20 April 2022 Morning Session Analysis

US Dollar jumped, buoyed by rate hike expectation.

The Dollar Index which traded against a basket of six major currencies extend its gains yesterday amid the rate hike expectation from Federal Reserve continue to spur bullish momentum on the US Dollar. As for now, the US Benchmark 10-year Treasury yields hit 2.93% on Tuesday, the highest since December 2018. Chicago Federal Reserve Bank President Charles Evans also reiterated that he would support the Federal Reserve to increase their interest rate by 50 basis-point during the next monetary policy meeting in order to combat the high inflation rate. Besides, St Louis Federal Reserve Bank President James Bullard also said that the Fed would likely to increase their interest rates to 3.5% by the end of the year while reiterating that he did not rule out the possibility of a 75-basis point rate hike in future. Tightening monetary policy would likely to reduce the money circulation in the US Dollar market, which sparkling the appeal for the currency. As of writing, the Dollar Index appreciated by 0.21% to 101.00.

In the commodities market, the crude oil price surged 0.80% to $103.20 during the early Asian trading session over the backdrop of bullish inventory data. According to American Petroleum Institute, US API Weekly Crude Oil Stock came in at -4.496M, less than the market forecast at 2.533M. On the other hand, the gold price depreciated by 0.08% to $1947.98 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.80% | – | – |

| 22:00 | USD – Existing Home Sales (Mar) | 6.02M | 5.80M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 9.382M | 0.863M | – |

Technical Analysis

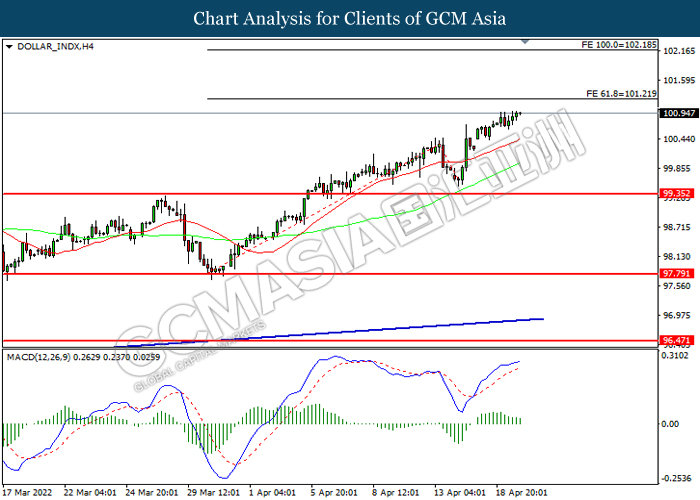

DOLLAR_INDX, H4: Dollar index was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 101.20, 102.20

