19 May 2022 Afternoon Session Analysis

Fed’s Hawkish stance on rate hike spurred US Dollar.

The Dollar Index, which traded against a basket of six major currencies, rebounded after hitting the 1-week low level amid the high possibility of a continued rate hike over the next couple of meetings of the Federal Reserve. Early yesterday, the chairman of the Fed, Jerome Powell, reiterated his view that the Fed will continue its 50 basis point rate hike. At the same time, he also stated that the ongoing rate hike pace is appropriate, whereas they will only start to slow down the rate hike when the inflation rate is coming down in a convincing way. The hawkish stance of the Federal Reserve continued to be the tailwind for the dollar index. Besides, the sharp decline in the US stock market has hammered the market sentiment, urging investors to encash their stock holdings to avoid further losses. At this juncture, investors are still waiting for the upcoming data, such as initial jobless claims to scrutinize the further direction of the dollar index. As of writing, the dollar index slightly retraced 0.16% to 103.65.

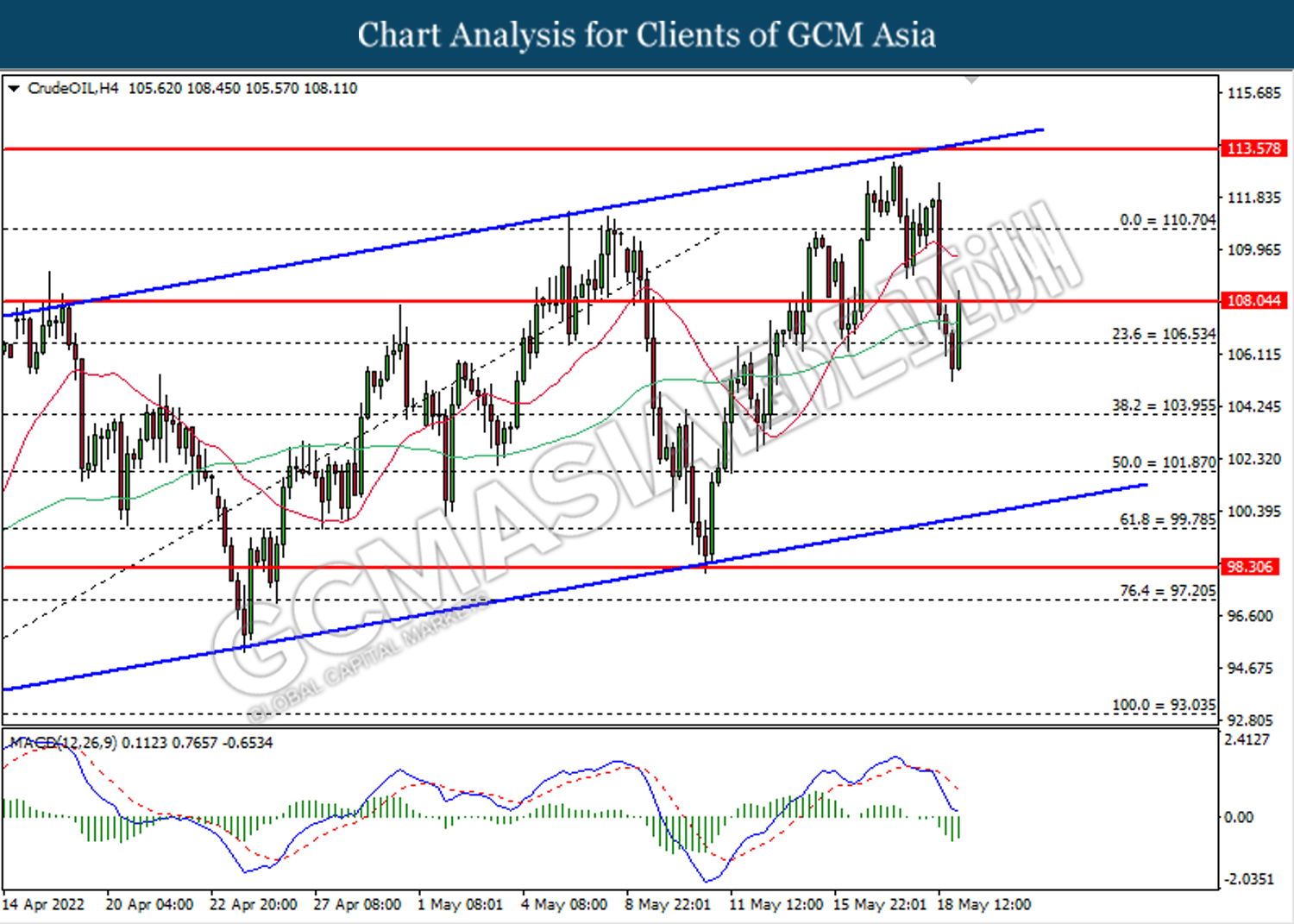

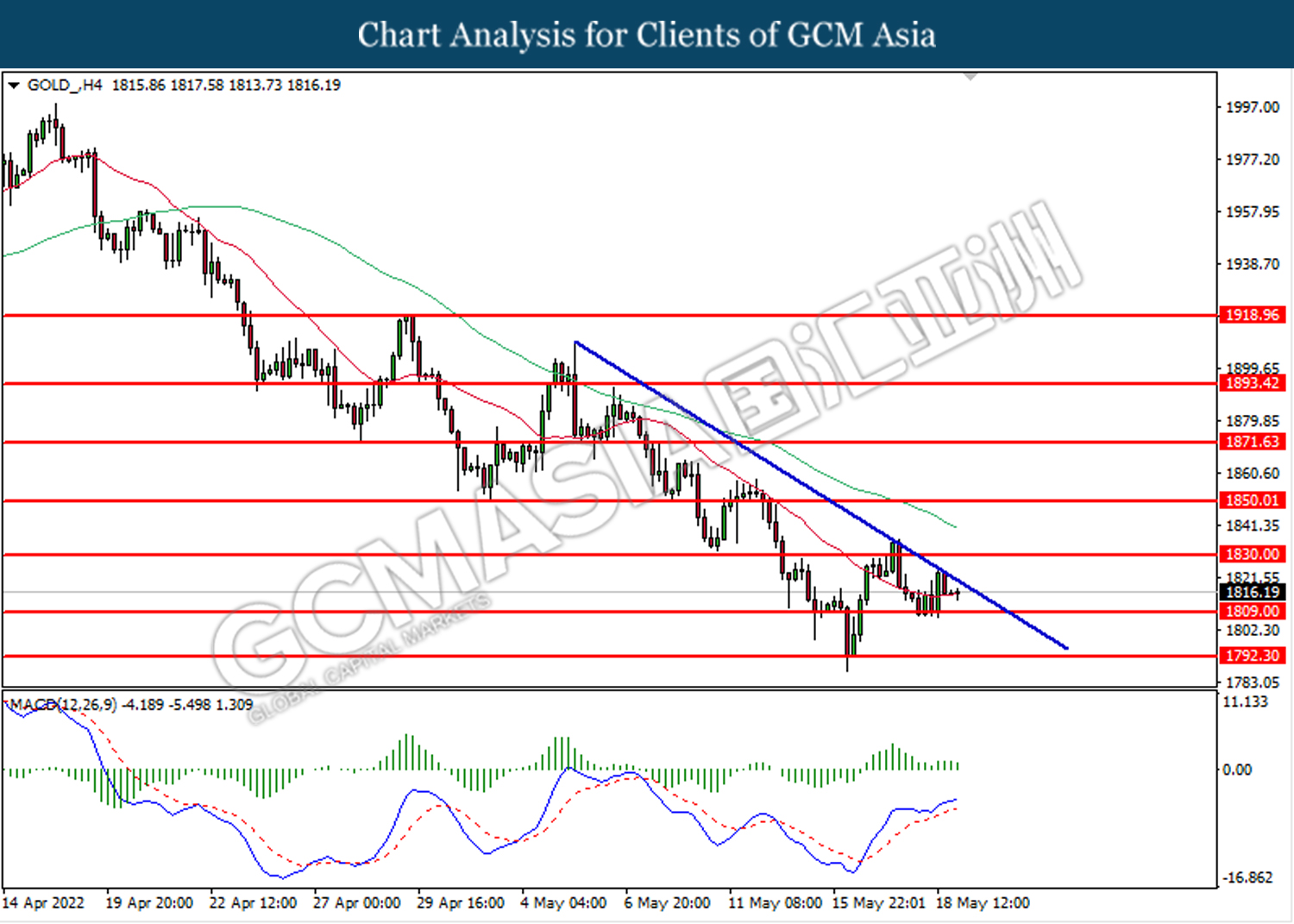

In the commodities market, crude oil prices are up by 0.99% to $109.45 per barrel as of writing as EIA reported a draw in US oil inventories. According to the EIA Institute, US Crude Oil Inventories data came in at -3.394M, missing the economist forecast of a stockpile at 1.383M. Besides, gold prices dropped 0.02% amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | Initial Jobless Claims | 203K | 200K | – |

