11 May 2022 Afternoon Session Analysis

Antipodean currencies slumped amid bearish China economic outlook.

The Chinese-proxy currencies such as Australia Dollar and New Zealand Dollar extend their losses following the rising inflation risk in China continue to spark higher cost for their major trade partner. The China’s consumer prices surged significantly last month amid the logistic disruption caused by strict Covid-19 lockdown. According to the National Bureau of Statistics (NBS), the official consumer price index (CPI) in China rose significantly by 2.1% in April from a year earlier, up from the previous reading of 1.5% in March. The food prices in China also rose by 1.9% last month compared to a year earlier. Meanwhile, the official producer price index (PPI) rose by 8% in April from a year earlier, which also fared higher than the market expectation at 7.7%. The above-estimate Chinese consumer and producer price inflation data, reflecting the supply chain disruption issues in China, which also dialing down further market optimism toward the economic momentum in Australian and New Zealand. As of writing, AUD/USD depreciated by 0.03% to 0.6950 and NZD/USD slumped 0.02% to 0.6328.

In the commodities market, the crude oil price appreciated by 2.03% to $101.45 per barrel as of writing. The oil market edged higher mostly due to technical correction. Nonetheless, investors would continue to scrutinize the latest updates with regards of further China and US economic data to gauge the likelihood prospect for the global economic growth to determine the demand outlook for this black-commodity. On the other hand, the gold price depreciated by 0.08% to $1837.00 per troy ounces as of writing amid rate hike expectation from global central bank.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core CPI (MoM) (Apr) | 0.3% | 0.4% | – |

| 20:30 | USD – CPI (MoM) (Apr) | 1.2% | 0.2% | – |

| 22:30 | USD – Crude Oil Inventories | 1.302M | -0.829M | – |

Technical Analysis

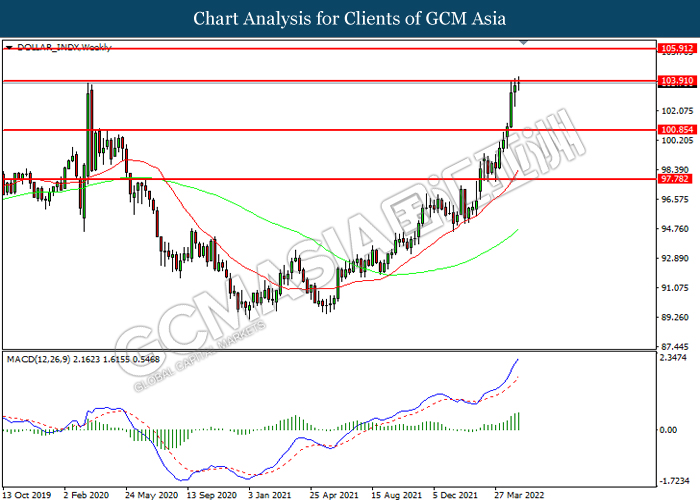

DOLLAR_INDX, Weekly: Dollar index was traded higher while currently testing the resistance level at 103.90. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it breakout the resistance level.

