19 April 2022 Afternoon Session Analysis

Euro eased following Russia invasion of Ukraine.

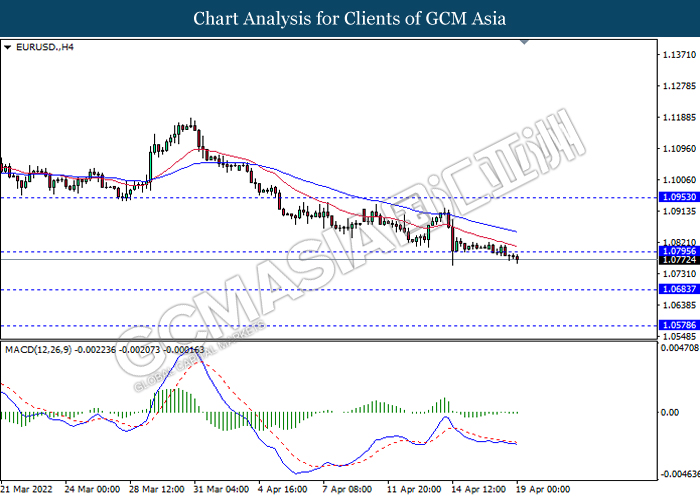

Euro edged down since yesterday amid the backdrop of rising tensions of Russia-Ukraine conflict. According to Reuters, Ukrainian authorities appeared a fact that missiles struck Lviv early on Monday and explosions rocked other cities as Russian forces kept up their bombardments after claiming near full control of the strategic southern port of Mariupol. Russia invasion of Ukraine would likely to disrupt the global supply chain, including commodities market, leading to the spike of commodities price such as crude oil. The surge of oil price would increase the import cost of companies in Europe region as Europe was one of the dependent on Russia oil, dialing down the market optimism toward economic progression in Europe region. Besides, the rising tension of Russia-Ukraine would likely to cause further aggressive sanction on Russia commodities, spurring further bearish momentum on Euro. As of writing, EURUSD depreciated by 0.09% to 1.0770.

In commodities market, crude oil price extend its gains by 0.46% to $108.11 per barrel as of writing over the expectation of sanctions on Russia oil from European Union. On the other hand, gold price edged down by 0.30% to $1980.50 per troy ounces following the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Building Permits (Mar) | 1.865M | 1.830M | – |

Technical Analysis

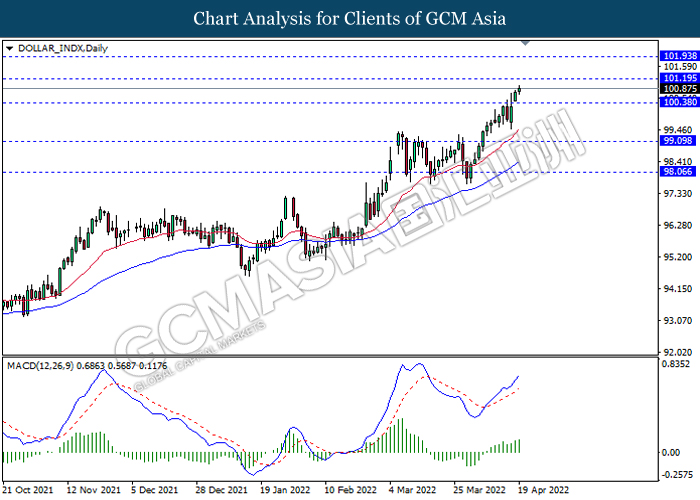

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 101.20, 101.95

Support level: 100.40, 99.10

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3010, 1.3090

Support level: 1.2930, 1.2845

EURUSD, H4: EURUSD was traded lower following prior breakout below the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0795, 1.0955

