24 May 2022 Morning Session Analysis

Euro surged following ECB signaled rate hike.

The Euro received significant bullish momentum yesterday following the European Central Bank unleashed their hawkish tone toward the economic momentum in Europe region. According to CNBC, the ECB President Christine Lagarde claimed that the central bank is likely to raise its deposit interest rate from negative territory by the end of September and could raise further if it sees the inflation unable to stabilize at 2.0%. Currently, the ECB’s deposit rate is -0.5%, meaning the commercial banks are charged for depositing cash at the central bank. Besides, the Euro extend its gains over the backdrop of upbeat economic data. According to Ifo Institute for Economic Research, Germany Ifo Business Climate Index notched up from the previous reading at 91.9 to 93.0, exceeding the market forecast at 91.4. As of writing, EUR/USD appreciated by 0.01% to 1.0690.

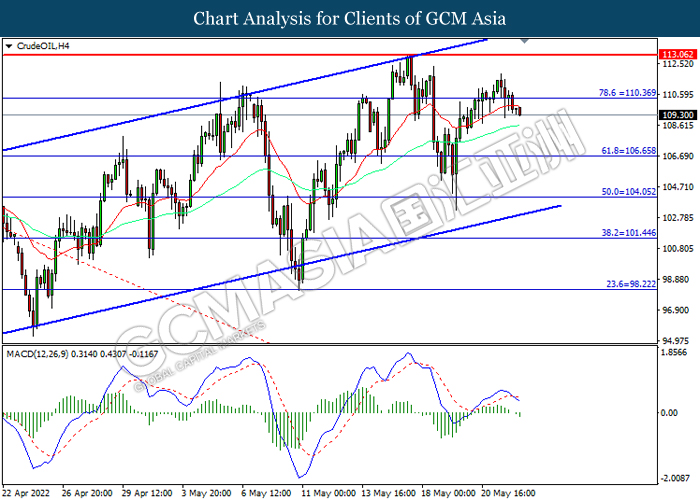

In the commodities market, the crude oil price slumped 1.05% to $109.40 per barrel as of writing. The oil market edged lower amid investors concern that rising recession risk in future would likely to drag down the market demand on this black-commodity. On the other hand, the gold price surged 0.03% to $1854.10 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | EUR – German Manufacturing PMI (May) | 54.6 | 54.0 | – |

| 16:30 | GBP – Composite PMI | 58.2 | – | – |

| 16:30 | GBP – Manufacturing PMI | 55.8 | – | – |

| 16:30 | GBP – Services PMI | 58.9 | – | – |

| 22:00 | USD – New Home Sales (Apr) | 763K | 750K | – |

Technical Analysis

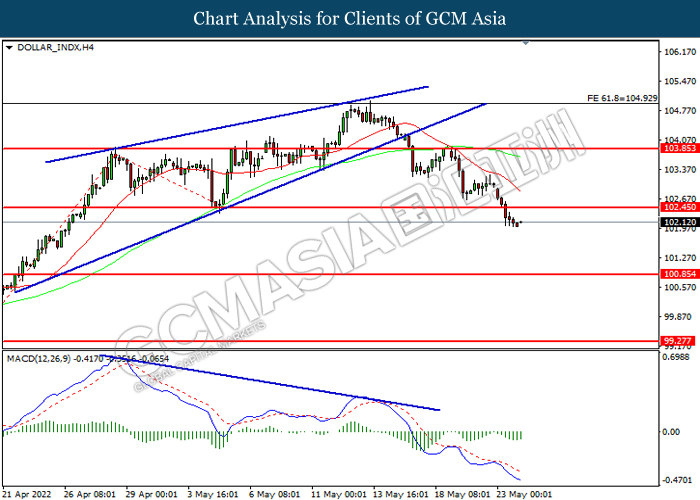

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.45, 103.85

Support level: 100.85, 99.25

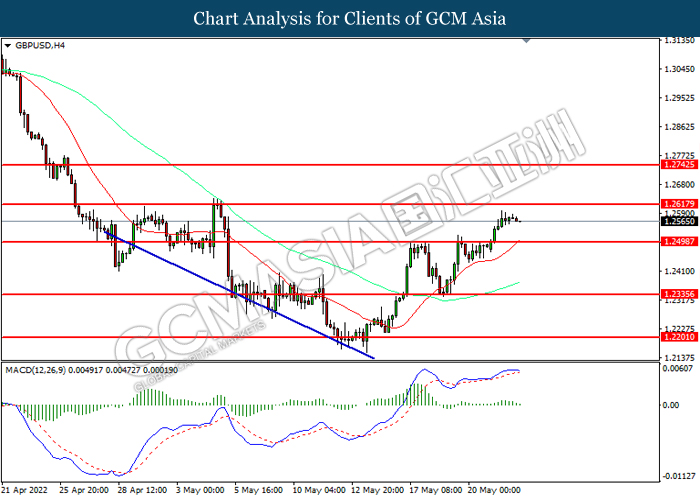

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correcgtion.

