6 November 2017 Weekly Analysis

GCMAsia Weekly Report: November 6 – 10

Market Review (Forex): October 30 – November 3

U.S. Dollar

Greenback pared its losses against six major currencies on Friday following the release of better-than-expected US factory orders and services sector data. The dollar index rose 0.22% to 94.83 in late trade after touching a low of 94.11.

A recap on the earlier session, US Labor Department reported a short fall in nonfarm payrolls, leading to an initial selloff on the greenback. For the month of October, US economy added 261,000 jobs, falling short of forecast for 315,000. In addition to that, average hourly earnings came in flat, missing consensus forecast of 0.2%. On the other note, overall unemployment rate ticked down by 0.1% to 4.1%, suggesting a continuous robustness in the labor market.

On the other hand, factory orders came in at 1.4%, slightly higher than economist forecast of 1.3%. As for services sector, ISM reported an expansion in non-manufacturing employment while its PMI rose to its highest level since the index debuted in 2008. According to economists, the non-manufacturing sector reflected a third consecutive strong growth, indicating a positive outlook for business conditions and economic growth.

US Nonfarm Payrolls

US Economy generated 261,000 jobs in October, missing economist target of 315,000 jobs.

US Unemployment Rate

US unemployment continued its downtrend, attaining 4.1% for the month of October while portraying a robust labor market.

US Average Hourly Earnings

Average hourly earnings came in flat at 0%, indicating a slower growth in wages which could lead to diminished inflationary pressure.

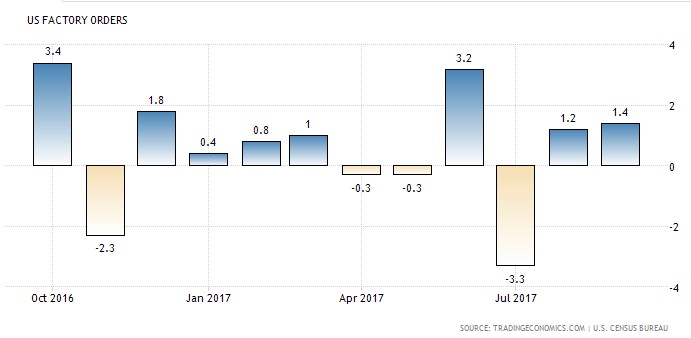

US Factory Orders

US Factory Orders grew by 1.4% for the month of October, exceeding economist forecast of 1.3%.

US ISM Non-Manufacturing PMI

Non-manufacturing PMI rose to its highest level since 2008, with a reading of 60.1 for the month of October.

USD/JPY

Pair of USD/JPY was down by 0.25% to 113.62, off from prior three-months high at 114.43.

EUR/USD

Euro edged lower against the US dollar, down 1.48% for the week while closing in at $1.1608 following Catalonia’s parliament announcement for independence from Madrid, raising overall political risk in the economic bloc.

GBP/USD

Pound sterling was down by 0.21% to $1.3133, pressured by the prospect of a dovish rate hike which will not be followed by subsequent rate rise in for the time being.

Market Review (Commodities): October 30 – November 3

GOLD

Gold price fell to its lowest level in a week as the dollar regained its bullish momentum following upbeat US factory orders and services sector data. Its prices settled down 0.53% to $1,271.38 during late Friday trading while recording its third consecutive weekly decline of 0.2%.

However, the losses were remained capped as investors place their focus on a proposed tax overhaul outlined by the Republicans last Thursday. Although some traders believed that the tax reform could warrant for higher growth and more interest rate hikes, others were remained skeptical at how the large tax discount would be funded instead.

Crude Oil

Crude oil price extended its rally on Friday, touching its highest level in more than two years amid higher expectation that major oil producers will extend a deal to curb production beyond its expiry date next March.

Price of the commodity surged $1.10 or 2% while ended the week at $55.64 a barrel. For the week, its prices have recorded its fourth consecutive rise of 3.2%. its prices extended a rally which began early last month, mainly driven by bullish sentiment towards members and non-members of OPEC in extending a production cut deal at the end of this month. The oil cartel will be meeting on 30th November to discuss on the current market situation and their production cut plan.

