31 May 2022 Afternoon Session Analysis

Dollar Index slumped amid risk on sentiment heightened.

The US Dollar extends its losses amid the risk-on sentiment in the global financial market, which spurring further bearish momentum on the safe-haven US Dollar. Though, the overall trend for the US Dollar remained stable as US stock and bond markets close for Memorial Day public holiday. The other appeal for the riskier asset Chinese proxy currencies such as Australia and New Zealand Dollar surged significantly following Shanghai emerged further from its Covid-19 lockdown, announcing the resumption of public transport services from 1st June. The authorities also reiterated that the restriction on private cars will be lifted and movement into and out of housing communities will also be allowed on 1st June, except for some residential complexes in medium and high-risk areas. Besides, the authorities in capital Beijing claimed that the Covid-19 outbreak in the region was still under control, after a week of steadily declining case numbers. The announcement of the easing Covid-19 lockdown in China as well as the recent dovish economic data had spurred risk appetite in the global financial market, which diminishing the market demand on the safe-haven US Dollar. As of writing, the dollar index down by 0.01% to 101.65.

In the commodities market, crude oil prices up by 0.64% to $119.20 per barrel as EU has reached a consensus in principle on implementing sanctions toward the oil imported from Russia. Besides, gold prices dropped -0.29% to $1850.85 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

18:00 EUR EU Leaders Summit

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Unemployment Change (May) | -13K | -16K | – |

