26 April 2022 Afternoon Session Analysis

Australia Dollar remained bearish amid stagflationary risk.

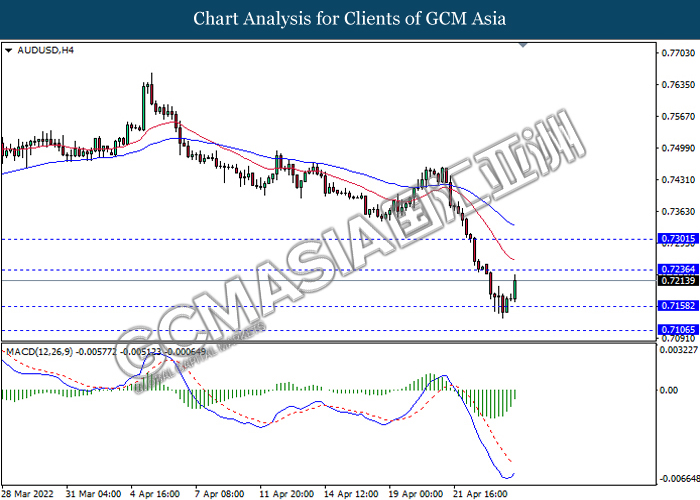

AUDUSD rebounded from its recent low since yesterday. Nonetheless, the overall trend of the pair remained bearish amid the backdrop of rising tensions between Russia-Ukraine. According to Reuters, a senior International Monetary Fund (IMF) officially appeared a warning on Tuesday, which claimed that the Asian region faces a “stagflationary” outlook, citing the Ukraine war, spike in commodity costs and a slowdown in China as creating significant uncertainty. As China was the one of the largest trading partner for Australia, the negative economic progression in China would drag down the market optimism toward economic momentum in Australia region, prompting investors to selloff Australia Dollar. Besides, the AUDUSD pairing receive further pressure following the China Covid-19 fears. China’s capital of Beijing warned over the weekend that the Covid-19 virus had spread undetected in the city for a week, and that more cases would be found with investigation. It stoked a shift market sentiment toward other currencies which having better prospects such as US Dollar, spurring further bearish momentum on the pair. As of writing, AUDUSD edge up by 0.55% to 0.7217.

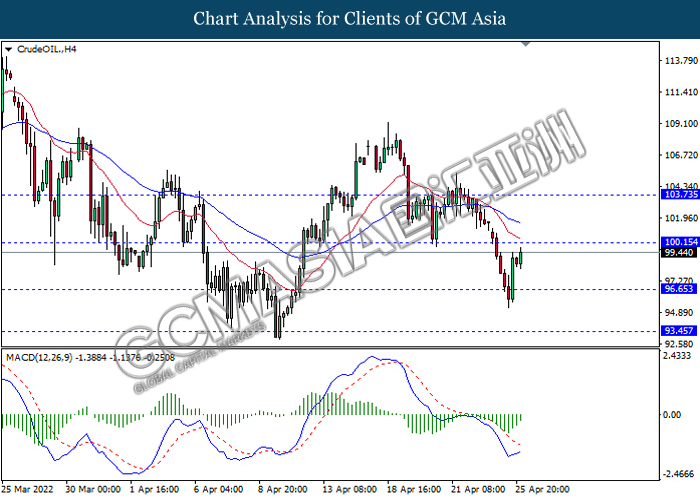

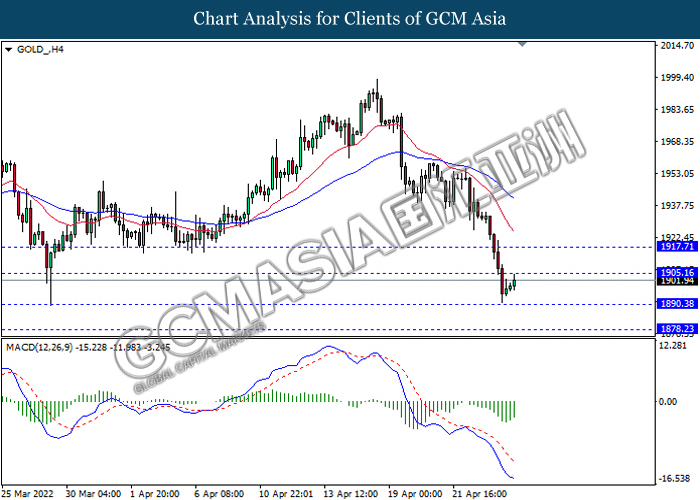

In commodities market, crude oil price appreciated by 1.17% to $99.69 per barrel as of writing after falling sharply the prior session on worries that continued COVID-19 lockdowns in China would eat into demand. On the other hand, gold price appreciated by 0.44% to 1904.40 per troy ounces as of writing following the ease of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Durable Goods Orders (MoM) (Mar) | -0.60% | 0.60% | – |

