19 April 2022 Morning Session Analysis

US Dollar surged as US Treasury yield hit two-year high.

The Dollar Index which traded against a basket of six major currencies rose to a fresh two-year high yesterday, in line with higher US Treasury yields following investors speculated for at least 50 basis point rate hike from Federal Reserve. Currently, the US Rate future markets has priced in a 96% chance of a 50-basis point rate hike during the Fed’s monetary policy meeting in next month. Besides, the benchmark 10-year US Treasury yield rose 4 basis points to 2.851%, reaching its highest level since late 2018. Besides, the US Dollar extend its gain as rising tensions between Russia-Ukraine had stoked a shift in sentiment toward the safe-haven US Dollar. According to Reuters, Russia’s missiles had continued to strike Lviv in western Ukraine. Meanwhile, explosions rocked other cities in Ukraine as Russian forces kept up their bombardments after claiming near full control of Mariupol. As of writing, the Dollar Index appreciated by 0.50% to 100.85.

In the commodities market, the crude oil price extends its gains by 0.04% to 107.89 per barrel as of writing. The oil market received further bullish momentum as escalating tensions between Russia-Ukraine had insinuated hopes upon an aggressive sanction from EU region to Russia. On the other hand, the gold price depreciated by 0.04% to $1976.80 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Mar) | 1.865M | 1.830M | – |