| 17:00 | EUR – CPI (YoY) (May) | 7.40% | 7.70% | – |

| 20:30 | CAD – GDP (MoM) (Mar) | 1.10% | 0.50% | – |

| 22:00 | USD – CB Consumer Confidence (May) | 107.3 | 103.9 | – |

Technical Analysis

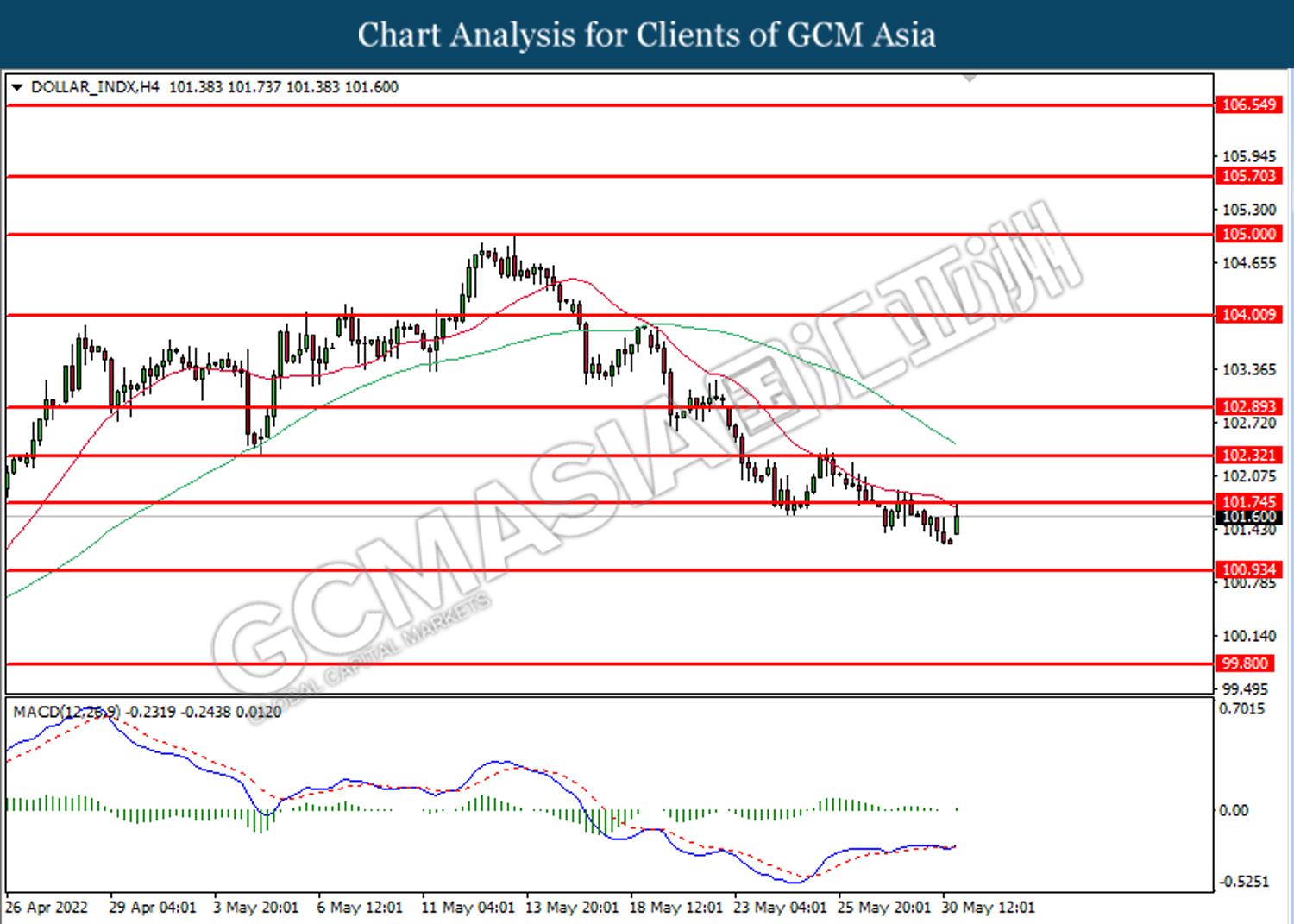

