1 June 2022 Afternoon Session Analysis

Euro dived following the release of the economic data.

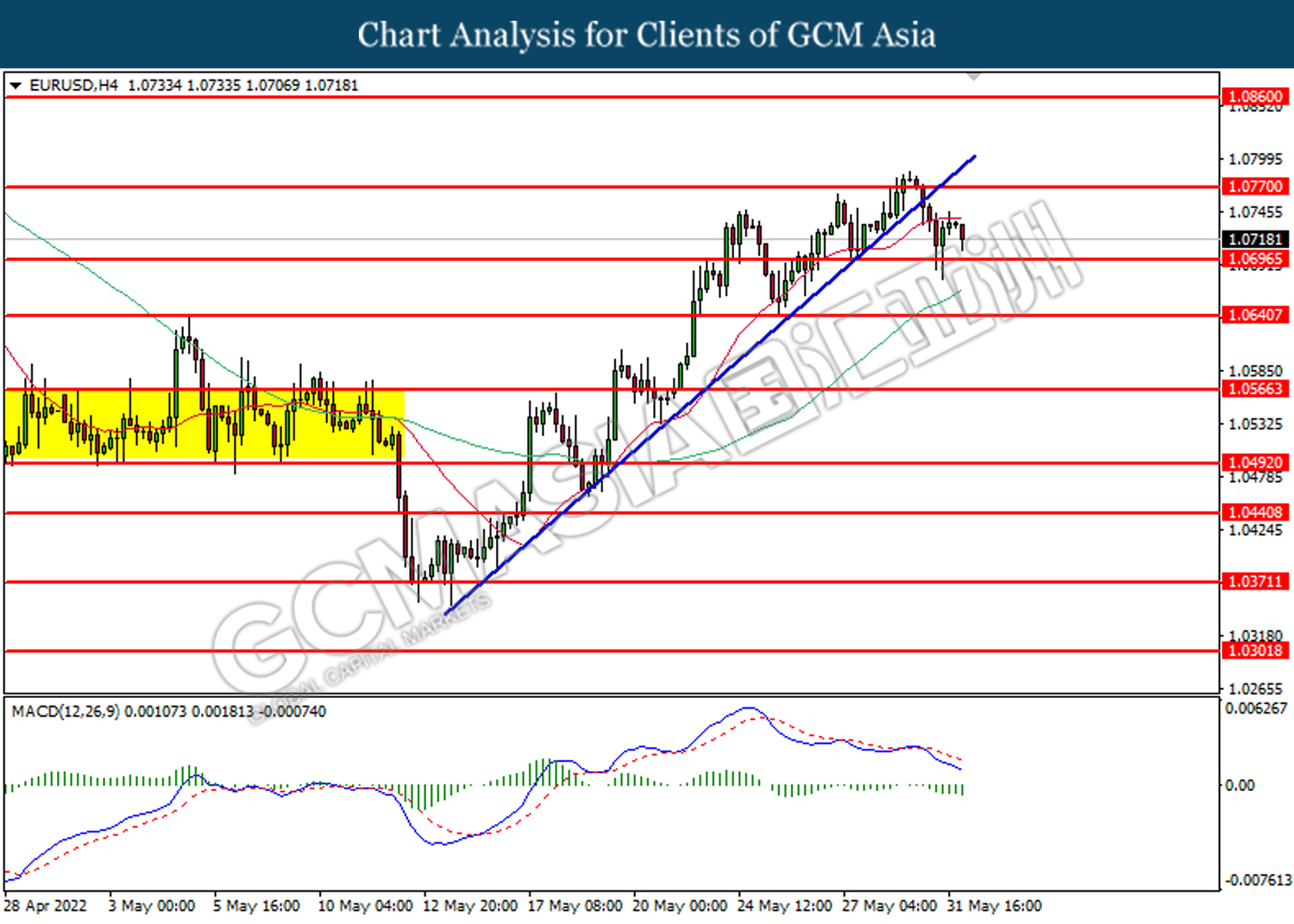

The Euro retreated from higher level yesterday following the released of bearish economic data. According to Destatis, the Germany Unemployment Change came in at only -4K, missing the market forecast at -16K. Such negative economic data had dialed down the market optimism toward the economic progression in Europe countries, diminishing the demand on Euro. Nonetheless, the losses experienced by the Euro was limited amid the rate hike expectation from ECB continue to linger in the European bond market following spiking number of inflation data was released. The Eurozone inflation soared to a new record high in the year to May, spurring further pressure on the European Central Bank to speed up the pace of its contractionary monetary policy in future. The Eurozone Consumer Price Index (CPI) notched up significantly from the previous reading of 7.4% to 8.1%, much higher than the economist forecast at 7.7%. The data prompted a significant fall in eurozone bond markets, as investors increased their bets on how much the ECB will raise its interest rate by this year. Italy’s 10-year government bond yield rose by 0.11% to 3.11% on Tuesday. As of writing, the pair of EUR/USD dropped -0.11% to 1.0720.

