9 May 2022 Afternoon Session Analysis

CAD slumped as bearish data.

The Canada Dollar slumped over the backdrop of a string of bearish economic data last week, which dialing down the market optimism toward the economic progression in Canada. According to Statistic Canada, the Canada Employment Change notched down significantly from the previous reading of 72.5K to 15.3K, missing the market forecast at 55.0K. The employment Change is a measure of the change in the number of employed people in Canada. Generally speaking, a drop in this indicator has negative implications for consumer spending which spurring negative prospect toward the economic momentum. Besides, Canada claimed that they would continue to provide Ukraine with all kinds of humanitarian and financial assistance. This year’s state budget of Canada provides another 4 1 billion for a loan to Ukraine through the IMF mechanism. Currently, the tensions between Ukraine-Russia intensified, spurring further concerns the impact of the Russian invasion toward the Canada’s economy. As of writing, USD/CAD increased by 0.24% to 1.2937.

In the commodities market, the crude oil price depreciated by 0.60% to $110.45 per barrel. The oil market slumped amid the fears upon the global recession could dampen oil demand, though investors are currently eying EU talks on the implementation of sanction upon Russia to receive further trading signal. On the other hand, the gold price depreciated by 0.40% to $1876.15 per troy ounces as of writing amid rate hike expectation from Fed.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

N/A

Technical Analysis

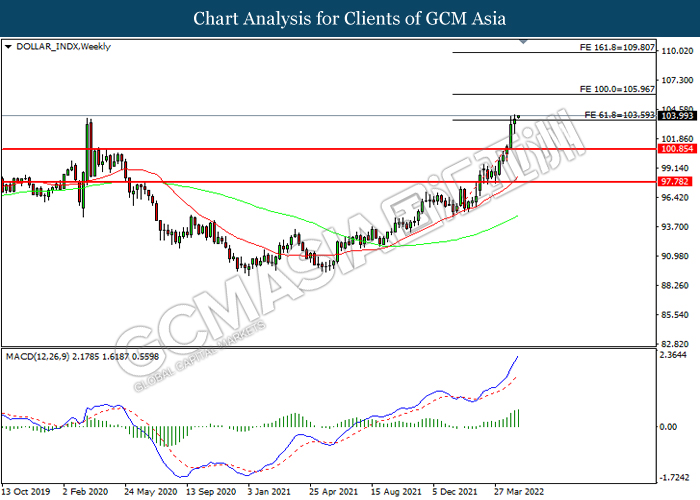

DOLLAR_INDX, Weekly: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains toward resistance level.

