29 April 2022 Afternoon Session Analysis

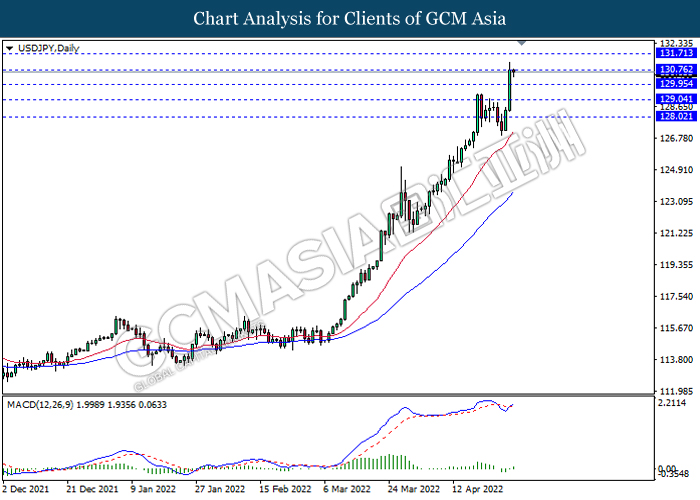

USDJPY spiked over dovish tone from Bank of Japan.

USDJPY surged to its recent high yesterday amid the backdrop of dovish statement from Bank of Japan (BoJ), which spurred further bullish momentum on the pair. According to Reuters, the BoJ strengthened its commitment on Thursday to keep interest rates ultra-low by vowing to buy unlimited amounts of bonds daily to defend its yield target. Besides, Lee Hardman, a currency analyst at MUFG Bank in London has claimed that the BoJ gave the ‘all clear’ to continue selling the yen. The ultra-low interest rate in Japan would diminish the risk-off return of the investors, dialed down the market optimism toward Japanese Yen. Furthermore, the low interest rate was implemented as economic progression of a country was bad, indicating the economic progression of Japan might be worse than the market expectation, prompting investors to shift their capitals toward other currencies which having better prospects such as US Dollar. As of writing, USDJPY edged down by 0.10% to 130.72

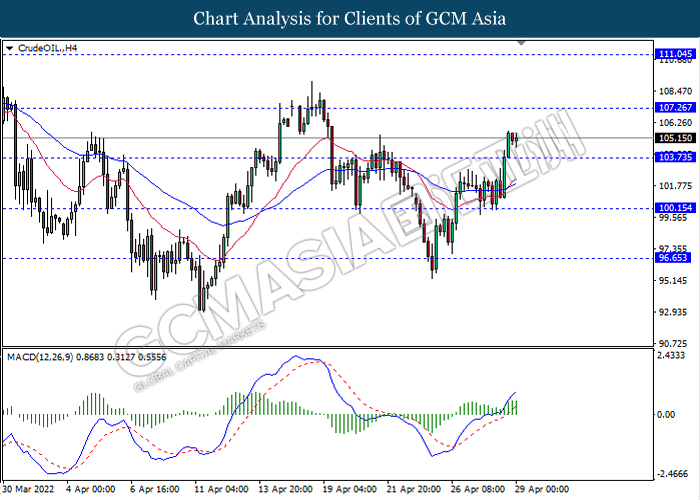

In commodities market, crude oil price depreciated by 0.28% to $105.05 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish following the supply disruption fears as Western sanctions curb crude and products exports from Russia underpinned prices. On the other hand, gold price appreciated by 0.51% to $1900.90 per troy ounces as of writing over the soaring inflation driven up inflation-hedged assets demand such as gold.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German GDP (QoQ) (Q1) | -0.30% | 0.20% | – |

| 17:00 | EUR – CPI (YoY) (Apr) | 7.40% | 7.40% | – |

| 20:30 | CAD – GDP (MoM) (Feb) | 0.20% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 103.75, 104.30

