13 April 2022 Afternoon Session Analysis

Euro slumped amid Russia invasion of Ukraine.

Euro extend its losses since yesterday over the backdrop of rising tension between Russia-Ukraine. According to Reuters, President Vladimir Putin appeared a speech on Tuesday, which claimed that the peace talks with Ukraine had hit a dead end, using his first public comments on the conflict in more than a week to vow his troops would win and to goad the West for failing to bring Moscow to heel. Russia invasion of Ukraine would lead to the disruption of global supply chain, including commodities market, causing the commodities price such as crude oil to spike. The surge of crude oil price would bring negative prospects toward economic progression in Europe region by increasing the import cost of companies, dialing down the market optimism toward economic prospects in Europe. It prompted investors to shift their capitals toward other currencies such as US Dollar. Besides, the chairmen of three parliamentarian committees said on Tuesday after a visit to Ukraine, claimed that the European Union should impose an embargo on Russian oil as soon as possible, according to Reuters. The implementation of embargo on Russian oil would likely to diminish oil circulation in the market, spurring further bearish momentum on Euro. As of writing, EURUSD appreciated by 0.12% to 1.0839.

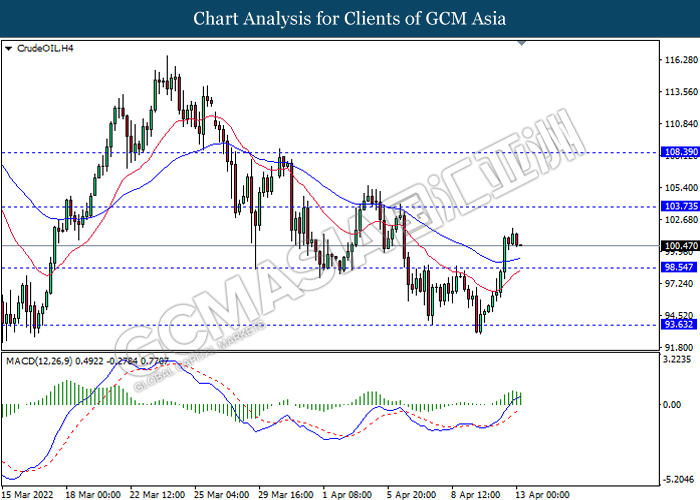

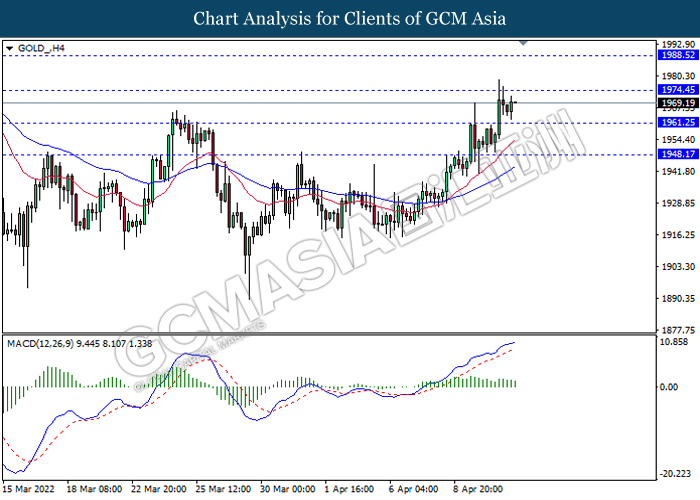

In commodities market, crude oil price surged by 0.23% to $100.83 per barrel as of writing following the war-driven oil supply disruption. On the other hand, gold price depreciated by 0.26% to $1971.00 per troy ounces as of writing. Nonetheless, the overall trend of gold price remained bullish amid the backdrop of rising tension between Russia-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

22:00 CAD BoC Monetary Policy Report

23:00 CAD BOC Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Mar) | 6.20% | 6.70% | – |

| 20:30 | USD – PPI (MoM) (Mar) | 0.80% | 1.10% | – |

| 22:00 | CAD – BoC Monetary Policy Report | – | – | – |

| 22:00 | CAD – BoC Interest Rate Decision | 0.50% | 1.00% | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 2.421M | – |