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

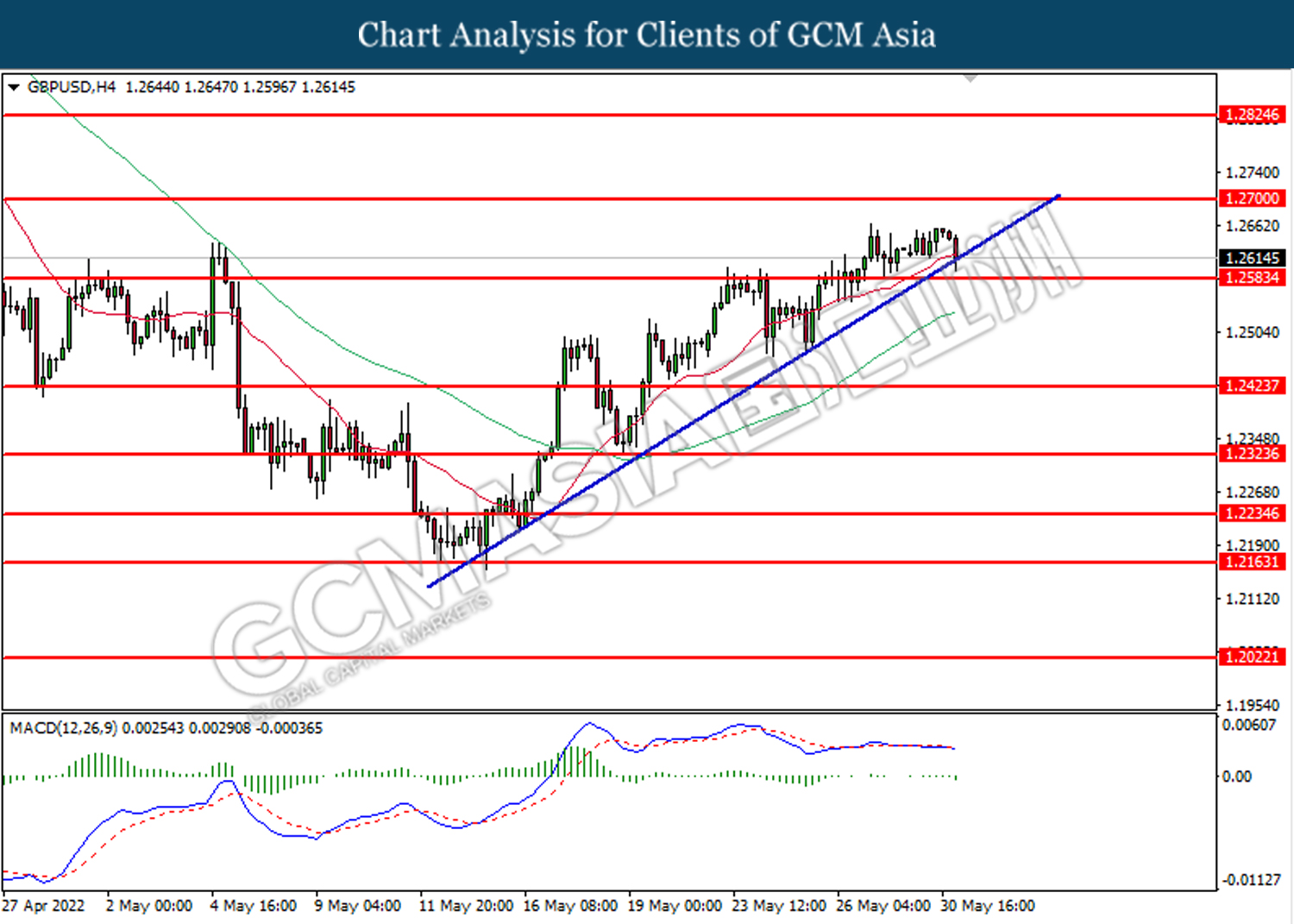

GBPUSD, H4: GBPUSD was traded lower while currently testing the upward trendline. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the upward trendline.

