20 May 2022 Morning Session Analysis

US Dollar slumped over the downbeat economic data.

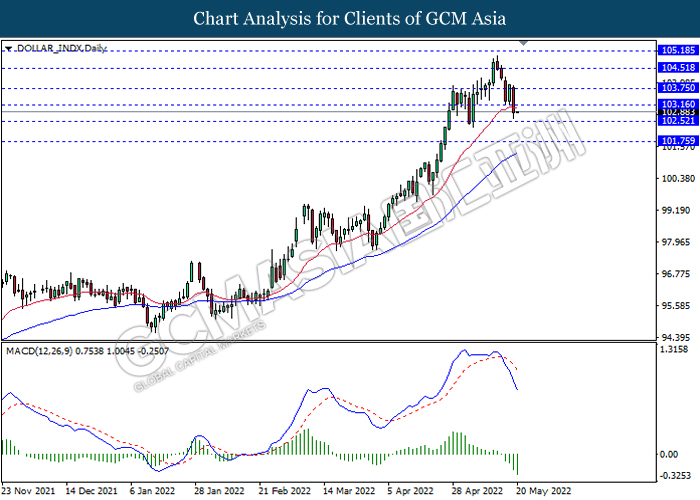

The Dollar Index which traded against a basket of six major currencies eased since yesterday after the negative economic data was unleashed. According to US Department of Labor, US Initial Jobless Claims notched up from the previous reading of 197K to 218K, exceeding the market forecast of 200K, which indicating that the number of people who apply for the unemployed insurance for the first time was increased. The downbeat data hinted that the current US labor market is fragile, dialed down the market optimism toward the economic progression in US. Besides, US Existing Home Sales recorded at the reading of 5.61M, missing the market forecast of 5.65M. Existing Home Sales measures the change in the annualized number of existing residential buildings that were sold during the previous month, and the lower than expected data showed that the recession in US housing market, spurred further bearish momentum on the US Dollar. As of writing, the Dollar Index depreciated by 0.91% to 102.91.

In commodities market, crude oil price edged down by 0.66% to $109.16 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish over the market expectation that China could ease some lockdown restrictions which would boost the oil demand going forward. On the other hand, gold price appreciated by 0.04% to $1841.91 per troy ounces as of writing amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | Retail Sales (MoM) (Apr) | -1.4% | -0.2% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 103.15, 103.75