| 20:30 | Philadelphia Fed Manufacturing Index (May) | 17.6 | 16.7 | – |

| 22:00 | Existing Home Sales (Apr) | 5.77M | 5.62M | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses toward the support level at 102.90.

Resistance level: 104.00, 105.00

Support level: 102.90, 102.30

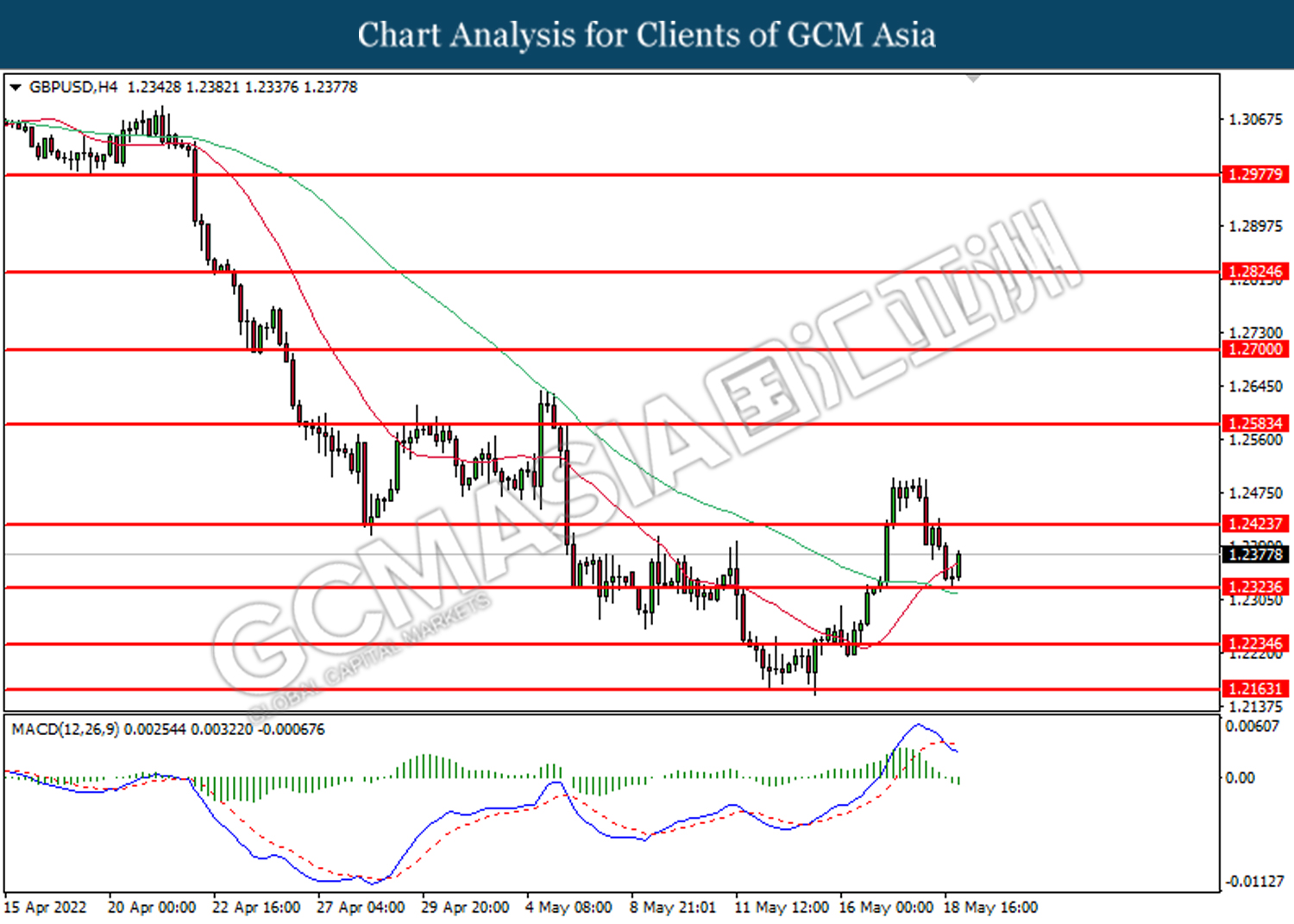

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level at 1.2325. However, MACD which