Resistance level: 1.2700, 1.2825

Support level: 1.2585, 1.2425

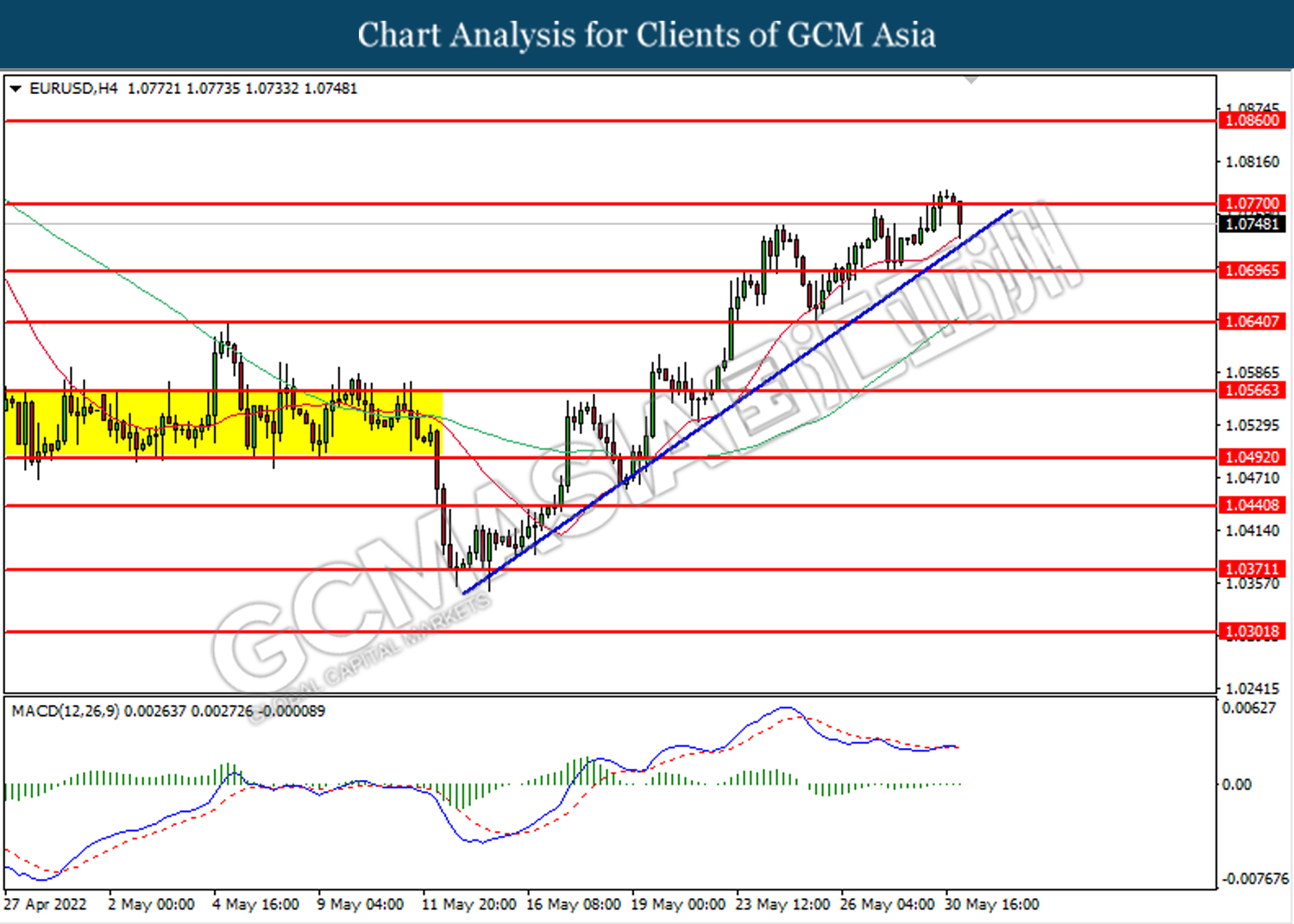

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its retracement toward the support level at 1.0695.

