21 April 2022 Morning Session Analysis

US Dollar slumped amid bearish economic data.

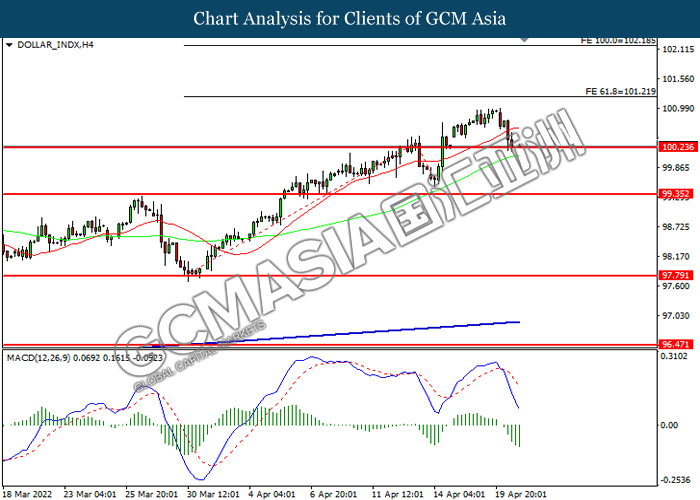

The Dollar Index which traded against a basket of six major currencies retreat from its recent high over the backdrop of bearish economic data, which dialled down the market optimism toward the economic progression in United States. According to National Association of Realtor, US Existing Home Sales notched down from the previous reading of 5.93M to 5.77M, missing the market forecast at 5.80M. The data dropped to the lowest level in nearly two years in March as the house prices raced to a record high, and economist expected the data would decline further with higher mortgage rate in future. Besides, the US Dollar extend its losses following the 10-year Treasury yield retreats from 3-year high, dragging down the appeal for the US Dollar. The yield on the benchmark 10-year Treasury note dipped more than 7 basis point to 2.844%. Though, the overall long-term trend for the US Dollar still remained bullish amid rate hike expectation from Fed during the FOMC meeting in May. As of writing, the Dollar Index depreciated by 0.61% to 100.34.

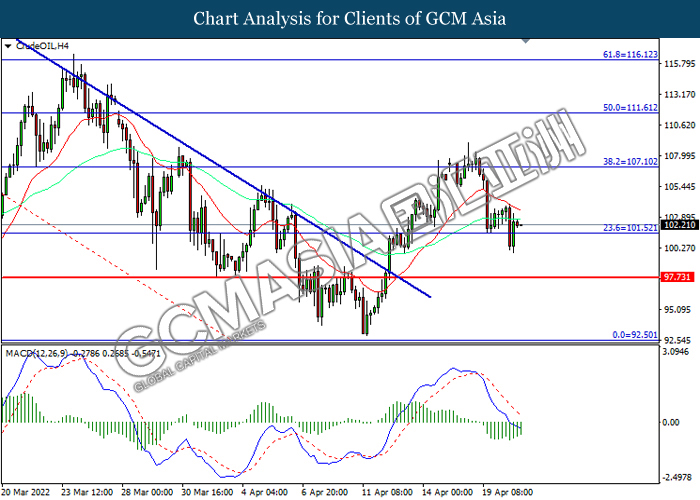

In the commodities market, the crude oil price surged 0.03% to $103.10 per barrel during the early Asian trading hours following the bullish inventory data was released. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at -8.020M, better than the market forecast at 2.471M. On the other hand, the gold price surged 0.03% to $1955.65 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 17:00 | EUR – CPI (YoY) (Mar) | 7.50% | 7.50% | – |

| 20:30 | USD – Initial Jobless Claims | 185K | 175K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Apr) | 27.4 | 20 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 101.20, 102.20

