29 April 2022 Morning Session Analysis

US Dollar surged on risk-off mood.

The Dollar Index which traded against a basket of six major currencies extend its gains amid the rising tensions between Russia-Ukraine issues continue to weigh down the economic prospect in the European region, which stoked a shift in sentiment toward the safe-haven US Dollar. According to Wall Street Journal, Germany is now ready to stop buying Russian oil, clearing the way for a European Union ban on crude imports from Russia. The compromise from Germany would likely to increase the likelihood that EU countries will agree on a phased-in embargo on Russian oil, with a decision possible as soon as next week. The implementation of sanction would jeopardize the global economic growth as well as sparked further stagflation risk in future. Nonetheless, the gains experienced by the US Dollar was limited by bearish economic data. According to Bureau of Economic Analysis, US Gross Domestic Product (GDP) for last quarter came in at -1.4%, missing the market forecast at 1.1%. As of writing, the Dollar Index surged 0.69% to 103.67.

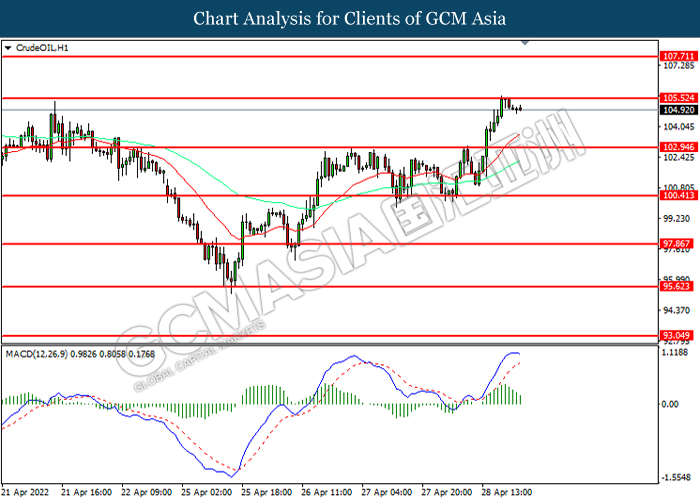

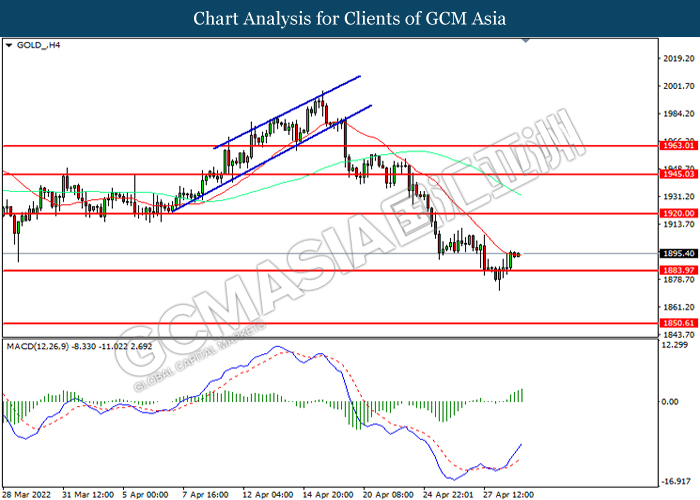

In the commodities market, the crude oil price extends its gains by 0.10% to $105.35 per barrel as of writing. The oil market received significant bullish momentum yesterday as market participants speculated that the EU would implement sanction on Russian oil supply in the short-term basis. On the other hand, the gold price appreciated by 0.02% to $1894.15 per troy ounces amid risk-off sentiment in the financial market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q1) | -0.30% | 0.20% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.40% | 7.40% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.20% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after breakout.

