15 April 2022 Afternoon Session Analysis

Euro eased amid the dovish tone of European Central Bank.

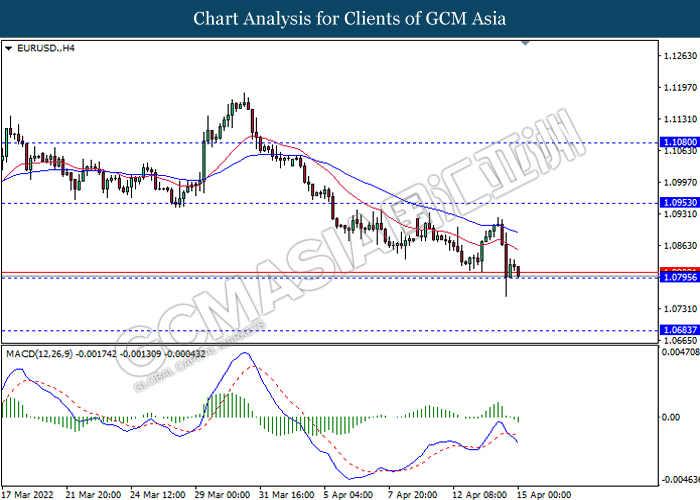

The Euro slumped significantly into two-year low against the US Dollar following the European Central Bank President Christine Lagarde unleashed her dovish tone toward the economic progression in EU yesterday, spurring significant selloff on Euro. According to Reuters, the European Central Bank President Christine Lagarde claimed that currently the European Central Bank was still in no rush to increase interest rates, in contrast with an aggressive contractionary monetary policy from US Federal Reserve. The ECB on Thursday concluded its latest meeting with cautious steps to unwind support to avoid economic shock to the European Union. The ECB confirmed their plan to slowly reduce the bond purchases program as well as the quantitative easing program this quarter. Meanwhile, the ECB also maintained their interest rate at 0.00%, aligned with the market forecast. As of writing, EUR/USD depreciated by 0.05% to 1.0819.

In commodities market, crude oil price appreciated by 2.17% to $106.51 per barrel as of writing amid the European Union might phase in a ban on Russian oil imports. Besides, gold price depreciated by 0.61% to $1972.50 per troy ounces as of writing following the surge of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Good Friday

All Day EUR European Union – Good Friday

All Day GBP United Kingdom – Good Friday

All Day AUD Australia – Good Friday

All Day CAD Canada – Good Friday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