Support level: 103.15, 102.60

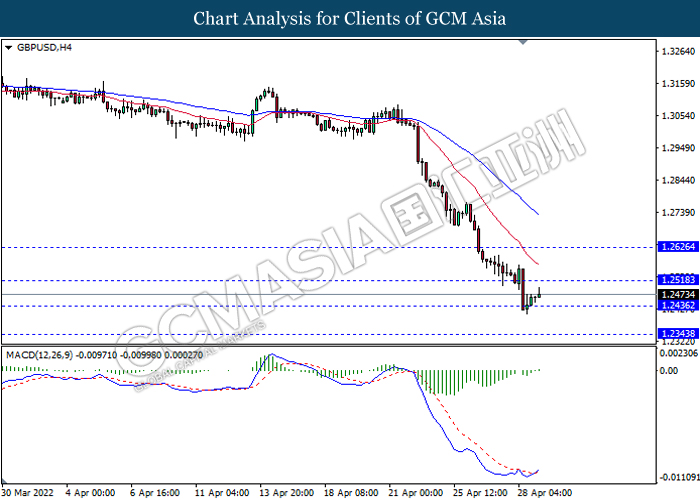

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2520, 1.2625

Support level: 1.2435, 1.2345

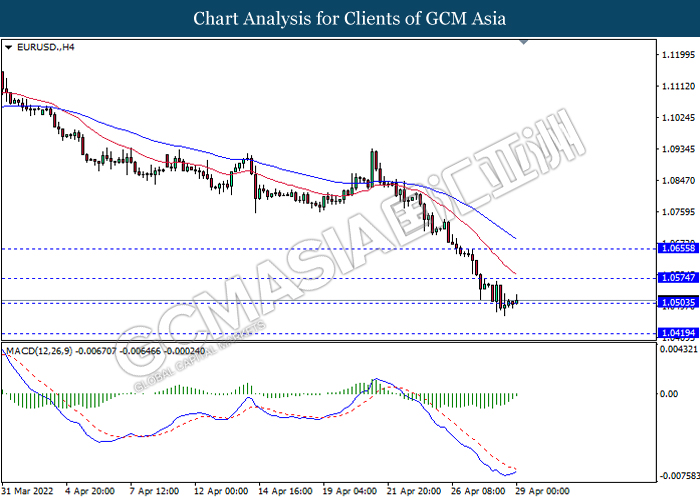

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

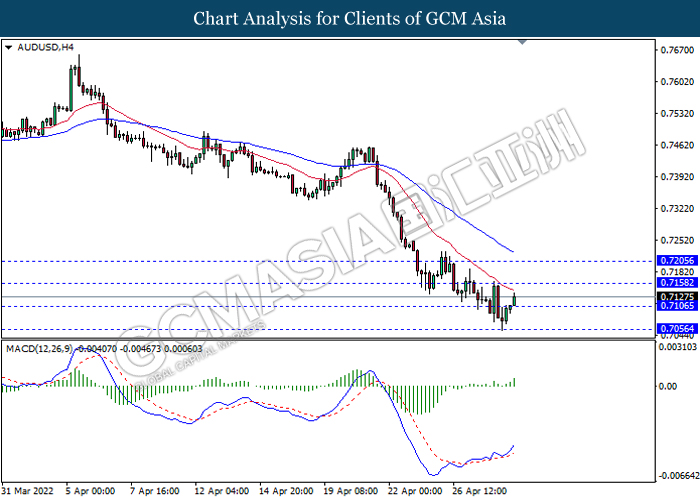

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains

Resistance level: 0.7160, 0.7205

Support level: 0.7105, 0.7055

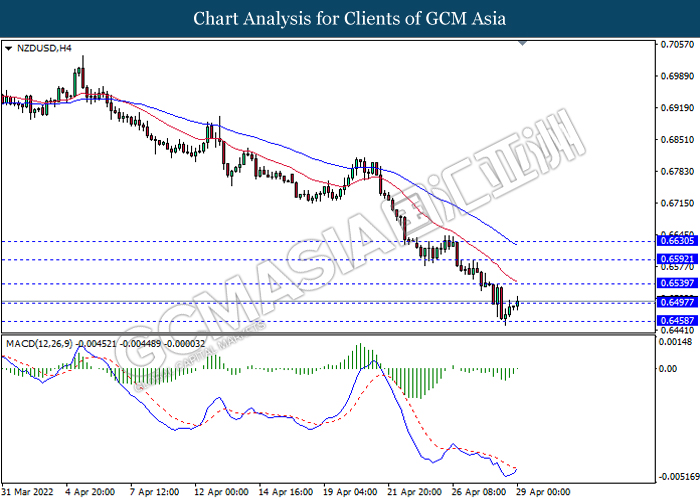

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6540, 0.6590