Support level: 1.0685, 1.0580

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 128.00, 129.05

Support level: 127.05, 126.00

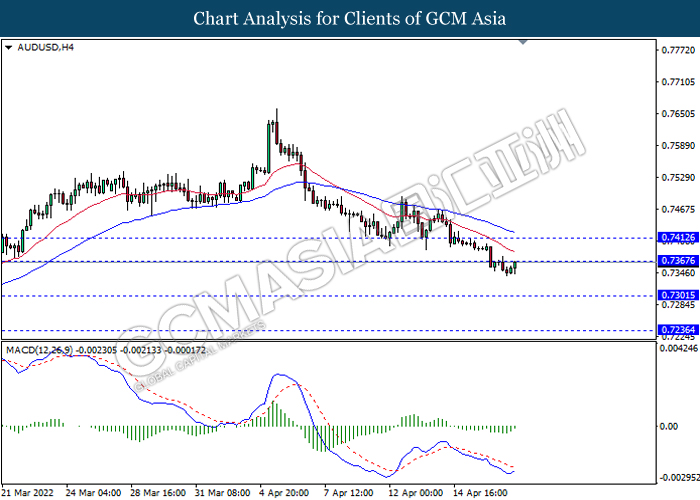

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7365, 0.7410

Support level: 0.7300, 0.7235

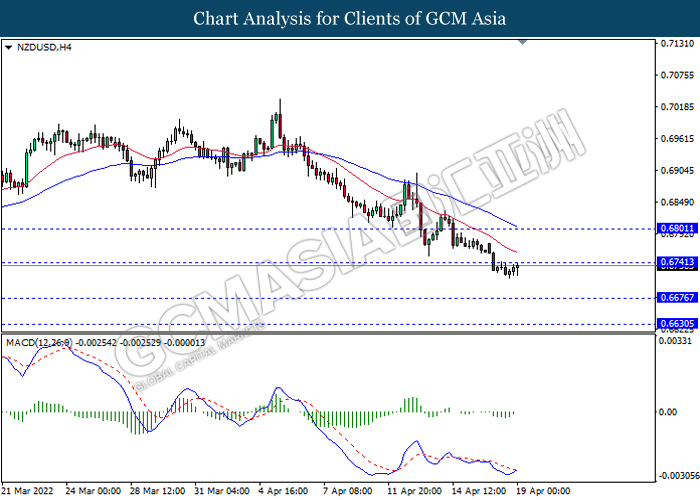

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6740, 0.6800

Support level: 0.6675, 0.6630

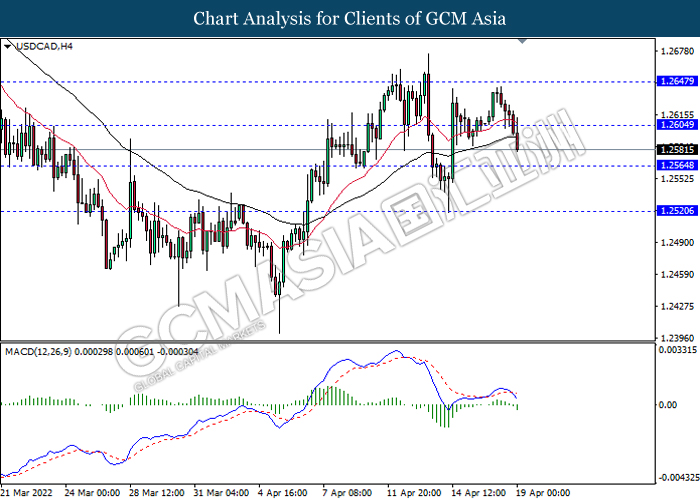

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2605, 1.2645

Support level: 1.2565, 1.2520

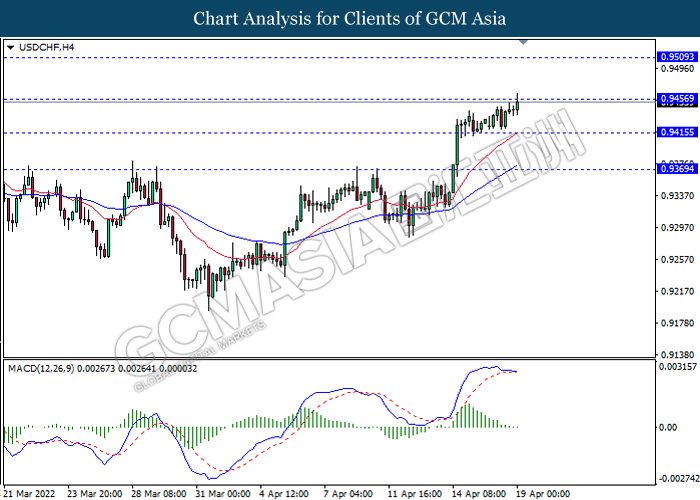

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9455, 0.9510

Support level: 0.9415, 0.9370

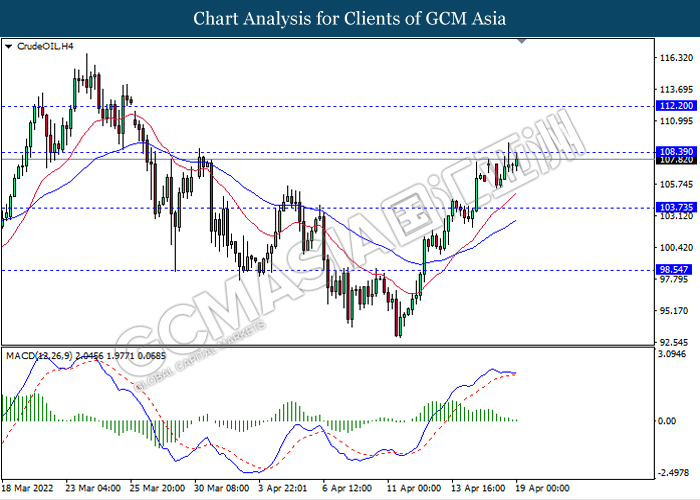

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 108.40, 112.20

Support level: 103.75, 98.55

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1988.50, 2004.45

Support level: 1974.45, 1961.65