2 June 2022 Morning Session Analysis

Inflation hover in the market, US Dollar spiked.

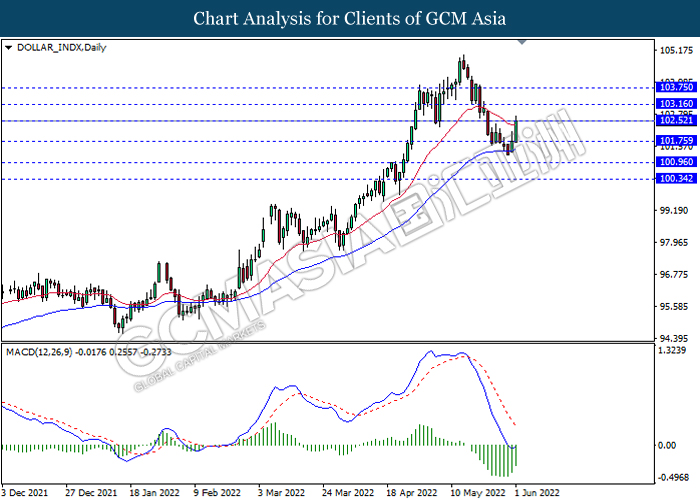

The Dollar Index which traded against a basket of six major currencies surged since yesterday amid the backdrop of soaring inflation risk keep hovering in the market. According to Reuters, the US Deputy Secretary of the Treasury Wally Adeyemo appeared a speech on Wednesday, which claimed that the high inflation is being driven by global phenomena that could not be anticipated, including Russia’s invasion of Ukraine and the lockdown of China. Both situation had led to the global supply chain disruption, which causing the commodities price to spike such as crude oil. Nonetheless, President Joe Biden told Fed Chair Jerome Powell on Tuesday that he will give sufficient space and independence for the Federal Reserve to stabilize the inflation rate, which increased the odds of rate hike from the Fed in the upcoming FOMC meetings, sparkling the appeal of the US Dollar. Besides, investors were prompted to shift their capitals toward safe-haven assets such as US Dollar in order to protect their capitals away from inflation. As of writing, the Dollar Index appreciated by 0.80% to 102.58.

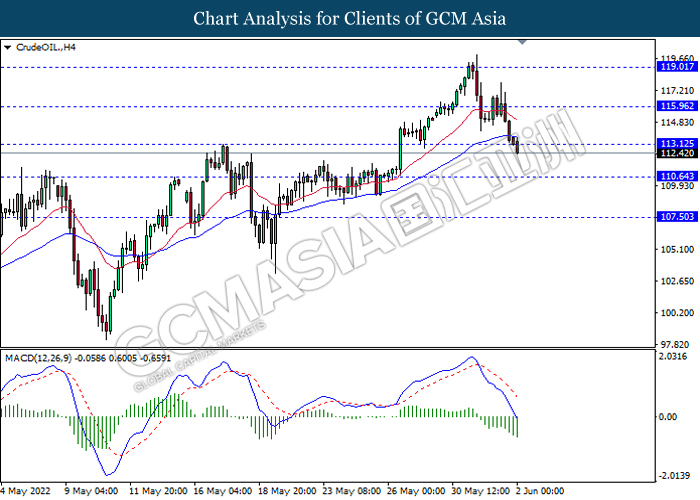

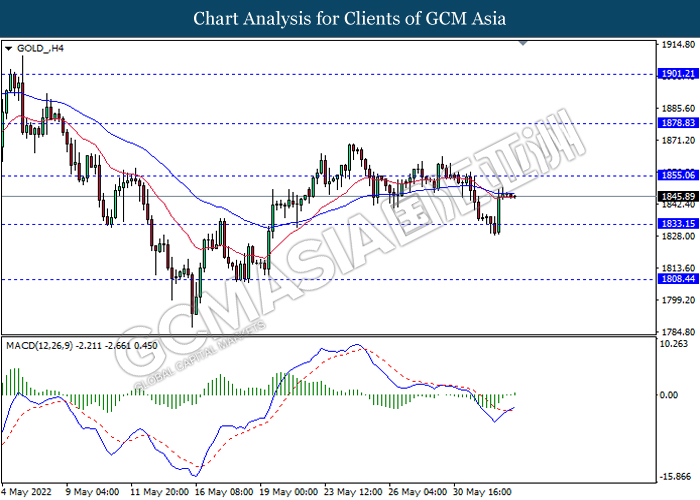

In the commodities market, crude oil price slumped by 1.53% to $113.51 per barrel as of writing. However, the overall trend for oil price remained bullish as EU agreed to phase in Russian oil ban. On the other hand, gold price edged up by 0.06% to $1850.05 per troy ounce as of writing following the risk-off sentiment toward safe-haven assets.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | USD – ADP Nonfarm Employment Change (May) | 247K | 280K | – |

| 20:30 | USD – Initial Jobless Claims | 210K | 210K | – |

| 23:00 | USD – Crude Oil Inventories | -1.019M | -0.737M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

