20 April 2022 Afternoon Session Analysis

Australia Dollar surged following the support from People’s Bank of China.

AUDUSD rebounded from its recent low following People’s Bank of China (PBOC) provide support to boost up economy, which spurred bullish momentum on the pair. According to Reuters, People’s Bank of China appeared a statement on Wednesday, which urged financial institutions to step up support for the contact-intensive service sector and small firms impacted by COVID-19. Besides, the People’s Bank of China also called for flexible adjustments to mortgage payment plans for home buyers impacted by COVID outbreaks, and vowed to keep property sector financing stable and orderly. The moves of PBOC would likely to bring positive prospects toward economic momentum in China by increasing citizens’ purchasing power and reducing companies’ cost. As China was one of the largest trading partner for Australia, it dialed up the market optimism toward economic progression in Australia region, prompting investors to purchase Australia Dollar. As of writing, AUDUSD edged up by 0.47% to 0.7405.

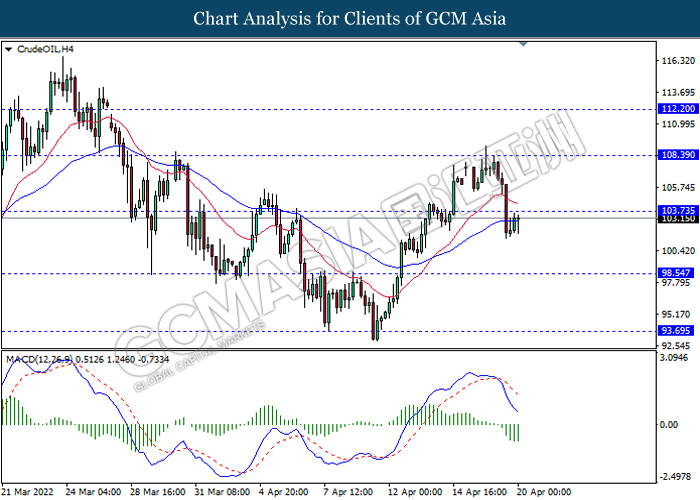

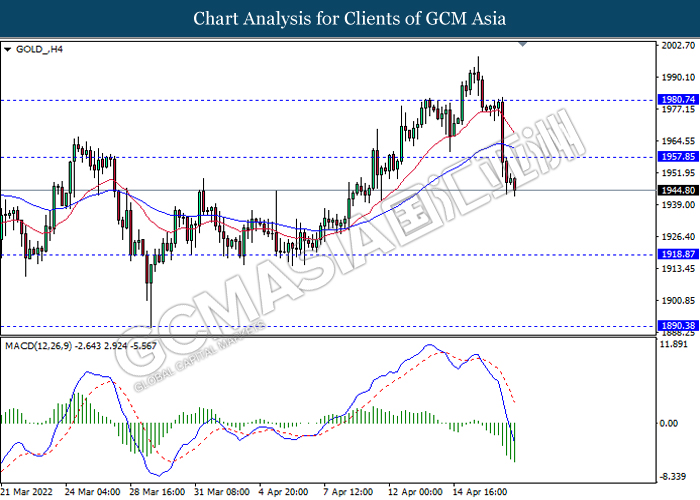

In commodities market, crude oil price appreciated by 0.83% to $102.88 per barrel as of writing. According to Bloomberg, the industry-funded American Petroleum Institute reported that US crude stockpiles declined by about 4.5 million barrels last week, according to people familiar with the data. On the other hand, gold price slumped by 0.62% to $1946.65 per troy ounces as of writing amid the backdrop of the rally of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core CPI (MoM) (Mar) | 0.80% | – | – |

| 22:00 | USD – Existing Home Sales (Mar) | 6.02M | 5.80M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 9.382M | 0.863M | – |