Resistance level: 1.0770, 1.0660

Support level: 1.0695, 1.0640

USDJPY, Daily: USDJPY was traded higher following prior rebound from the support level at 126.95. MACD which illustrated diminishing bearish momentum suggest the pair to be extend its gains toward the resistance level at 128.80.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

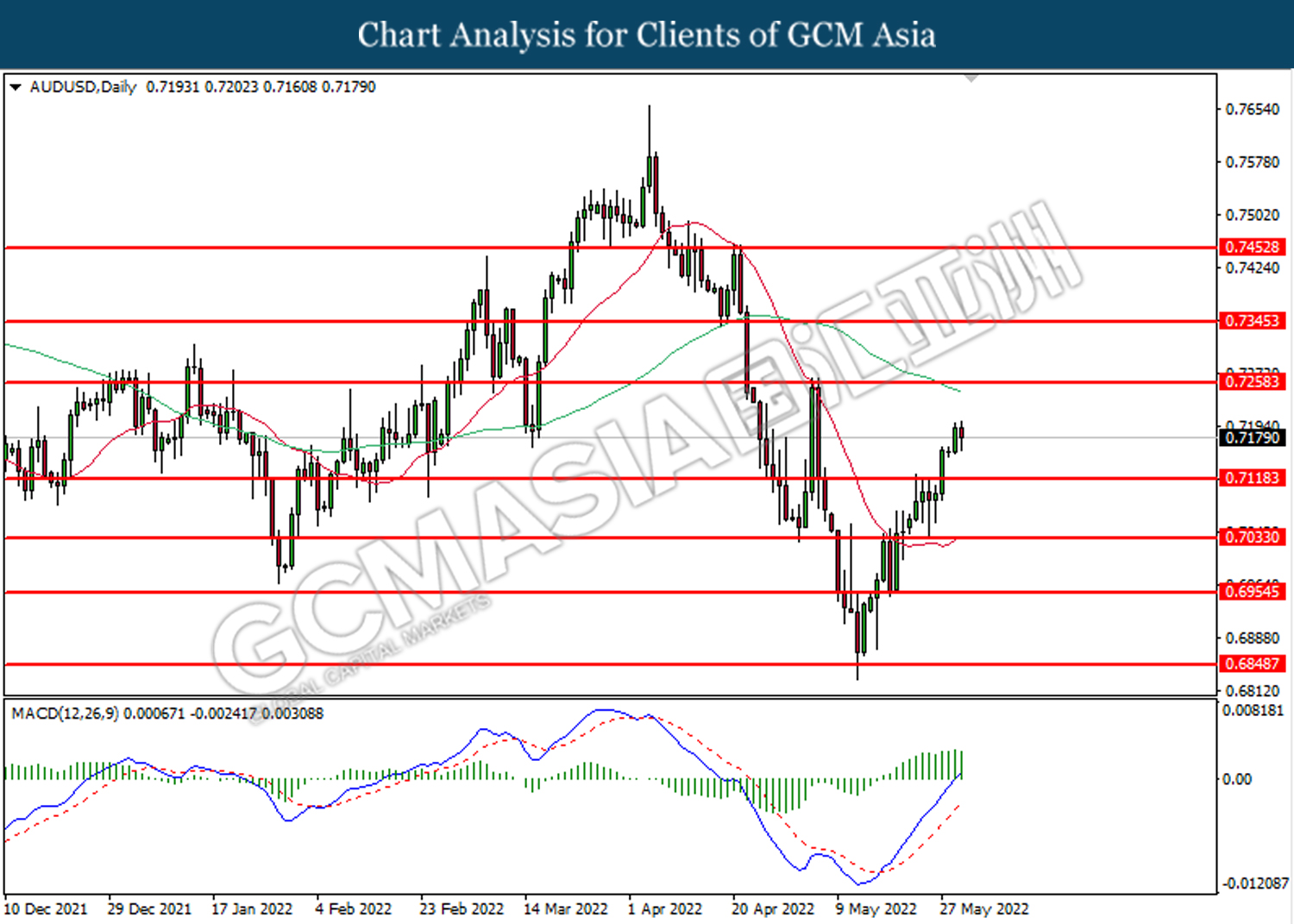

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

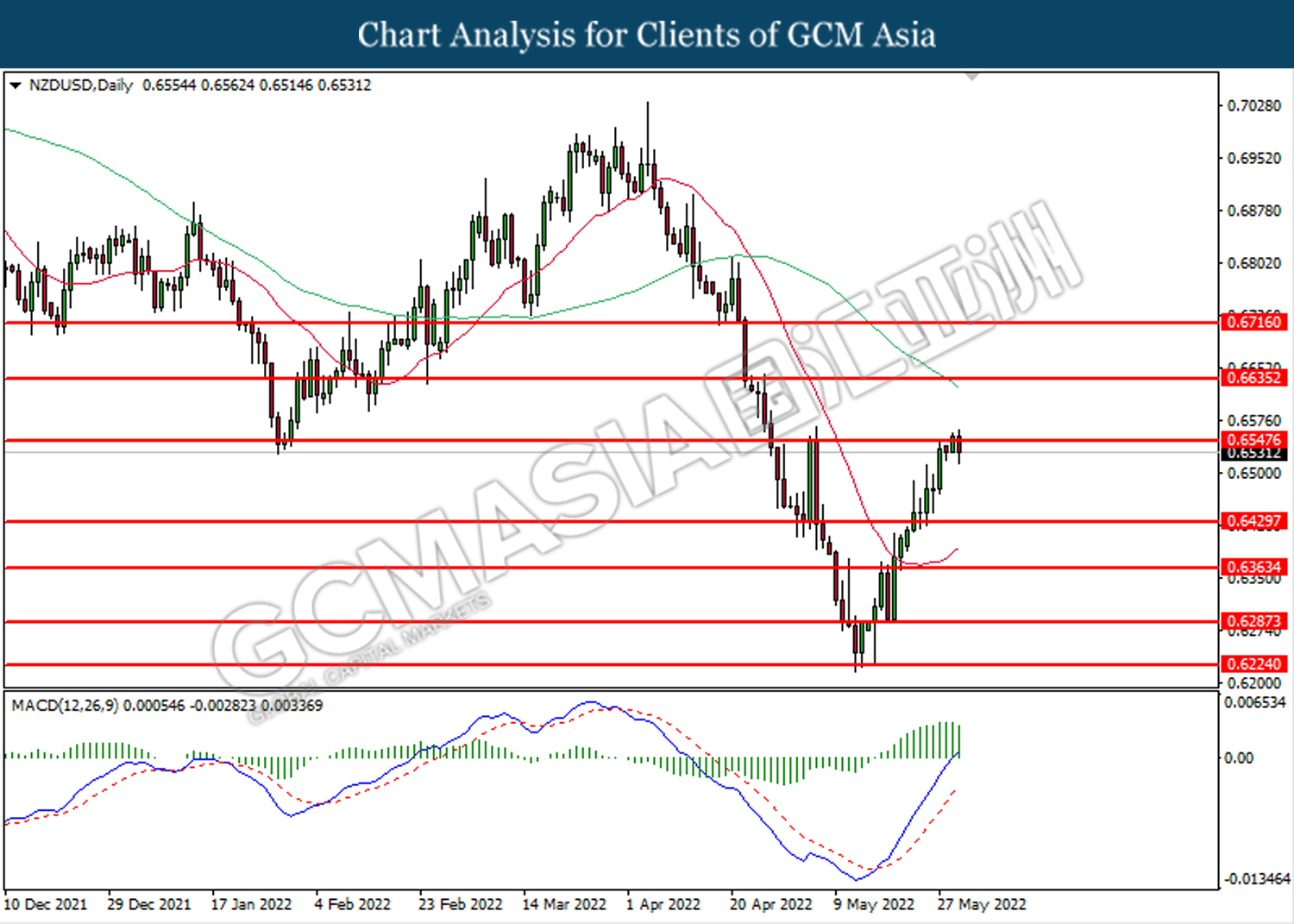

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level at 0.6545. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level at 0.6545.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