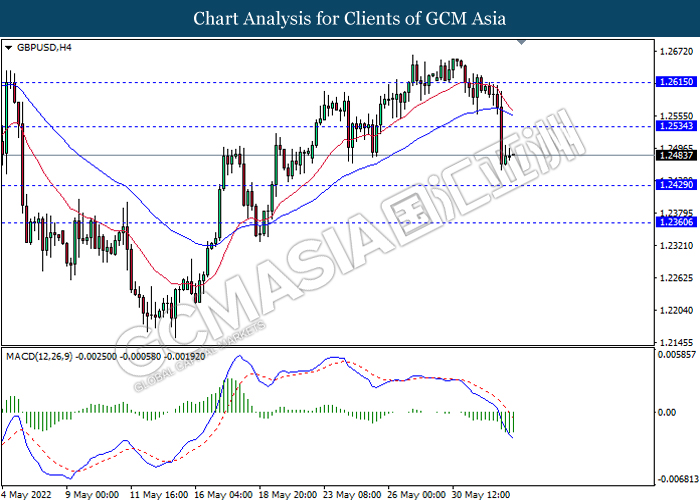

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2535, 1.2615

Support level: 1.2430, 1.2360

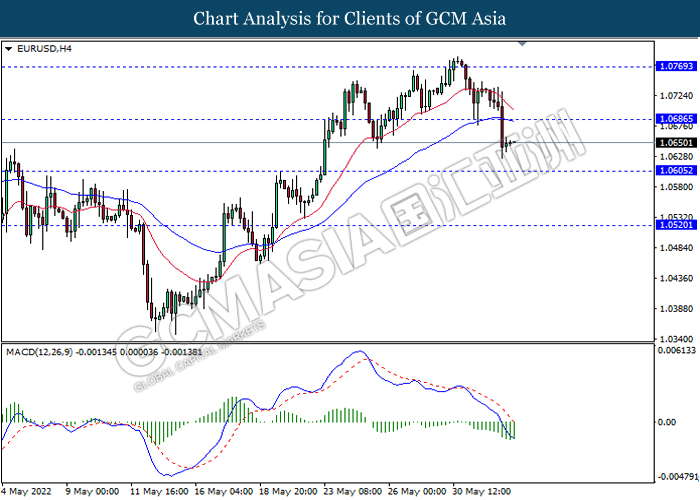

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0685, 1.0770

Support level: 1.0605, 1.0520

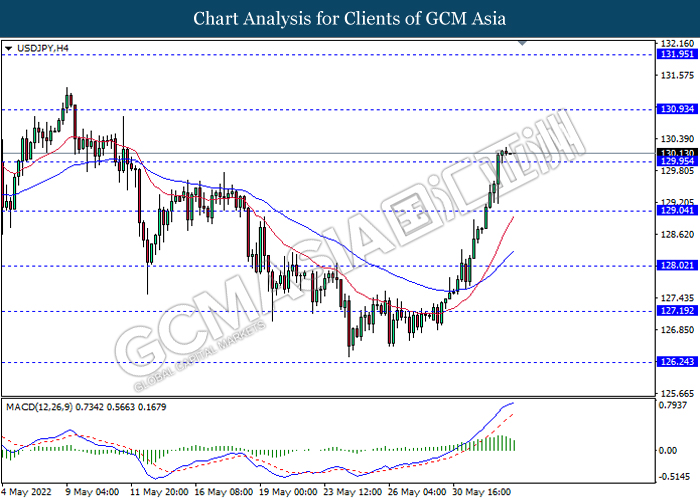

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 130.95, 131.95

Support level: 129.95, 129.05

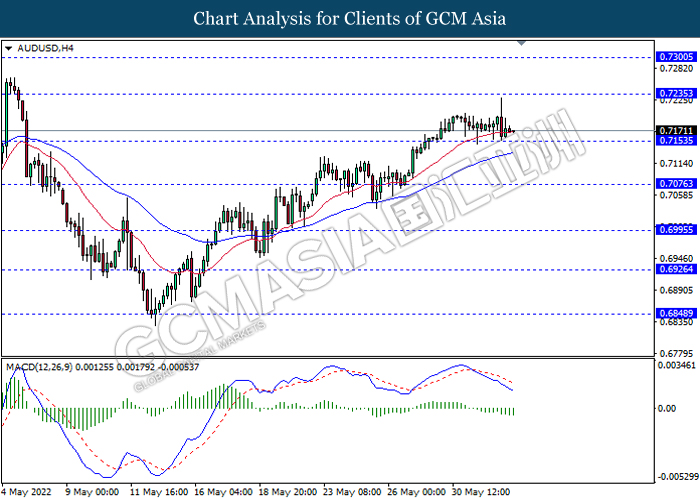

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.7235, 0.7300

Support level: 0.7155, 0.7075