In the commodities market, crude oil prices down by 0.24% to $116.20 per barrel as OPEC plans to rule out Russia from the oil production plan. Besides, gold prices slumped -0.02% to $1837.40 per troy ounce amid the strengthening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:55 | EUR – German Manufacturing PMI (May) | 54.7 | 54.7 | – |

| 16:30 | GBP – Manufacturing PMI (May) | 54.6 | 54.6 | – |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 300K | – |

| 22:00 | USD – ISM Manufacturing PMI (May) | 55.4 | 54.5 | – |

| 22:00 | USD – JOLTs Job Openings (Apr) | 11.549M | 11.400M | – |

| 22:00 | CAD – BoC Interest Rate Decision | 1.00% | 1.50% | – |

Technical Analysis

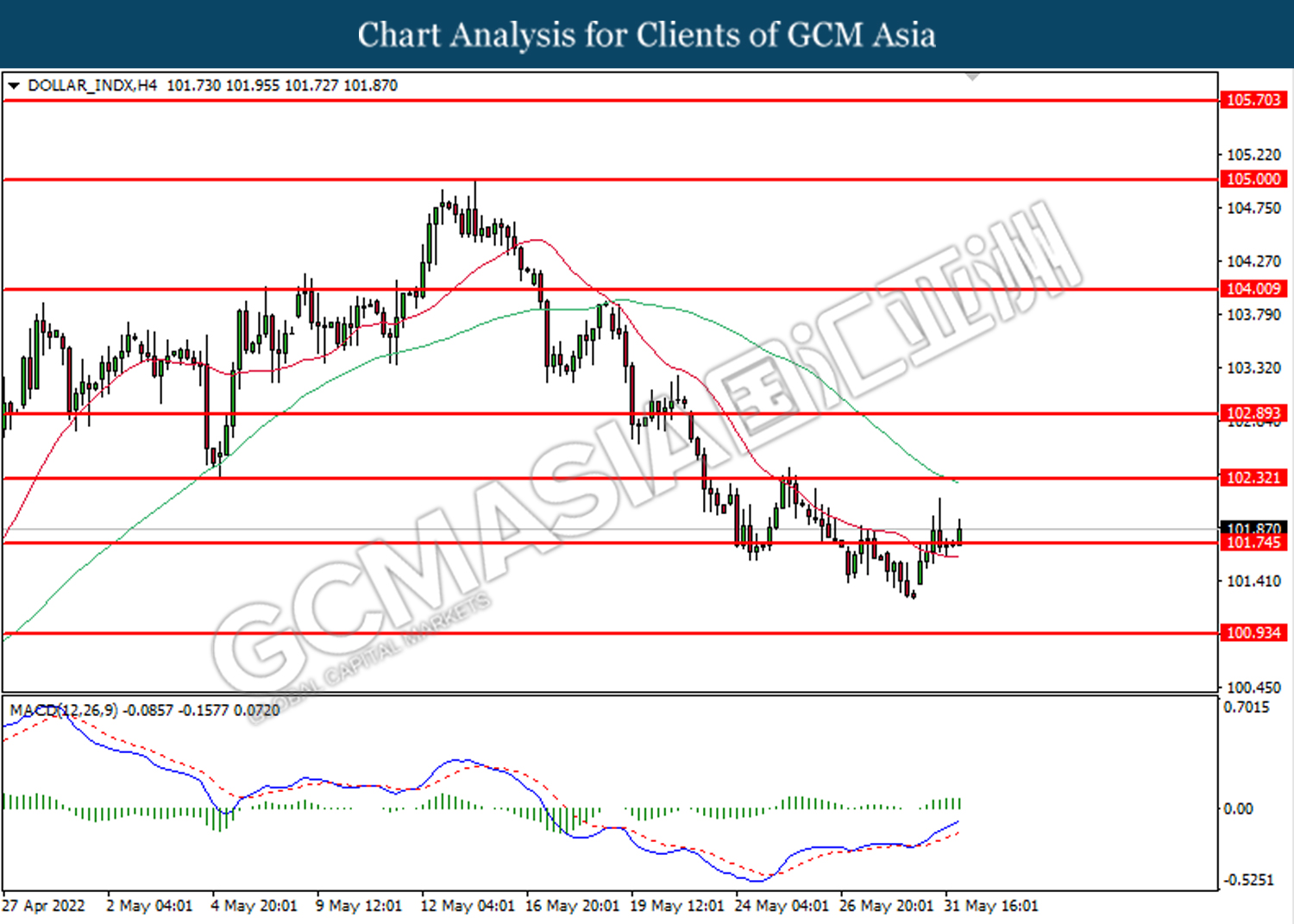

DOLLAR_INDX, H4: Dollar index was traded higher while currently testing the resistance level at 101.75. MACD which illustrated bullish bias momentum suggest the index to extend its gains after it successfully breakout above the resistance level.