Technical Analysis

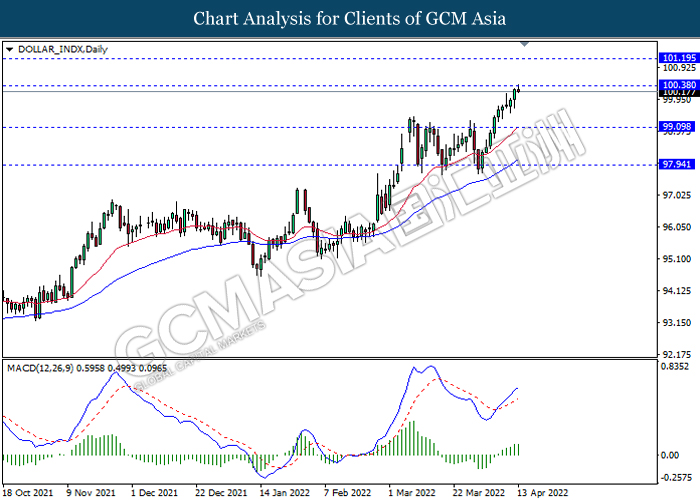

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 100.40, 101.20

Support level: 99.10, 97.95

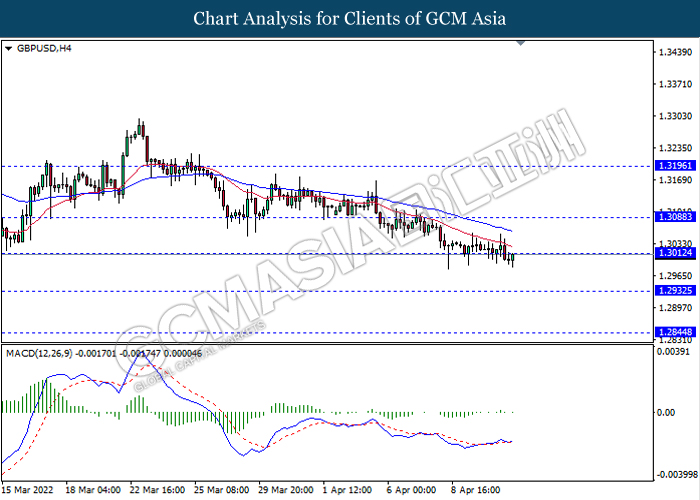

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.3010, 1.3090

Support level: 1.2930, 1.2845

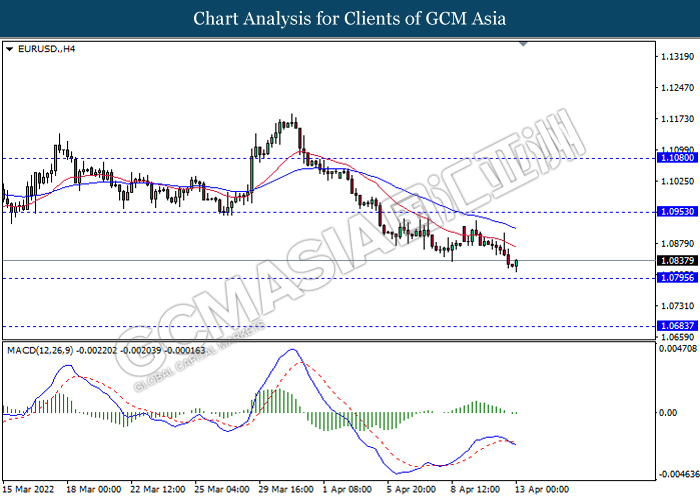

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0955, 1.1080

Support level: 1.0795, 1.0685

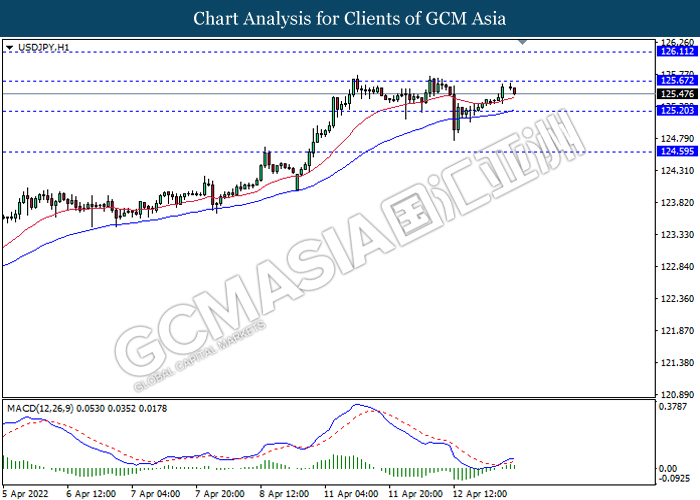

USDJPY, H1: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.65, 126.10

Support level: 125.20, 124.60

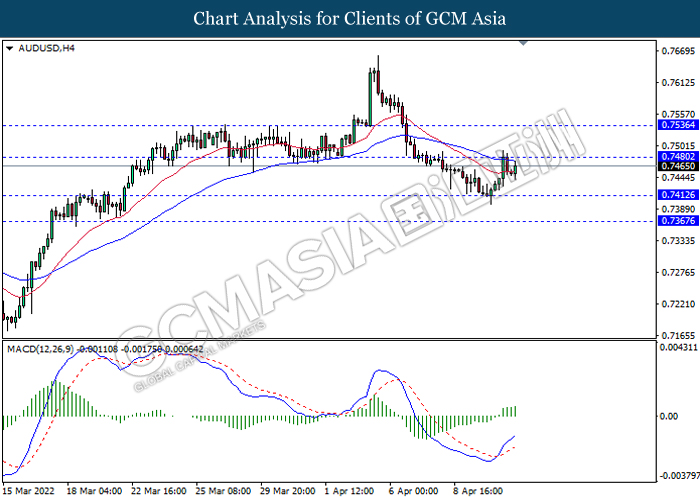

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7480, 0.7535