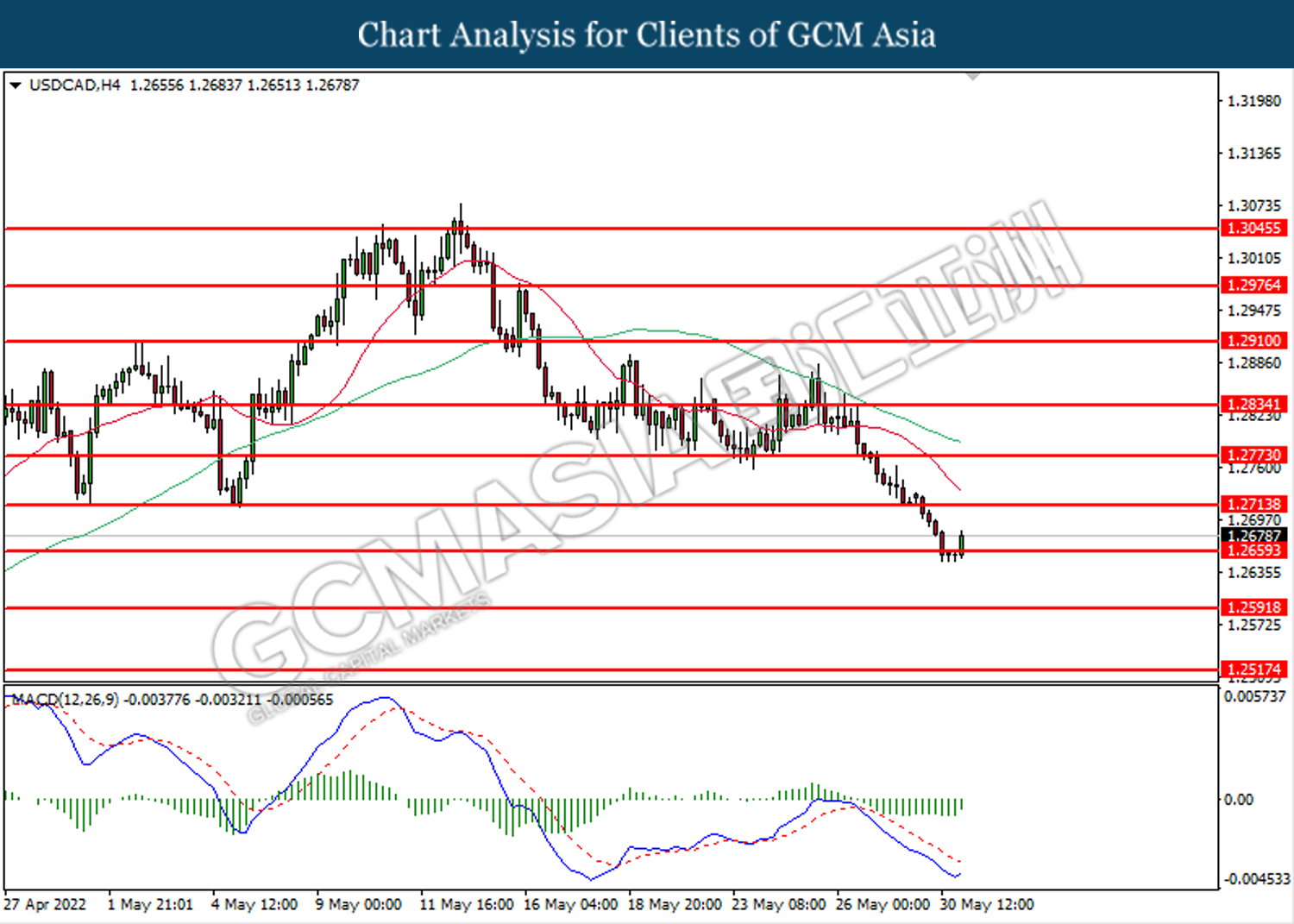

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level at 1.2660. MACD which illustrated diminishing bearish momentum suggest the pair to extend its rebound toward the resistance level at 1.2715.