Resistance level: 101.75, 102.30

Support level: 100.95, 99.80

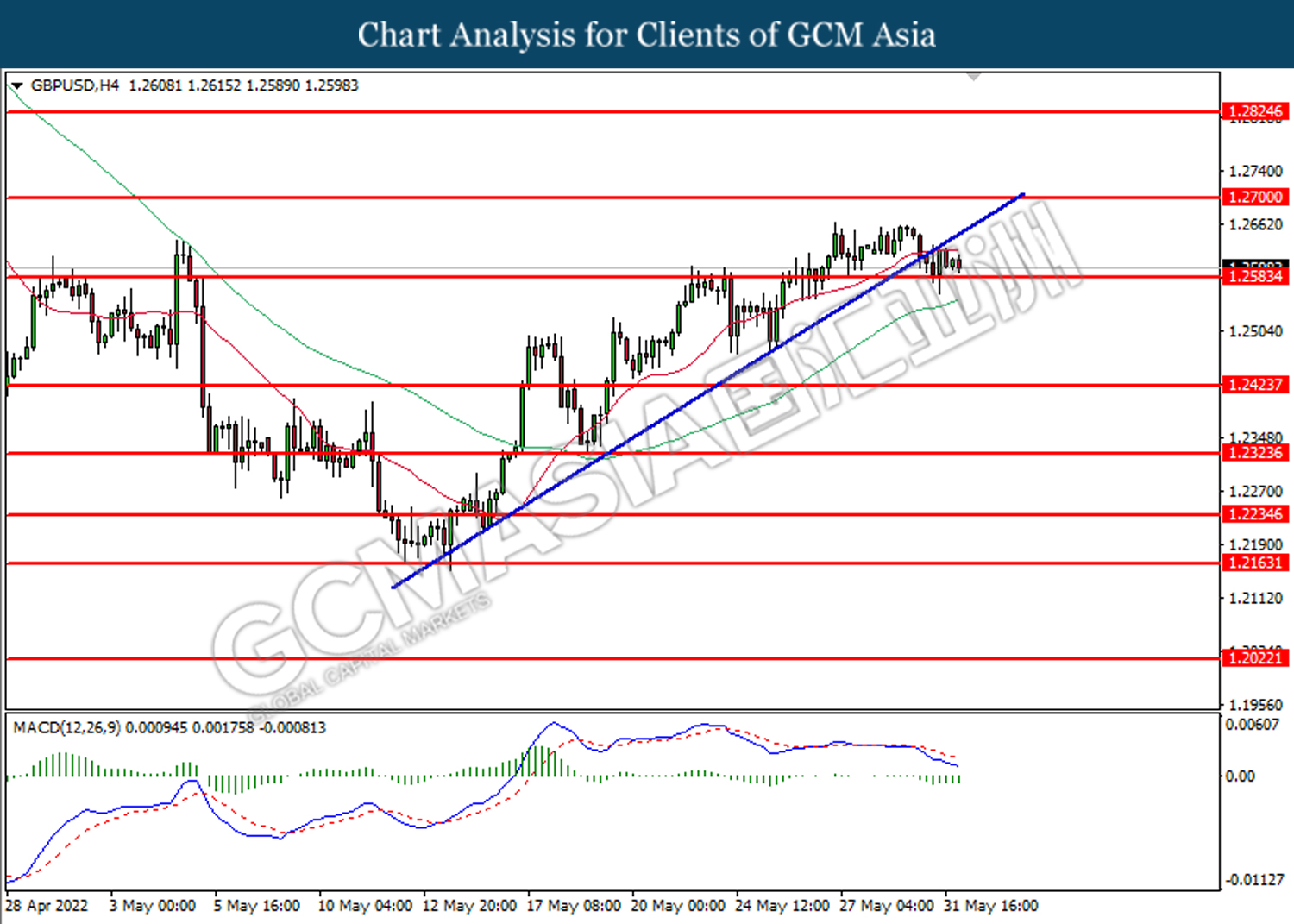

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level at 1.2585. MACD which illustrated bearish bias momentum suggest the pair to extend its losses after it successfully breakout below the support level.

Resistance level: 1.2700, 1.2825

Support level: 1.2585, 1.2425

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level at 1.0770. MACD which illustrated bearish bias momentum suggest the pair to extend its retracement toward the support level at 1.0695.