illustrated increasing bearish momentum suggest the pair to undergo short term correction toward a lower level.

Resistance level: 1.2425, 1.2585

Support level: 1.2325, 1.2235

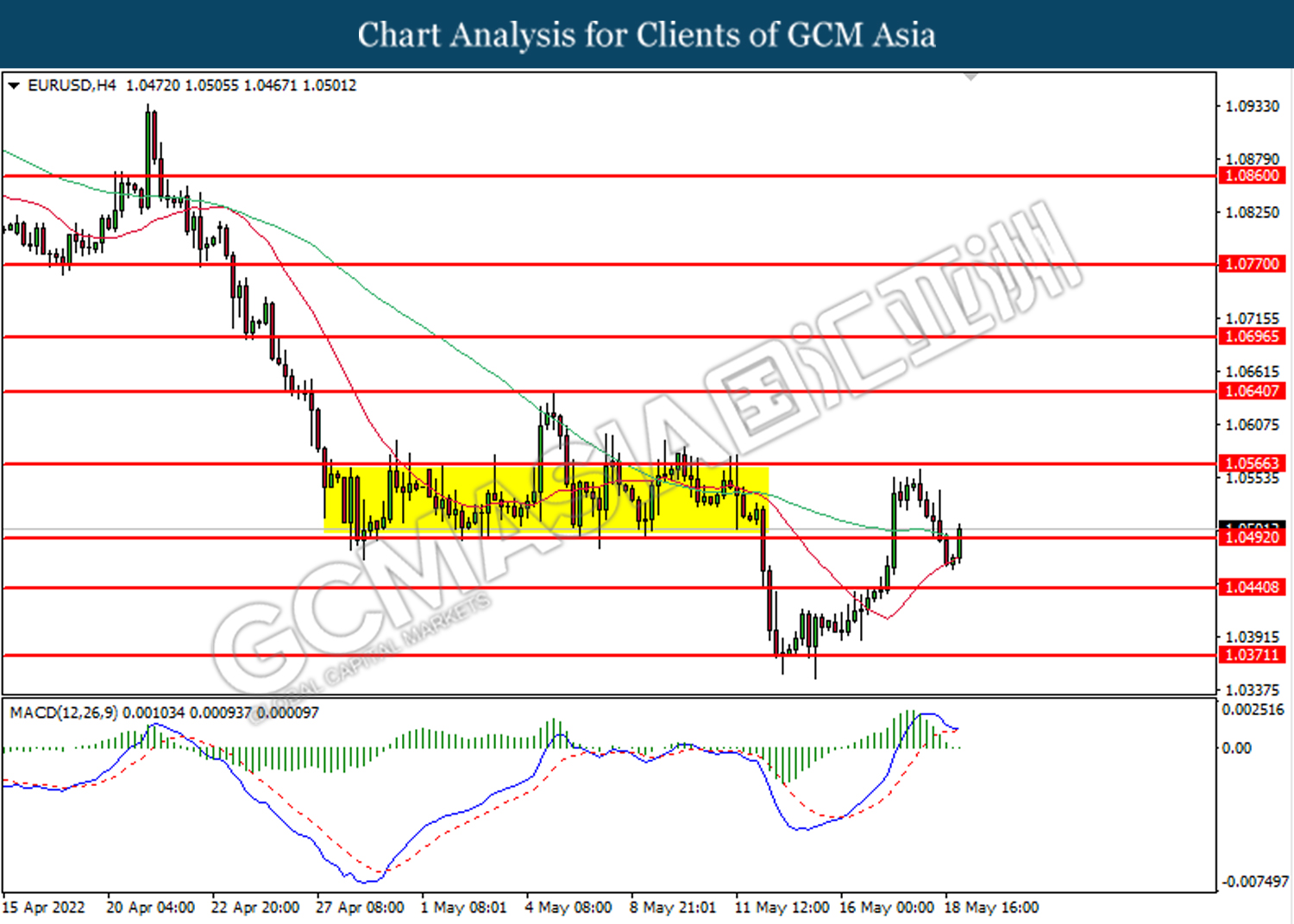

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0490. However, MACD which illustrated diminishing bullish momentum suggest the pair undergo short term technical correction toward a lower level.

