12 May 2022 Afternoon Session Analysis

Euro hovered recent low despite hawkish tone from ECB.

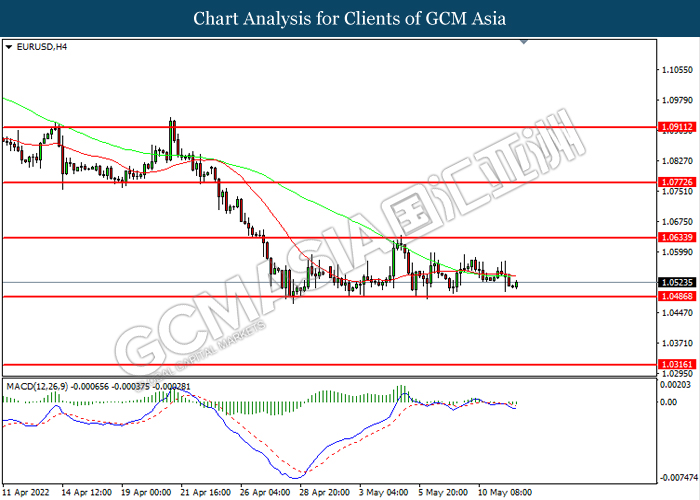

The Euro hovered at recent low despite European Central Bank unleashed hawkish tone toward the monetary policy in future amid the strengthening of US Dollar continue to weigh down the pair of EUR/USD. According to Financial Time, The European Central Bank President Christine Lagarde signaled that she would support increasing the ECB’s main interest rate in July, leading economists to declare that the first increase for more than a decade is almost certain to go ahead. Besides, she also reiterated that the central bank would reduce its bond buying program early in the third quarter. She added that such aggressive contractionary monetary policy for price stability would be critical in ensuring businesses and households’ expectation of future inflation did not rise further. As of writing, EUR/USD appreciated by 0.05% to 1.0516.

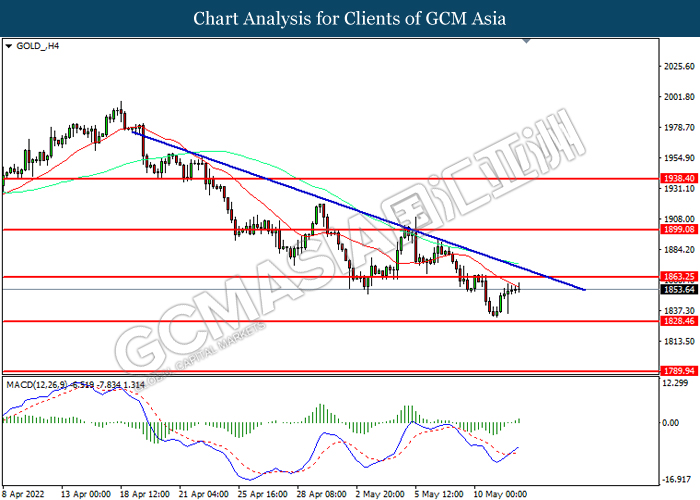

In the commodities market, the crude oil price depreciated by 0.82% to $104.40 per barrel as of writing over the backdrop for bearish inventory data. According to Energy Information Administration (EIA), the US Crude Oil Inventories notched up significantly form the previous reading of 1.302M to 8.487M, higher than the market forecast at -0.457M. On the other hand, the gold price appreciated by 0.12% to $1854.85 per troy ounces amid spiking inflation risk in global financial market continue to prompt investors to shift their portfolio toward safe-haven gold to hedge against the inflation risk.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