Resistance level: 1.0770, 1.0660

Support level: 1.0695, 1.0640

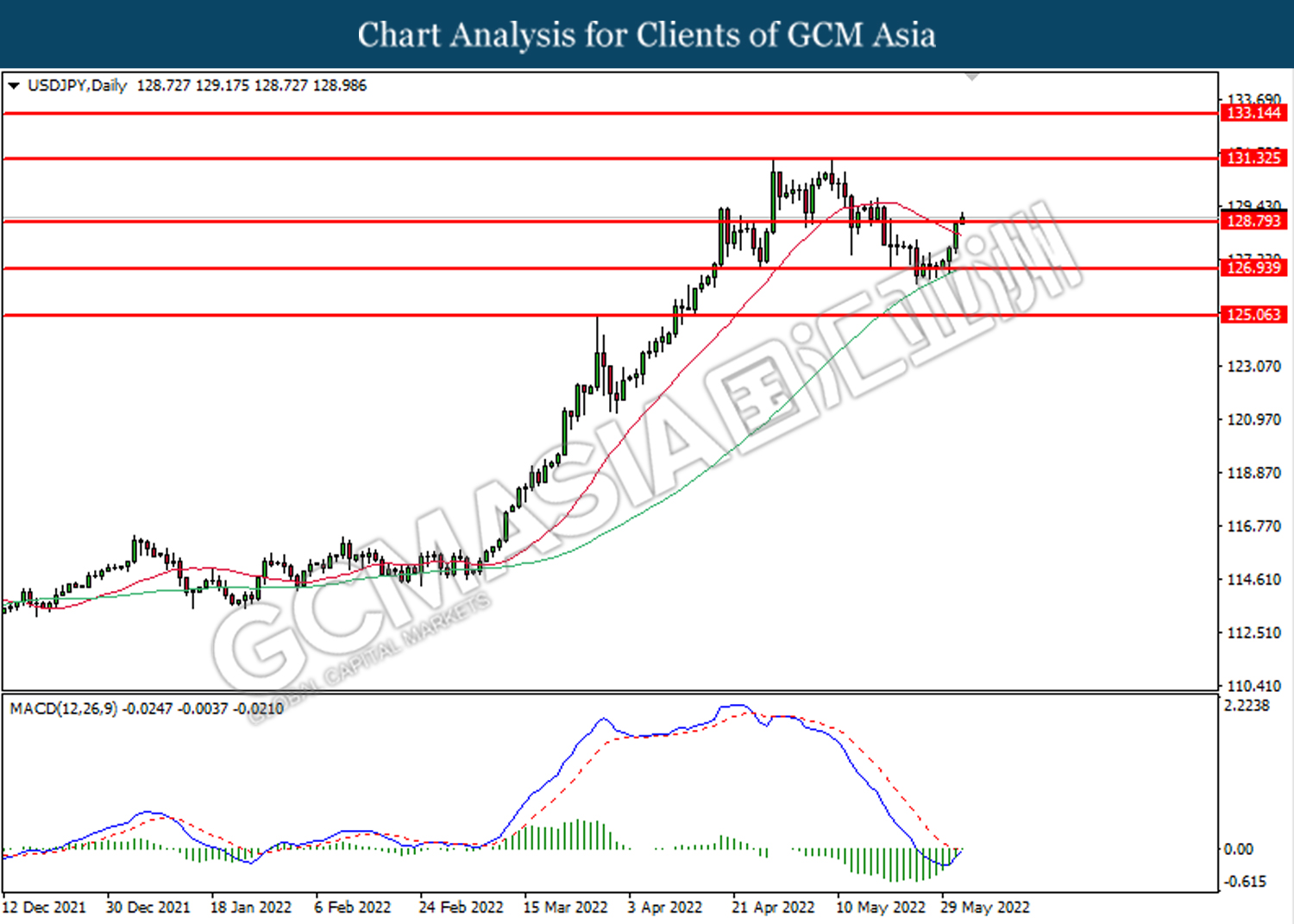

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 128.80. MACD which illustrated diminishing bearish momentum suggest the pair to be extend its gains after it successfully breakout above the resistance level.