Resistance level: 103.90, 105.90

Support level: 100.85, 97.80

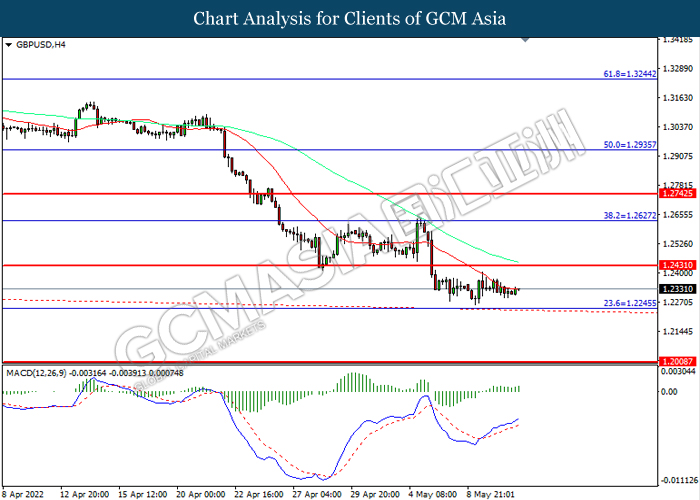

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

EURUSD, H4: EURUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

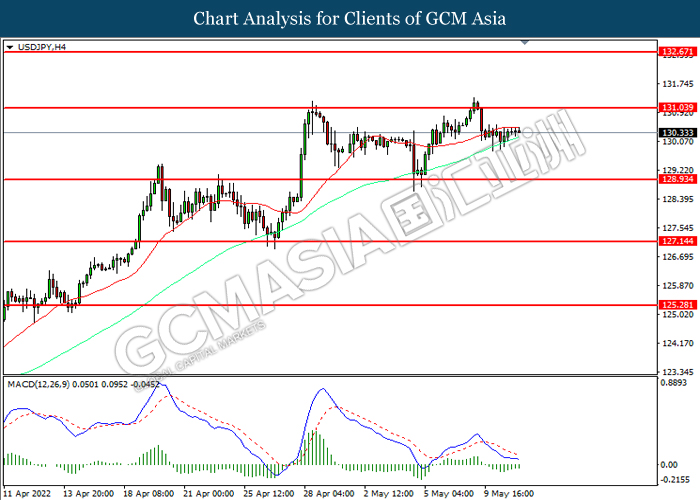

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

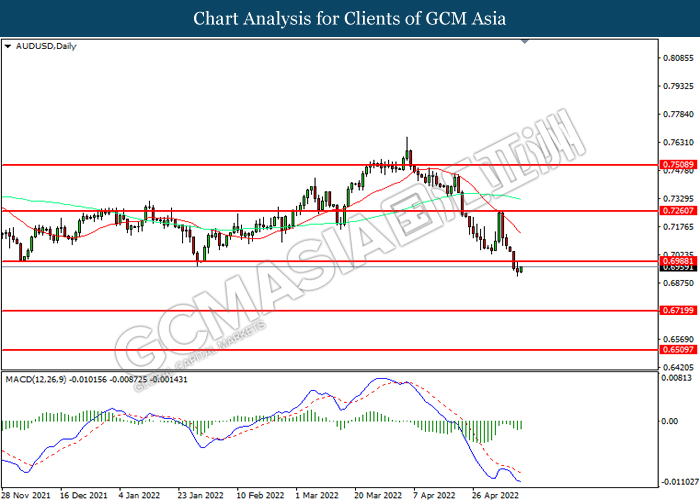

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7000, 0.7260

Support level: 0.6720, 0.6510

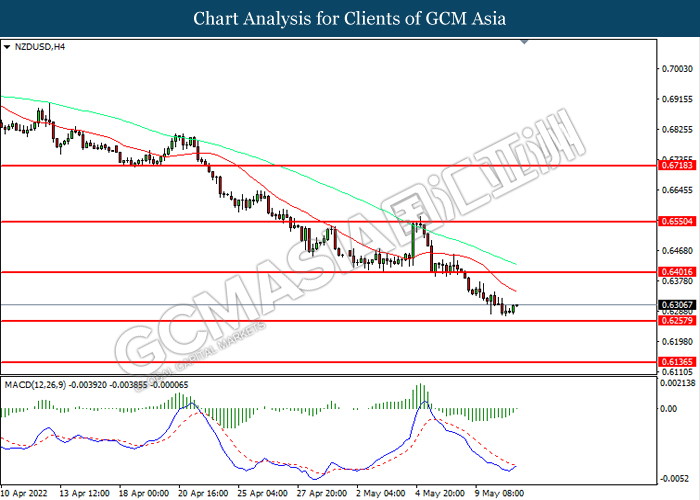

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

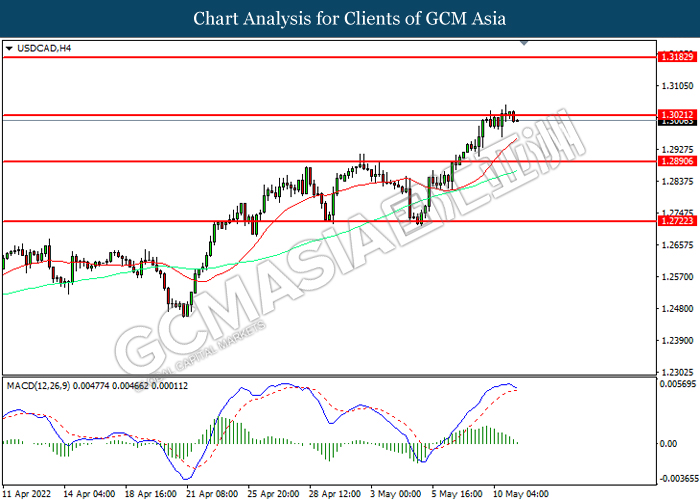

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3020. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3020, 1.3185

Support level: 1.2890, 1.2720

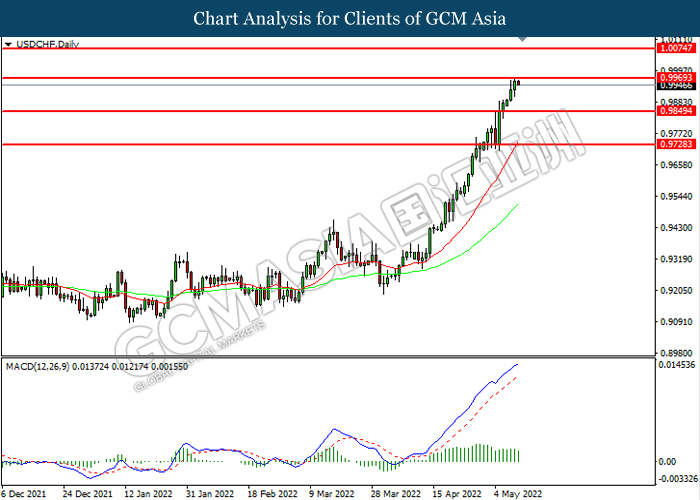

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9970, 1.0075

Support level: 0.9850, 0.9730

CrudeOIL, H1: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 102.80, 104.20

Support level: 100.40, 98.15

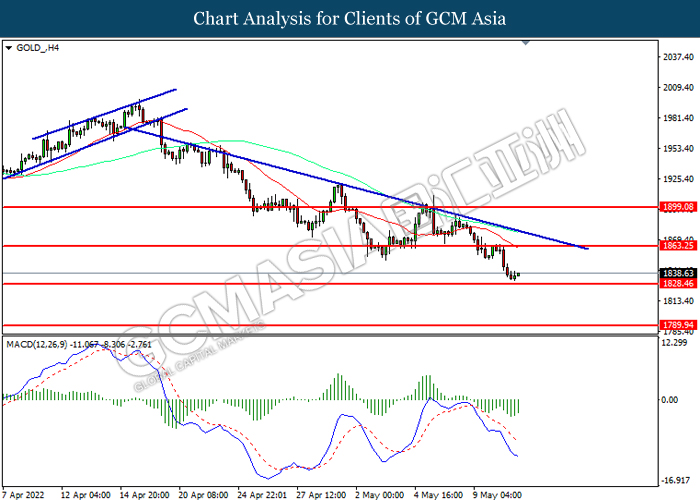

GOLD_, H4: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1863.25, 1899.10

Support level: 1828.45, 1789.95