Resistance level: 1.0490, 1.0565

Support level: 1.0440, 1.0370

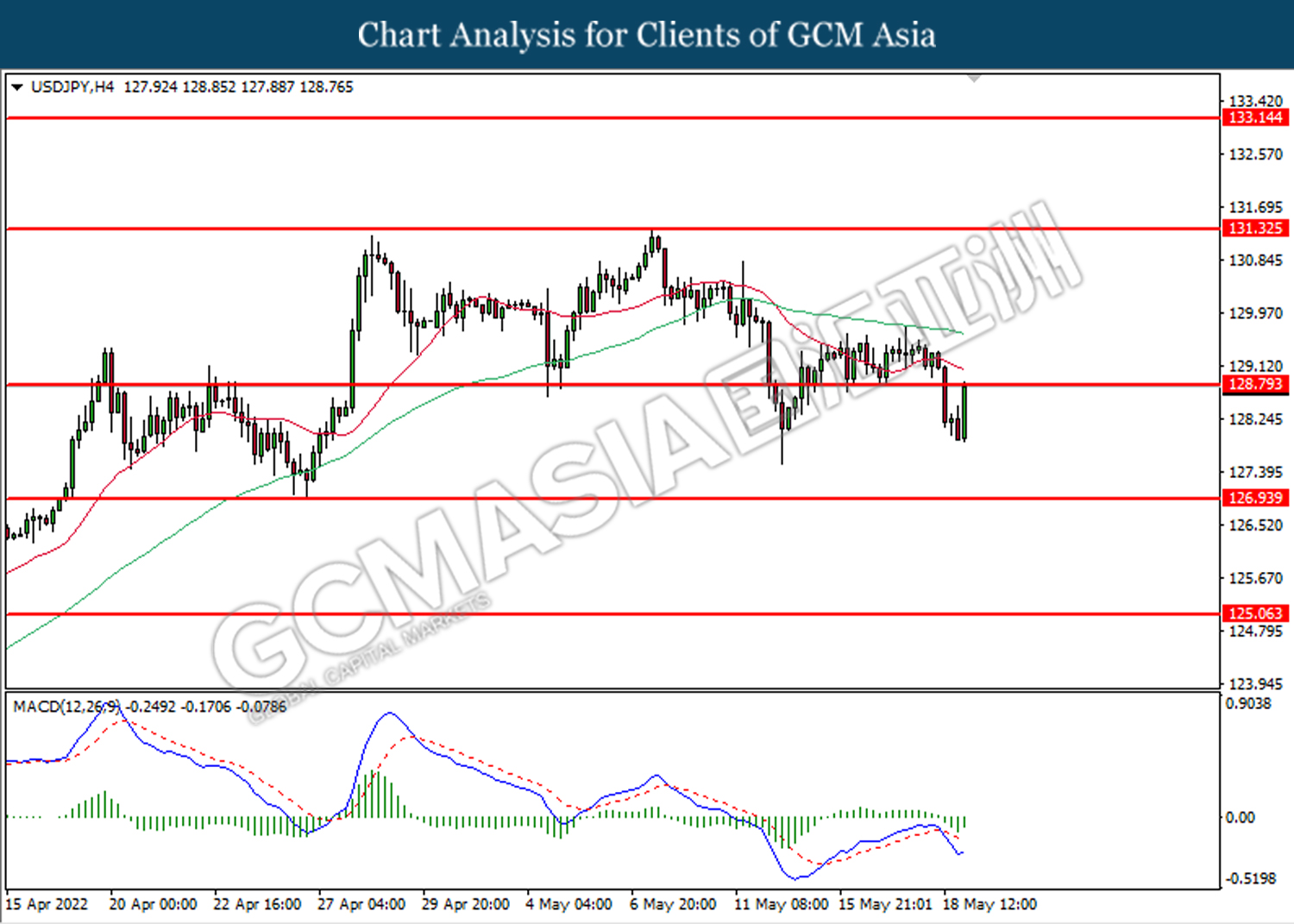

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 128.80. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

