14 April 2022 Morning Session Analysis

US Dollar hovered nearby recent high, eyed on FOMC monetary decision.

The Dollar Index which traded against a basket of six major currencies retreated from its recent high, which mostly caused by technical correction and profit taking from investors. Though, the overall trend for the US Dollar still remained bullish as spiking number of inflation rate had sparked hopes upon the contractionary monetary policy in future. According to US Bureau of Labor Statistics, US Producer Price Index (PPI) notched up significantly from the previous reading of 0.9% to 1.4%, exceeding the market forecast at 1.1%. On a yearly basis, the data climbed 11.2% compared to a year ago. PPI is considered a forward-looking inflation indicator as it tracks prices in the pipeline for good and services that eventually reach consumers. As for now, market participants are pricing in an almost certainty that the central bank will increase their interest rate by 50 basis point during the next monetary policy meeting. As for now, the Dollar Index depreciated by 0.44% to 99.85.

In the commodities market, the crude oil price extends its gains by 0.01% to $104.55 per barrel as of writing. The oil market surged over the backdrop of rising tensions between Russia-Ukraine continue to spur bullish momentum on the crude oil price. On the other hand, the gold price appreciated by 0.01% to $1978.25 per troy ounces as of writing amid bullish number of inflation data across the US and EU region had increased the appeal for the inflation-hedging commodities such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Apr) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Apr) | 0.00% | 0.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | 0.20% | 0.90% | – |

| 20:30 | USD – Initial Jobless Claims | 166K | 173K | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | 0.30% | 0.60% | – |