Technical Analysis

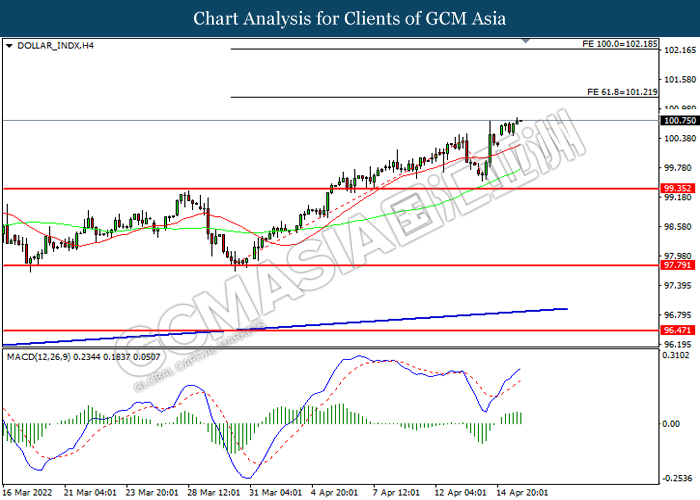

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 101.20, 102.20

Support level: 99.35, 97.80

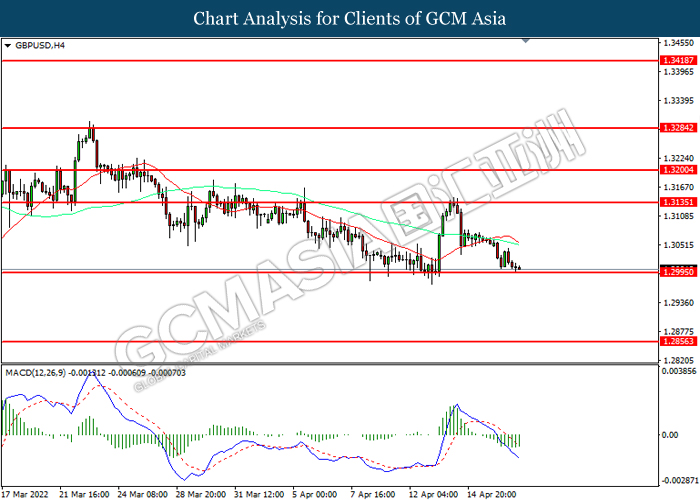

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

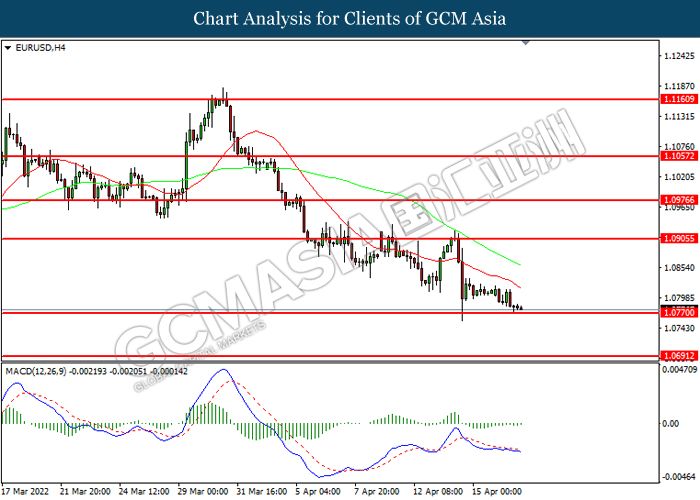

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

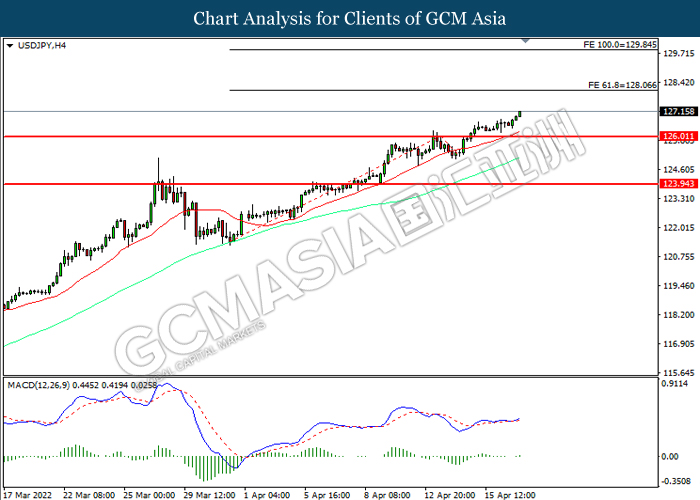

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 128.05, 129.85

Support level: 126.00, 123.95

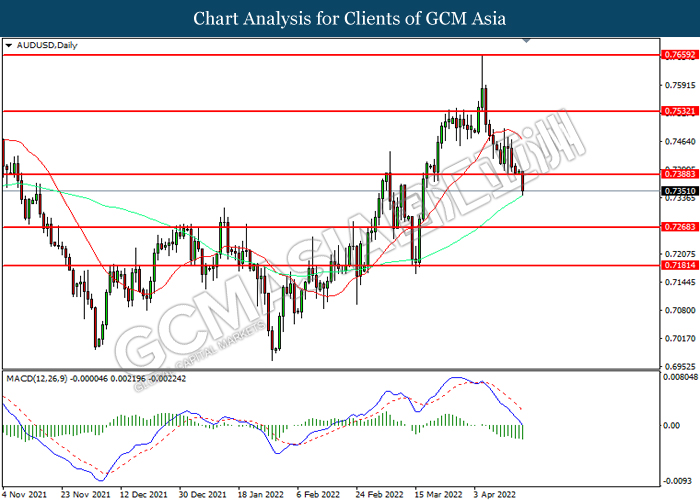

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7390, 0.7530

Support level: 0.7270, 0.7180

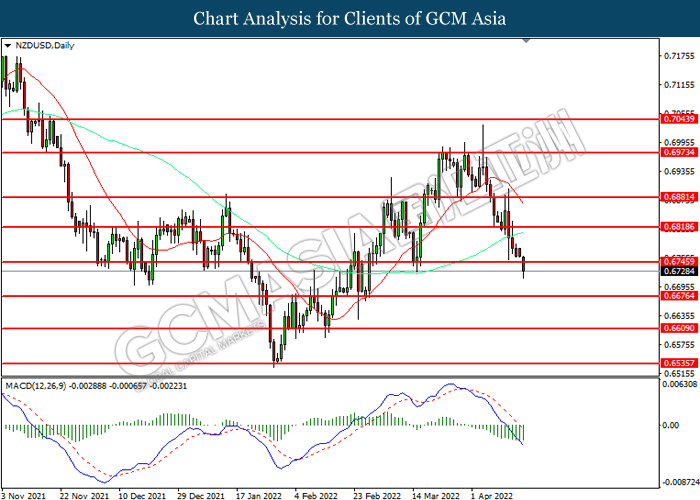