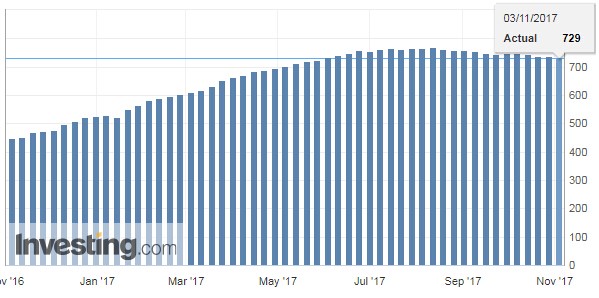

Oil prices also received another boost as US Baker Hughes reported a sizeable decline in active oil drilling rigs, cementing further expectation for a slowdown in domestic crude output. The number of active drilling rig was down by 8 to 729, its fourth weekly decline out of five weeks.

US Baker Hughes Oil Rig Count

US active drilling rigs were down by 8 to 729 last week.

Weekly Outlook: November 6 – 10

For the week, investors will be eying on the progress of US tax reform bill in a rather quiet week for economic data. In the other region, China is bound to release data on trade and inflation while both reserve banks from Australia and New Zealand will be announcing their stance on monetary policy.

As for oil traders, they will be eyeing on US inventories level reported by API and EIA to gauge the strength of crude demand for world’s largest oil consumer.

Highlighted economy data and events for the week: November 6 – 10

| Monday, November 6 |

Data EUR – German Factory Orders (MoM) (Sep) EUR – Markit Composite PMI (Oct) EUR – Services PMI (Oct) CAD – Ivey PMI (Oct)

Events USD – FOMC Member Dudley Speaks

|

| Tuesday, November 7 |

Data AUD – RBA Interest Rate Decision (Nov) EUR – German Industrial Production (MoM) (Sep) GBP – Halifax House Price Index (MoM) (Oct) USD – JOLTs Job Openings

Events EUR – ECB President Draghi Speaks CAD – BoC Gov Poloz Speaks USD – Fed Chair Yellen Speaks

|

| Wednesday, November 8 |

Data CrudeOIL – API Weekly Crude Oil Stock CNY – Trade Balance (USD) (Oct) CAD – Housing Starts (Oct) CAD – Building Permits (MoM) (Sep) CrudeOIL – Crude Oil Inventories

Events N/A

|

| Thursday, November 9 |

Data NZD – RBNZ Interest Rate Decision CNY – CPI (YoY) (Oct) CNY – PPI (YoY) (Oct) EUR – German Trade Balance USD – Initial Jobless Claims CAD – New Housing Price Index (MoM) (Sep)

Events N/A

|

|

Friday, November 10

|

Data GBP – Manufacturing Production (MoM) (Sep) GBP – Trade Balance (Sep) USD – Michigan Consumer Sentiment (Nov) CrudeOIL – US Baker Hughes Oil Rig Count

Events N/A

|

Technical weekly outlook: November 6 – 10

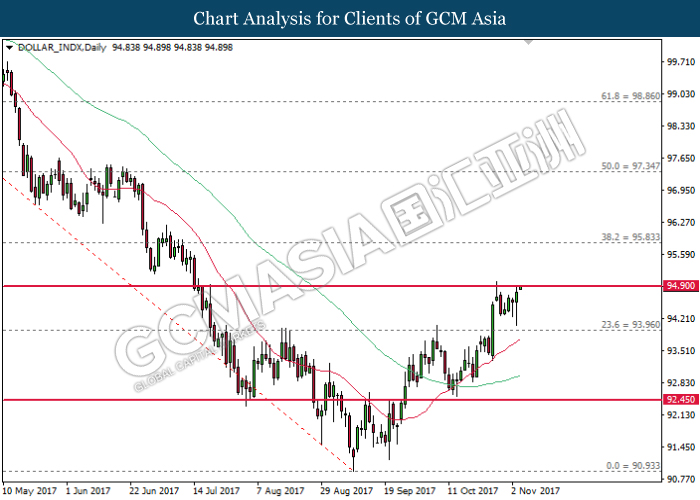

Dollar Index

DOLLAR_INDX, Daily: Dollar index was traded higher following prior rebound while currently testing at previous high of 94.90. A successful closure above this level would suggest an extension of bullish momentum towards the next target at 95.85.