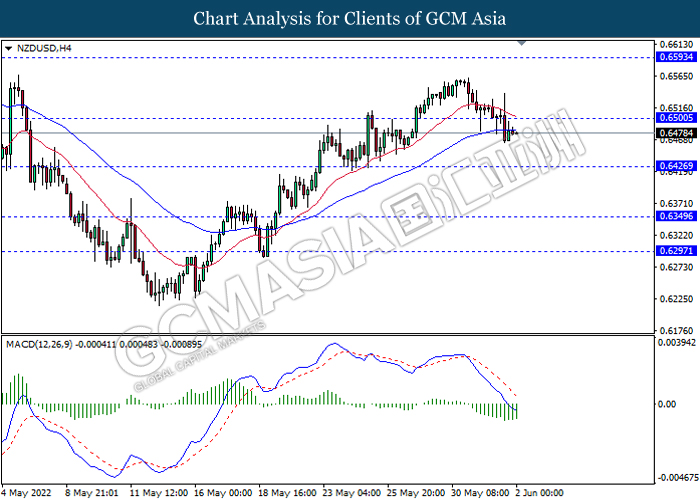

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6500, 0.6595

Support level: 0.6425, 0.6350

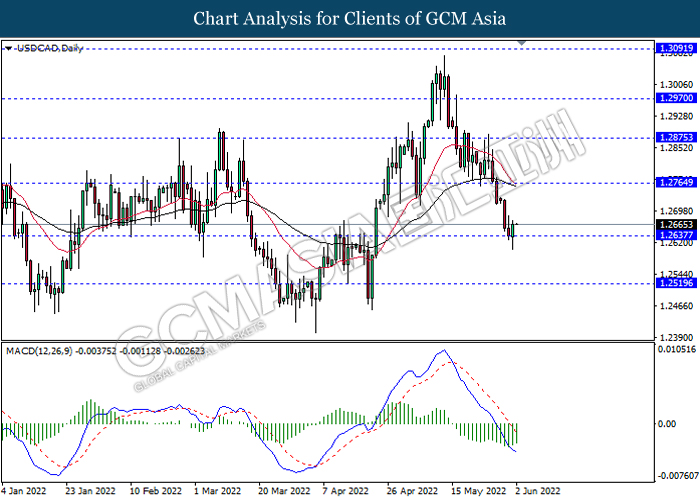

USDCAD, Daily: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2765, 1.2875

Support level: 1.2635, 1.2520

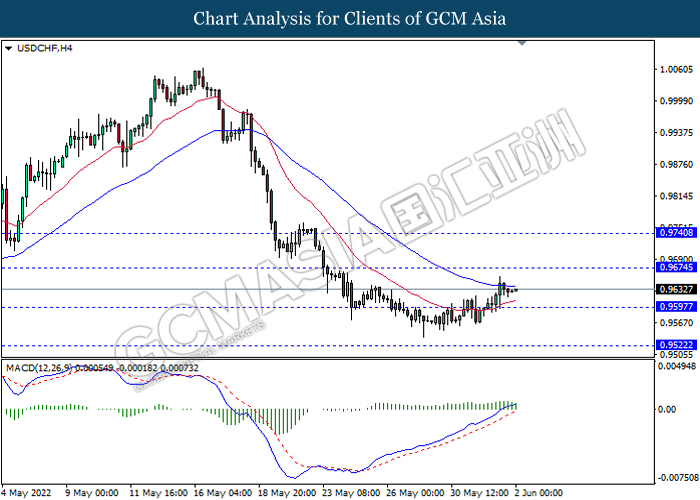

USDCHF, H4: USDCHF was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 113.10, 115.95

Support level: 110.65, 107.50

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 1855.05, 1878.85

Support level: 1833.15, 1808.45