11 May 2022 Morning Session Analysis

US Dollar surged on US inflation data expectation.

The Dollar Index which traded against a basket of six major currencies rallied on Wednesday amid the backdrop of inflation data expectation from the market. According to Reuters, investors will closely eye the April consumer price index reading on Wednesday for any signs inflation may be starting to cool, with expectations calling for a 8.1% annual increase compared to the 8.5% rise recorded in March. Nonetheless, the inflation fears continue to hover over the market, which would likely to lead Federal Reserve to imply another rate hike decision in the next FOMC meetings. The implementation of rate hike from Fed would diminish the US Dollar circulation in the market, dialed up the market optimism toward US Dollar. Besides, higher interest rate would increase investors’ risk-off return, prompting investors to shift their capitals toward safe-haven Dollar. For now, investors would continue to scrutinize the update of US Core Consumer Price Index (CPI) MoM economic data in order to gauge the likelihood movement of Dollar Index. As of writing, the Dollar Index edged up by 0.24% to 103.93.

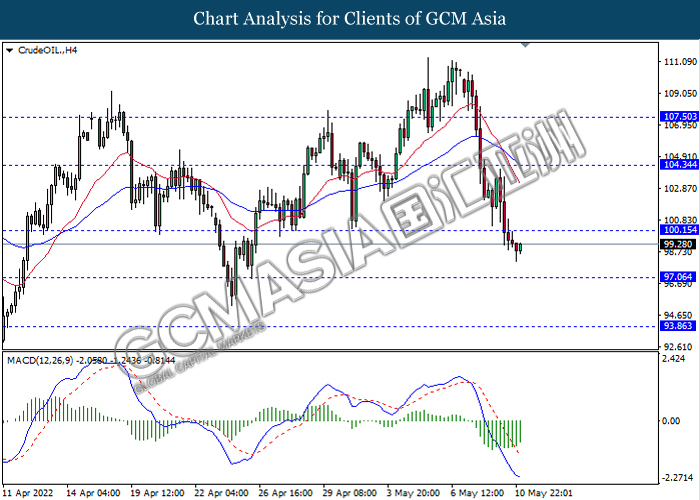

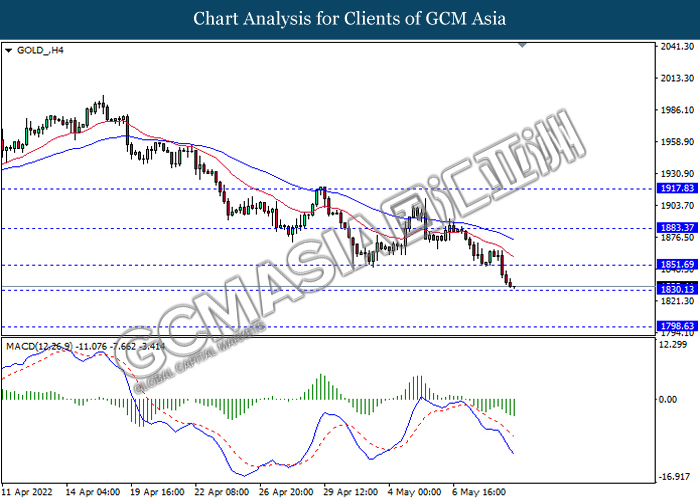

In commodities market, crude oil price depreciated by 0.40% to $99.33 per barrel as of writing following the Covid-19 lockdowns in China, which reducing the demand of crude oil. On the other hand, gold price eased by 0.31% to $1835.30 per troy ounce as of writing over the strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.3% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (Apr) | 1.2% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 1.302M | -0.829M | – |

