13 May 2022 Morning Session Analysis

US Dollar remained bullish following Fed’s hawkish tone.

The Dollar Index which traded against a basket of six major currencies surged since Thursday over the hawkish speech from Federal Reserve. According to Reuters, Federal Reserve Chair Jerome Powell appeared a speech on Thursday, which claimed that stabilizing the prices was the “bedrock” of the economy. He reiterated that the U.S. central bank’s battle to control inflation would “include some pain” as the impact of higher interest rates is felt, but that the worse outcome would be for prices to continue speeding ahead. As the war-driven inflation risk keep hovering in the market, Fed would likely to implement another aggressive tightening monetary policy in the next FOMC meeting, says 75 basic points rate hike in order to combat inflation. The soaring interest rate would increase the risk-off return of investors, prompting investors to shift their capitals toward US Dollar which having better prospects. At the moment, investors would continue to focus on the latest updates with regards of the rate hike decisions from Fed in order to receive further trading signals. As of writing, the Dollar Index appreciated by 0.90% to 104.80.

In commodities market, crude oil price appreciated by 0.81% to $106.99 per barrel as of writing following Russia unveiled a set of sanctions on energy companies operating on the continent that could further threaten supply. Besides, gold price slumped by 0.34% to $1818.76 per troy ounce as of writing amid the surging of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 22:00 | USD – Michigan Consumer Sentiment (May) | 65.2 | 64.0 | – |

