26 April 2022 Morning Session Analysis

US Dollar surged as risk-off mood in market.

The Dollar Index which traded against a basket of six major currencies surged amid diminishing risk appetite in the global financial market on renewed concerns about rate hike expectation from Fed and the implementation of lockdown from China, which prompting investors to shift their portfolio toward safe-haven Dollar. The global equity market received significant bearish momentum yesterday while the European stocks as well as the Chinese stock market slid to one-month low. Besides, the US Dollar extend its gains following the Federal Reserve unleashed numerous hawkish tones toward the economic progression in the United States region. Market participants currently expected the Federal Reserve to increase the interest rate by 50 basis point during the next monetary policy meeting. Nonetheless, investors would continue to scrutinize the latest updates with regards of the crucial economic data today to gauge the likelihood movement for the US Dollar. As of writing, the Dollar Index appreciated by 0.51% to 101.74.

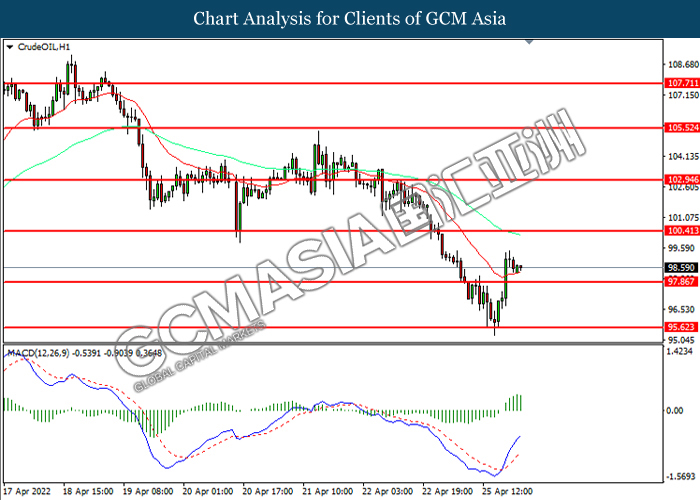

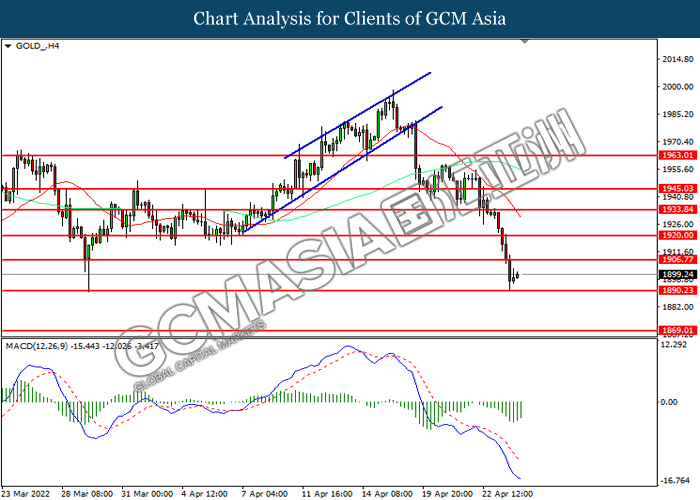

In the commodities market, the crude oil price depreciated by 0.02% to $98.59 per barrel as of writing. The oil market edged lower as the implementation of lockdown policy from China continue to weigh down the appeal for this black-commodity. On the other hand, the gold price depreciated by 0.02% to $1899.85 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.60% | 0.60% | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 107.2 | 108 | |