Resistance level: 94.90, 95.85

Support level: 93.95, 92.50

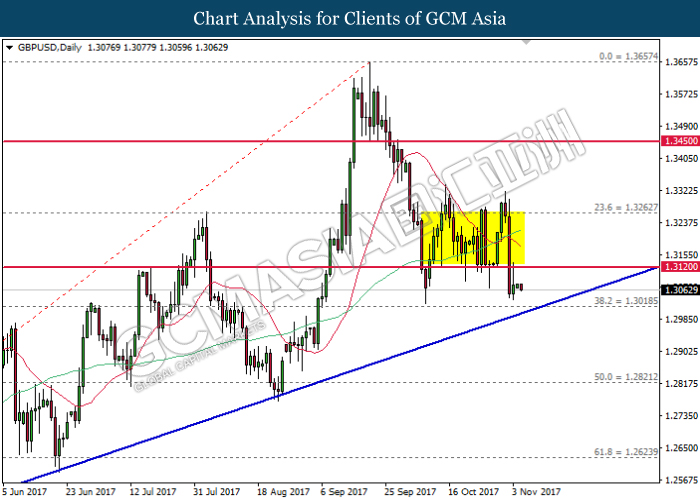

GBPUSD

GBPUSD, Daily: GBPUSD has breakout from the bottom level of sideways channel, signifying a change in trend direction to move further downwards. Such price action suggests the pair to extend its losses towards the upward trend line near the support level of 1.3020.

Resistance level: 1.3120, 1.3260

Support level: 1.3020, 1.2820

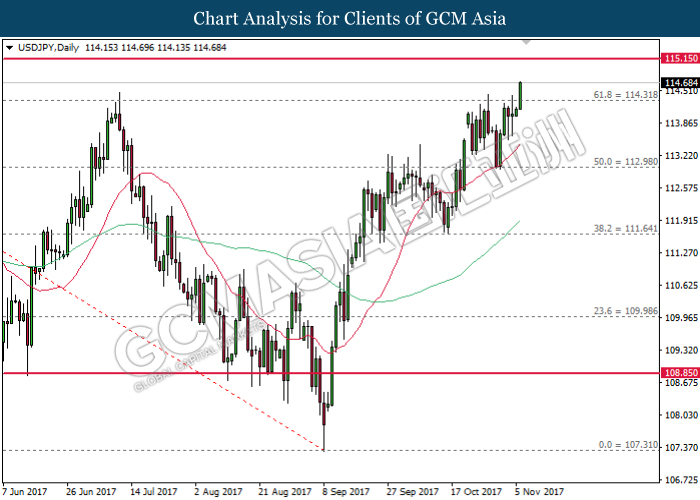

USDJPY

USDJPY, Daily: USDJPY extended gains following prior breakout near the strong resistance level of 114.30. Both moving average line which continues to expand upwards suggest further bullish bias and a close above the level of 114.30 would provide further clarification.