Support level: 99.35, 97.80

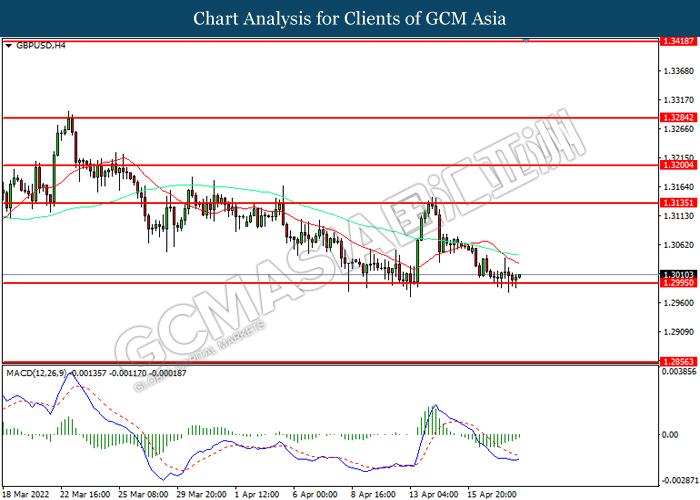

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

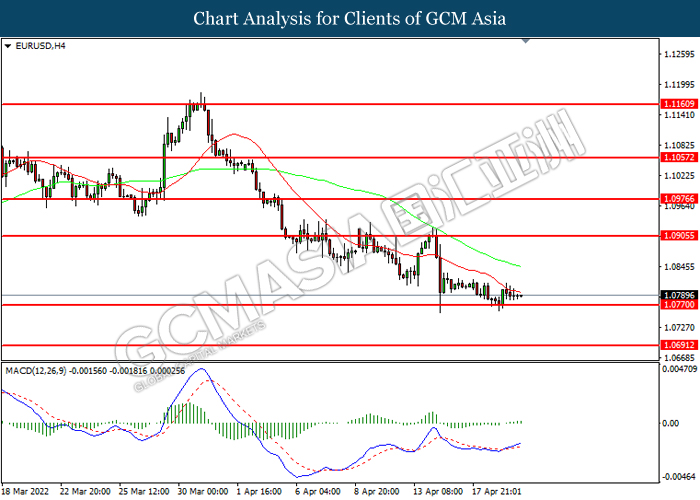

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

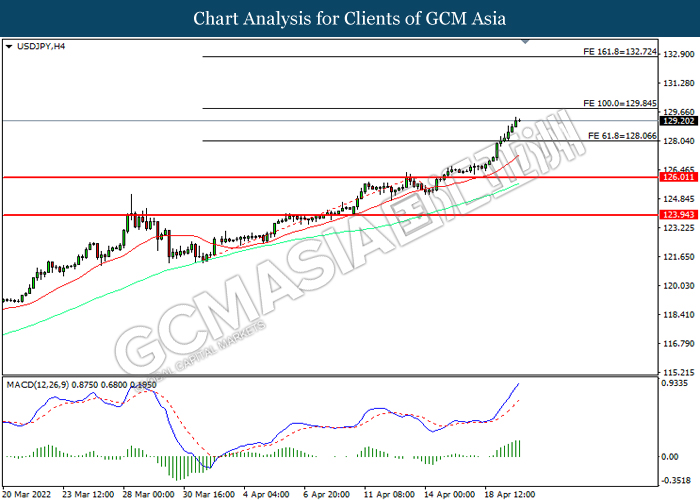

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 129.85, 132.70

Support level: 128.05, 126.00

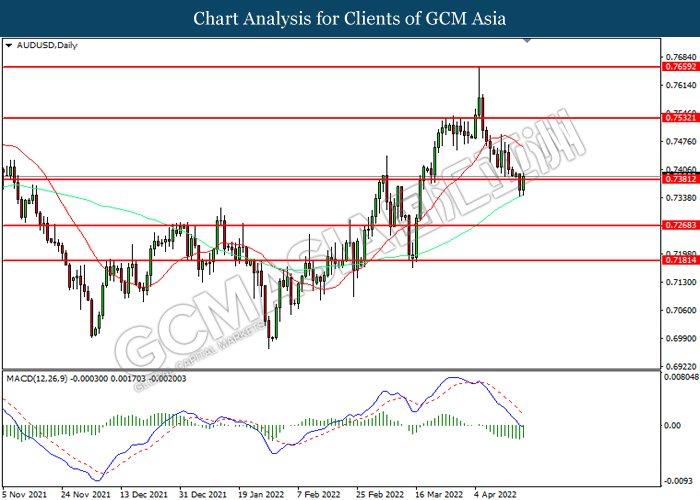

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7530, 0.7660

Support level: 0.7380, 0.7270

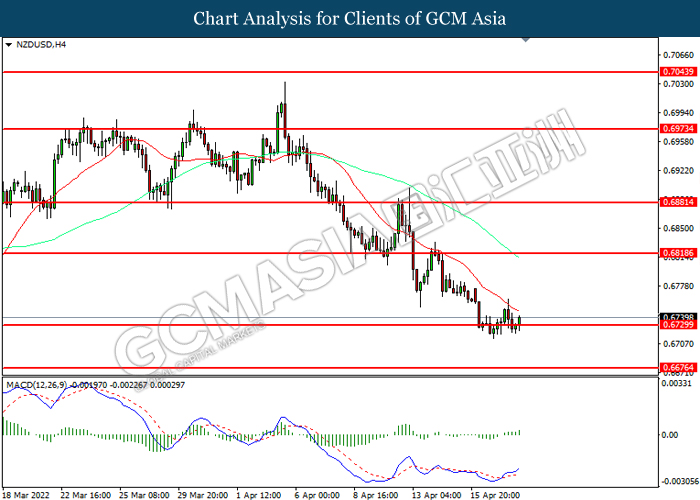

