23 May 2022 Afternoon Session Analysis

Pound rose following upbeat economic data was unleashed.

The Pound extend its gains on Monday amid the backdrop of positive retail sales data, which dialed up the market optimism toward Pound Sterling. According to Office for National Statistics, UK Retail Sales MoM notched up from the previous reading of -1.2% to 1.4%, exceeding the market forecast of -0.2%. The higher than expected reading indicated that the consumer spending in UK region was increased, which brought positive prospects toward economic progression in UK. Besides, the rising inflation risk would increase the odds of Bank of England (BoE) to implement tightening monetary policy. According to Bloomberg, Britain’s inflationary shock is likely to be worse than feared, BoE Chief Economist Huw Pill said as he warned price pressures were “substantial” and further interest-rate increases will be needed. The implementation of rate hike would likely to increase the risk-free return of investors, spurring further bullish momentum on the Pound. For now, investors would continue to scrutinize the latest updates with regards of the rate hike decision from BoE in order to gauge the likelihood movement of GBPUSD. As of writing, GBPUSD edged up by 0.40% to 1.2537.

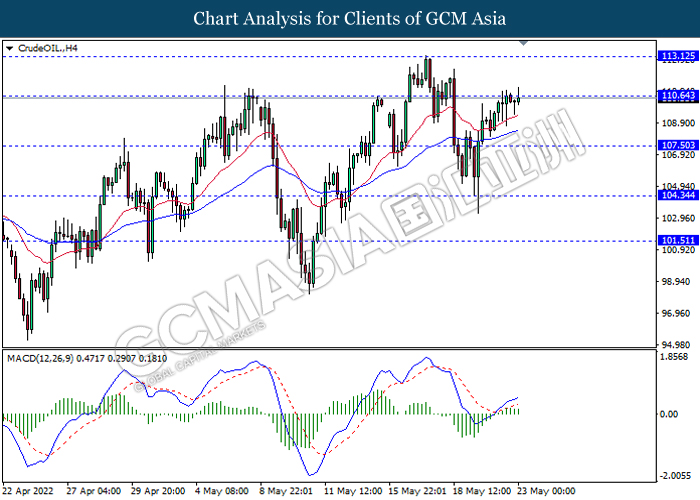

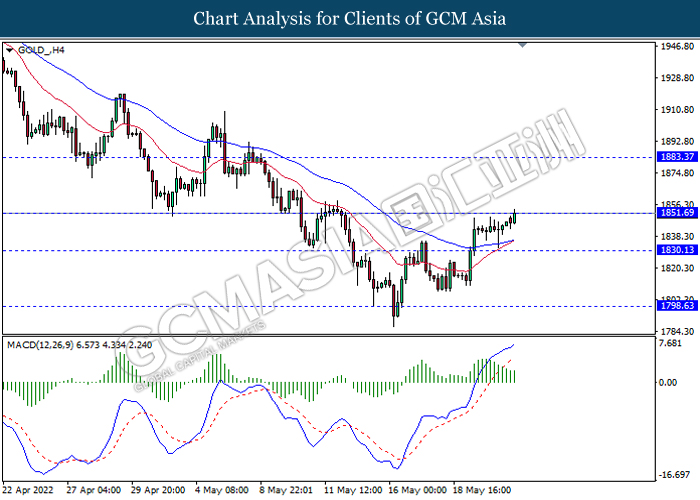

In commodities market, crude oil price appreciated by 0.37% to $110.69 per barrel as of writing over the easing lockdown in China had led to the soaring demand on crude oil. On the other hand, gold price appreciated by 0.48% to $1850.60 per troy ounces as of writing following the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German ifo Business Climate Index (May) | 91.8 | 91.4 | – |

Technical Analysis

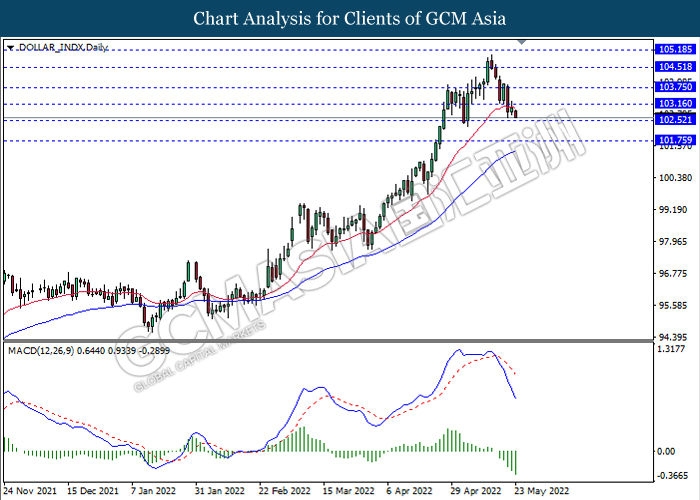

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses if successfully breakout the support level.