Support level: 102.50, 101.75

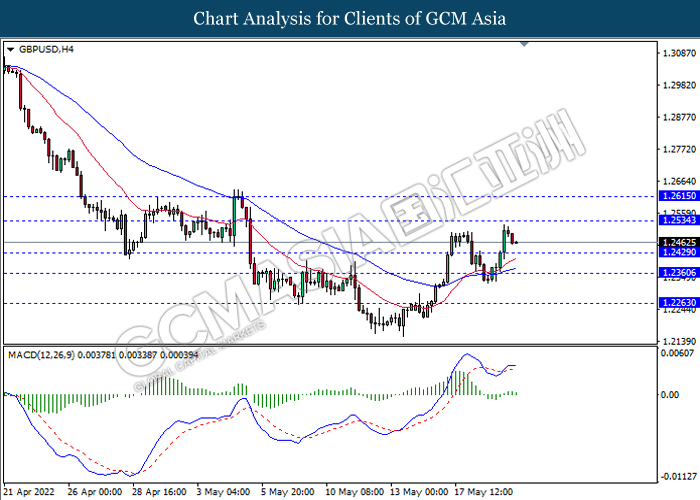

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

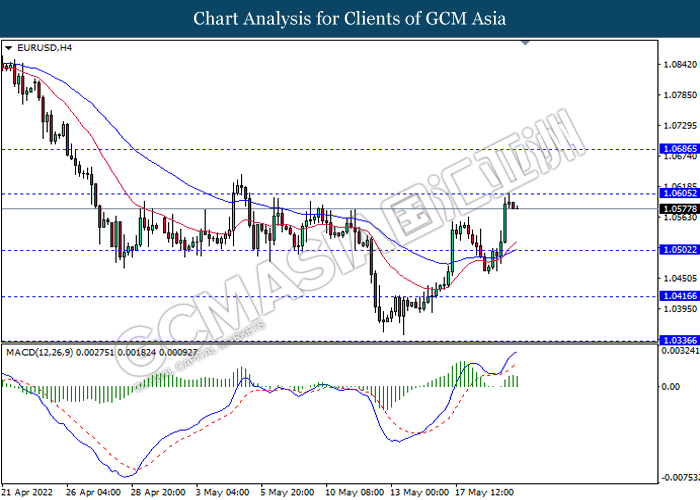

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0605, 1.0685

Support level: 1.0500, 1.0415

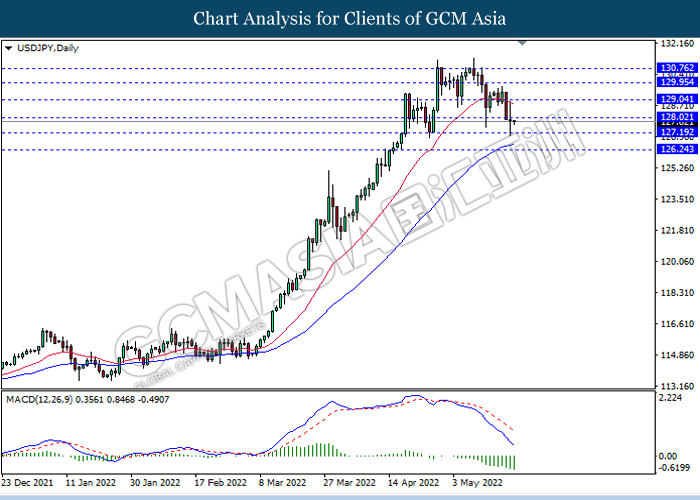

USDJPY, Daily: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to be extend its losses.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