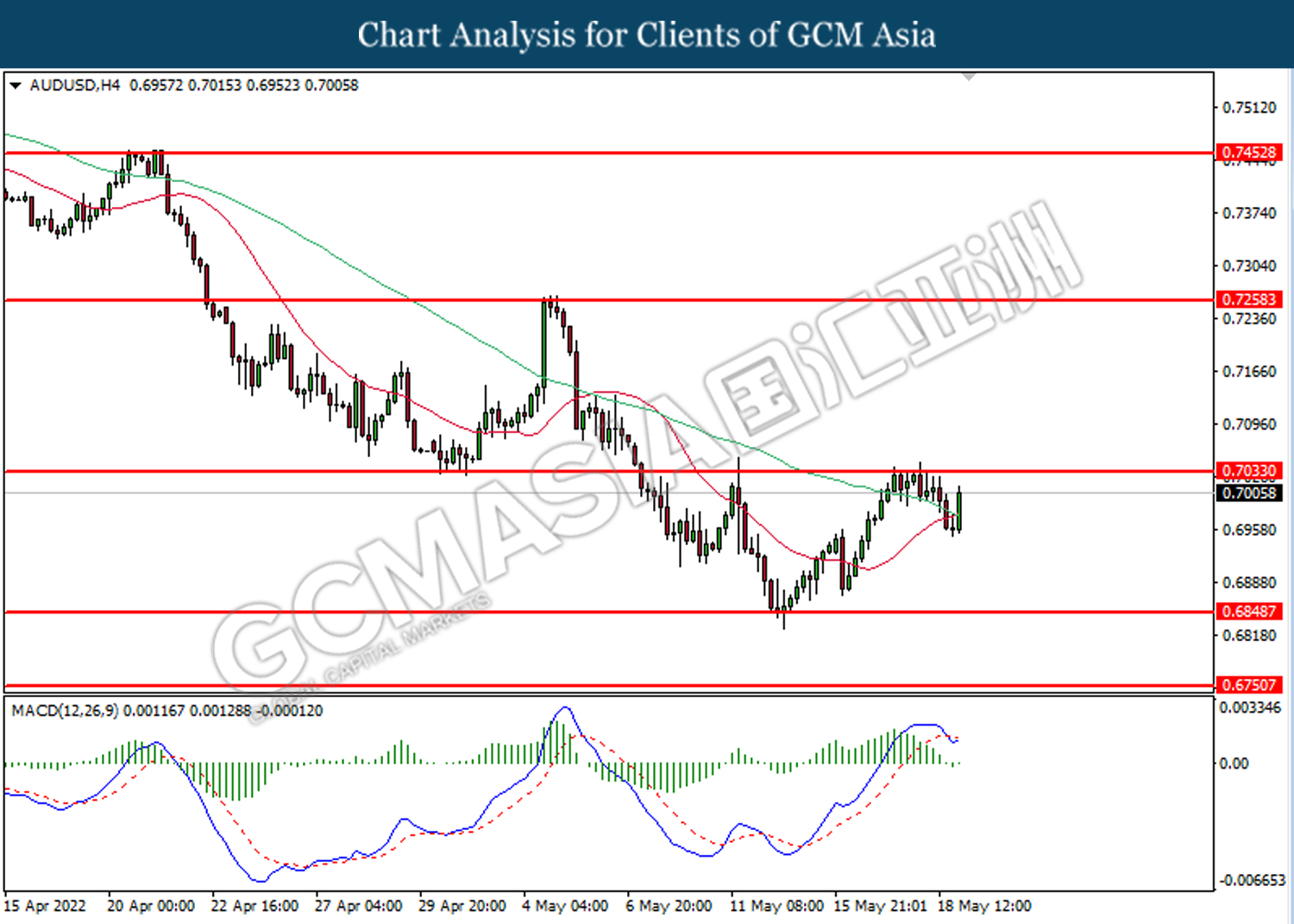

AUDUSD, H4: AUDUSD was traded higher following prior rebound at the lower level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.7035.