Resistance level: 105.95, 109.80

Support level: 103.60, 100.85

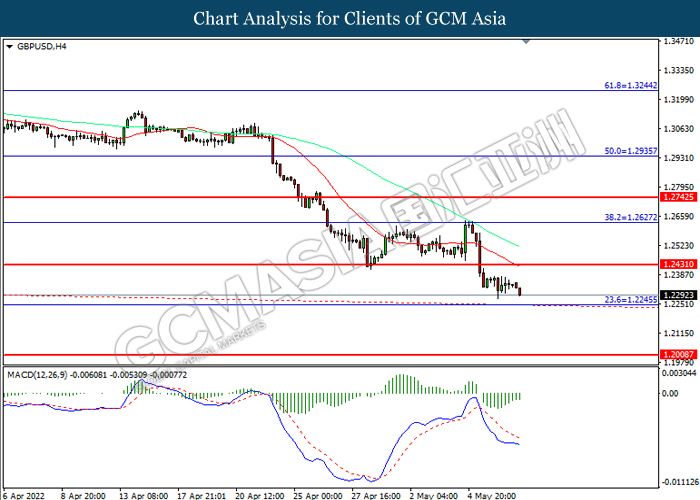

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

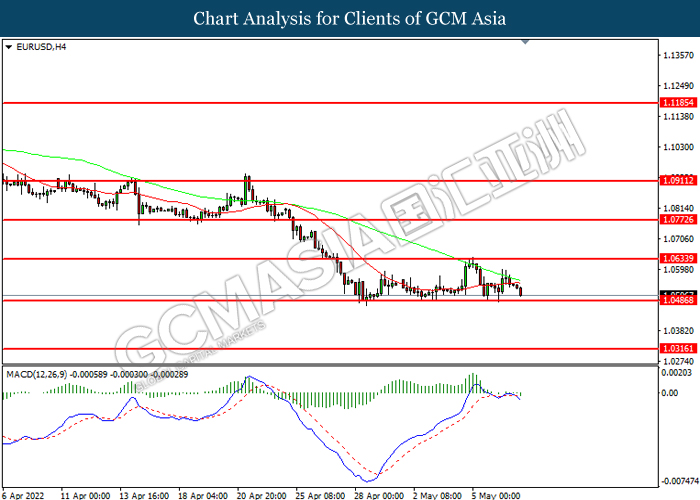

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout below the support level.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

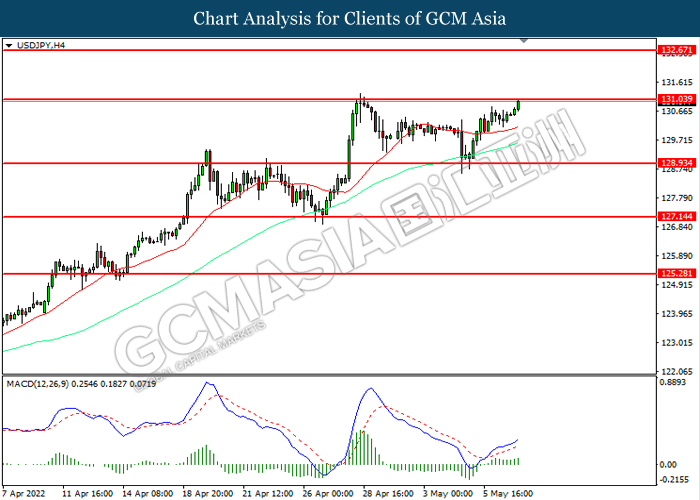

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after it breakout the resistance level.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

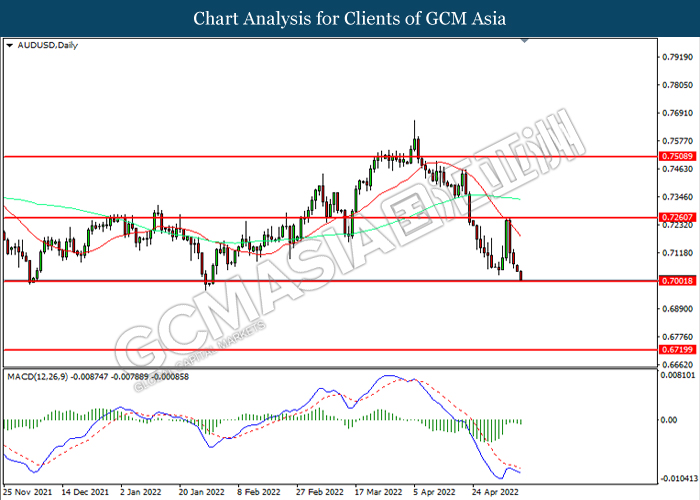

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after it breakout.

Resistance level: 0.7260, 0.7510

Support level: 0.7000, 0.6720

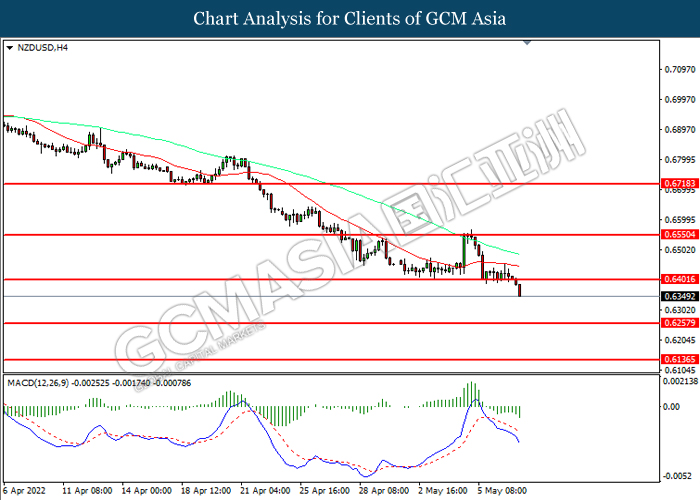

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

USDCAD, Daily: USDCAD was traded higher while currently testing the resistance level at 1.2960. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2960, 1.3060