Technical Analysis

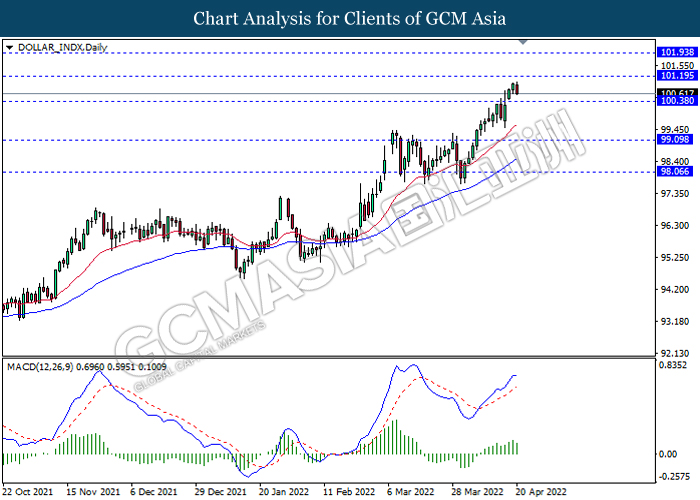

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.20, 101.95

Support level: 100.40, 99.10

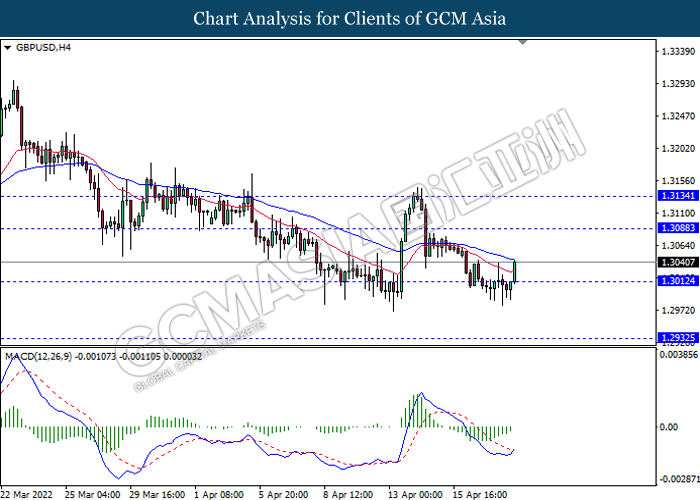

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3090, 1.3135

Support level: 1.3010, 1.2930

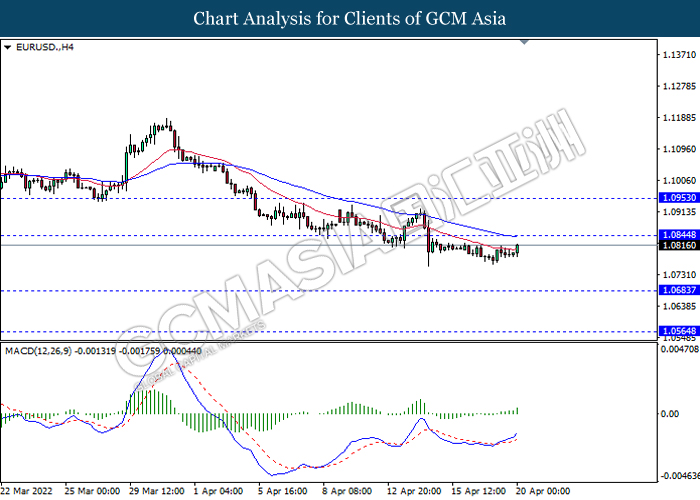

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0845, 1.0955

Support level: 1.0685, 1.0565

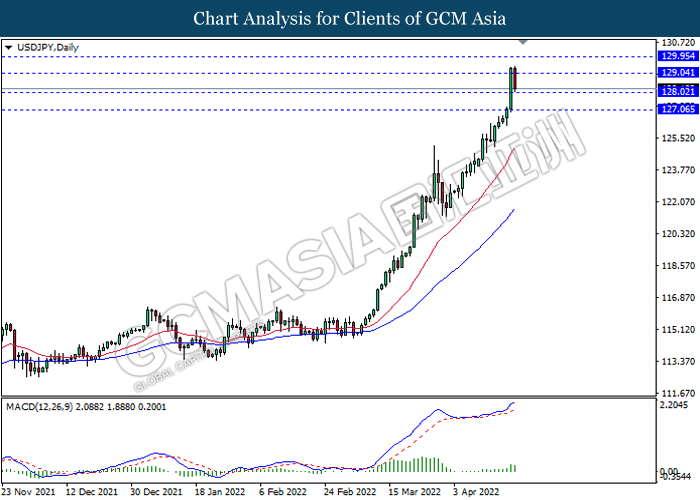

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.05

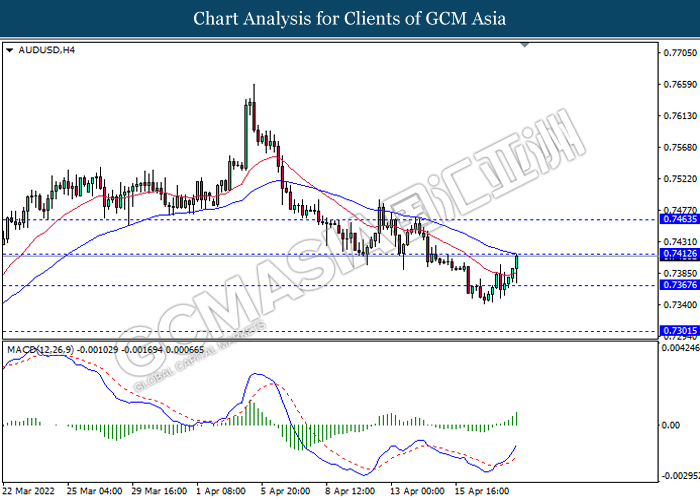

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7410, 0.7465