Resistance level: 0.7035, 0.7260

Support level: 0.6850, 0.6750

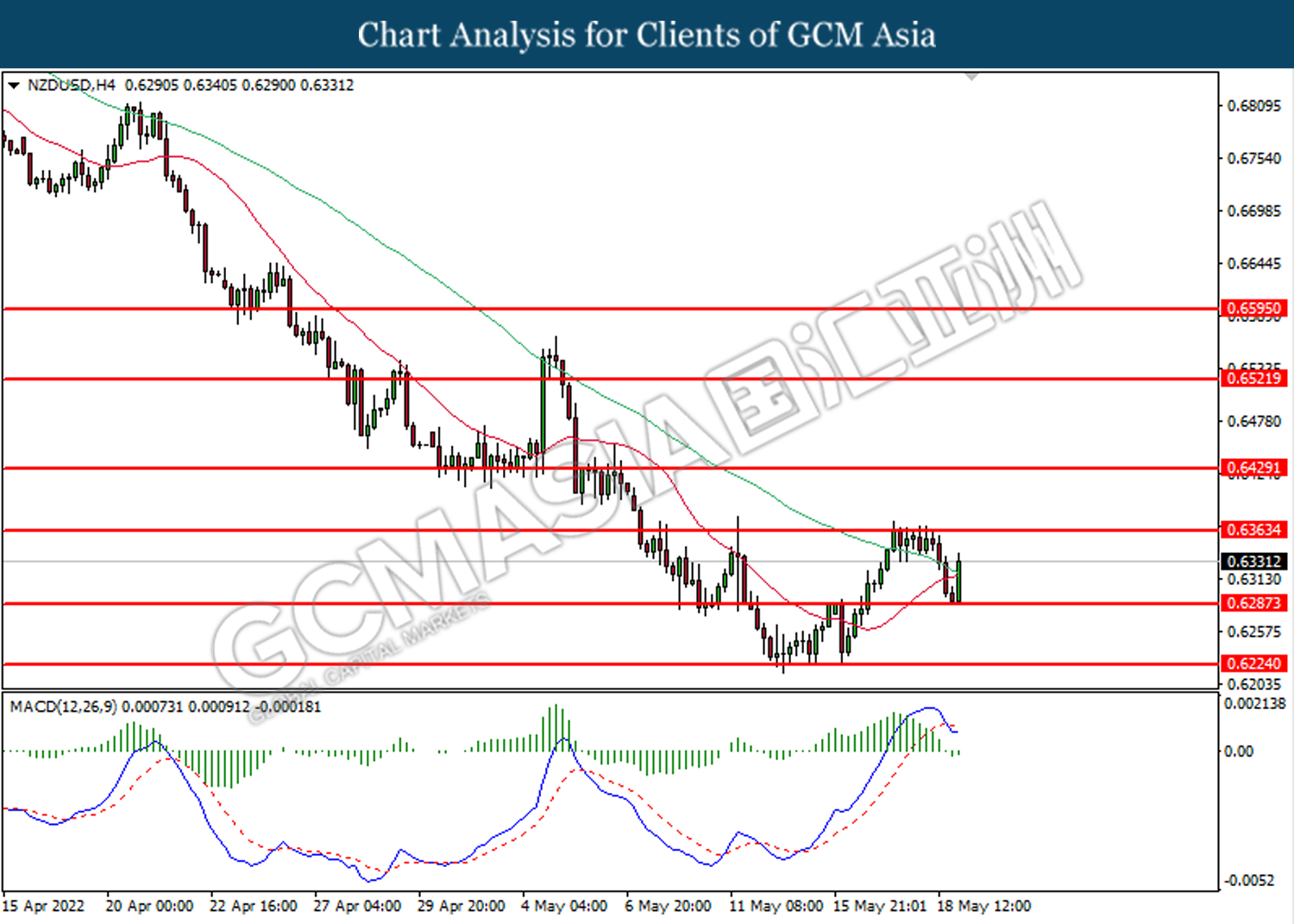

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level at 0.6285. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6365.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