Support level: 0.6495, 0.6460

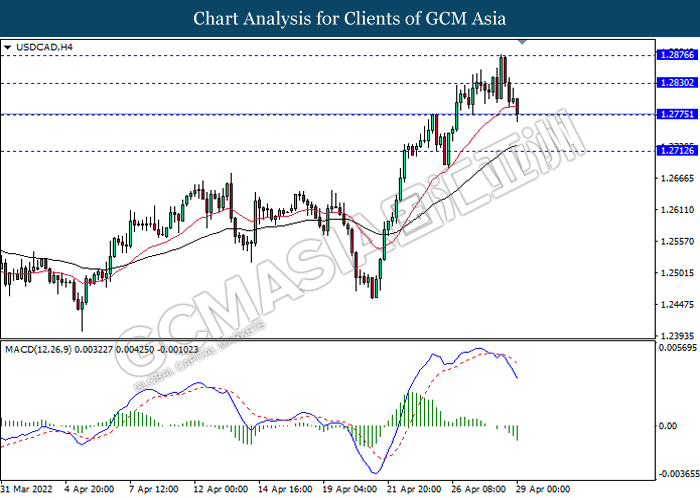

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.2830, 1.2875

Support level: 1.2775, 1.2710

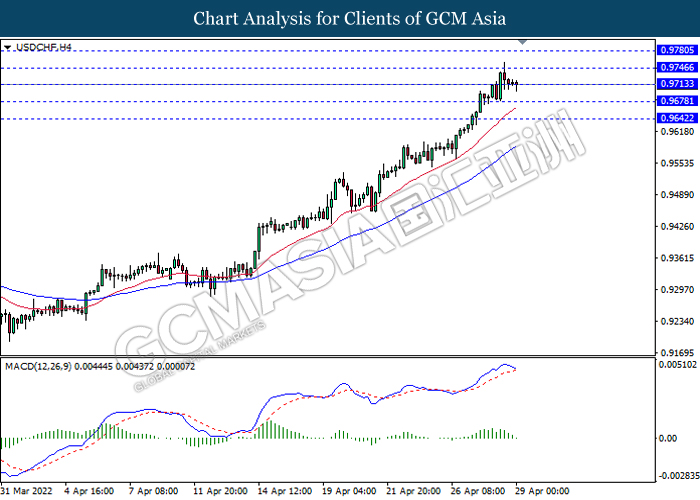

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9745, 0.9780

Support level: 0.9715, 0.9680

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.25, 111.05

Support level: 103.75, 100.15

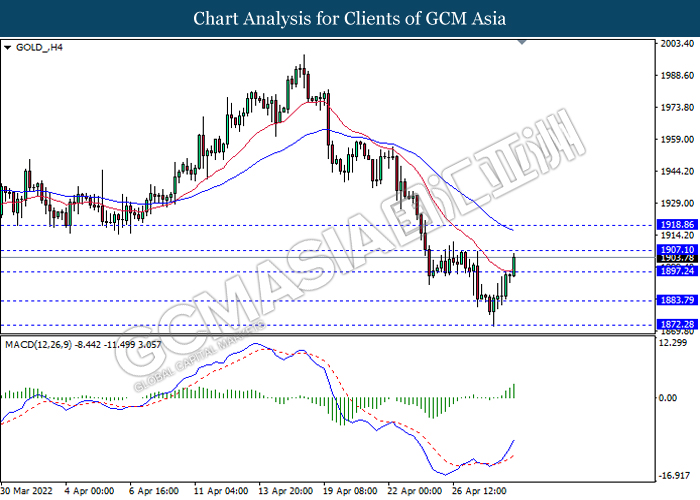

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1907.10, 1918.85

Support level: 1897.25, 1883.80