Resistance level: 1.2715, 1.2775

Support level: 1.2660, 1.2590

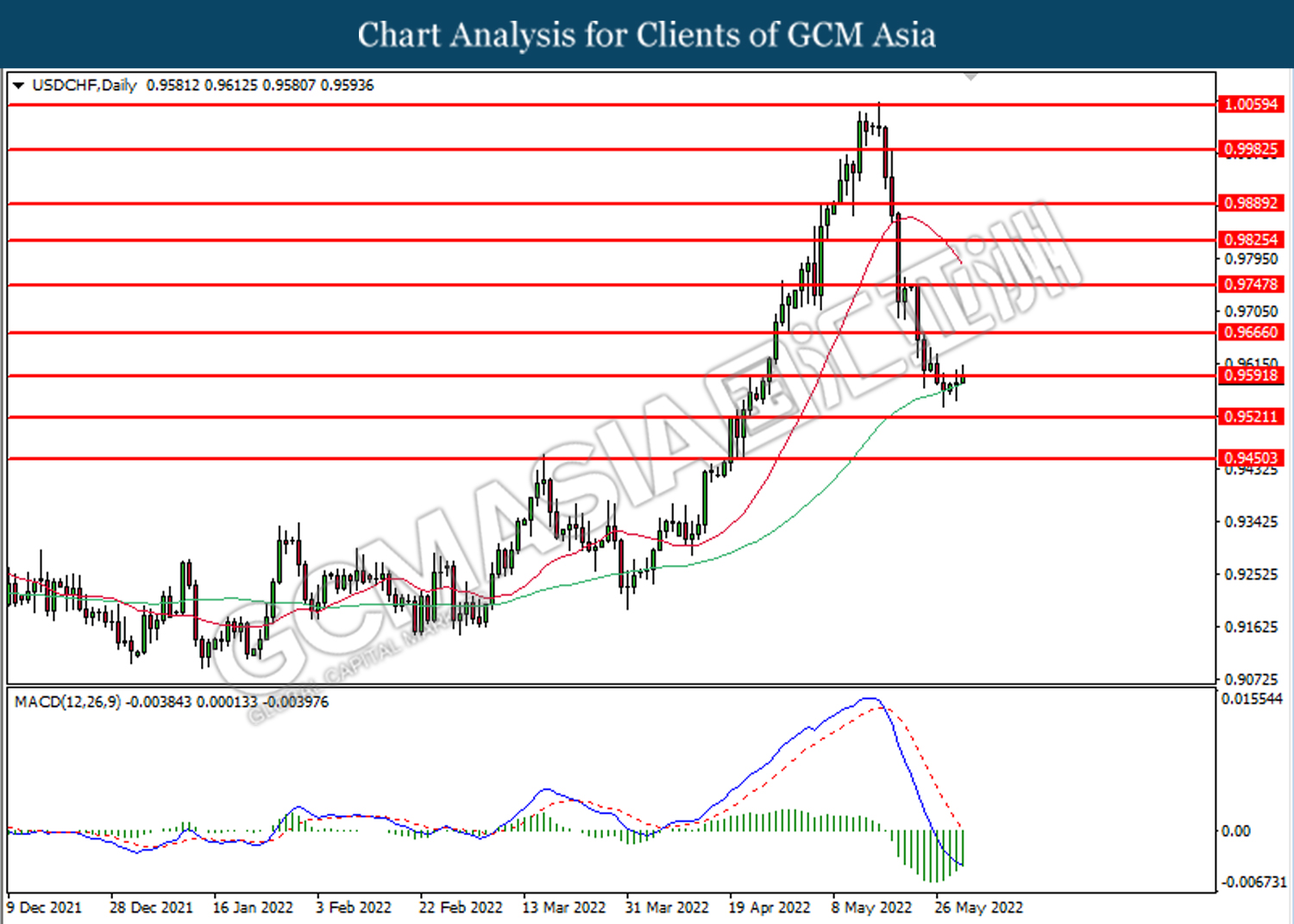

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

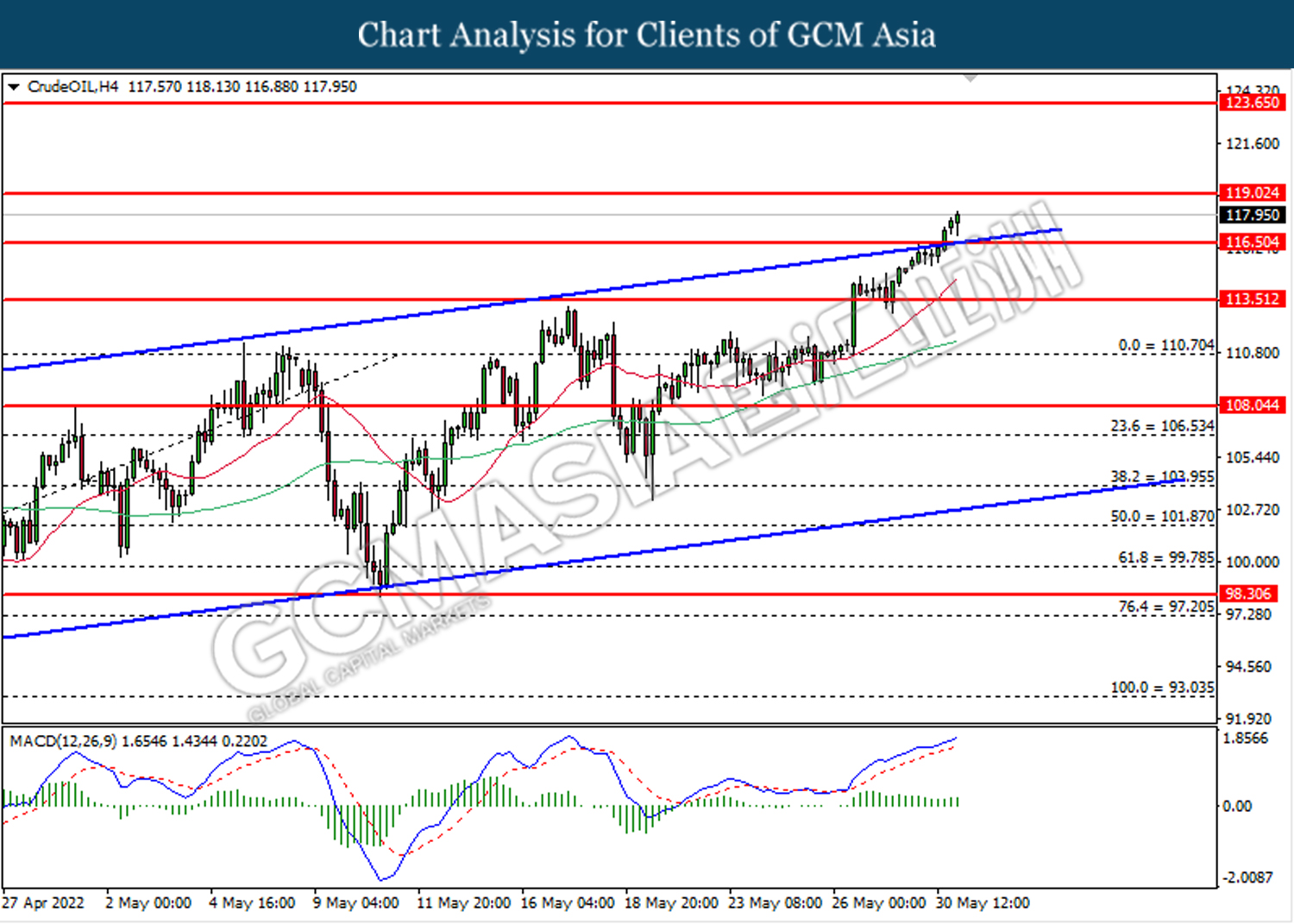

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level at 116.50. MACD which illustrated bullish momentum suggest the commodity to extend its gains toward the resistance level at 119.00.

