3 June 2022 Afternoon Session Analysis

Australia Dollar spiked following the hawkish tone from RBA.

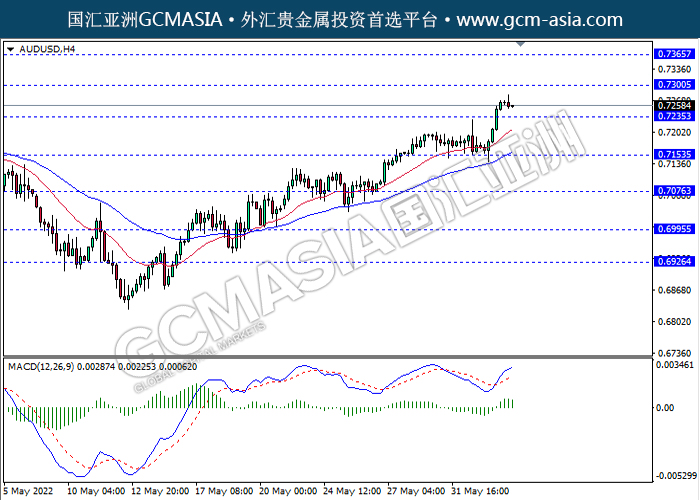

AUDUSD surged since yesterday amid the backdrop of the rate hike decision from the Australia’s central bank. According to Reuters, Australia’s central bank will raise rates by a modest 25 basis points for a second straight meeting in June to bring down soaring inflation. With the economy recovering smartly from the pandemic and inflation at a 20-year high of 5.1%, well above a 2-3% target range, the Reserve Bank of Australia (RBA) has only recently changed its tune on the need to raise interest rates. The rate hike decision from the RBA would likely to increase the risk-free return of the investors, which sparkling the appeal of the Australia Dollar. Besides, AUDUSD extended its gains following the China tariff reviews from the US officials. Deputy US Trade Representative Sarah Bianchi appeared a speech on Thursday, which said that the Biden administration is considering “all options” as it reviews potential changes to U.S. duties on Chinese imports, including tariff relief and new trade investigations in a shift of focus to strategic concerns with Beijing. The reducing tariffs would likely to boost up the international transaction of China, which brought the positive prospects toward Australia’s economic progression, as China was one of the largest trading partner for Australia, which dialed up the market optimism toward Australia Dollar. As of writing, AUDUSD edged down by 0.09% to 0.7258.

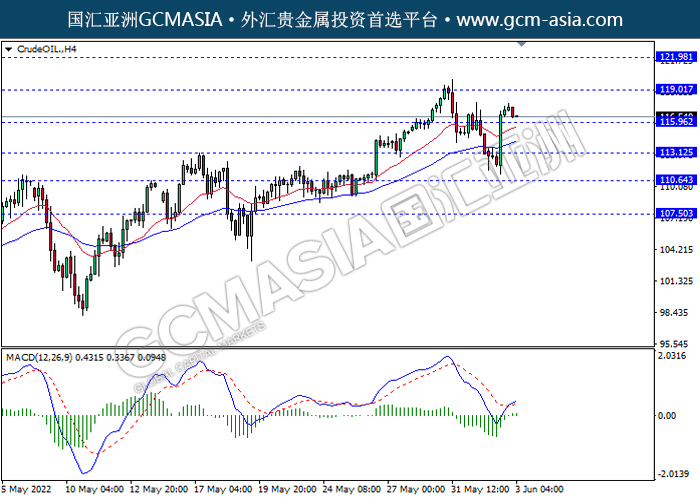

In the commodities market, crude oil price depreciated by 0.24% to $116.59 per barrel as of writing. Nonetheless, the overall trend for oil price remained bullish ahead of US Crude Oil Inventories fell more than market forecast, which is -5.068M lesser than -1.350M. On the other hand, gold price appreciated by 0.01% to $1871.50 per troy ounce as of writing over the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

All Day GBP United Kingdom – Bank Holiday

All Day CNY China – Dragon Boat Festival

All Day HKD Hong Kong – Dragon Boat Festival

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (May) | 428K | 325K | – |

| 20:30 | USD – Unemployment Rate (May) | 3.6% | 3.5% | – |

| 22:00 | USD – ISM Non-Manufacturing PMI (May) | 57.1 | 56.4 | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 101.75, 102.50