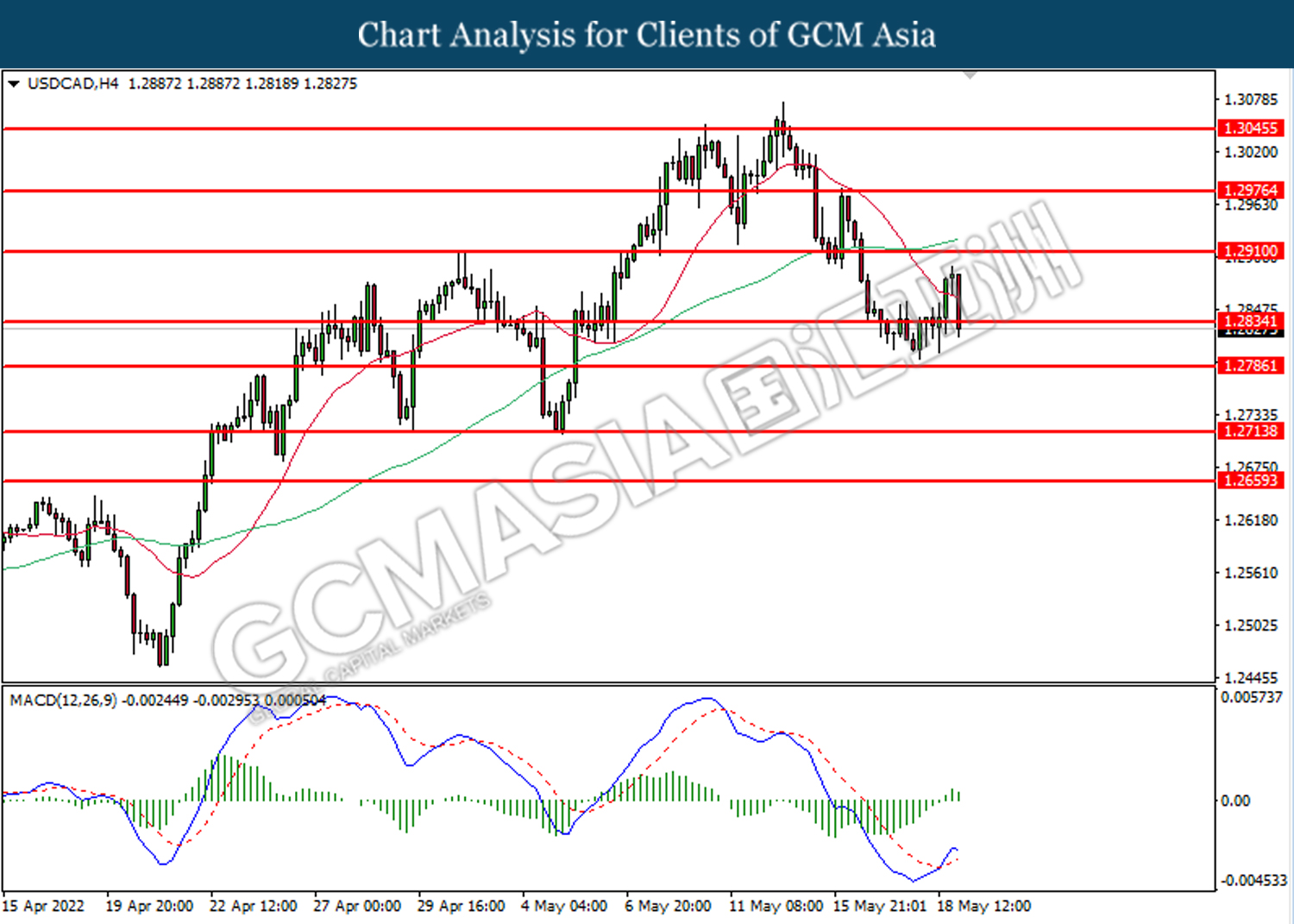

USDCAD, H4: USDCAD was traded lower while currently testing the support level at 1.2835. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2910, 1.2975

Support level: 1.2835, 1.2785

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level at 0.9890. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.9825.

Resistance level: 0.9890, 0.9980

Support level: 0.9825, 0.9725

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level at 108.05. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 108.05, 110.70

Support level: 106.55, 103.95

GOLD_, H4: Gold price was traded lower following prior retracement from the downtrend line. However, MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1809.00.

Resistance level: 1830.00, 1850.00

Support level: 1809.00, 1792.30