Resistance level: 103.15, 103.75

Support level: 102.50, 101.75

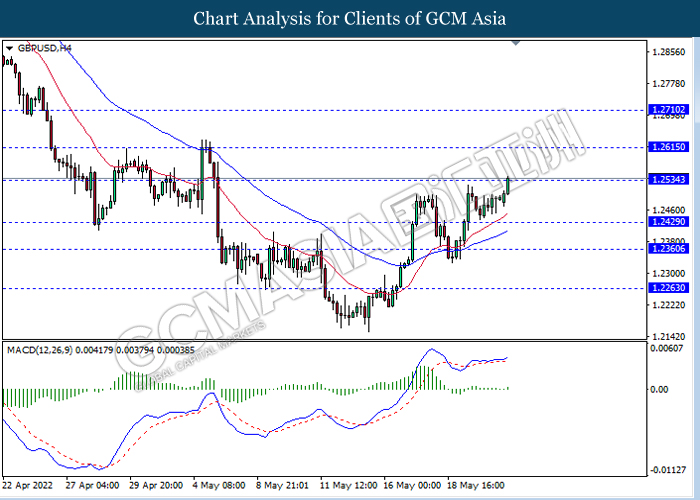

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

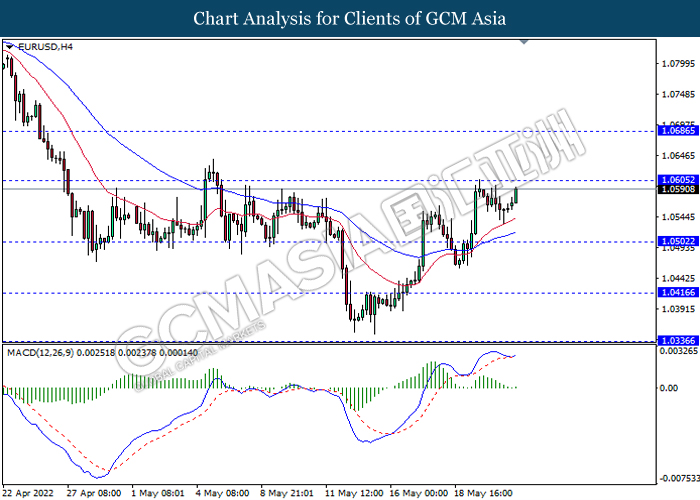

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0605, 1.0685

Support level: 1.0500, 1.0415

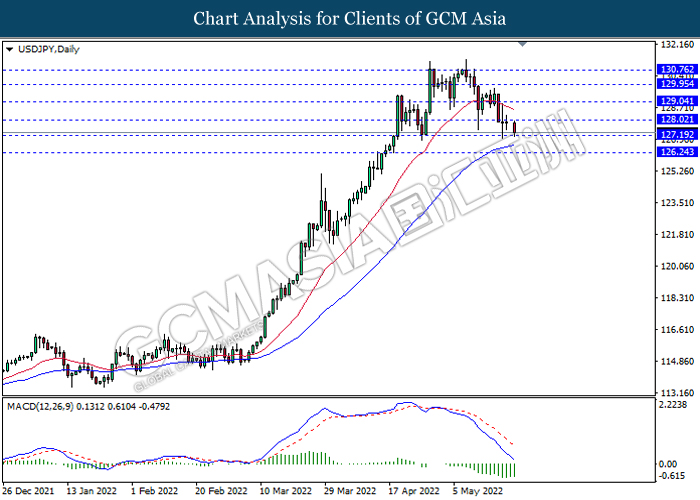

USDJPY, Daily: USDJPY was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 128.00, 129.05