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6745, 0.6820

Support level: 0.6675, 0.6610

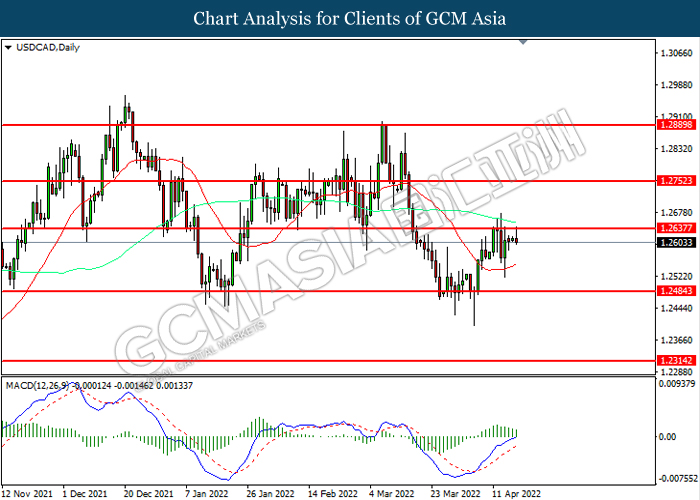

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

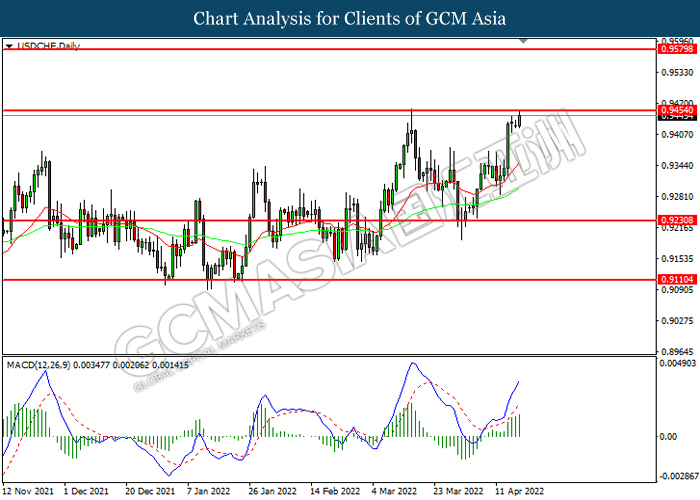

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9455, 0.9580

Support level: 0.9230, 0.9110

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 107.10. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

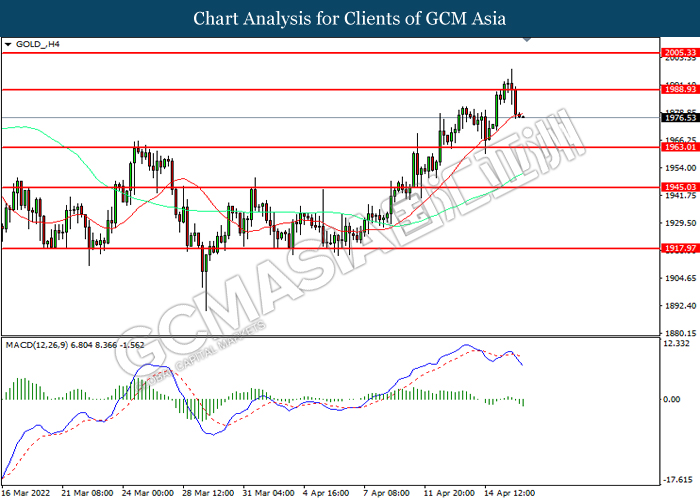

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1988.95. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 1988.95, 2005.35

Support level: 1963.00, 1945.05