18 April 2022 Afternoon Session Analysis

Euro slumped as rising Russian-Ukraine tensions spurred stagflation risk.

The Euro extends its losses over the backdrop of rising tensions between Russia-Ukraine, which dialling down the market optimism toward the economic progression in the European region. German economists are forecasting a recession in Europe’s largest economy if Russian oil and gas supplies were to stop, and effects could lead to significant stagflation risk in future. According to ABC news, multiple rockets struck the centre of Ukraine’s second-largest city on Sunday. Currently, the Russia-Ukraine conflict is still not easing, US Secretary of State Antony Blinken told European allies that the US believes the Russian military operations in Ukraine could last through the end of 2022. At the same time, the US and NATO had increased their shipments of the powerful weapon to Ukraine, pushing the crisis into unpredictable territory. As of writing, EUR/USD depreciated by 0.07% to $1.0798.

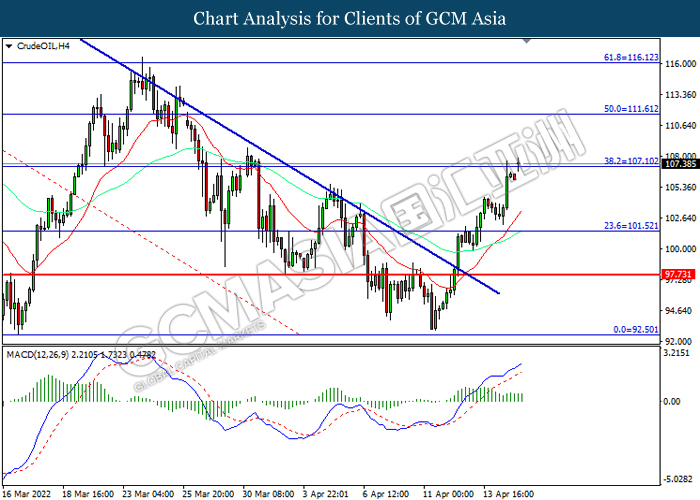

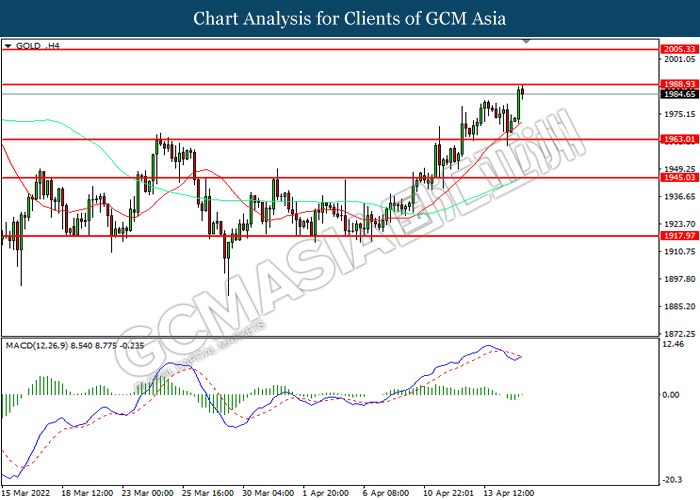

In the commodities market, the crude oil price appreciated by 1.25% to 108.25 per barrel as of writing. The oil market edged higher amid rising tensions in Libya had prompted the authorities to halt oil production from its EI Feel oilfield on Sunday. On the other hand, the gold price surged 0.57% to $1984.65 per troy ounces as of writing amid diminishing risk appetite in the global financial market.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Easter

All Day EUR Germany – Easter

All Day CHF Switzerland – Easter

All Day EUR Italy – Easter

All Day EUR France – Easter

All Day EUR Spain – Easter

All Day AUD Australia – Easter

All Day HKD Hong Kong – Easter

All Day NZD New Zealand – Easter

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

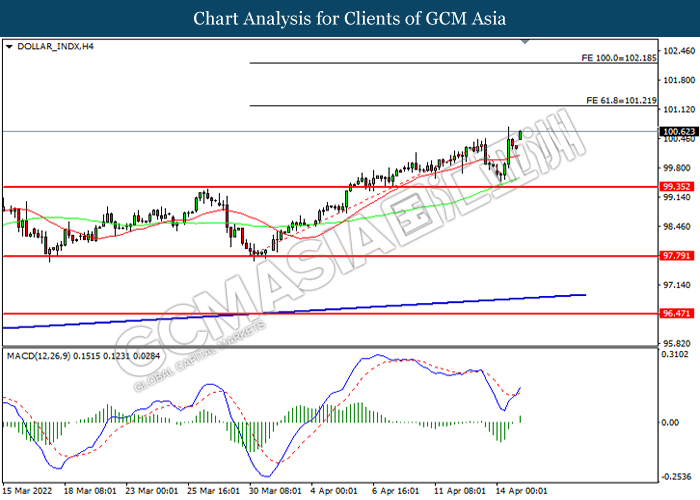

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the index to extend its gains after breakout.