Technical Analysis

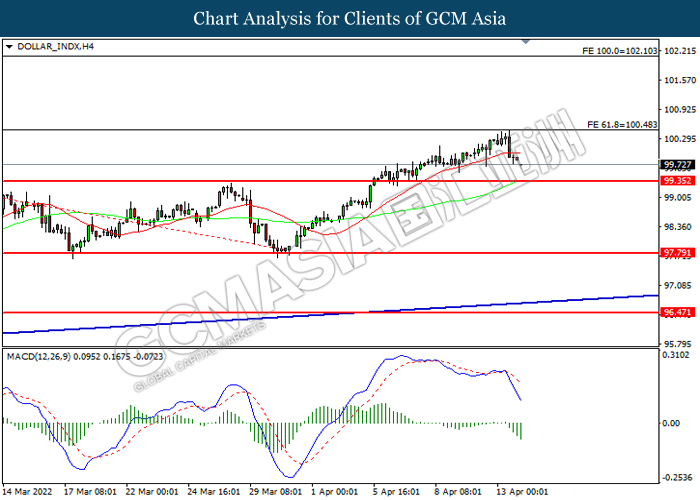

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

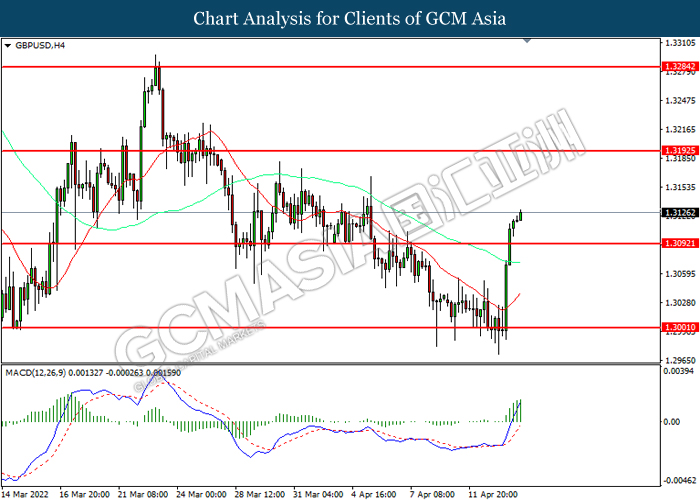

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3000

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0905, 1.0975

Support level: 1.0805, 1.0690

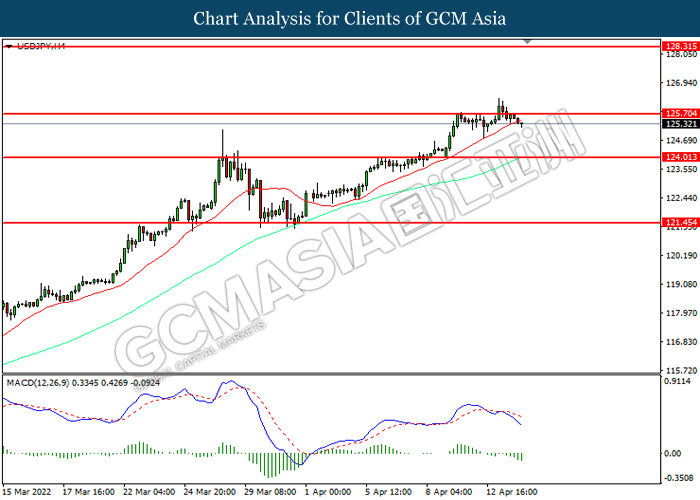

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

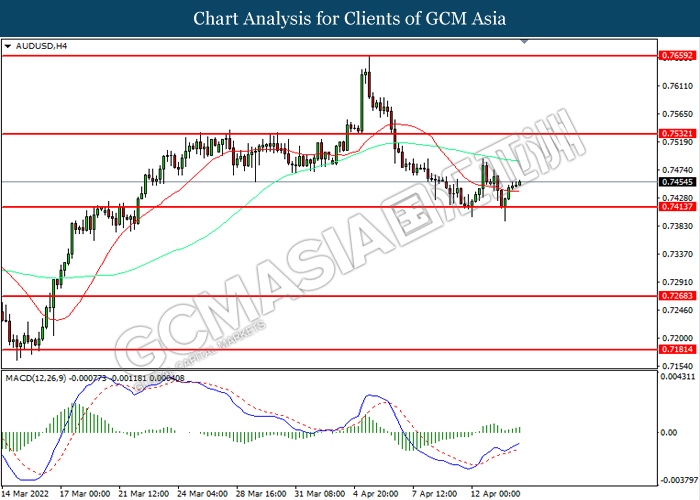

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

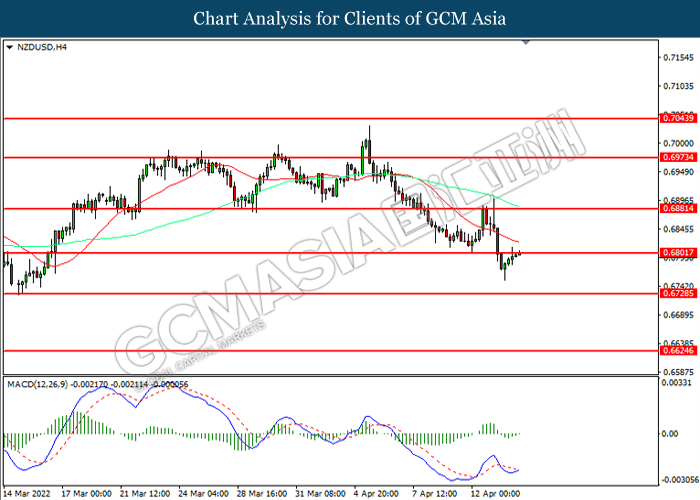

