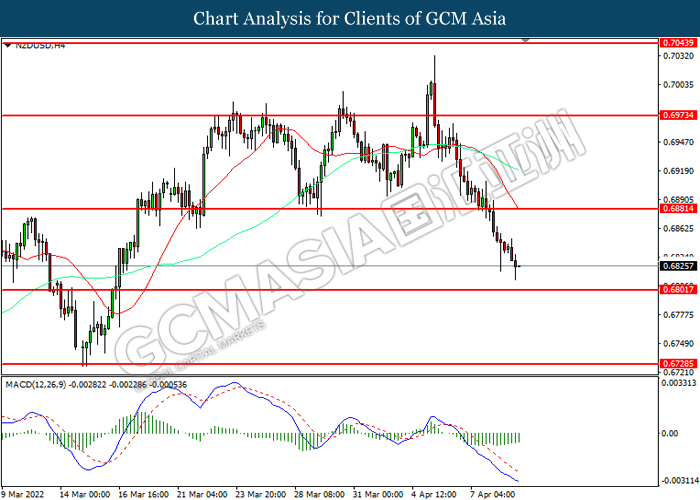

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

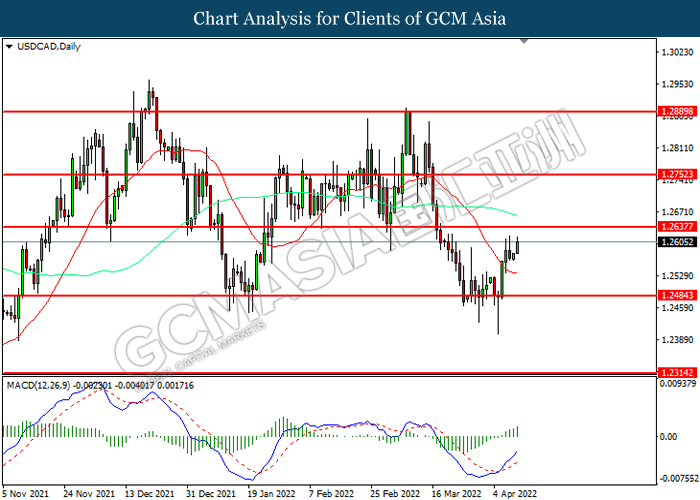

USDCAD, Daily: USDCAD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

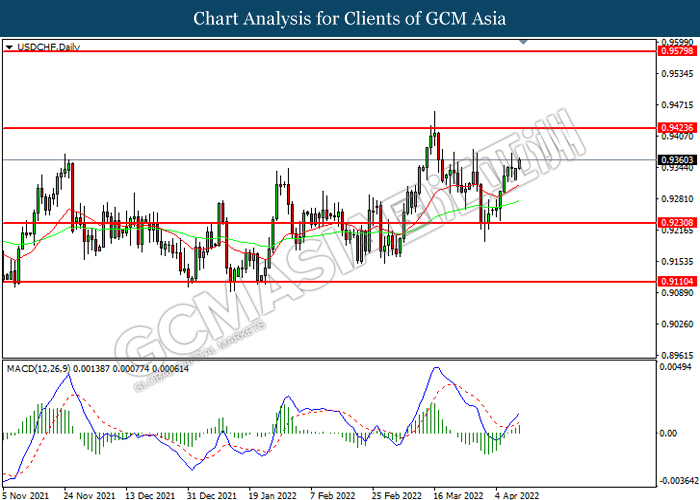

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses.

Resistance level: 97.75, 101.50

Support level: 92.50, 88.70

GOLD_, H4: Gold price was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1944.55, 1973.00

Support level: 1912.60, 1881.35