Support level: 100.25, 99.35

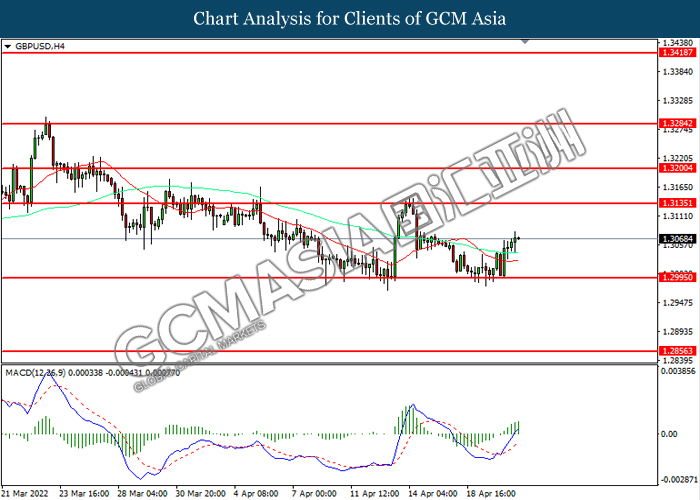

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.3135, 1.3200

Support level: 1.2995, 1.2855

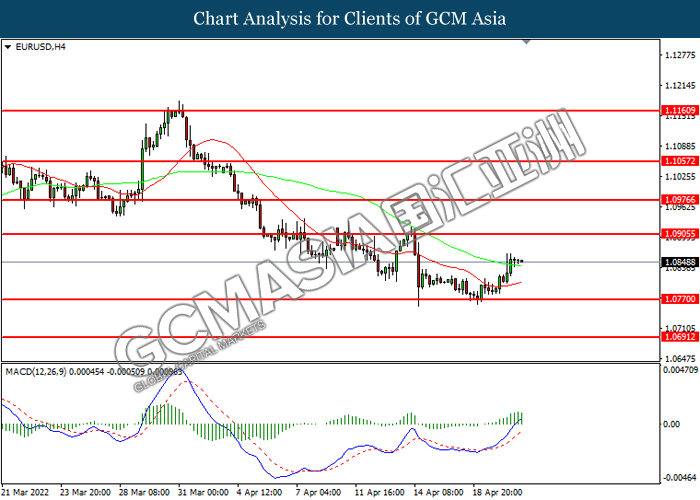

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.0905, 1.0975

Support level: 1.0770, 1.0690

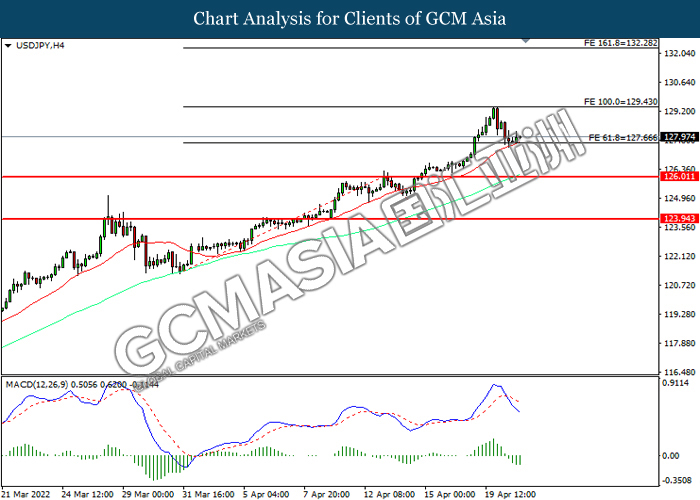

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 129.45, 132.30

Support level: 127.65 , 126.00

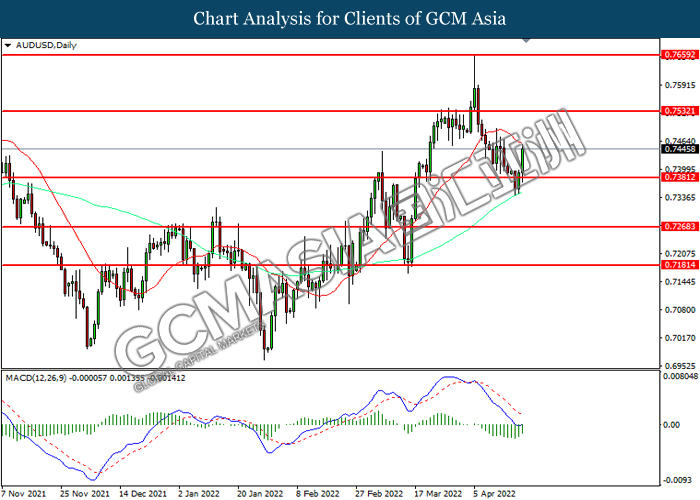

AUDUSD, Daily: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7530, 0.7660

Support level: 0.7380, 0.7270

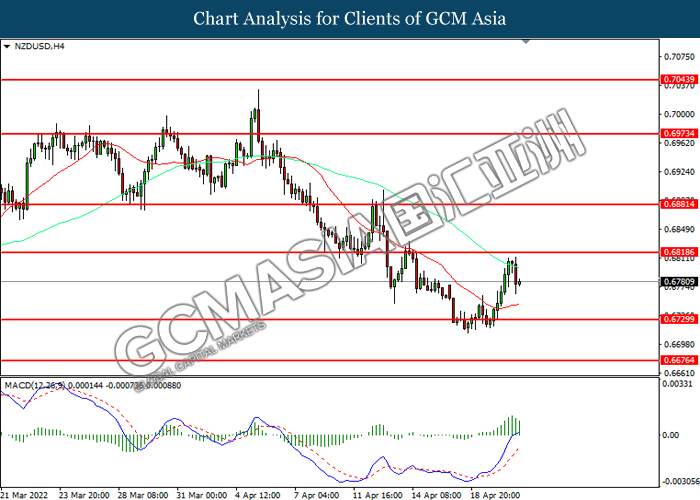

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6820, 0.6880

Support level: 0.6730, 0.6675

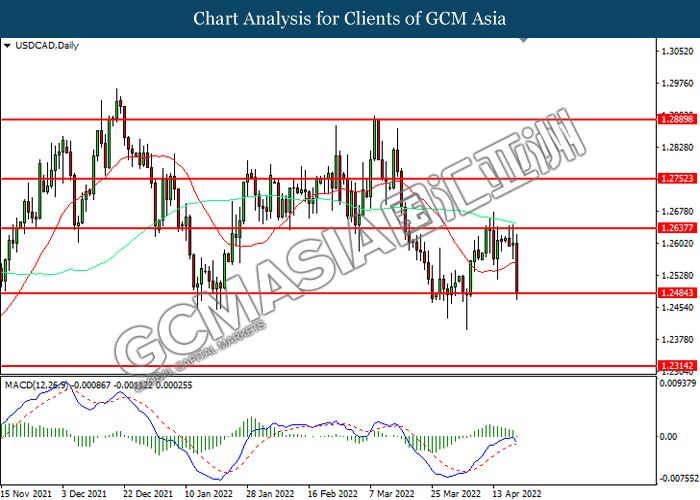

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after it breakout the support level.

Resistance level: 1.2635, 1.2750

Support level: 1.2485, 1.2315

USDCHF, Daily: USDCHF was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains.

Resistance level: 107.10, 111.60

Support level: 101.50, 97.75

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 1963.00, 1975.00

Support level: 1945.05, 1917.95