Resistance level: 128.80, 131.35

Support level: 126.95, 125.05

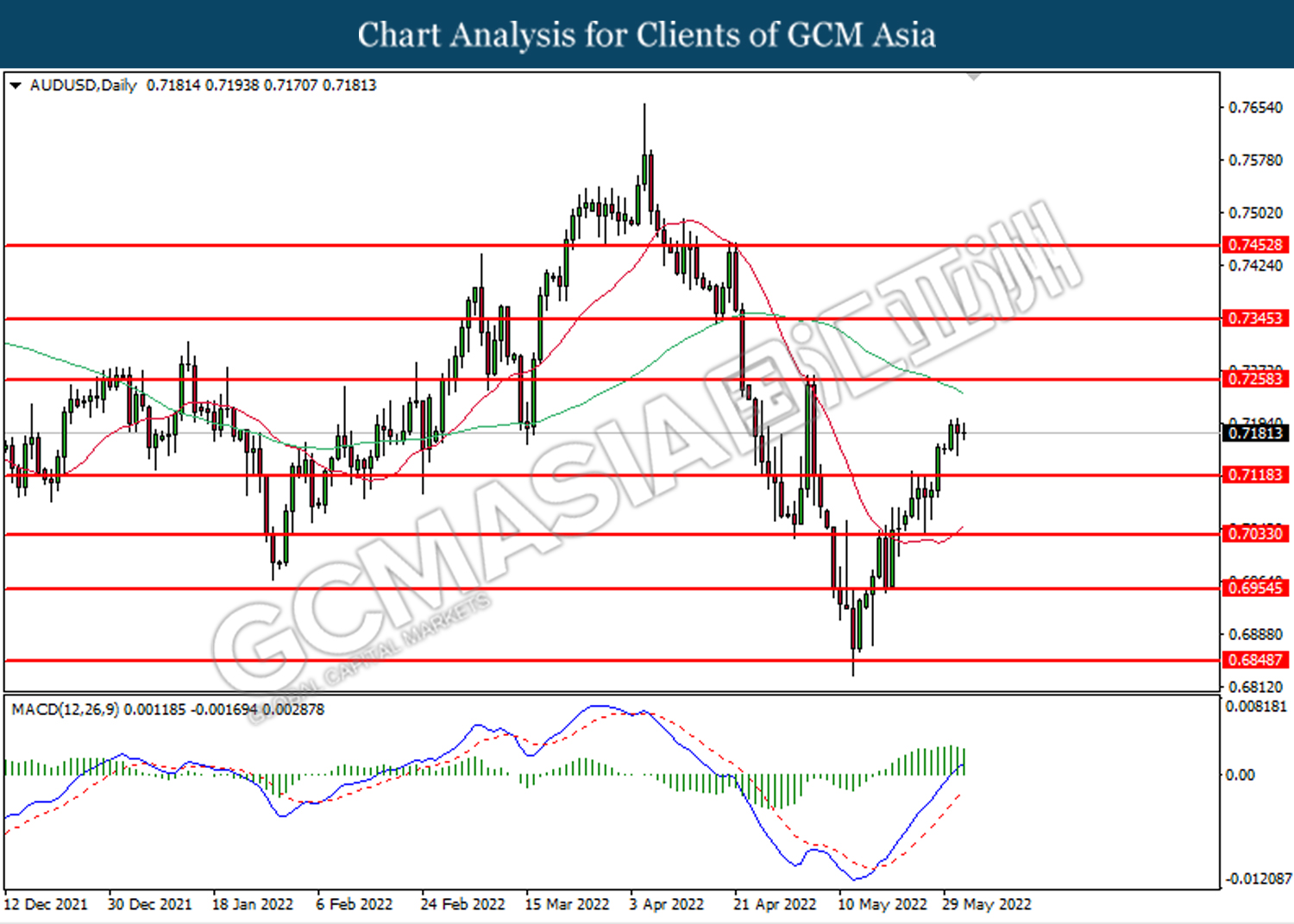

AUDUSD, Daily: AUDUSD was traded higher following prior breakout above the previous resistance level at 0.7120. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 0.7260.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

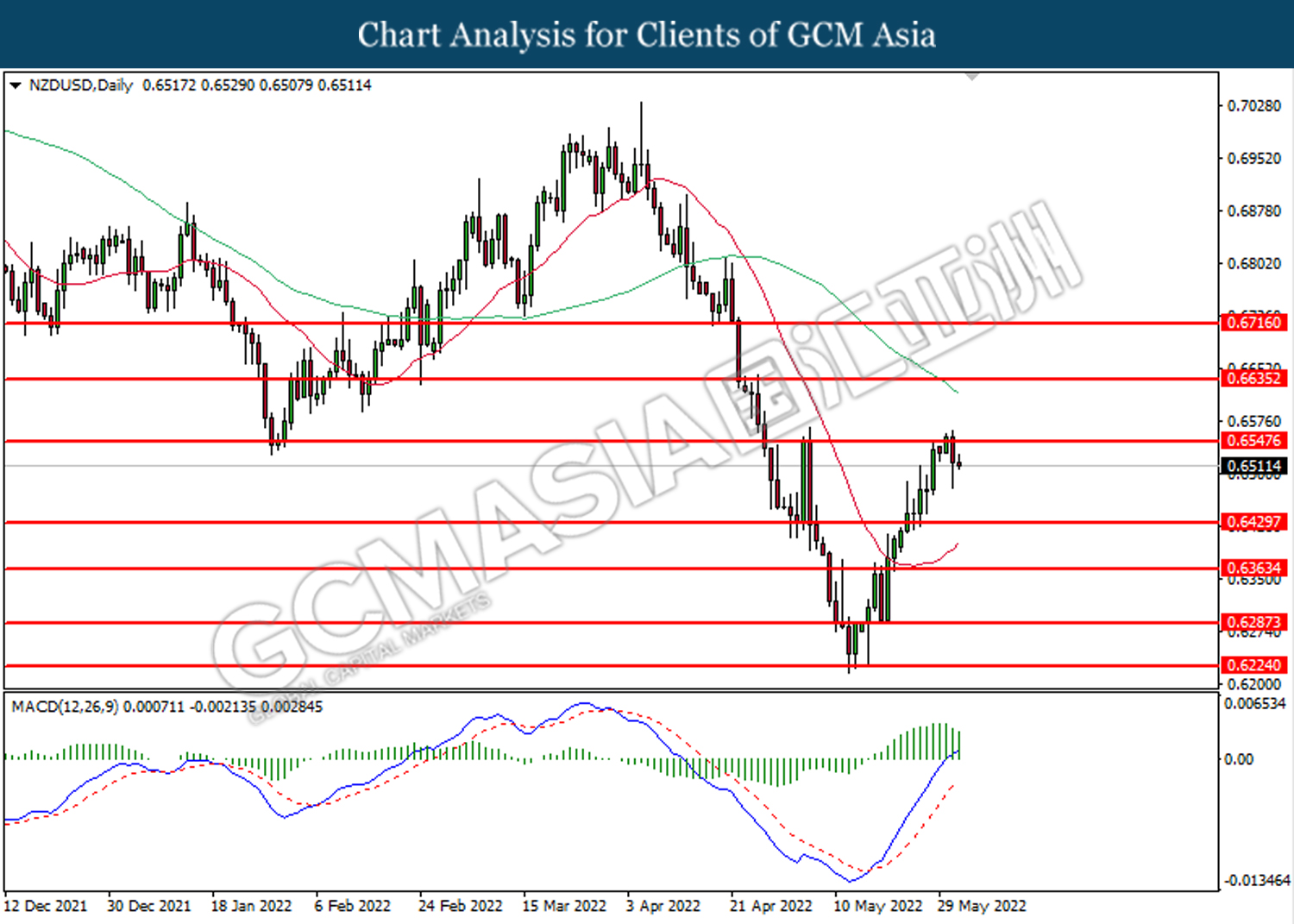

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6545. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6430.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