Technical Analysis

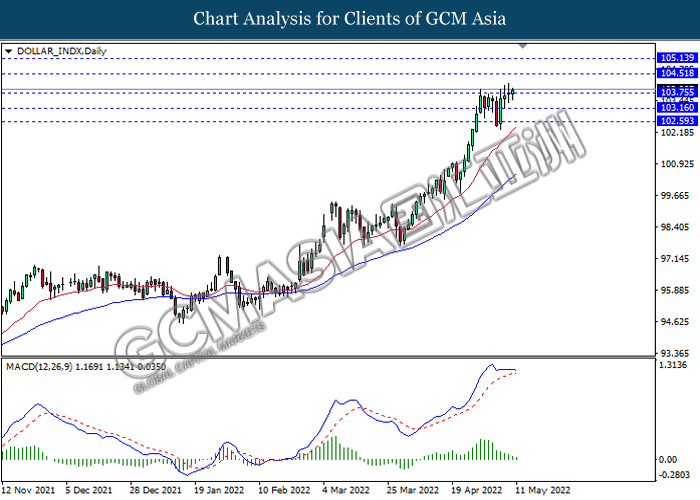

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 104.50, 105.15

Support level: 103.75, 103.15

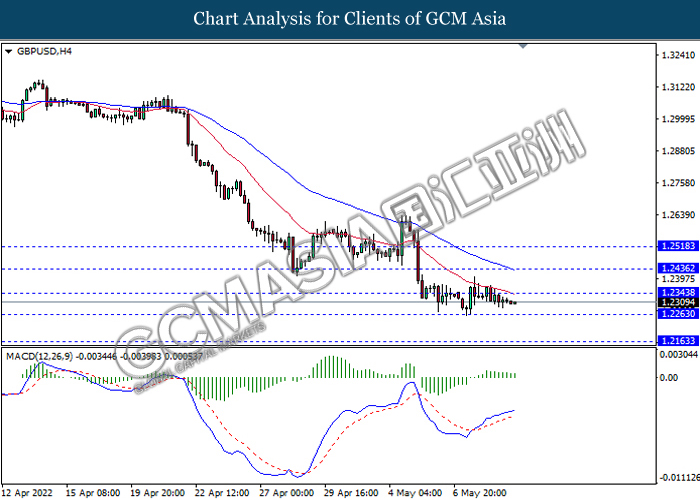

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2345, 1.2435

Support level: 1.2265, 1.2165

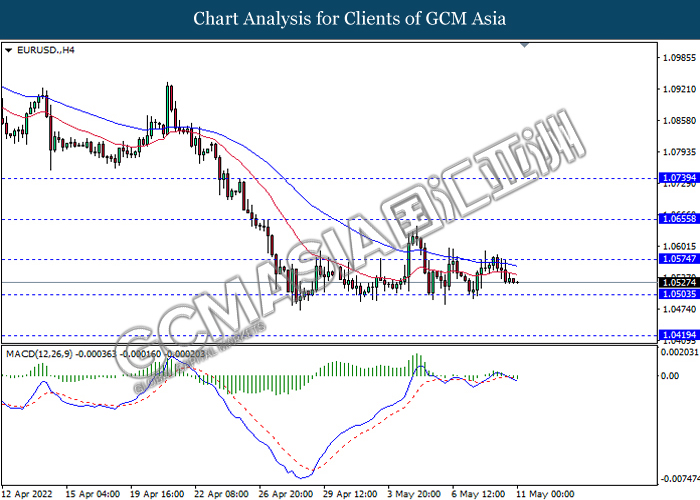

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.0575, 1.0655

Support level: 1.0505, 1.0420

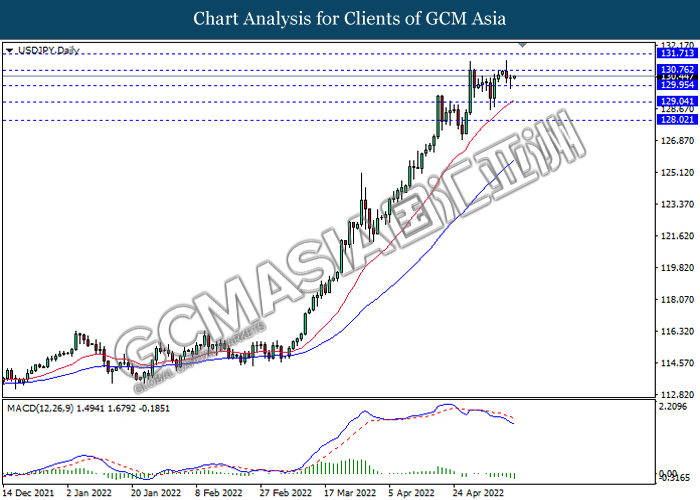

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to be extend its gains.