Technical Analysis

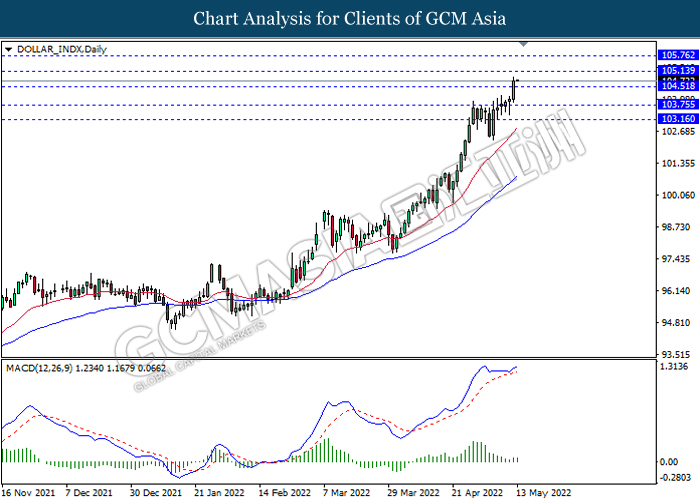

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.15, 105.75

Support level: 104.50, 103.75

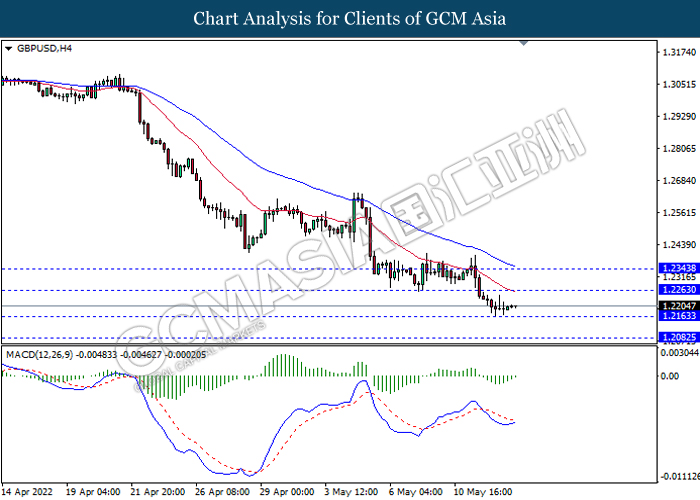

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2265, 1.2345

Support level: 1.2165, 1.2080

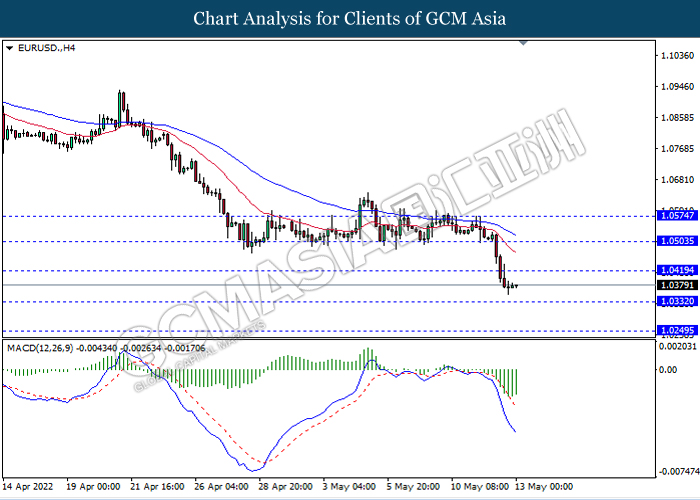

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0420, 1.0505

Support level: 1.0330, 1.0250

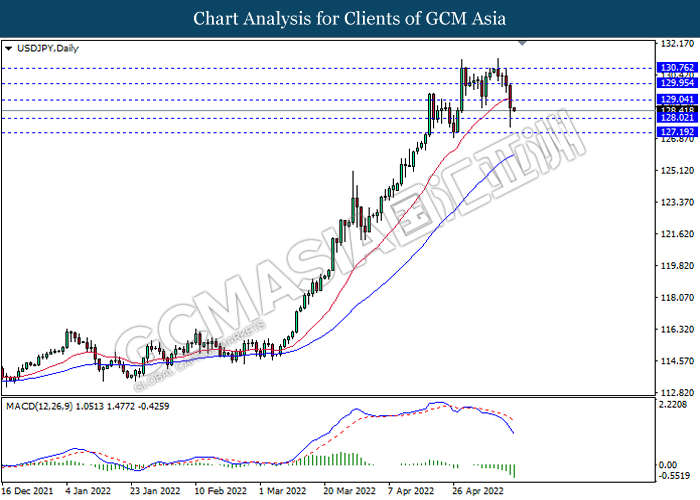

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 129.05, 129.95

Support level: 128.00, 127.20

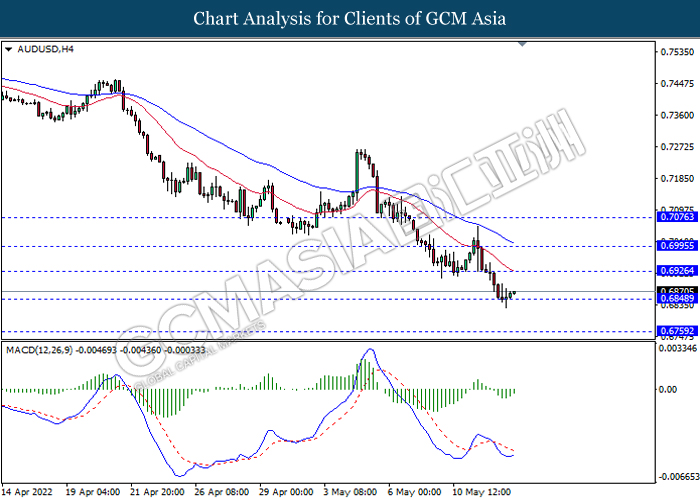

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6925, 0.6995