Resistance level: 1.2615, 1.2745

Support level: 1.2500, 1.2335

EURUSD, H4: EURUSD was traded higher while currently near the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0700, 1.0855

Support level: 1.0585, 1.0485

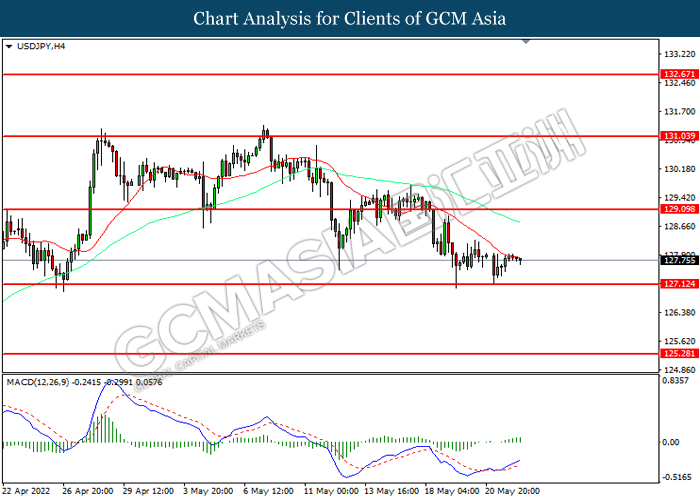

USDJPY, H4: USDJPY was traded within a range while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 129.10, 131.05

Support level: 127.15, 125.30

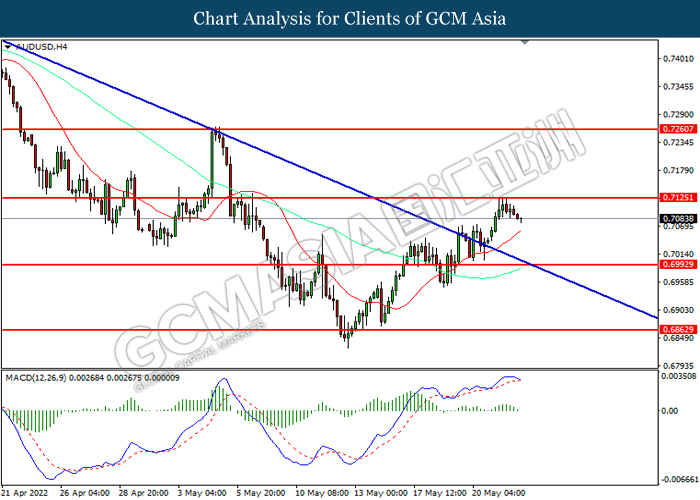

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward support level.

Resistance level: 0.7125, 0.7260

Support level: 0.6995, 0.6865

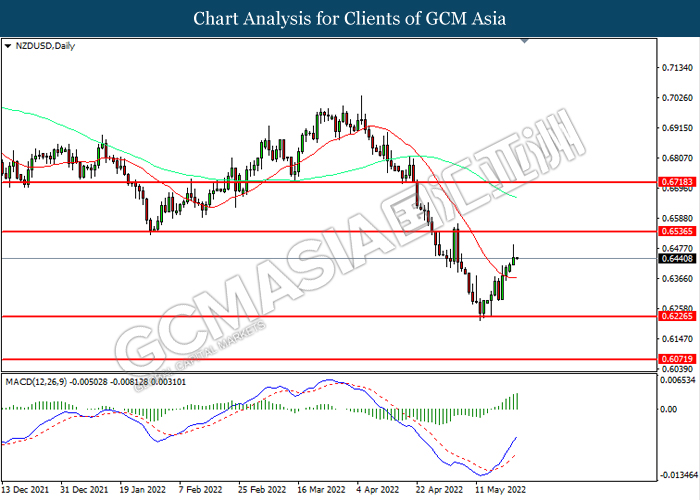

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

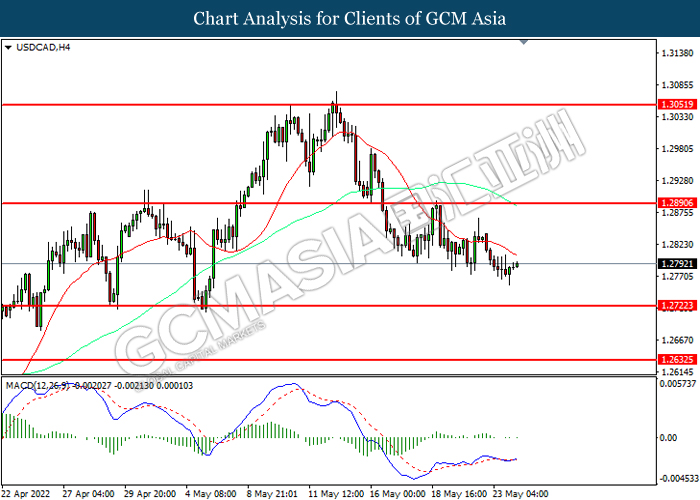

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend it losses.

Resistance level: 1.2890, 1.3050

Support level: 1.2720, 1.2635

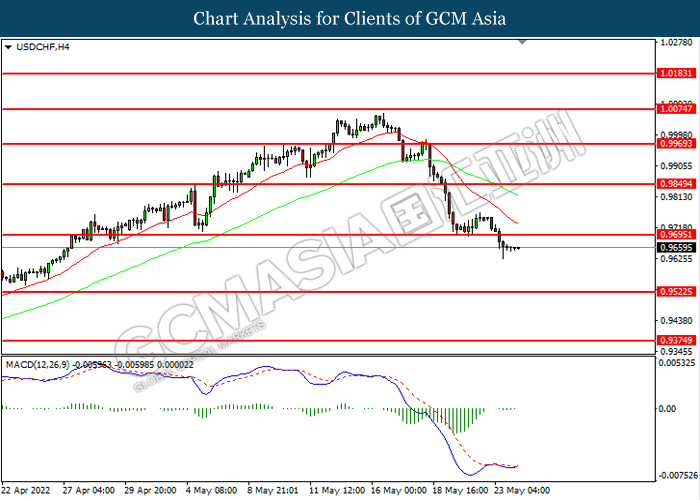

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum to extend its losses toward support level.

Resistance level: 0.9695, 0.9850

Support level: 0.9525, 0.9375

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 110.35, 113.05

Support level: 106.65, 104.05

GOLD_, H1: Gold price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 1863.25, 1878.95

Support level: 1848.55, 1829.40