Resistance level: 101.20, 102.20

Support level: 99.35, 97.80

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

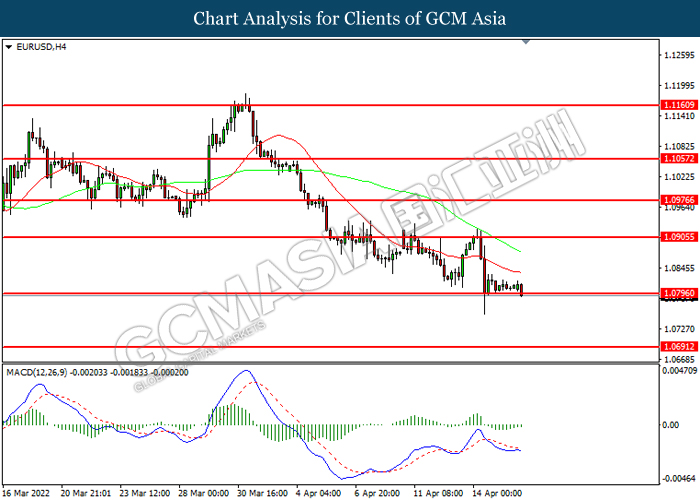

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0905, 1.0975

Support level: 1.0795, 1.0690

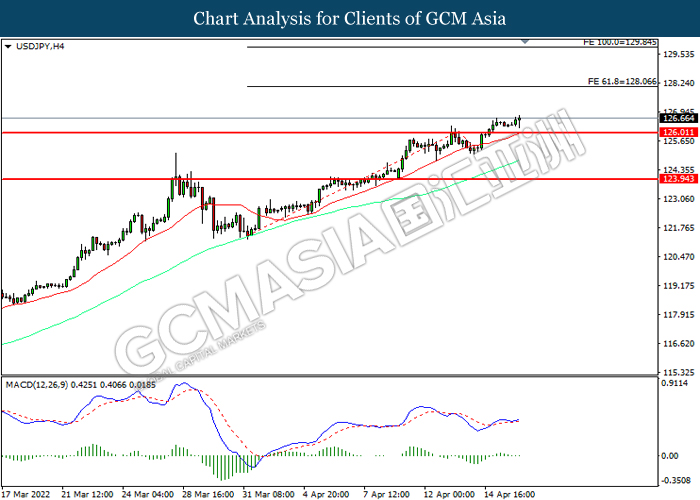

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 128.05, 129.85

Support level: 126.00, 123.95

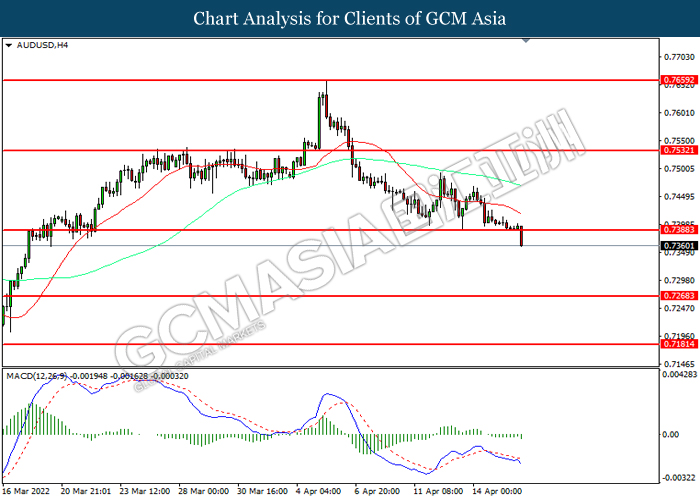

AUDUSD, H4: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7390, 0.7530

Support level: 0.7270, 0.7180

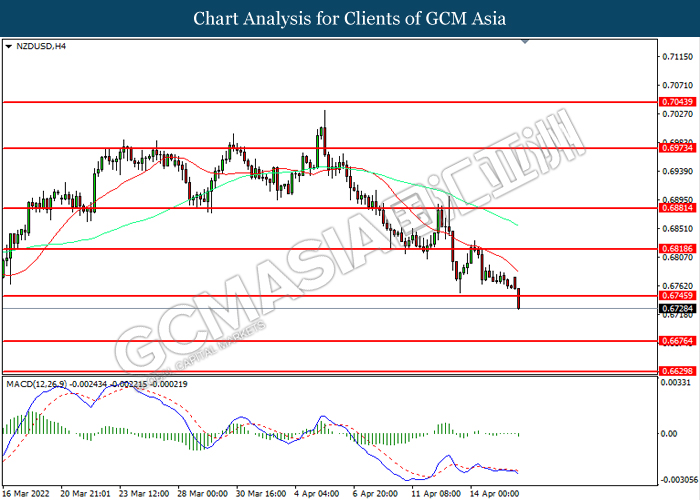

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6745, 0.6820

Support level: 0.6675, 0.6630

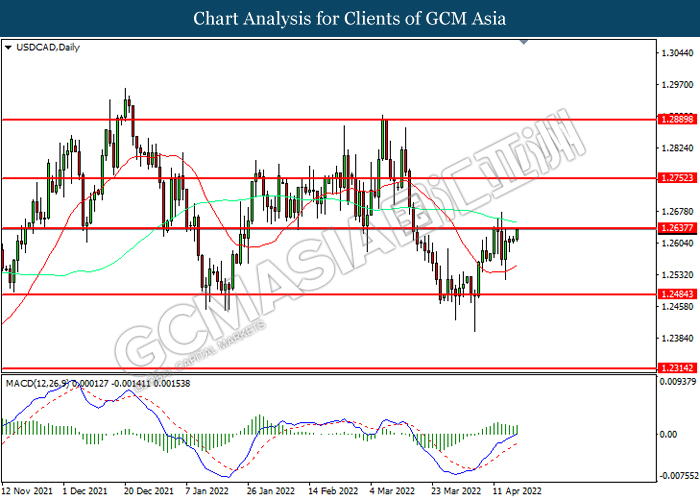

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9430, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 107.10. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after breakout the resistance level.

Resistance level: 1988.95, 2005.35

Support level: 1963.00, 1945.05