Resistance level: 130.75, 131.70

Support level: 129.95, 129.05

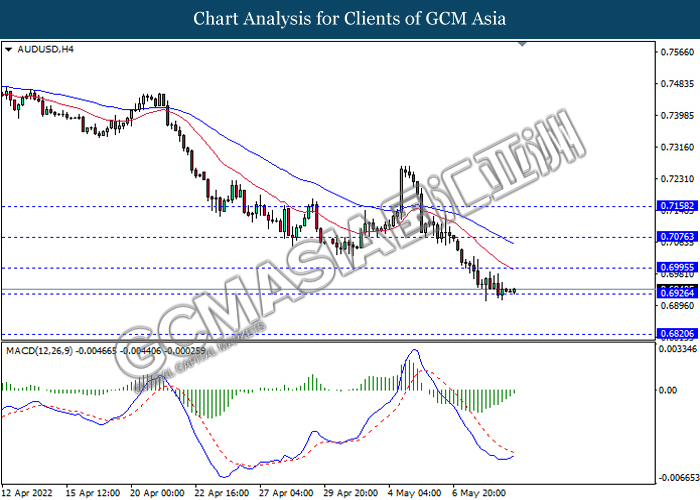

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6995, 0.7075

Support level: 0.6925, 0.6820

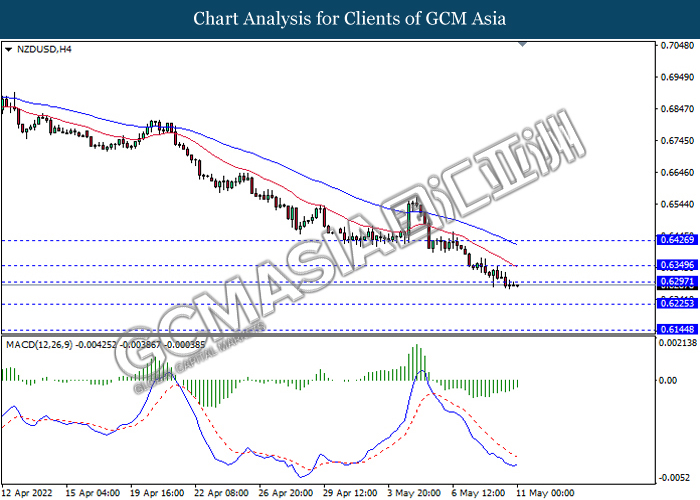

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

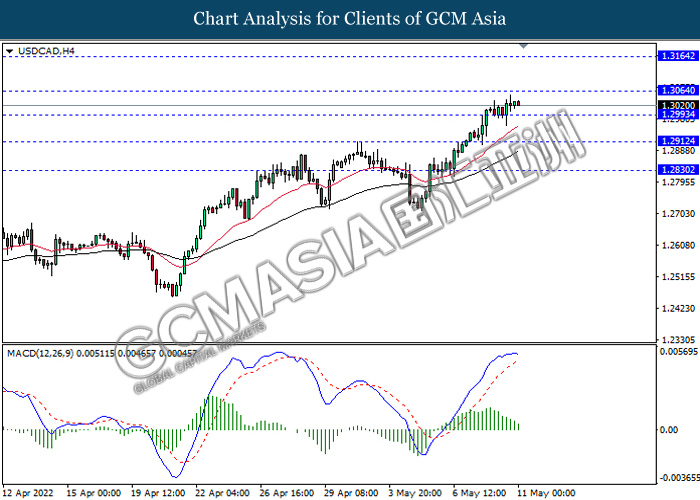

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3065, 1.3165

Support level: 1.2995, 1.2910

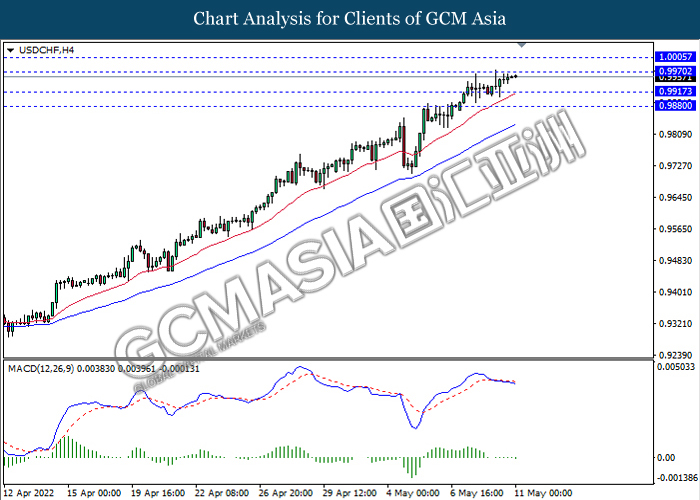

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9970, 1.0005

Support level: 0.9915, 0.9880

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 100.15, 104.35

Support level: 97.05, 93.85

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses if successfully breakout the support level.

Resistance level: 1851.70, 1883.35

Support level: 1830.15, 1798.65