Support level: 1.2865, 1.2735

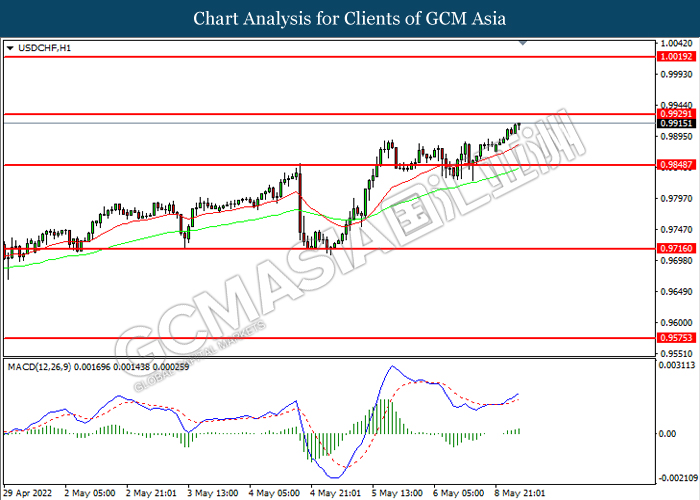

USDCHF, H1: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9930, 1.0020

Support level: 0.9850, 0.9715

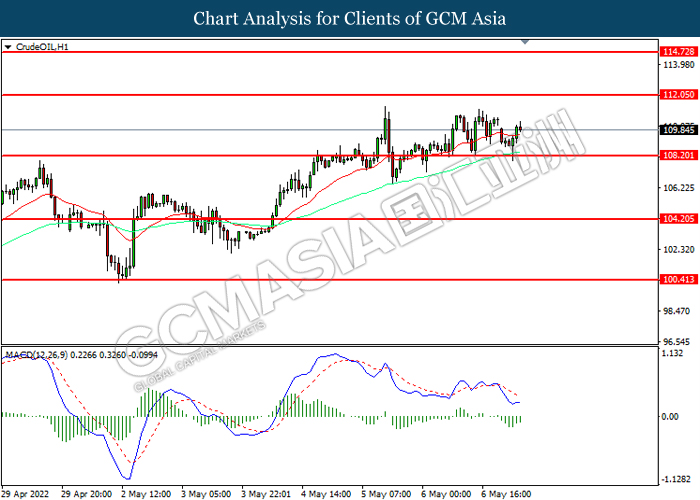

CrudeOIL, H1: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains toward resistance level at 112.05.

Resistance level: 112.05, 114.75

Support level: 108.20, 104.20

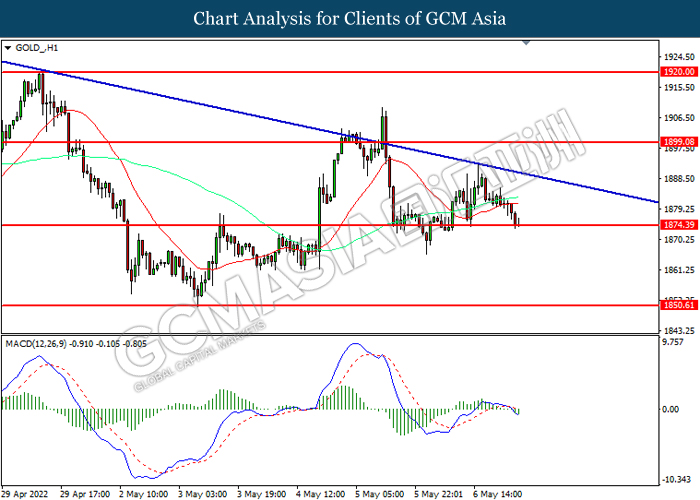

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1899.10, 1920.00

Support level: 1874.40, 1850.60