| 22:00 | USD – New Home Sales (Mar) | 772K | 765K |

Technical Analysis

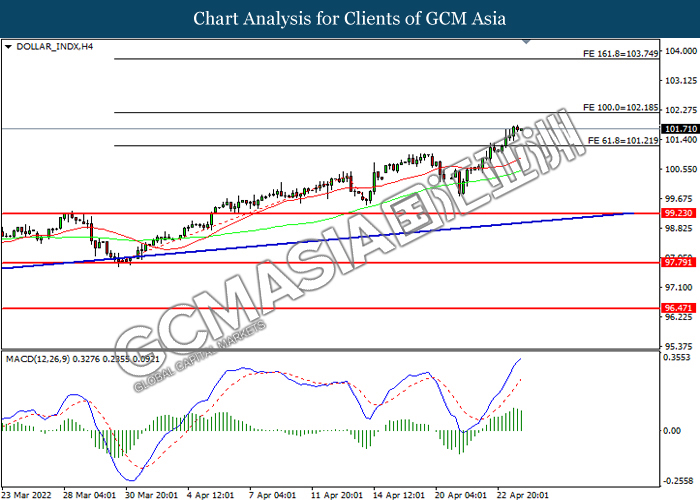

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.20, 103.75

Support level: 101.20, 99.35

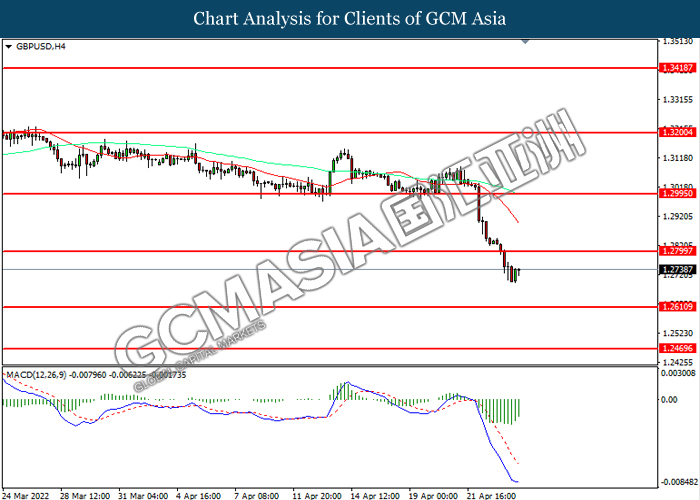

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2800, 1.2995

Support level: 1.2610, 1.2470

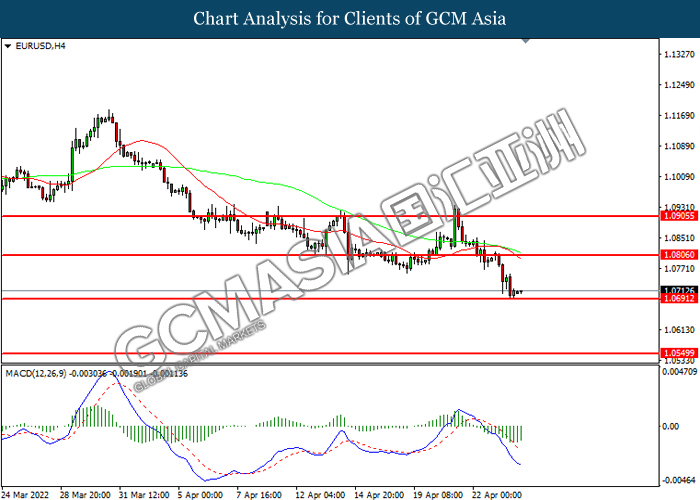

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0805, 1.0905

Support level: 1.0690, 1.0550

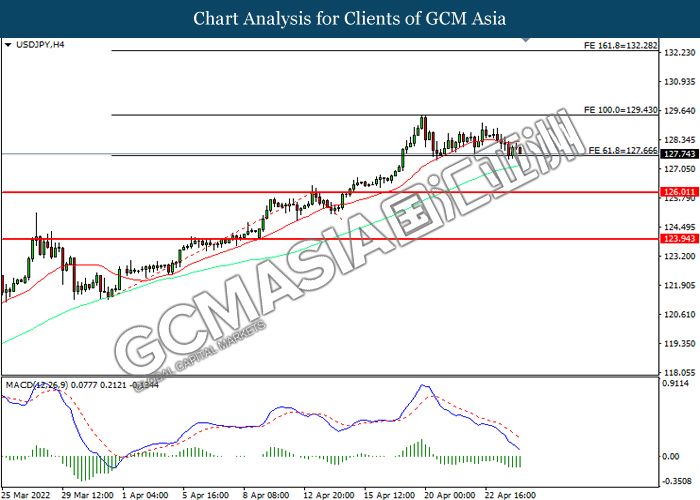

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 129.45, 132.30

Support level: 127.65, 126.00

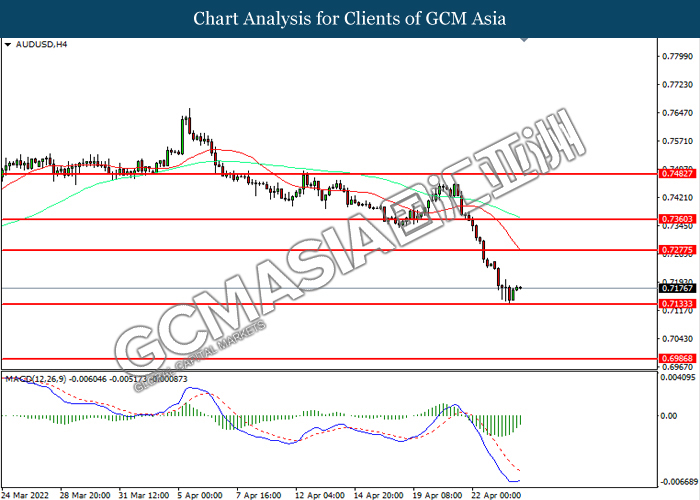

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.7280, 0.7360