Resistance level: 119.00, 123.65

Support level: 116.50, 113.50

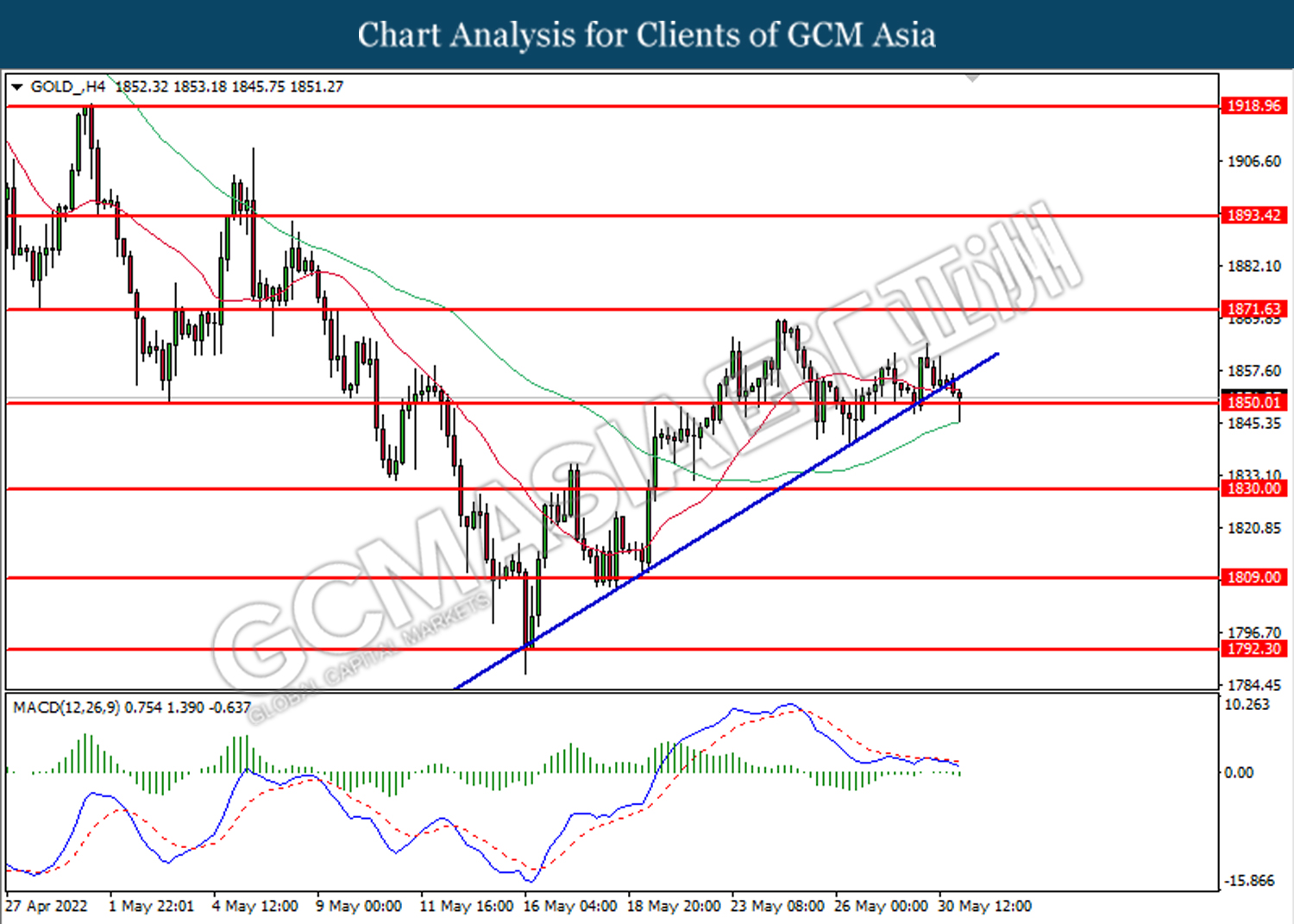

GOLD_, H4: Gold price was traded lower while currently testing the support level at 1850.00. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses after it successfully breakout below the support level.

Resistance level: 1871.65, 1893.40

Support level: 1850.00, 1830.00