17 May 2022 Afternoon Session Analysis

Euro surged amid hawkish expectation upon ECB.

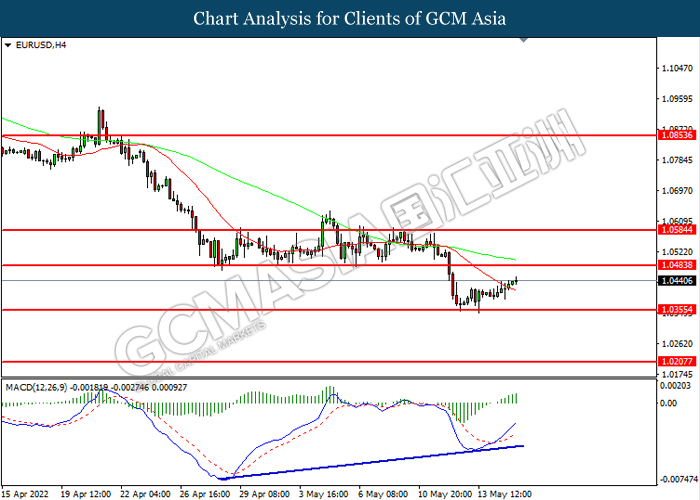

Euro rebounded significantly following the European Central Bank policymaker Francois Villeroy de Galhau claimed on Monday that the weakness of Euro in the currency markets could threaten the European Central Bank’s efforts to combat its inflation risk. Market participants expected that the depreciation of Euro would likely to prompt the European Central Bank to manipulate the Euro market while spurring higher possibility for the rate hike in order to attract further foreign investment into the Euro market. Villeroy claimed that the ECB governing council meeting could be expected in June while further contractionary monetary policy decision will be discussed. The Euro zone government bond yields rebounded toward recent multi-year high. Germany’s 10-year bond yield rose as much as 6.7 basis point to over 1%. Meanwhile, the money market pricing suggests investors speculated that the European Central Bank would likely to announce for a 25-basis point rate hike at ECB’s July meeting. As of writing, EUR/USD appreciated by 0.06% to 1.0440.

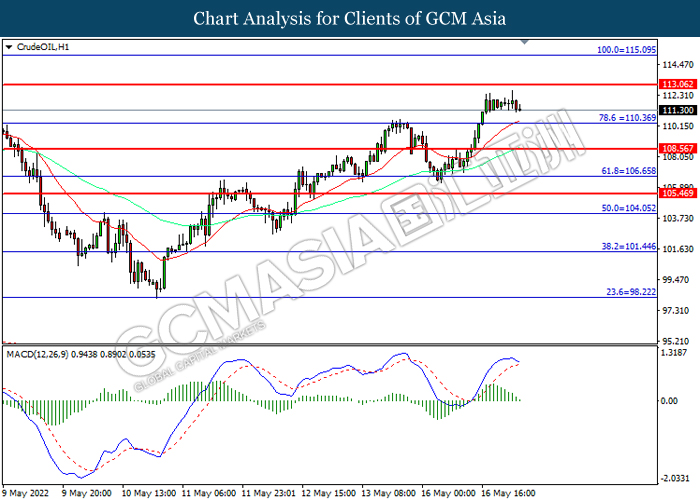

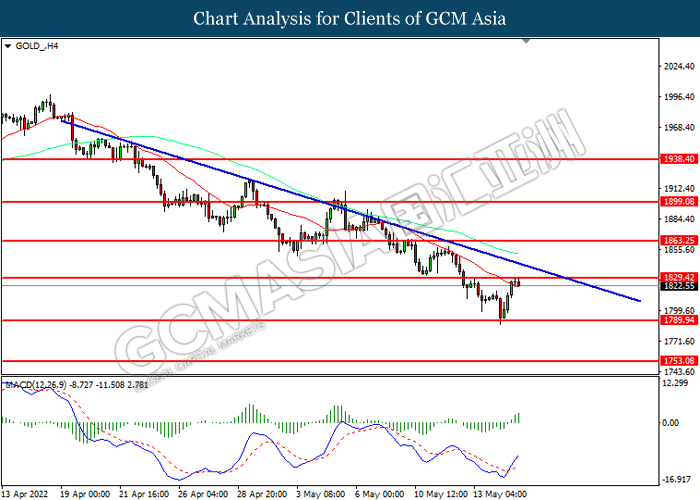

In the commodities market, the crude oil price surged 0.27% to $111.30 per barrel as of writing. The oil price extends its gains following the European Union’s diplomats and officials expressed optimism about reaching a deal on a phased embargo Russian oil. On the other hand, the gold price appreciated by 0.03% to $1823.00 per barrel as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Mar) | 5.4% | 5.4% | – |