Support level: 0.7135, 0.6985

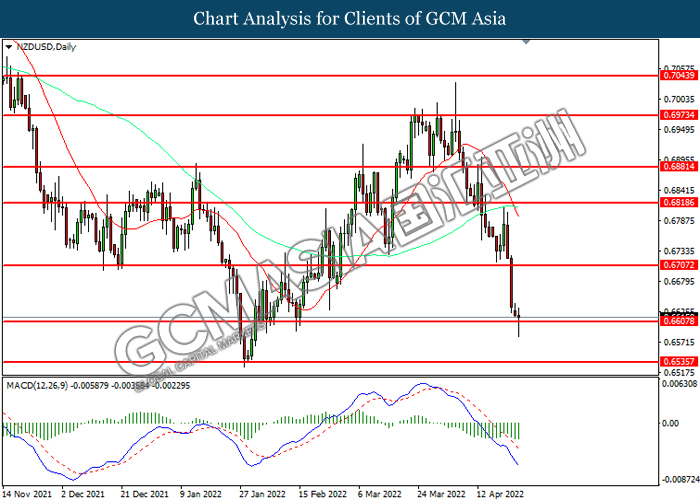

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6705, 0.6820

Support level: 0.6605, 0.6535

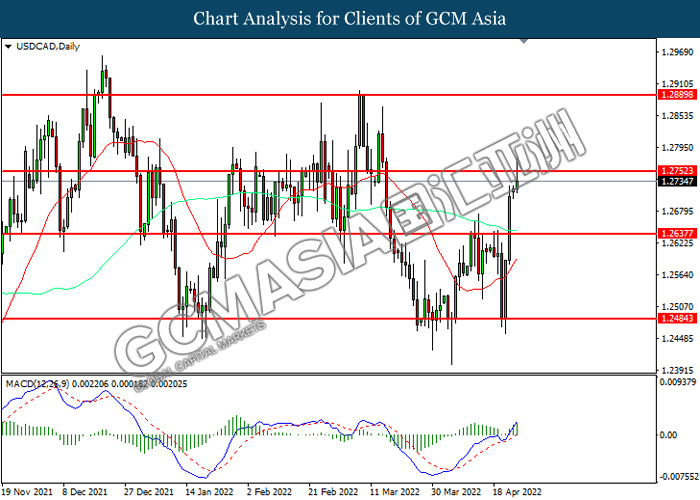

USDCAD, Daily: USDCAD was traded higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2750, 1.2890

Support level: 1.2635, 1.2485

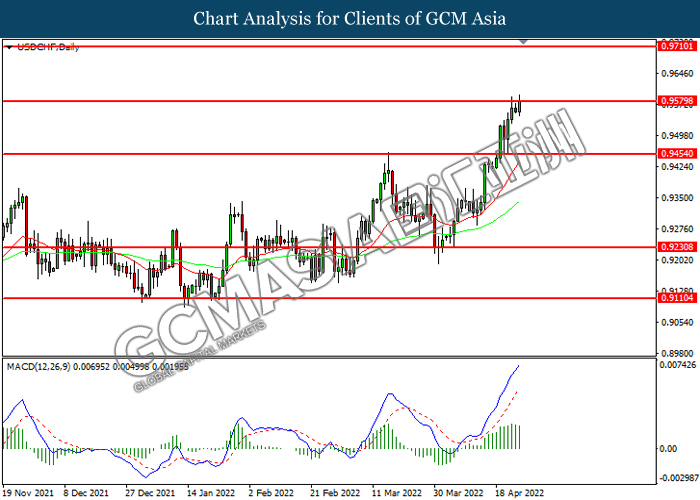

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9580, 0.9710

Support level: 0.9455, 0.9230

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains toward resistance level.

Resistance level: 100.40, 102.95

Support level: 97.85, 95.60

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1906.80, 1920.00

Support level: 1890.25, 1869.00