16:00 USD IEA Monthly Report

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – GDP (QoQ) (Q1) | 1.3% | 1.0% | – |

| 14:00 | GBP – Manufacturing Production (MoM) (Mar) | -0.4% | -0.5% | – |

| 20:30 | USD – Initial Jobless Claims | 200K | 194K | – |

| 20:30 | USD – PPI (MoM) (Apr) | 1.4% | 0.5% | – |

Technical Analysis

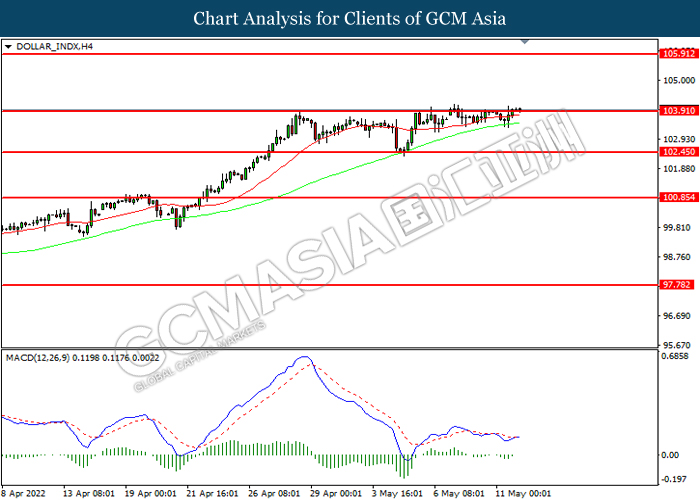

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level at 103.90. MACD which illustrated increasing bullish momentum suggest the index to extend its gains after it breakout the resistance level.

Resistance level: 103.90, 105.90

Support level: 102.45, 100.85

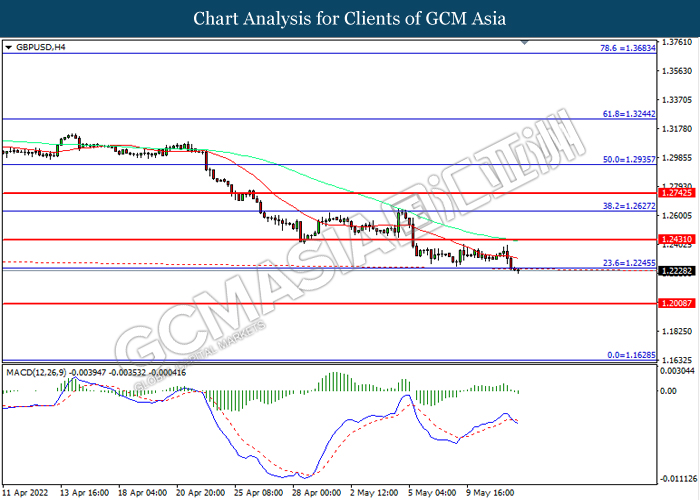

GBPUSD, H4: GBPUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2430, 1.2625

Support level: 1.2245, 1.2010

EURUSD, H4: EURUSD was traded lower while currently near the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.0635, 1.0775

Support level: 1.0485, 1.0315

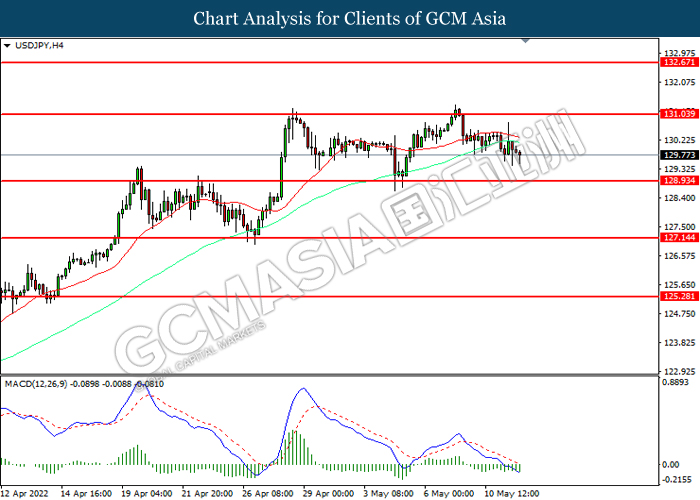

USDJPY, H4: USDJPY was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.05, 132.65