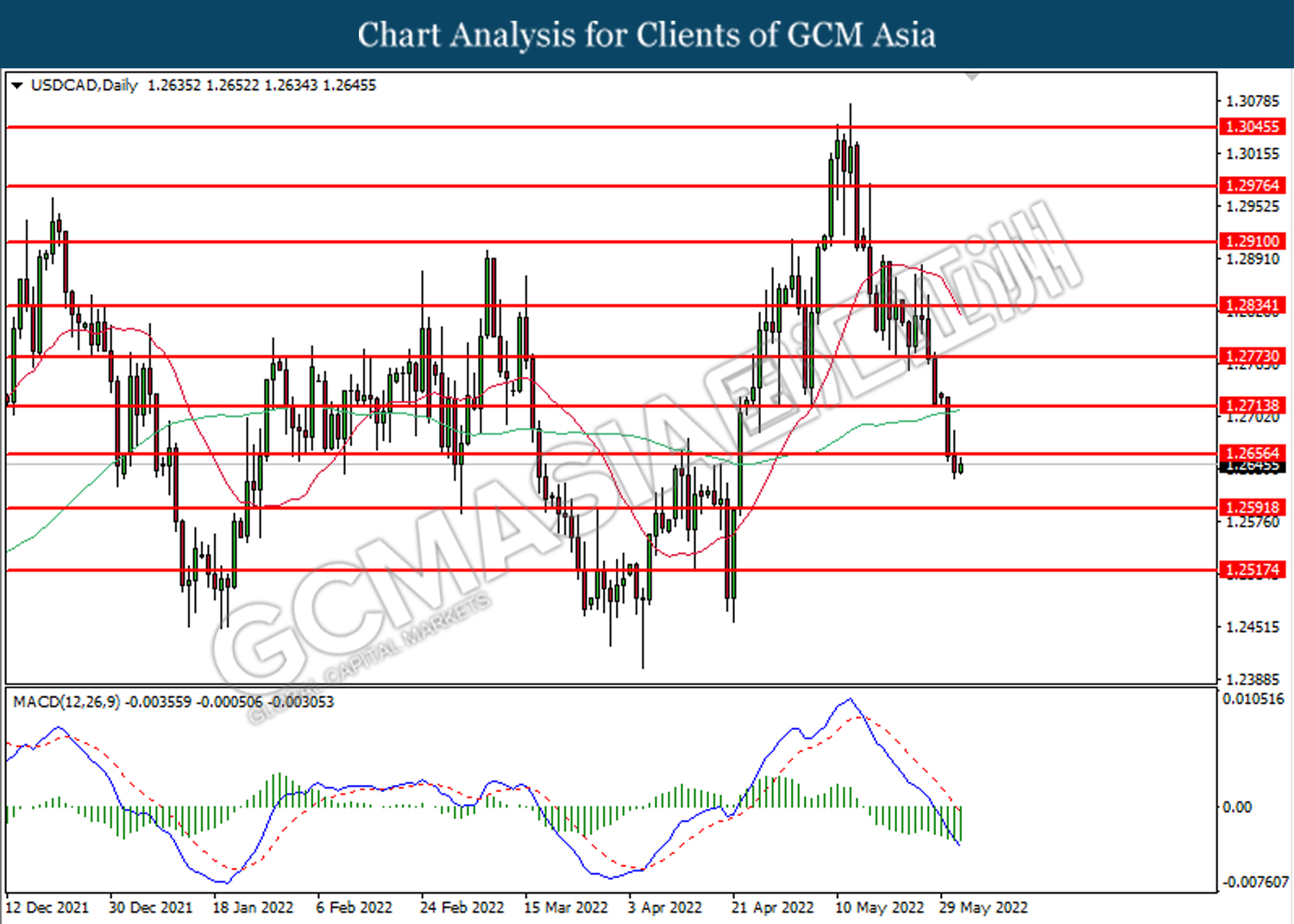

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level at 1.2655. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2590.