| 22:00 | USD – CB Consumer Confidence (Apr) | 107.2 | 108 | |

| 22:00 | USD – New Home Sales (Mar) | 772K | 765K |

Technical Analysis

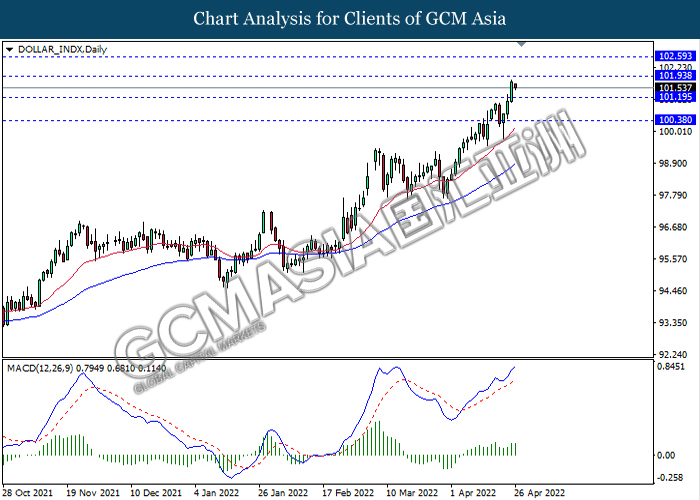

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 101.95, 102.60

Support level: 101.20, 100.40

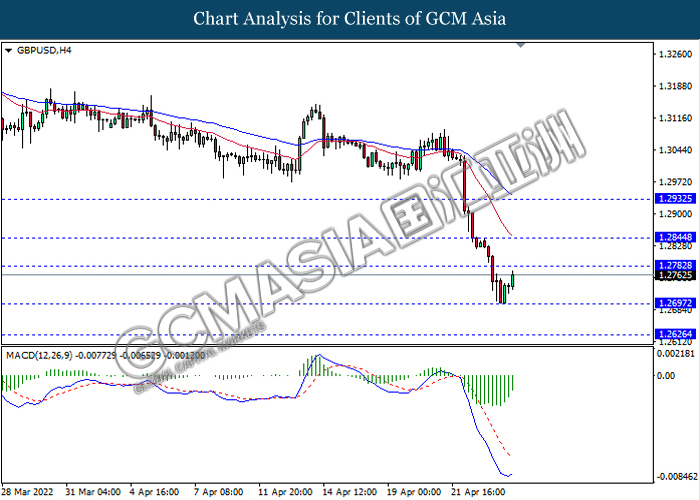

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2780, 1.2845

Support level: 1.2695, 1.2625

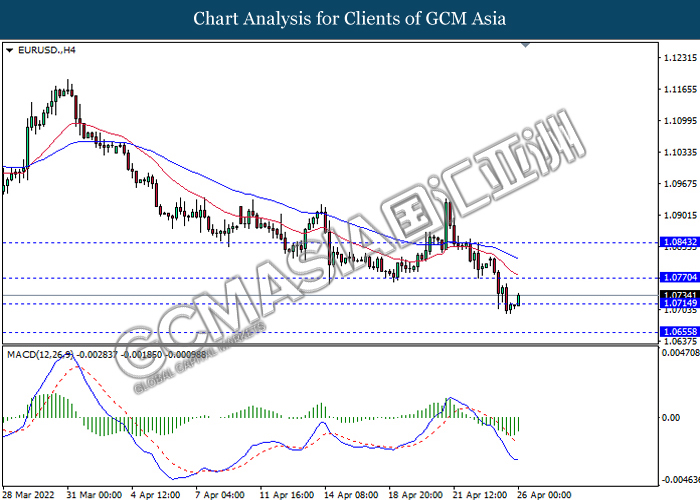

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0770, 1.0845

Support level: 1.0715, 1.0655

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 128.00, 129.05

Support level: 127.05, 126.10

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.7235, 0.7300

Support level: 0.7160, 0.7105

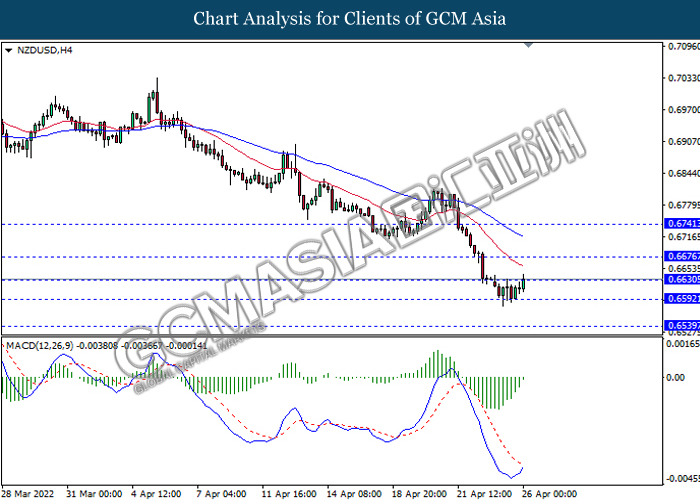

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6675, 0.6740

Support level: 0.6630, 0.6590

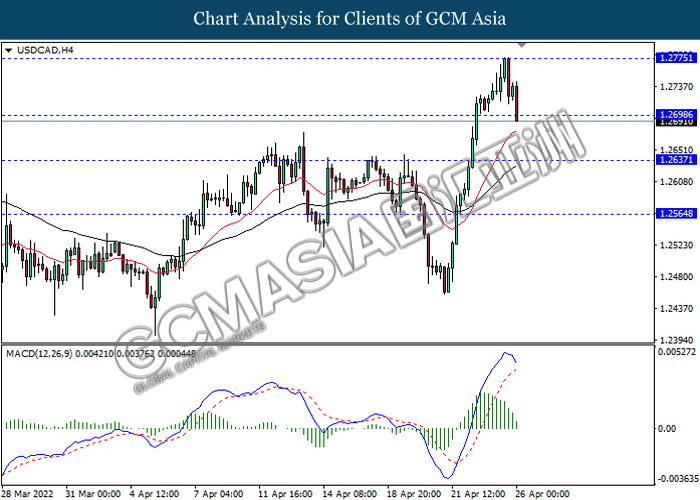

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2700, 1.2775

Support level: 1.2635, 1.2565

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9605, 0.9640

Support level: 0.9555, 0.9510

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 100.15, 103.75

Support level: 96.65, 93.45

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1905.15, 1917.70

Support level: 1890.40, 1878.25