| 14:00 | GBP – Claimant Count Change (Apr) | -46.9K | -38.8K | – |

| 20:30 | USD – Core Retail Sales (MoM) (Apr) | 1.4% | 0.3% | – |

| 20:30 | USD – Retail Sales (MoM) (Apr) | 0.7% | 0.8% | – |

Technical Analysis

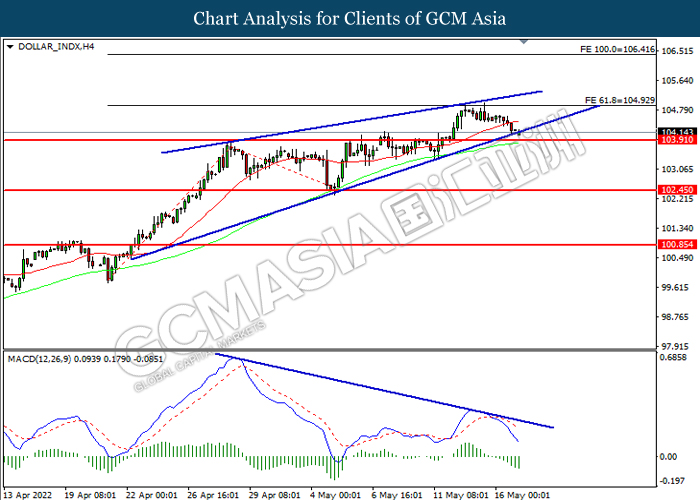

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward support level.

Resistance level: 104.95, 106.40

Support level: 103.90, 102.45

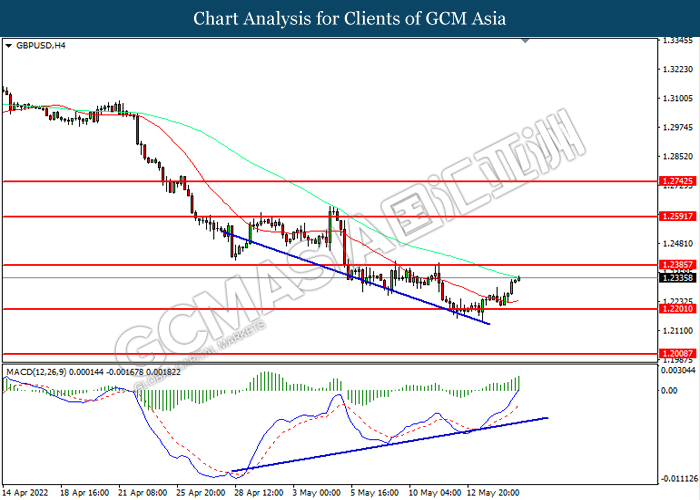

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2385, 1.2590

Support level: 1.2200, 1.2010

EURUSD, H4: EURUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0485, 1.0585

