14 April 2022 Afternoon Session Analysis

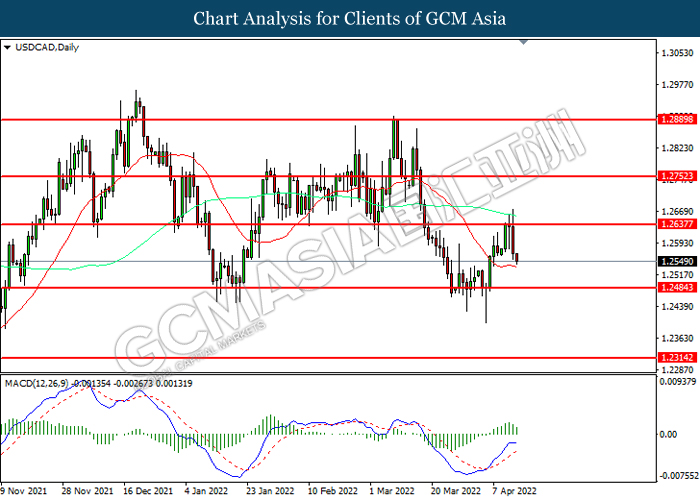

USDCAD eased amid rate hike from Bank of Canada.

USDCAD slumped from its recent high since Wednesday following the rate hike from Bank of Canada (BoC). According to Bank of Canada statement, Canada Interest Rate notched up from the previous reading of 0.50% to 1.00%, which fulfilled the market forecast of 1.00%. The Quantitative Tightening would begin on April 25. Besides, the BoC Governing Council judges that rates need to rise further and emphasizes that interest rates would be the bank’s primary tool for setting monetary policy. The BoC reiterated that they would guide the timing and pace of further rate hikes, as the BoC remains committed to achieving the 2% inflation target. The war-driven inflation risk had led to the spike of commodities price such as crude oil. Thus, BoC decided to increase interest rate in order to combat inflation risk by diminishing money circulation in the market. Rate hike from BoC would likely to bring positive prospects toward Canadian Dollar, prompting investors to shift their capitals towards Canadian Dollar. Investors would continue to scrutinize the latest updates with regards of interest rate decision from BoC in order to gauge the likelihood movement of the pair. As of writing, USDCAD depreciated by 0.13% to 1.2550.

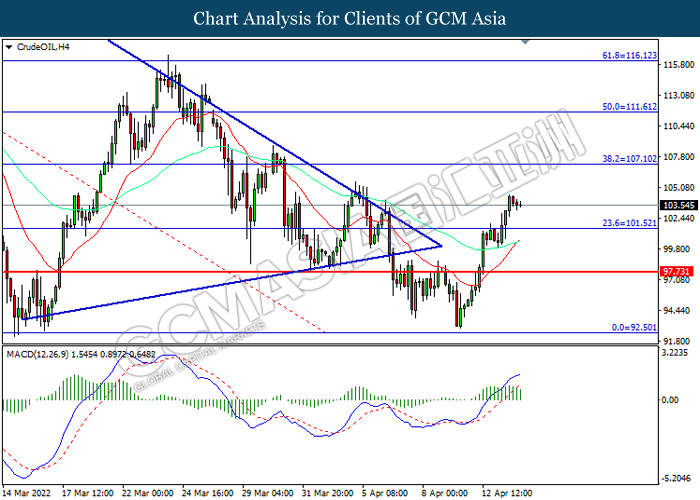

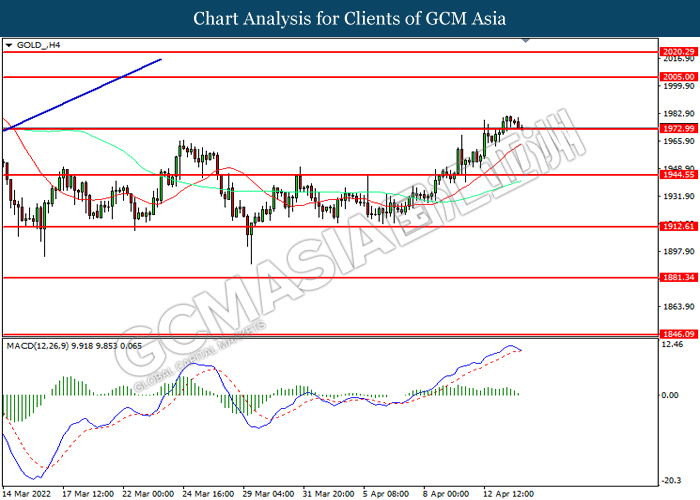

In commodities market, crude oil price edged down by 0.82% to $103.39 per barrel as of writing following US Crude Oil Inventories came in at the reading of 9.382M, exceeding the previous reading of 2.421M and the market forecast of 0.863M. Besides, gold price depreciated by 0.33% to $19787.10 per troy ounces as of writing. Nonetheless, overall trend for gold price remained bullish over the backdrop of rising tension between Russia-Ukraine.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:30 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 19:45 | EUR – Deposit Facility Rate (Apr) | -0.50% | -0.50% | – |