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6800, 0.6880

Support level: 0.6730, 0.6625

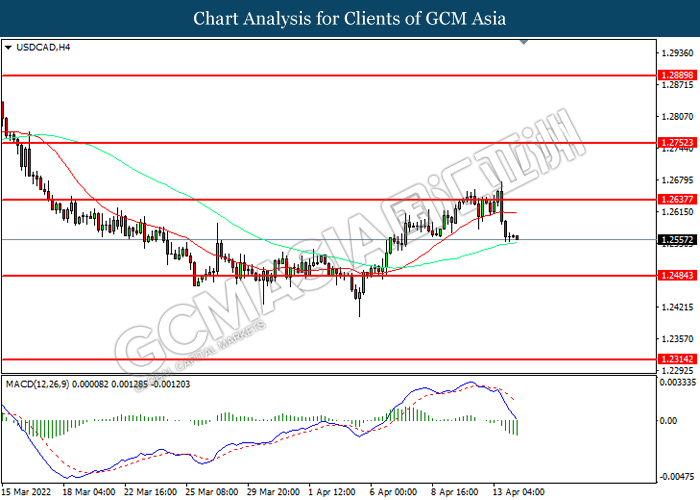

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses/

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

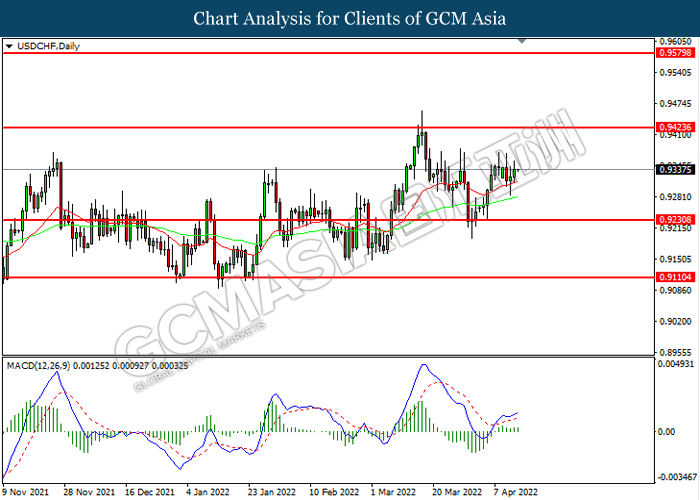

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

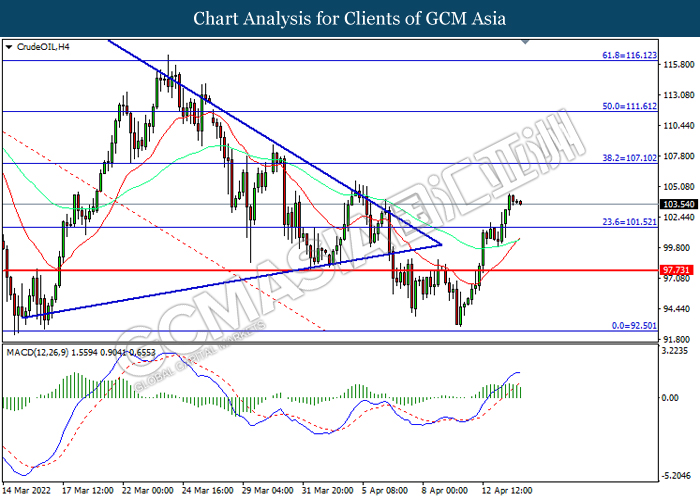

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

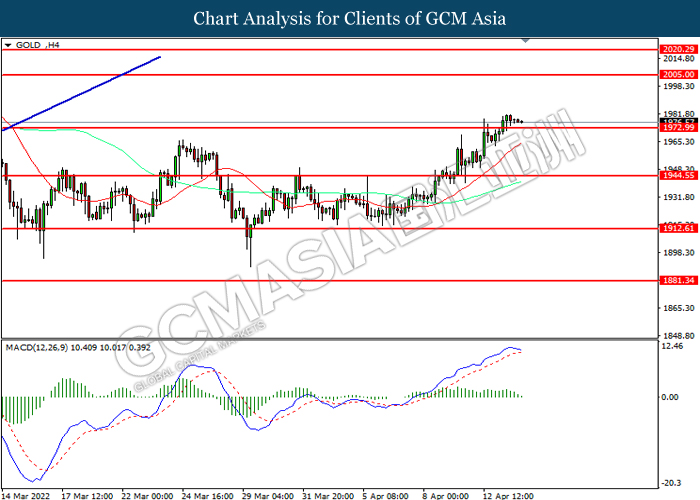

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 2005.00, 2020.30

Support level: 1973.00, 1944.55