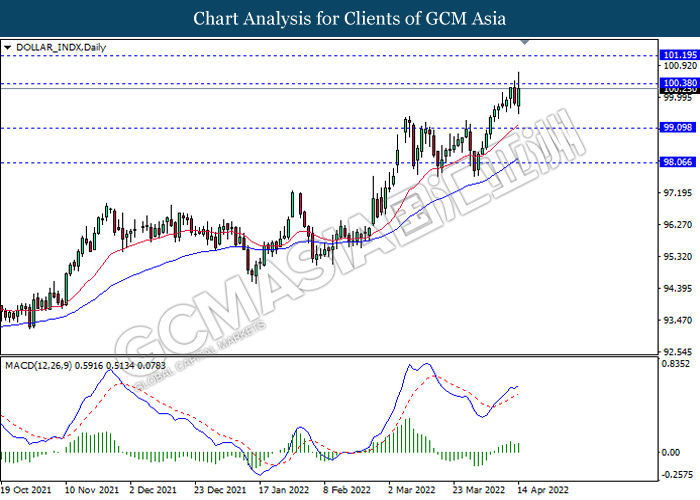

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 100.40, 101.20

Support level: 99.10, 98.05

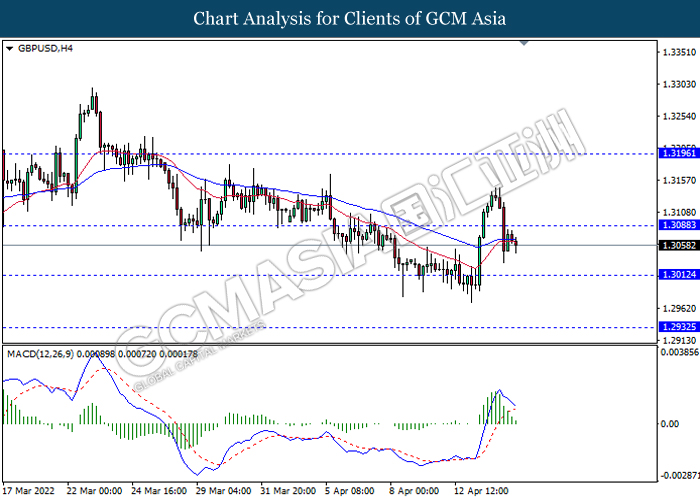

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3090, 1.3195

Support level: 1.3010, 1.2930

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0955, 1.1080

Support level: 1.0795, 1.0685

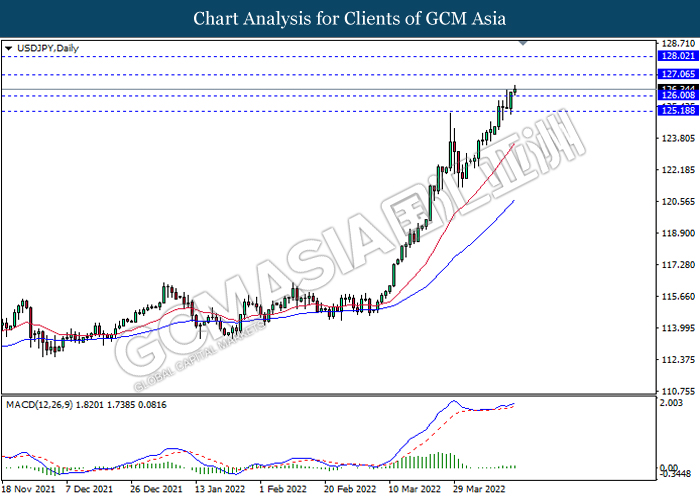

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 127.05, 128.00

Support level: 126.00, 125.20

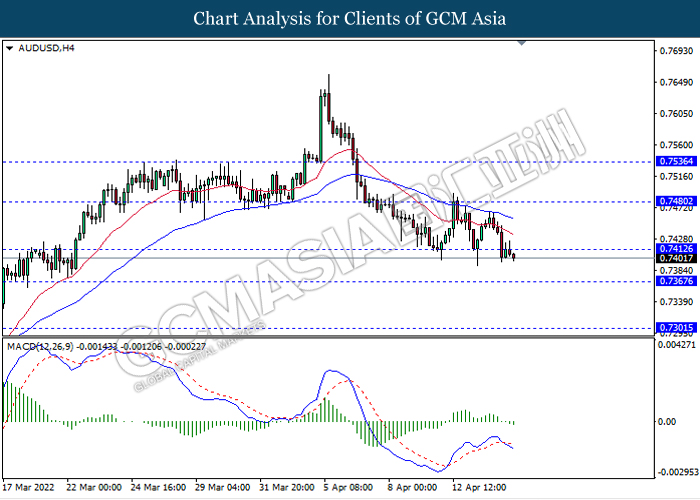

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7410, 0.7480

Support level: 0.7365, 0.7300

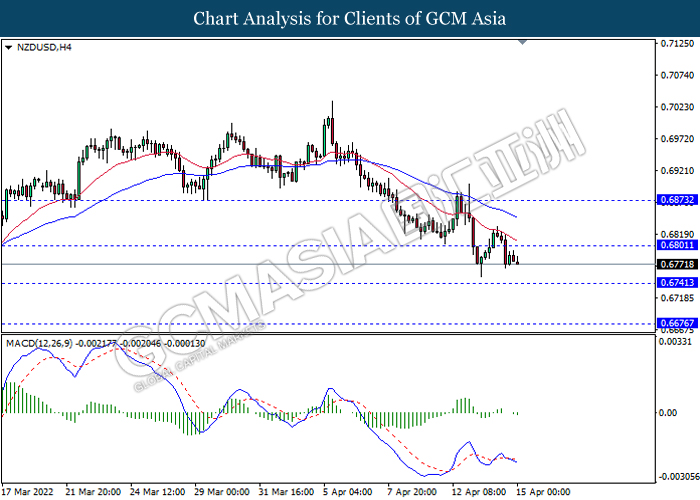