Support level: 1.0355, 1.0205

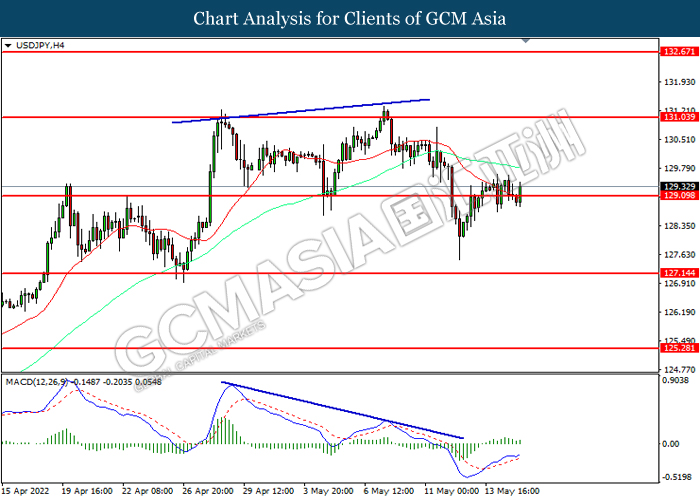

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 131.05, 132.65

Support level: 129.10, 127.15

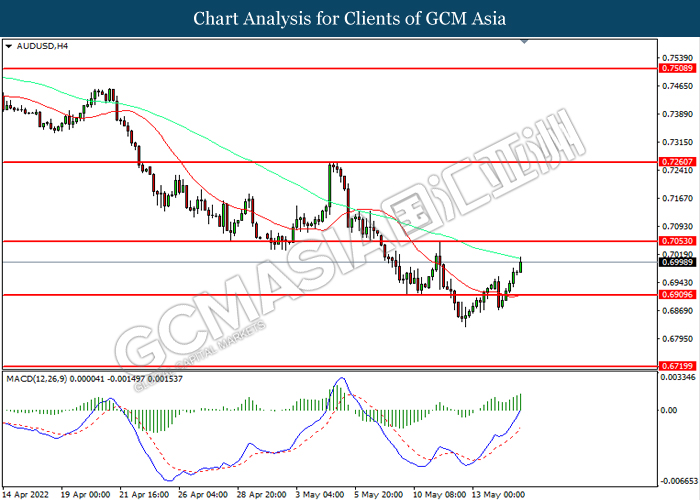

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.7055, 0.7260

Support level: 0.6910, 0.6720

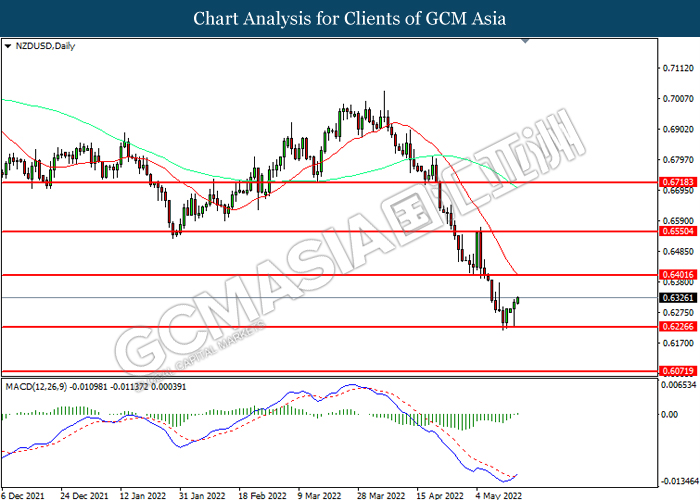

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6400, 0.6550

Support level: 0.6225, 0.6070

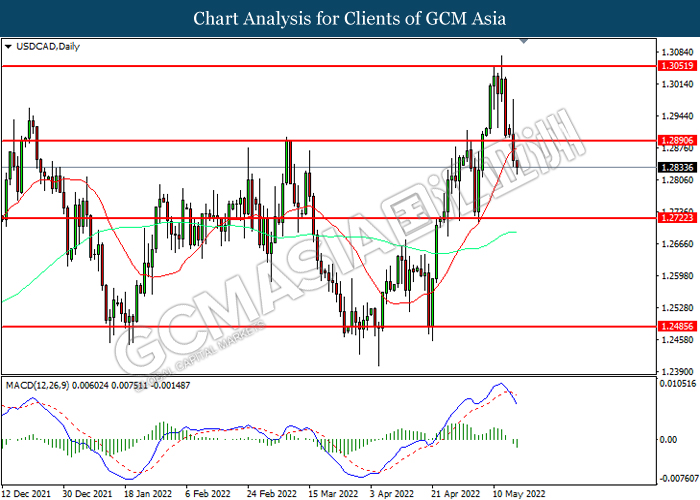

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2485

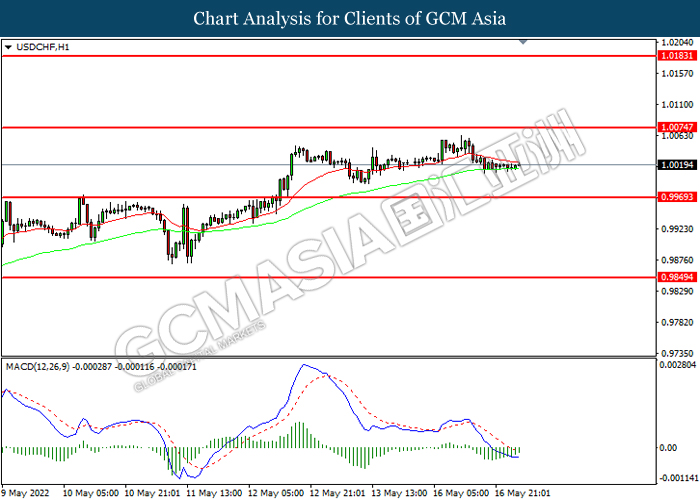

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0075, 1.0185

Support level: 0.9970, 0.9850

CrudeOIL, H1: Crude oil price was traded lower retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward support level.

Resistance level: 113.05, 115.10

Support level: 110.35, 108.55

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1829.40, 1863.25

Support level: 1789.95, 1753.10