Support level: 0.6850, 0.6760

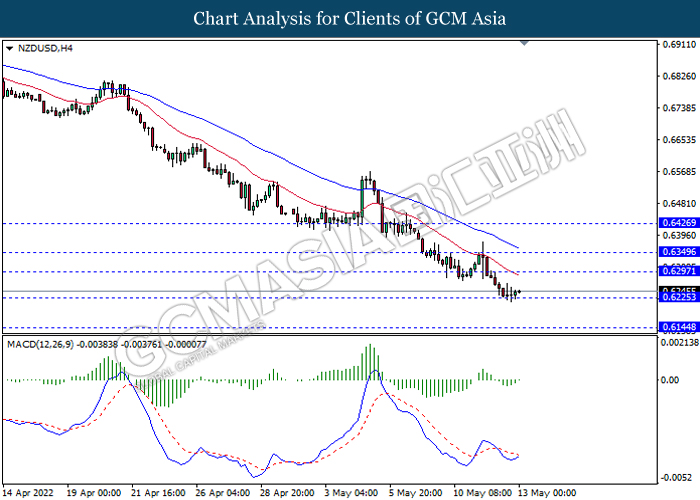

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6225, 0.6145

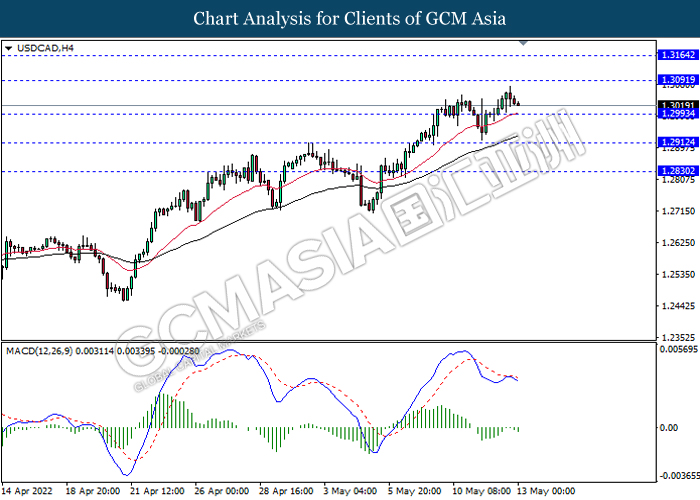

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3090, 1.3165

Support level: 1.2995, 1.2910

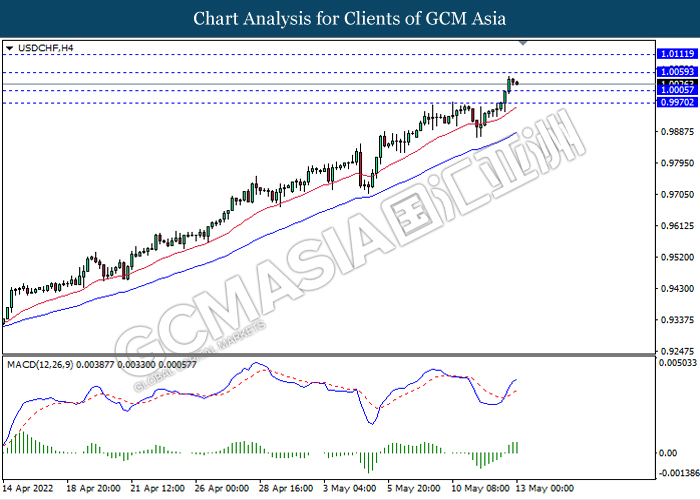

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0060, 1.0110

Support level: 1.0005, 0.9970

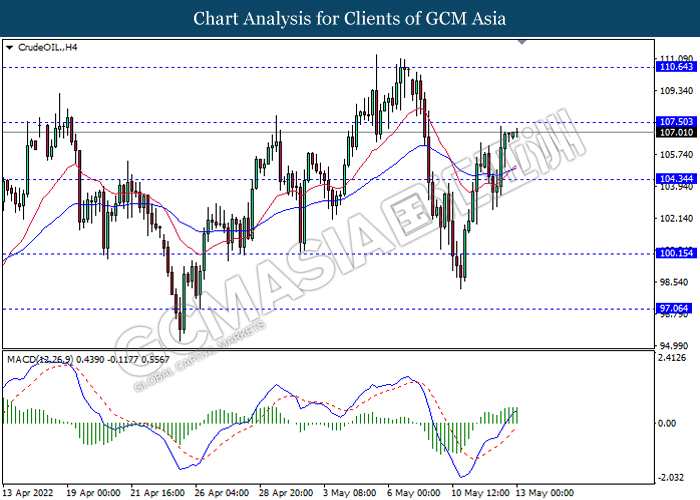

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 107.50, 110.65

Support level: 104.35, 100.15

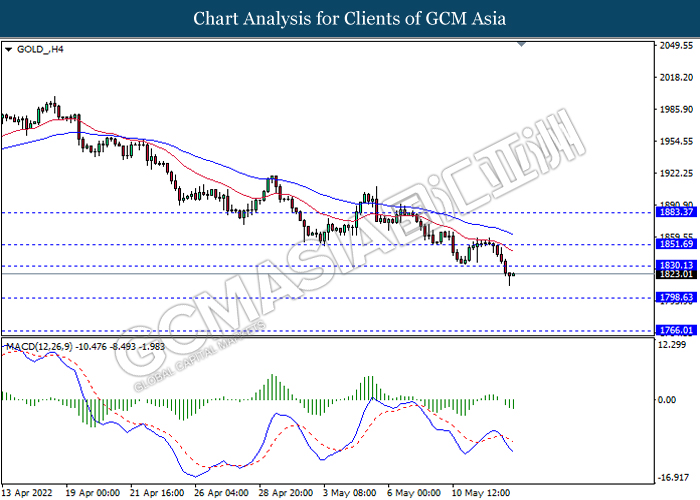

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1830.15, 1851.70

Support level: 1798.65, 1766.00