Support level: 100.95, 100.35

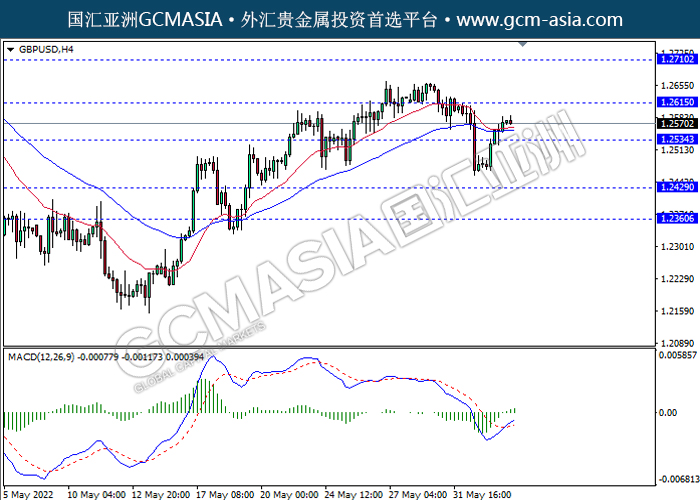

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

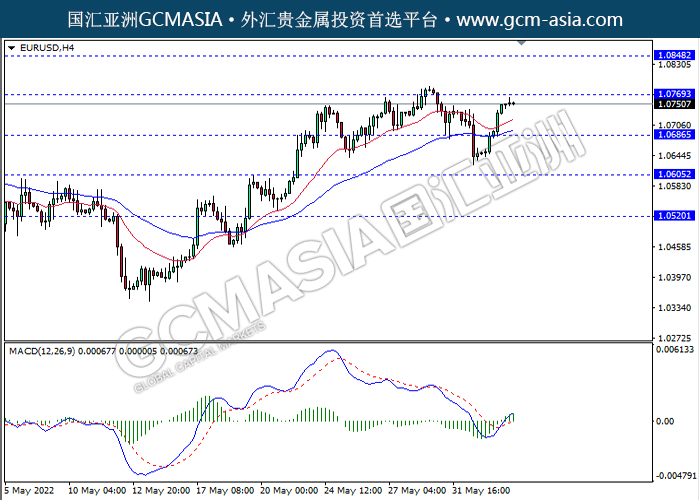

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

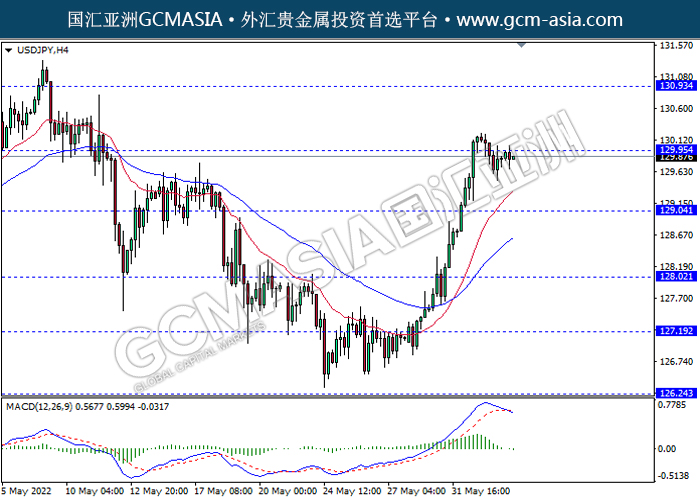

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 129.95, 130.95

Support level: 129.05, 128.00

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7300, 0.7365

Support level: 0.7235, 0.7155

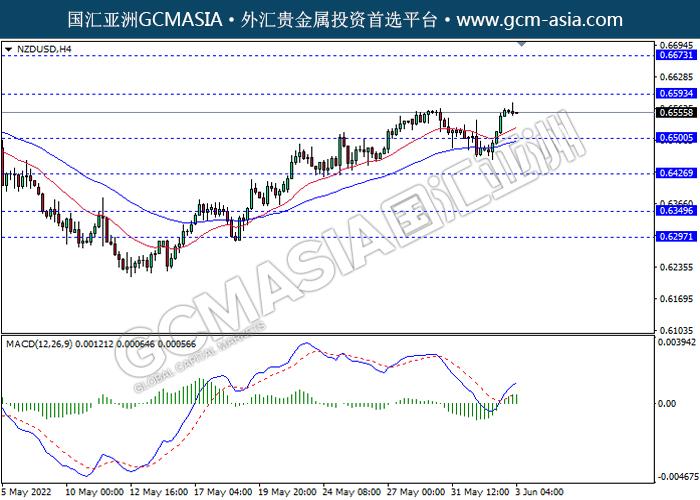

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6595, 0.6675