Resistance level: 115.15, 116.20

Support level: 114.30, 113.00

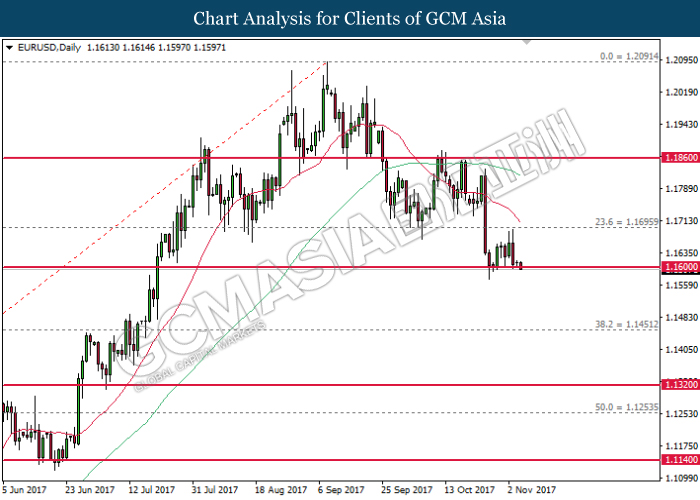

EURUSD

EURUSD, Daily: EURUSD extended its bearish momentum following prior failure to close above the resistance level of 1.1700. Both MA lines which continues to expand downwards suggest ongoing bearish bias and a successful close below the strong support level of 1.1600 would suggest an extension of downward momentum.

Resistance level: 1.1700, 1.1860

Support level: 1.1600, 1.1450

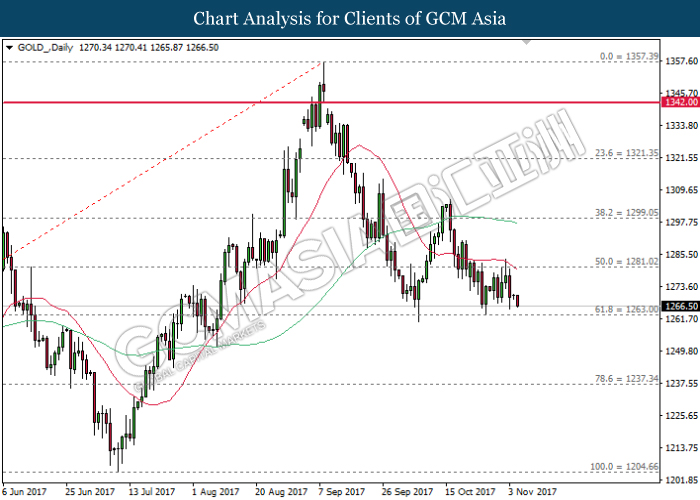

GOLD

GOLD_, Daily: Gold price was offered lower following prior inability to close above the 20-MA line (red) near 1281.00. Both MA lines which begins to skew downwards suggest gold price to extend its losses after breaking the strong support level at 1263.00.

Resistance level: 1281.00, 1299.05

Support level: 1263.00, 1237.35

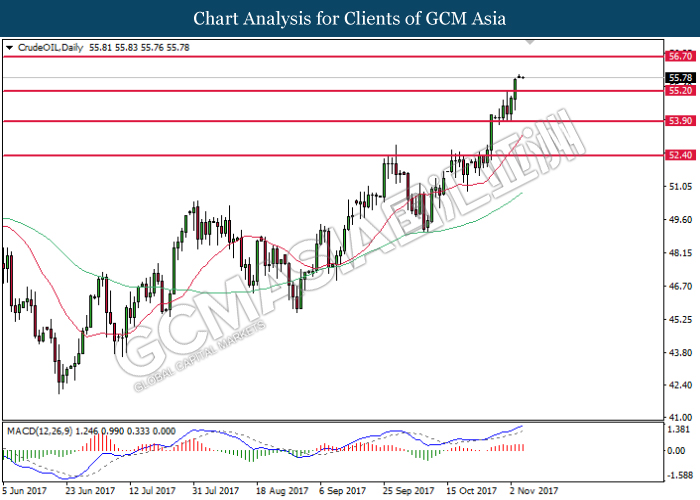

Crude Oil

CrudeOIL, Daily: Crude oil price advance further upwards following prior closure above the resistance level of 55.20. Signal line from MACD which illustrate substantial bullish bias suggest the commodity price to extend its upward momentum towards the next target at 56.70.

Resistance level: 56.70, 57.90

Support level: 55.20, 53.90