Support level: 128.95, 127.15

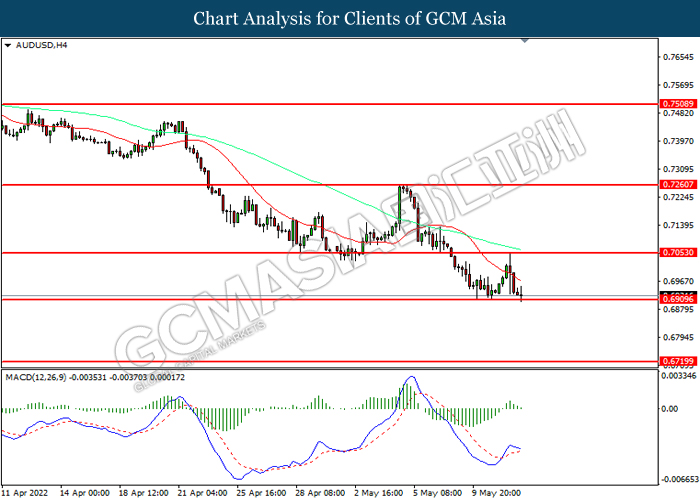

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.7055, 0.7260

Support level: 0.6910, 0.6720

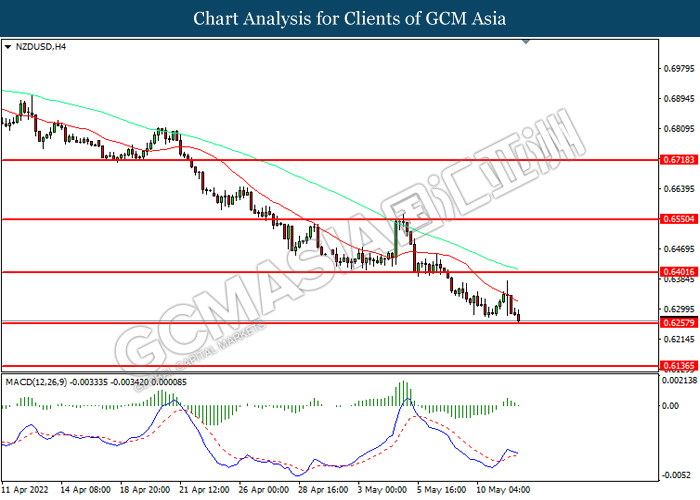

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6400, 0.6550

Support level: 0.6260, 0.6135

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level at 1.3020. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.3020, 1.3185

Support level: 1.2890, 1.2720

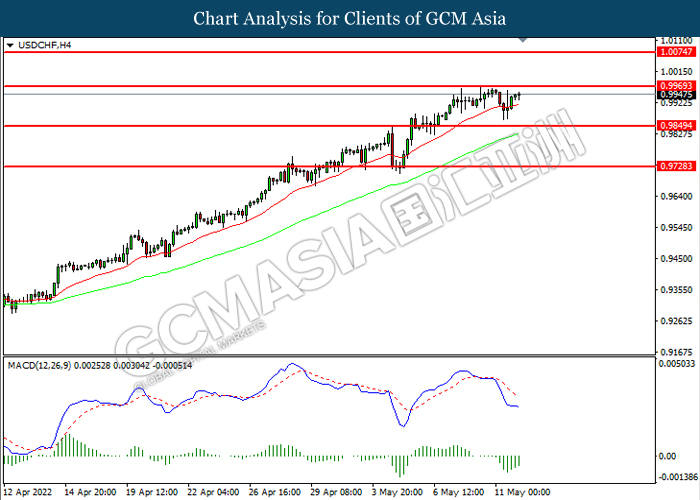

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9970, 1.0075

Support level: 0.9850, 0.9730

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 106.65, 110.35

Support level: 104.05, 101.45

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains after breakout the resistance level.

Resistance level: 1863.25, 1899.10

Support level: 1828.45, 1789.95