Support level: 0.6500, 0.6425

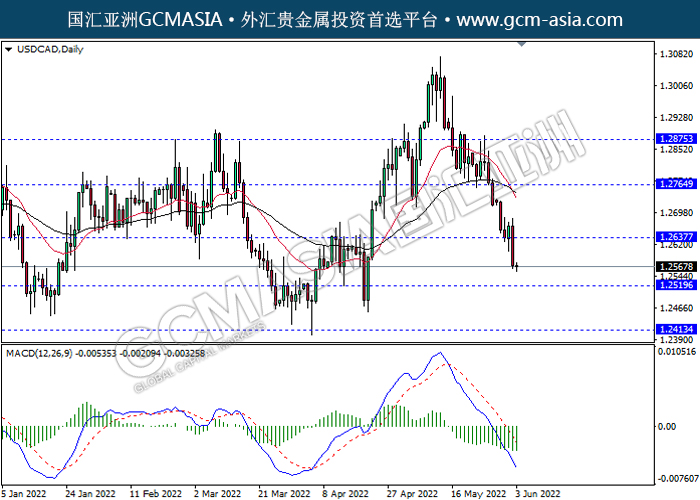

USDCAD, Daily: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

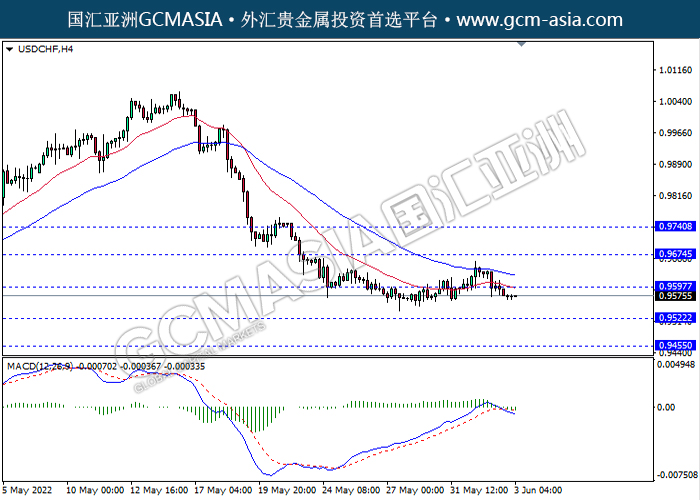

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9595, 0.9675

Support level: 0.9520, 0.9455

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 119.00, 122.00

Support level: 115.95, 113.10

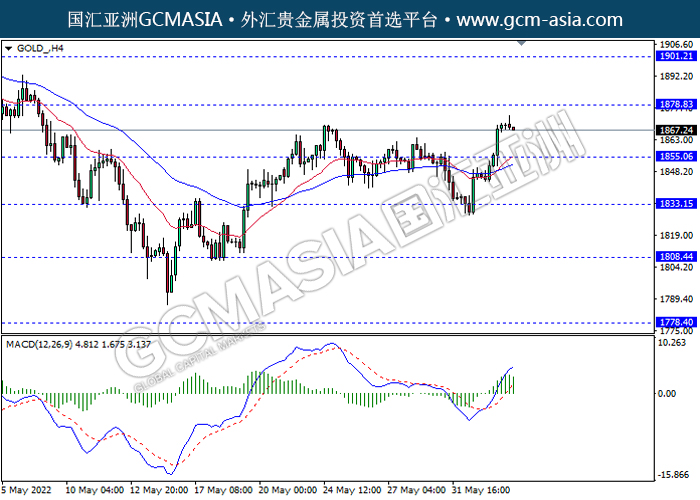

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1878.85, 1901.20

Support level: 1855.05, 1833.15