| 19:45 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 19:45 | EUR – ECB Interest Rate Decision (Apr) | 0.00% | 0.00% | – |

| 20:30 | USD – Core Retail Sales (MoM) (Mar) | 0.20% | 0.90% | – |

| 20:30 | USD – Initial Jobless Claims | 166K | 173K | – |

| 20:30 | USD – Retail Sales (MoM) (Mar) | 0.30% | 0.60% | – |

Technical Analysis

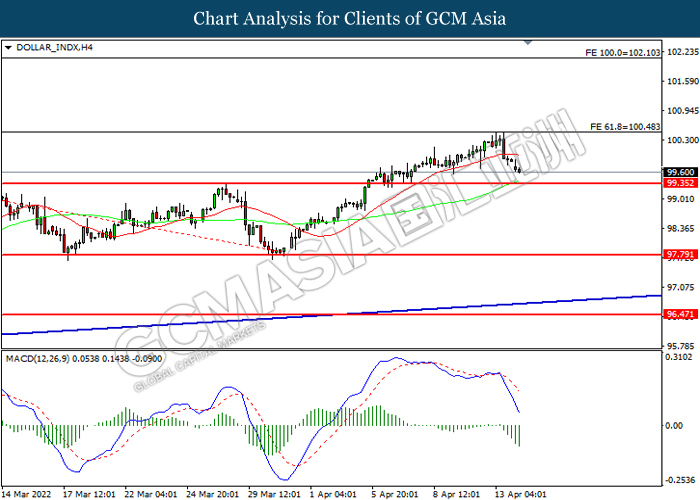

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 100.50, 102.10

Support level: 99.35, 97.80

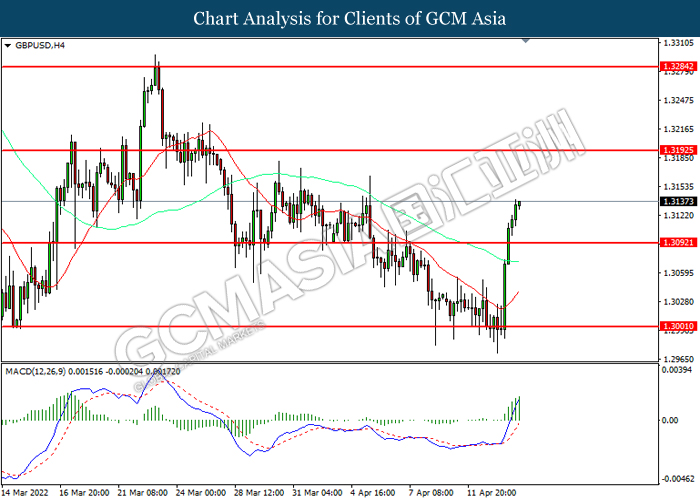

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3195, 1.3285

Support level: 1.3090, 1.3000

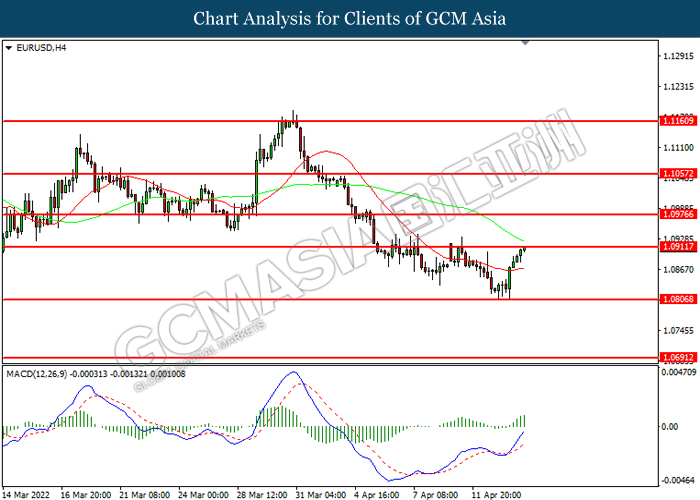

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.0910, 1.0975

Support level: 1.0805, 1.0690