Support level: 0.7410, 0.7365

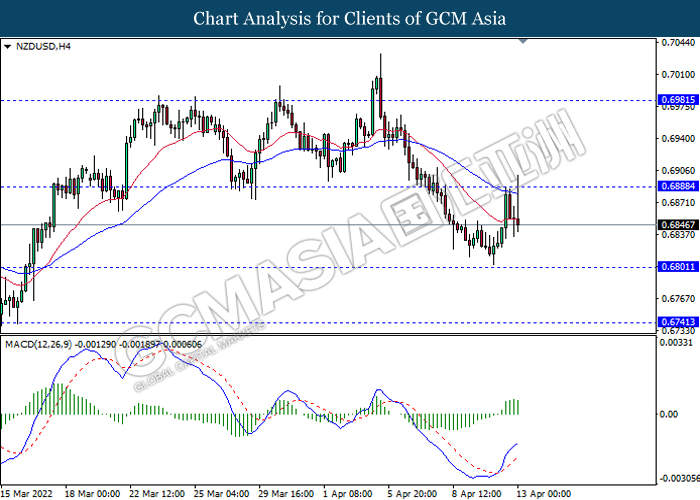

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6890, 0.6980

Support level: 0.6800, 0.6740

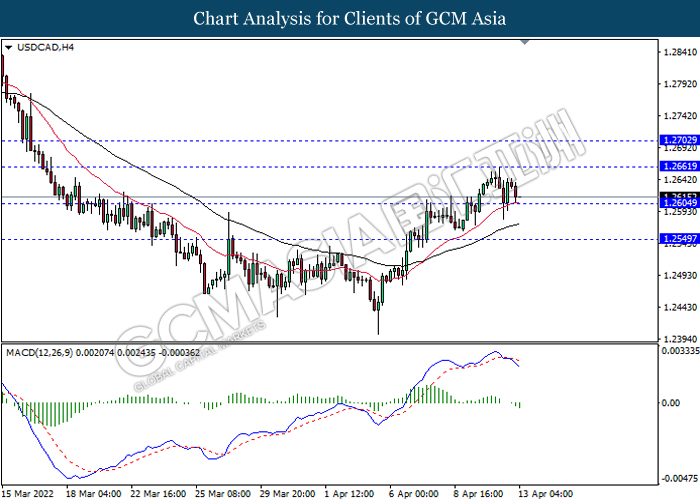

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2660, 1.2700

Support level: 1.2605, 1.2550

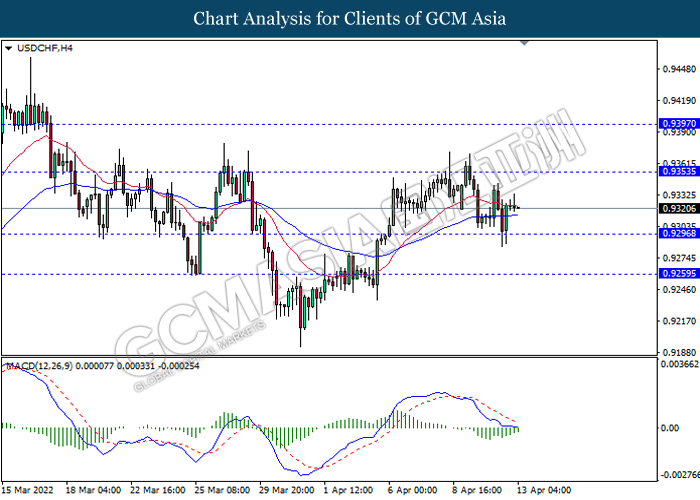

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9355, 0.9395

Support level: 0.9295, 0.9260

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 103.75, 108.40

Support level: 98.55, 93.65

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1974.45, 1988.50

Support level: 1961.25, 1948.15