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6800, 0.6875

Support level: 0.6740, 0.6675

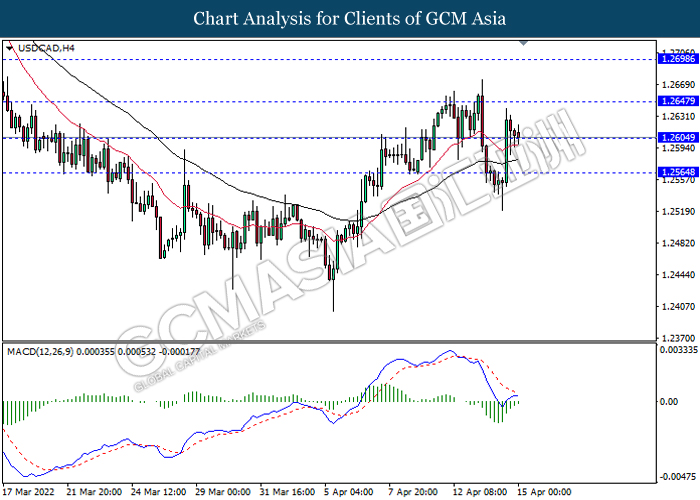

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2645, 1.2700

Support level: 1.2605, 1.2565

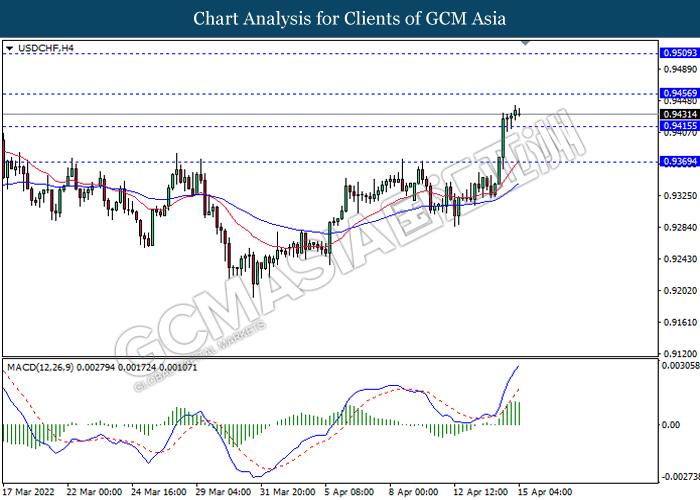

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9455, 0.9510

Support level: 0.9415, 0.9370

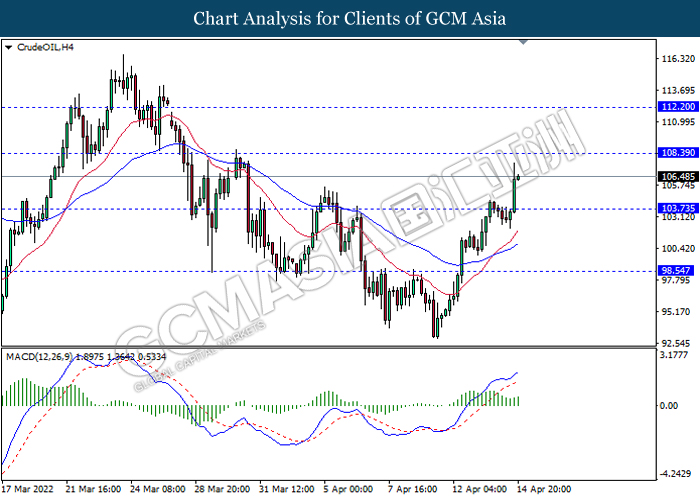

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 108.40, 112.20

Support level: 103.75, 98.55

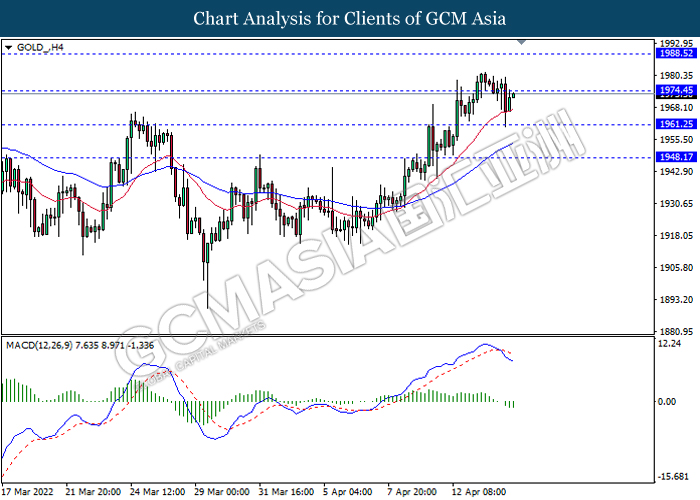

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1974.45, 1988.50

Support level: 1961.25, 1948.15