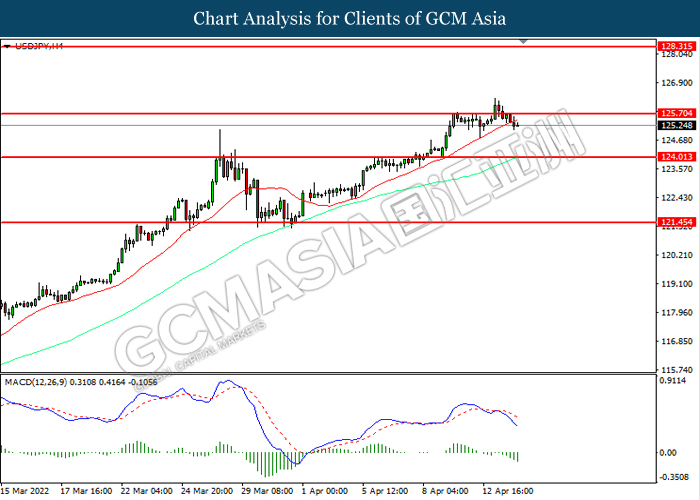

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 125.70, 128.30

Support level: 124.00, 121.45

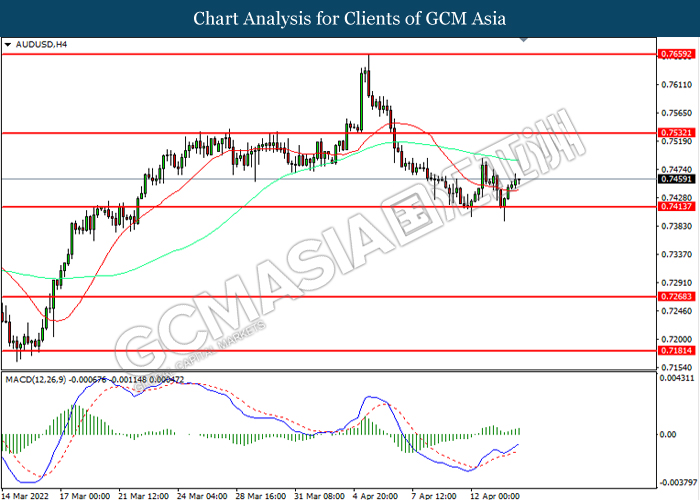

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7415, 0.7270

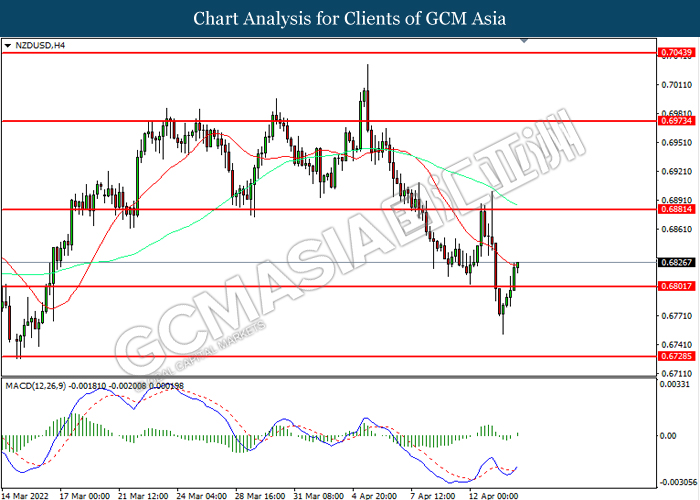

NZDUSD, H4: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6880, 0.6975

Support level: 0.6800, 0.6730

USDCAD, Daily: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

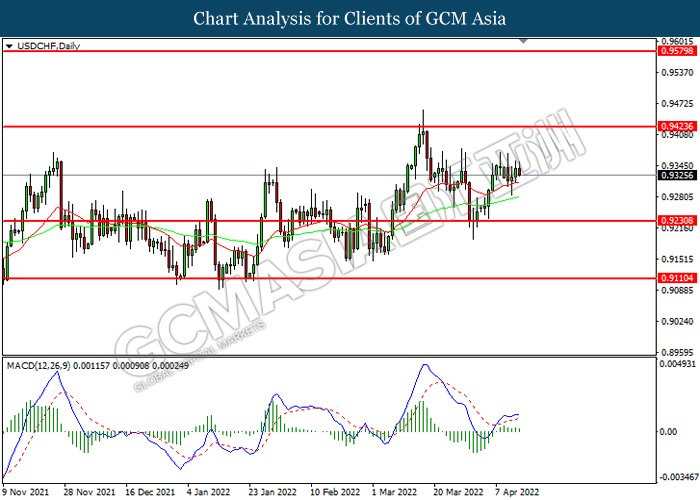

USDCHF, Daily: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9425, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after it breakout the support level.

Resistance level: 2005.00, 2020.30

Support level: 1973.00, 1944.55