Support level: 127.20, 126.25

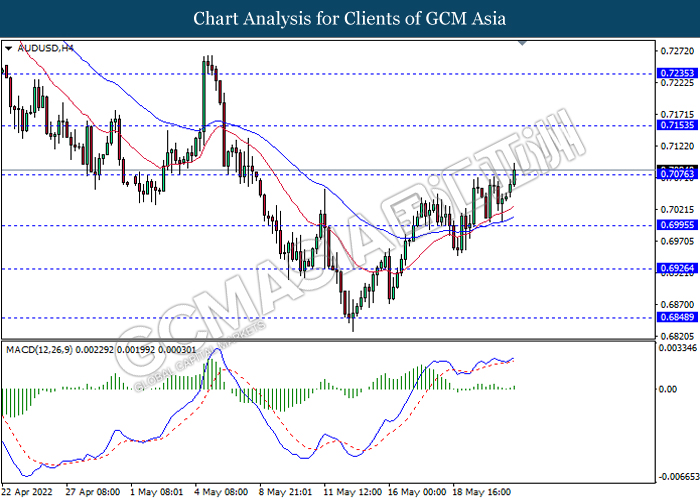

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains

Resistance level: 0.7155, 0.7235

Support level: 0.7075, 0.6995

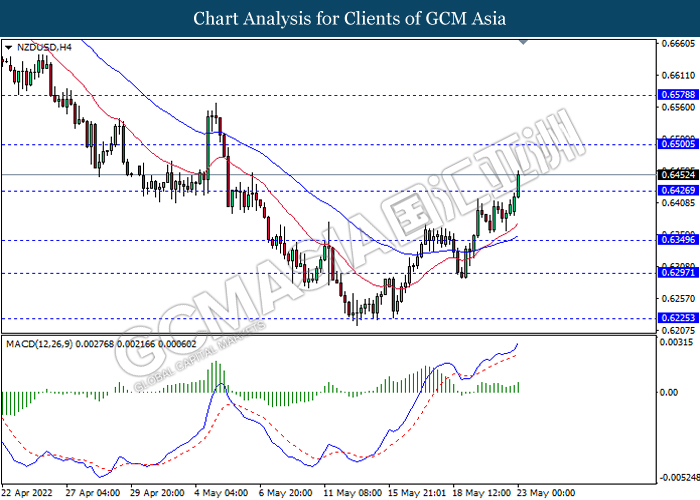

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6500, 0.6580

Support level: 0.6425, 0.6350

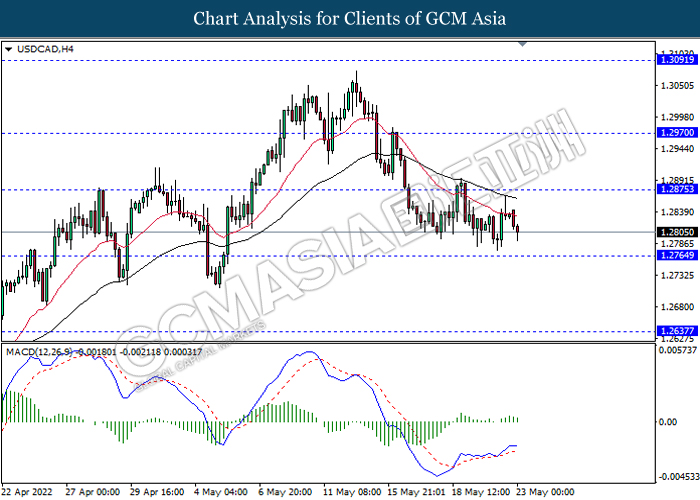

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2875, 1.2970

Support level: 1.2765, 1.2635

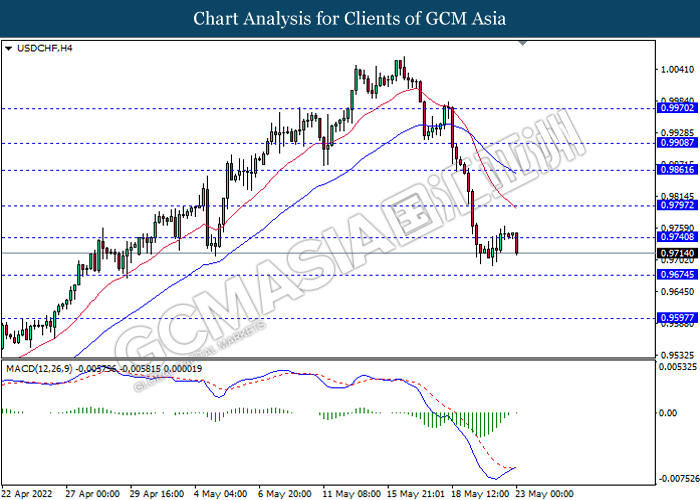

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9740, 0.9795

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 110.65, 113.10

Support level: 107.50, 104.35

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1851.70, 1883.35

Support level: 1830.15, 1798.35