Resistance level: 1.2655, 1.2715

Support level: 1.2590, 1.2515

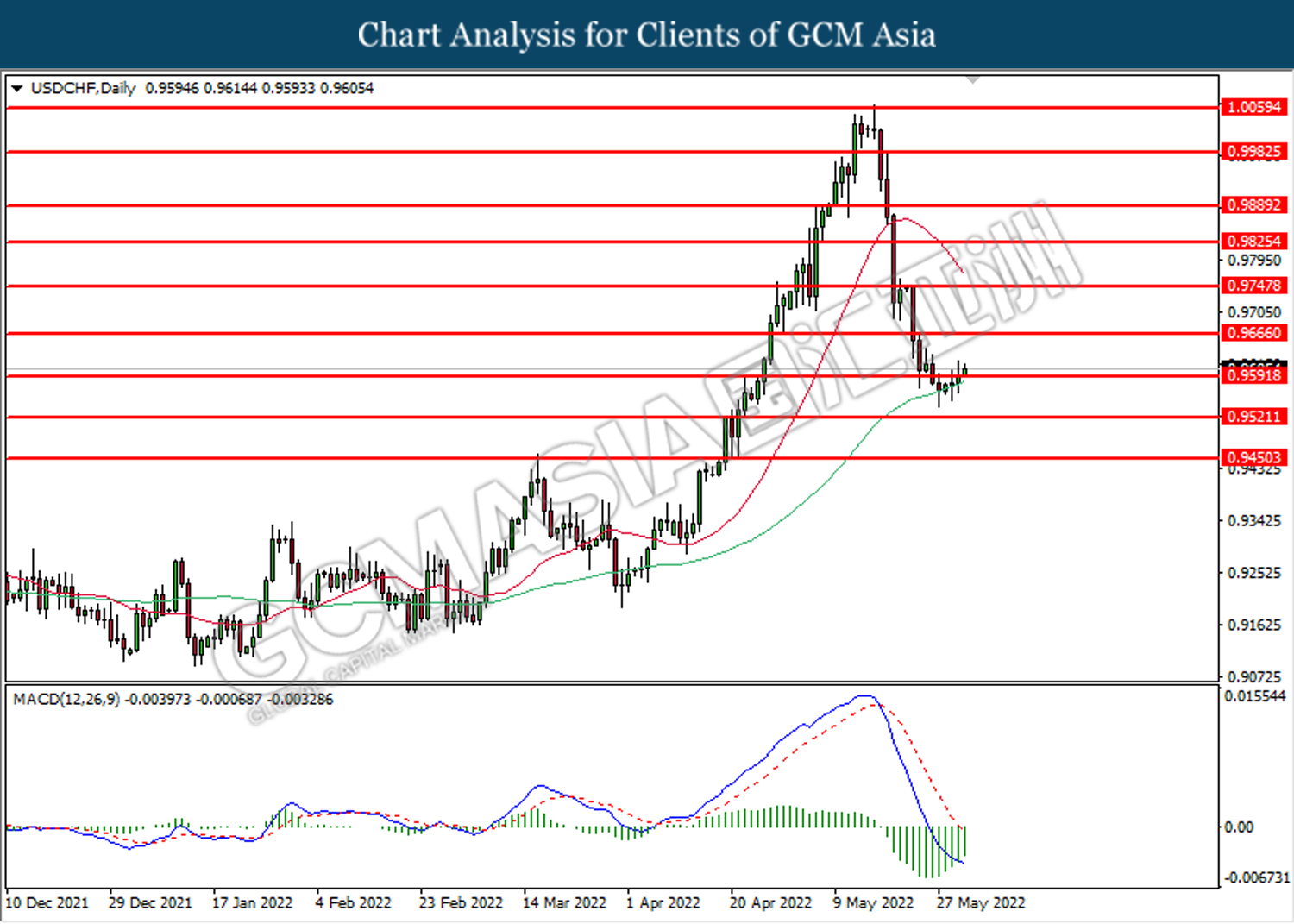

USDCHF, Daily: USDCHF was traded higher while currently testing the resistance level at 0.9590. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 0.9590, 0.9665