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6820, 0.6880

Support level: 0.6730, 0.6675

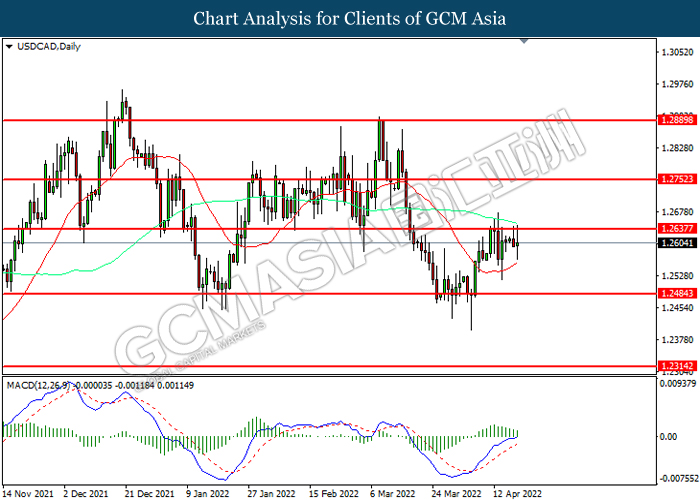

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

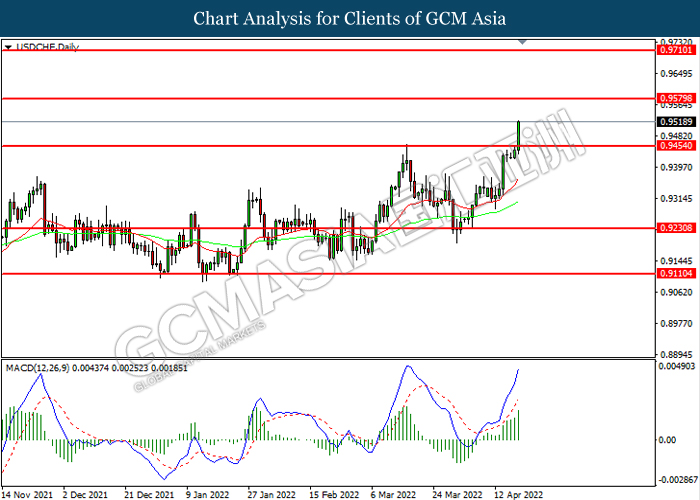

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

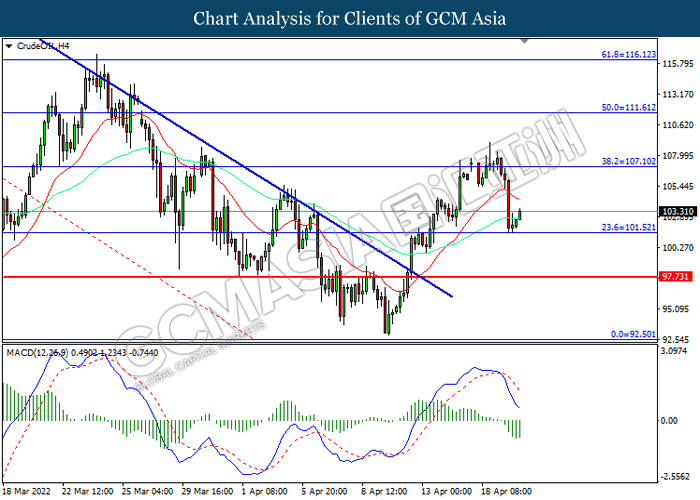

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

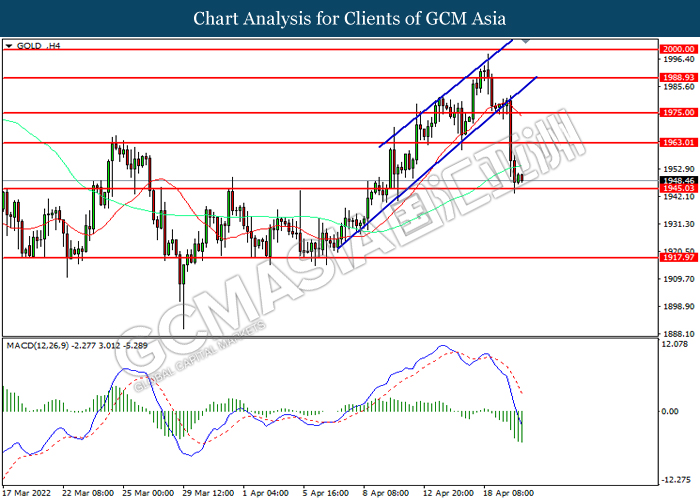

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1963.00, 1975.00

Support level: 1945.05, 1917.95