Support level: 0.7365, 0.7300

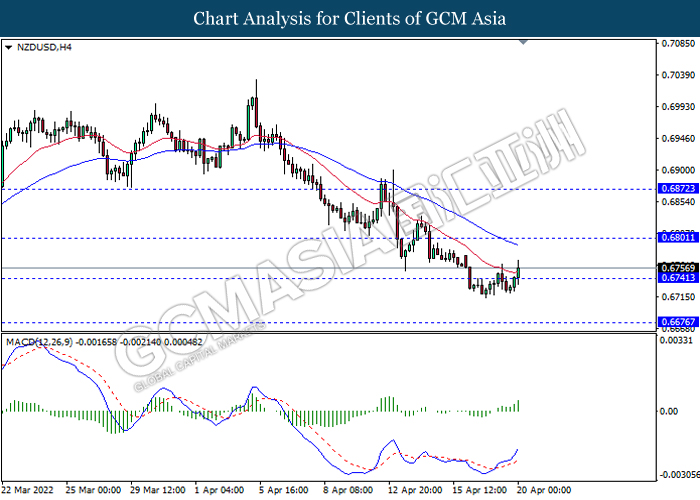

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6800, 0.6870

Support level: 0.6740, 0.6675

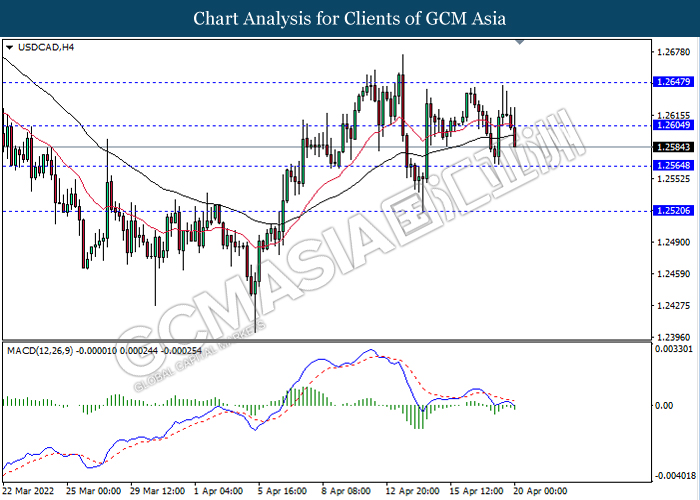

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2605, 1.2645

Support level: 1.2565, 1.2520

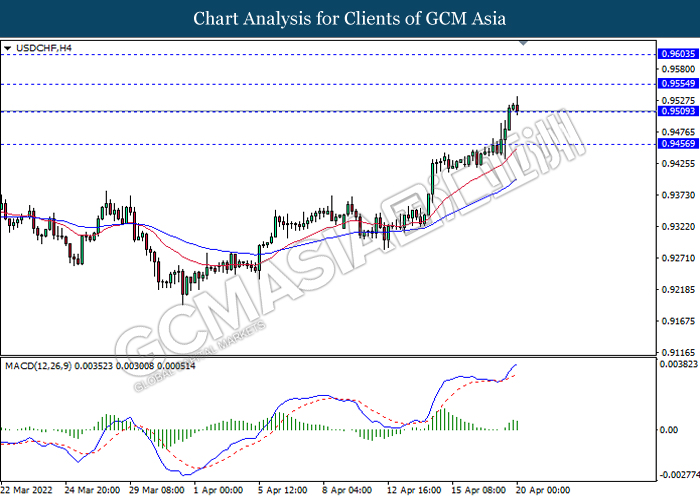

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9555, 0.9605

Support level: 0.9510, 0.9455

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 108.40

Support level: 98.55, 93.70

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1957.85, 1980.75

Support level: 1918.85, 1890.40