Support level: 0.9520, 0.9450

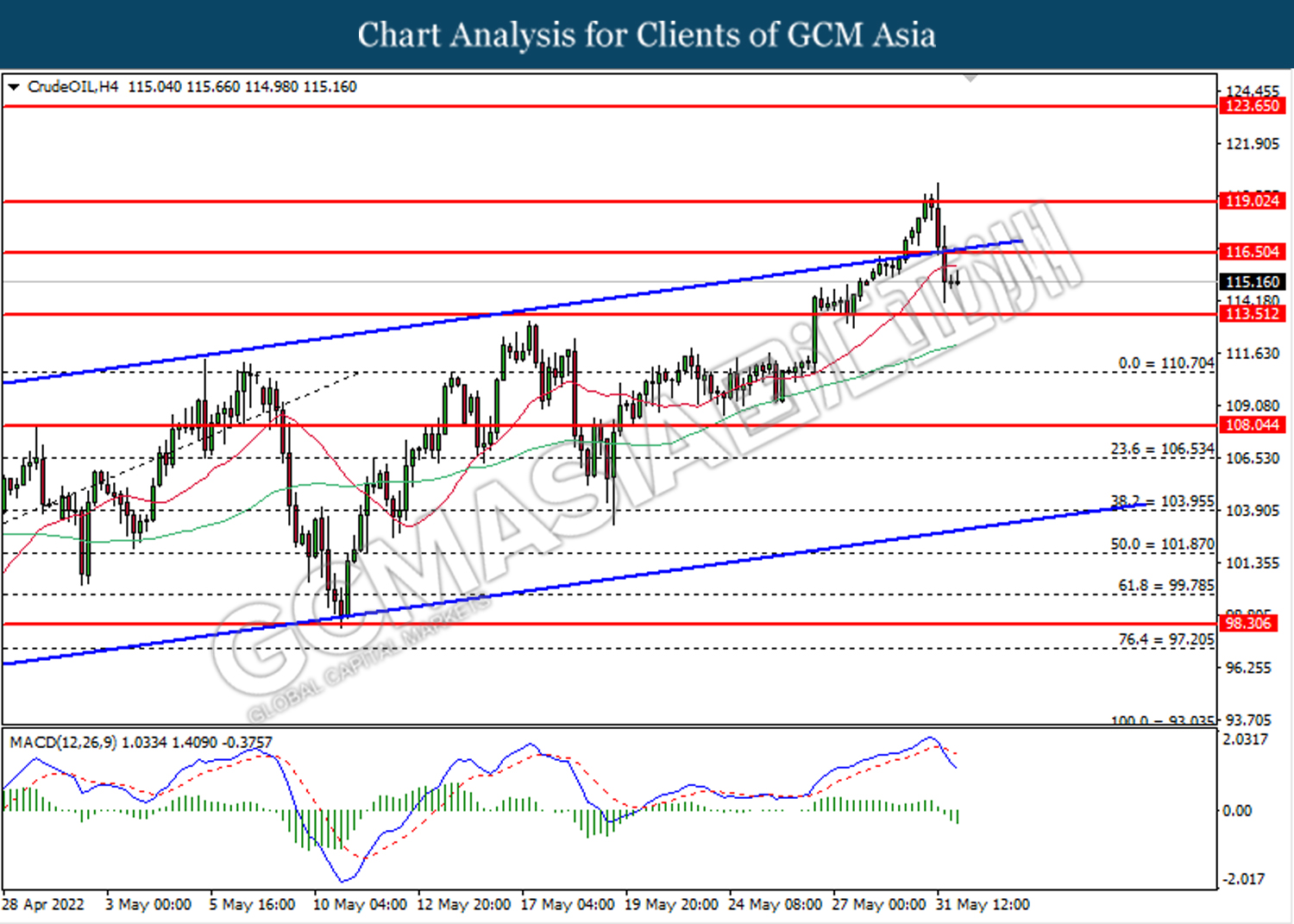

CrudeOIL, H4: Crude oil price was traded lower following prior breakout above the previous support level at 116.50. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 113.50.

Resistance level: 116.50, 119.00

Support level: 113.50, 110.70

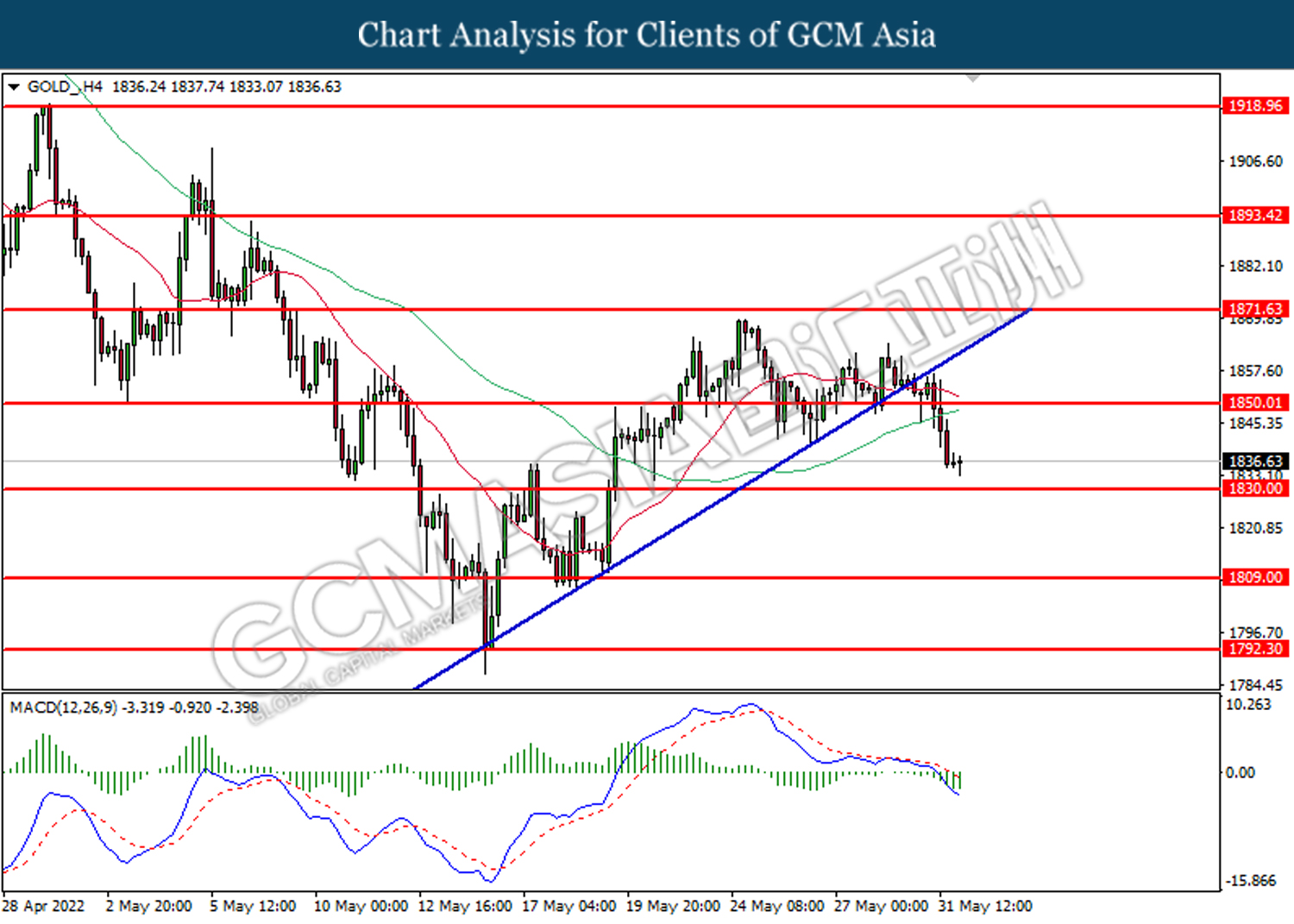

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level at 1850.00. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses toward the support level at 1830.00.

Resistance level: 1850.00, 1871.65

Support level: 1830.00, 1809.00