Resistance level: 103.60, 105.95

Support level: 100.85, 97.80

GBPUSD, Weekly: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2625, 1.2935

Support level: 1.2245, 1.2010

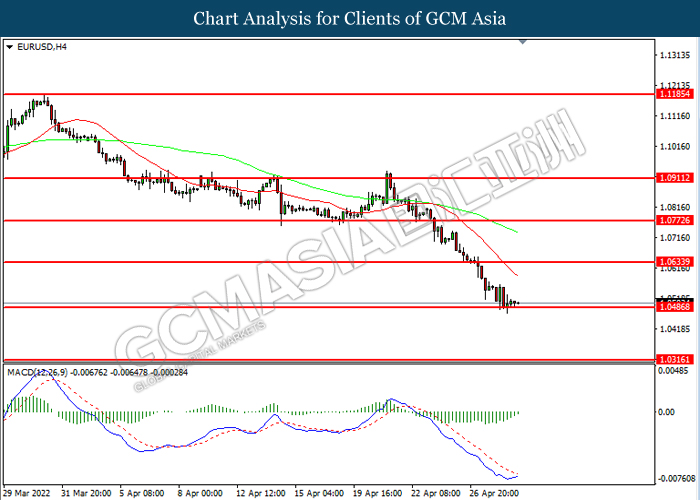

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

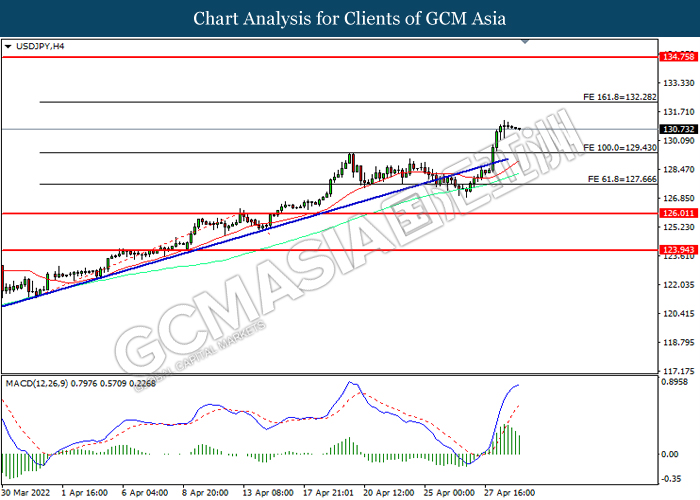

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 132.30, 124.75

Support level: 129.45, 127.65

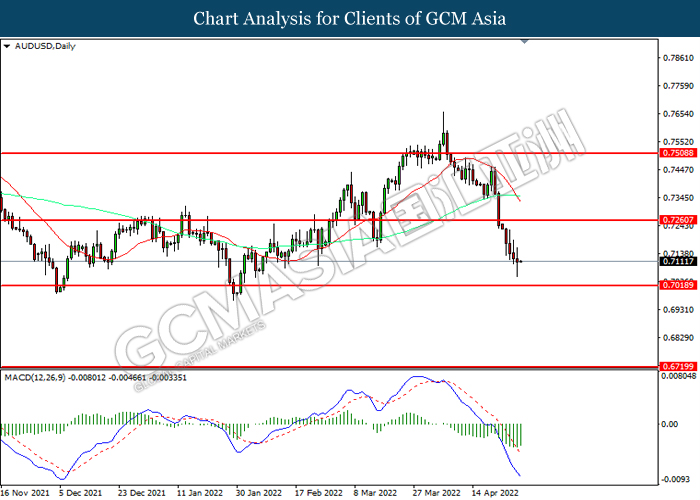

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.7260, 0.7510

Support level: 0.7020, 0.6720

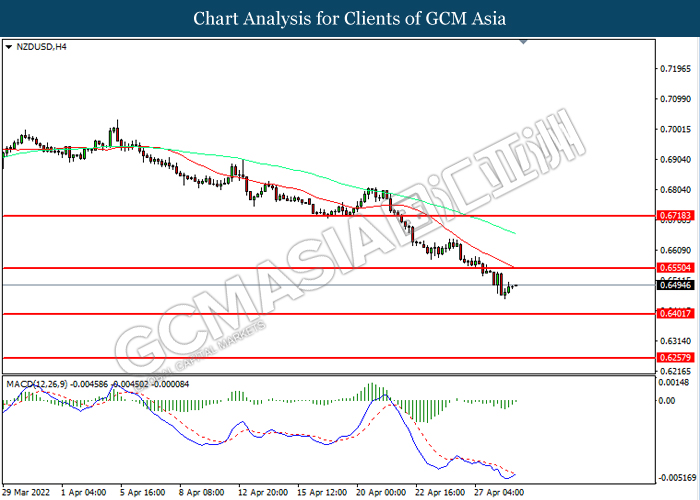

NZDUSD, Daily: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6550, 0.6720

Support level: 0.6400, 0.6260

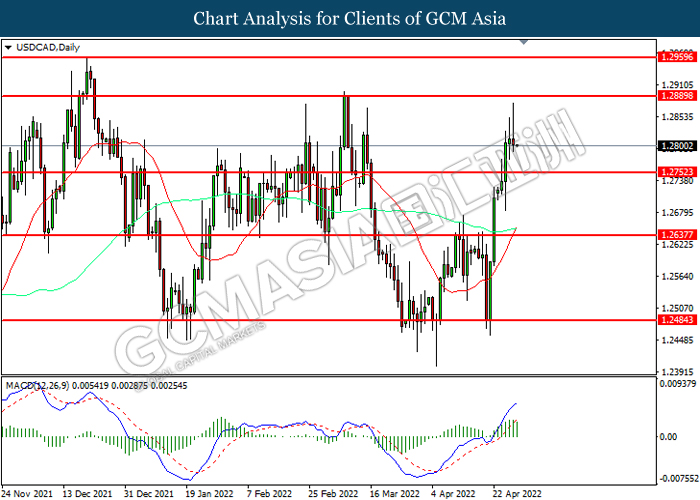

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2890, 1.2960

Support level: 1.2750, 1.2635

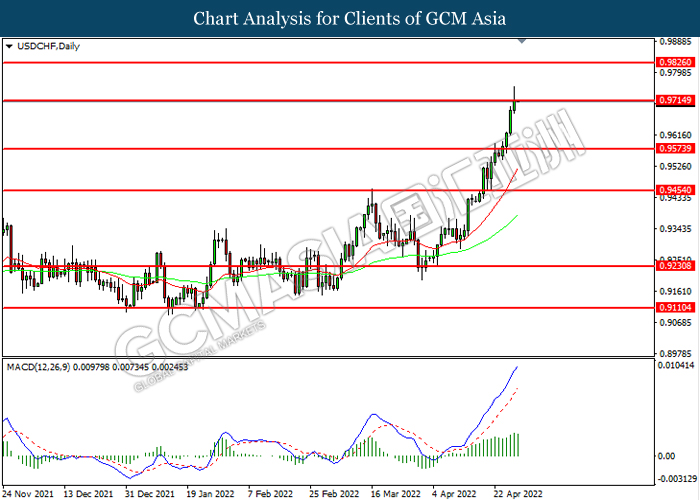

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9715, 0.9825

Support level: 0.9575, 0.9455

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 105.50, 107.70

Support level: 102.95, 100.40

GOLD_, H4: Gold price was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1920.00, 1945.05

Support level: 1883.95, 1850.60