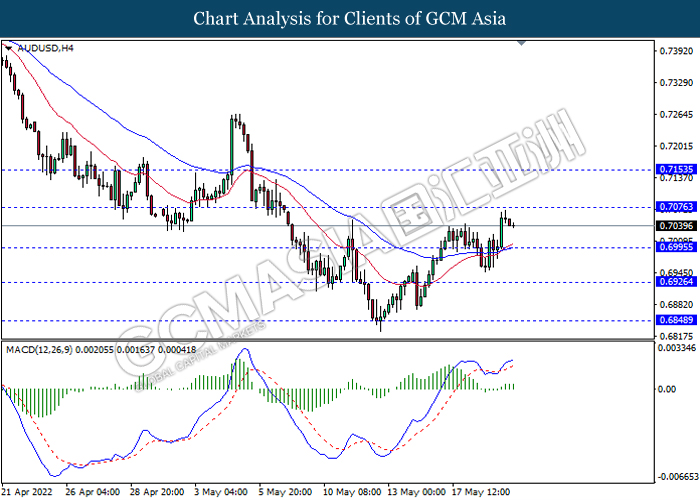

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7075, 0.7155

Support level: 0.6995, 0.6925

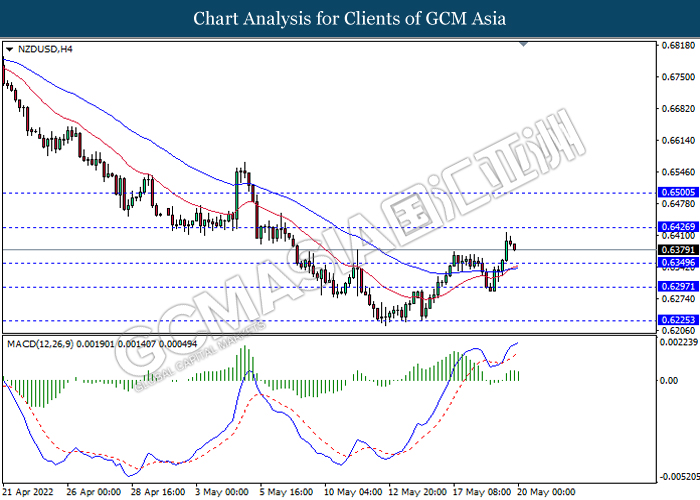

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6425, 0.6500

Support level: 0.6350, 0.6295

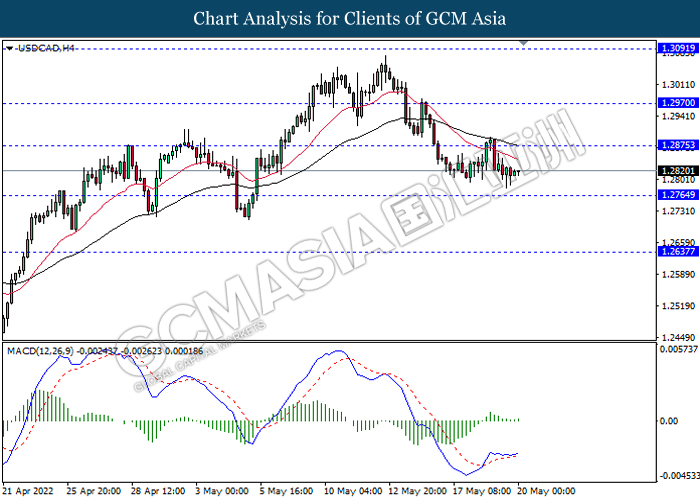

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

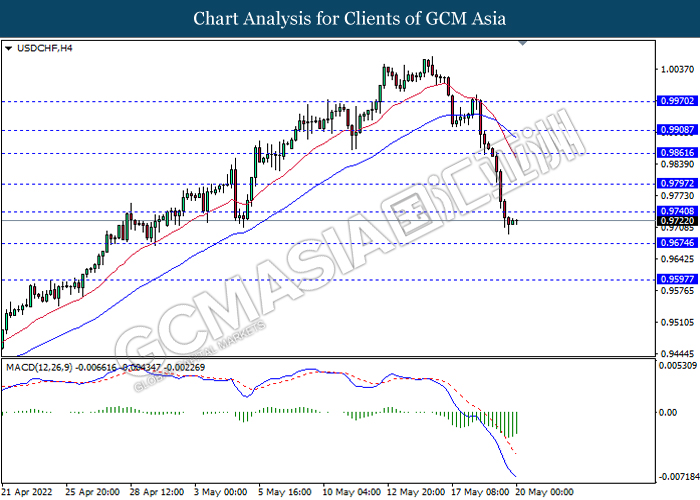

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9795

Support level: 0.9675, 0.9595

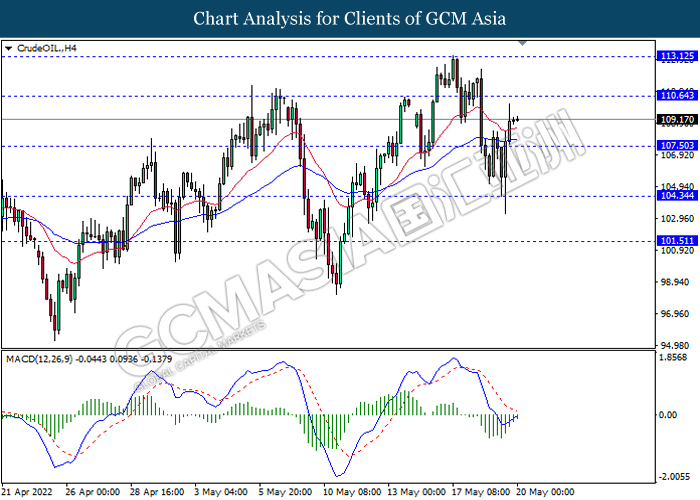

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

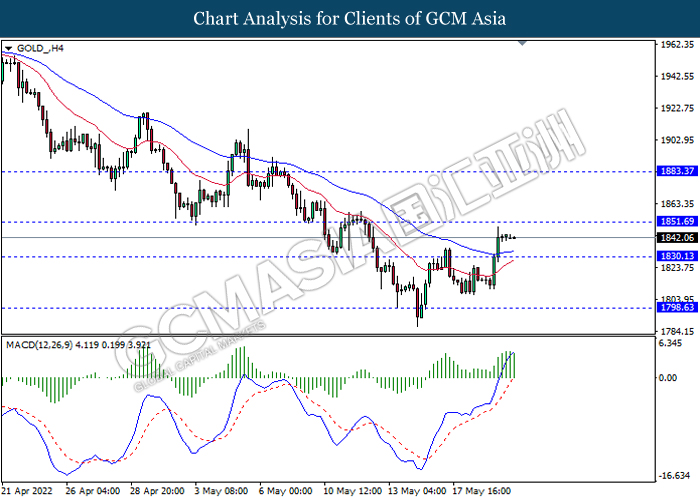

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1851.70, 1883.35

Support level: 1830.15, 1798.65