8 June 2022 Morning Session Analysis

Pound rallied after bullish economic data was released.

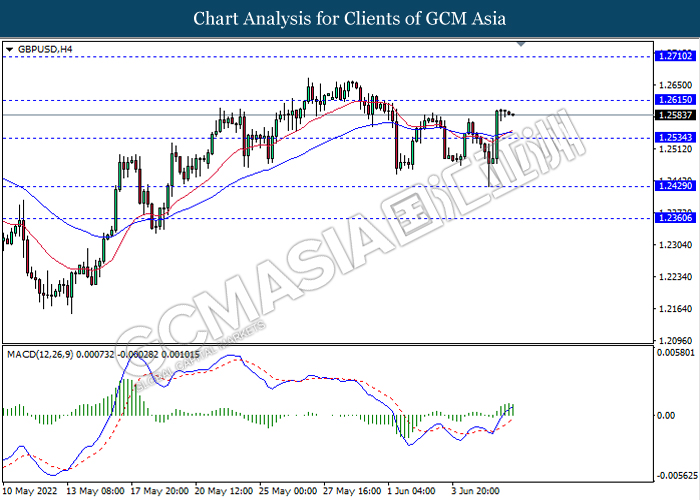

The GBPUSD rebounded from its recent low on Tuesday amid the backdrop of upbeat economic data. According to Markit Economics, the UK Composite Purchasing Managers’ Index (PMI) for May came in at the reading of 53.1, which higher than the market forecast of 51.8. Besides, the UK Services Purchasing Managers Index (PMI) for May recorded at the reading of 53.4, exceeding the market forecast of 51.8, according to The Chartered Institute of Purchase & Supply and the NTC Economics. Both data were used as the indicator for measuring the activity level of economy sector. The higher-than-expected reading showed that the recovery of economy activities, which brought positive prospects toward the economic progression in UK region. Furthermore, the Pound extended its gains over the slump of US Dollar. According to Reuters, market participants were expecting that the inflation risk may reach its peak, which decreased the odds of rate hike from Federal Reserve to slow down the inflation. It dragged down the appeal of US Dollar, and prompted investors to shift their capital toward other currencies which having better prospects such as Pound. As of writing, GBPUSD edged up by 0.02% to 1.2590.

In the commodities market, crude oil price depreciated by 0.04% to $119.36 per barrel as of writing following the US API Weekly Crude Oil Stock surged over the market forecast. On the other hand, gold price appreciated by 0.13% to $1854.55 per troy ounces as of writing amid the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:30 | GBP – Construction PMI (May) | 58.2 | 56.6 | – |

| 22:30 | USD – Crude Oil Inventories | -5.068M | -1.800M | – |

Technical Analysis

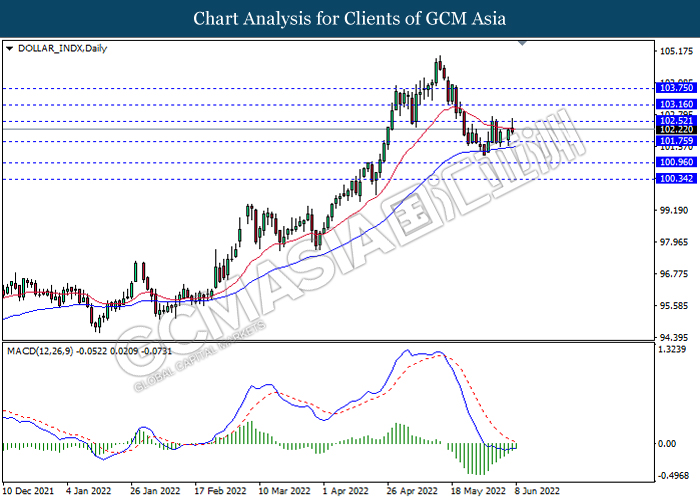

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 102.50, 103.15

Support level: 101.75, 100.95

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2615, 1.2710

Support level: 1.2535, 1.2430

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0770, 1.0850

Support level: 1.0685, 1.0605

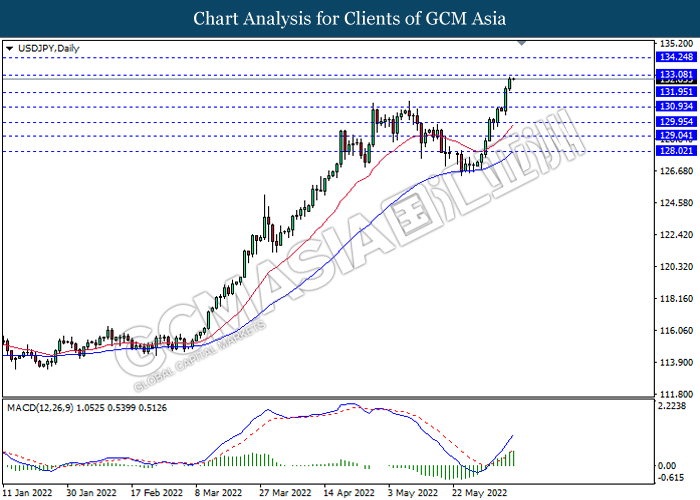

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 133.10, 134.25

Support level: 131.95, 130.95

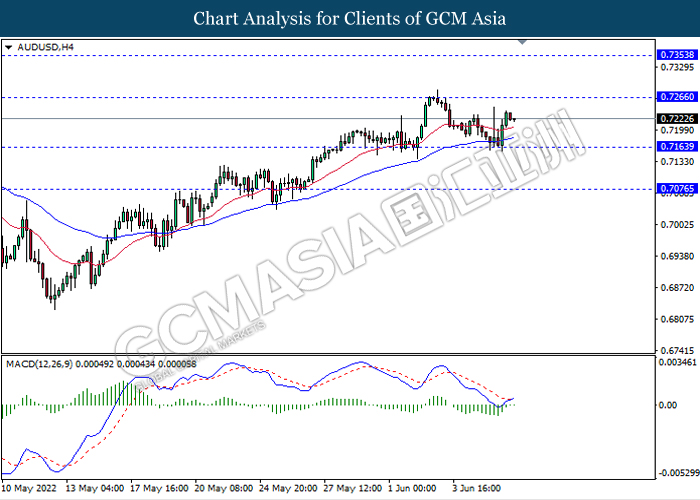

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7265, 0.7355

Support level: 0.7165, 0.7075

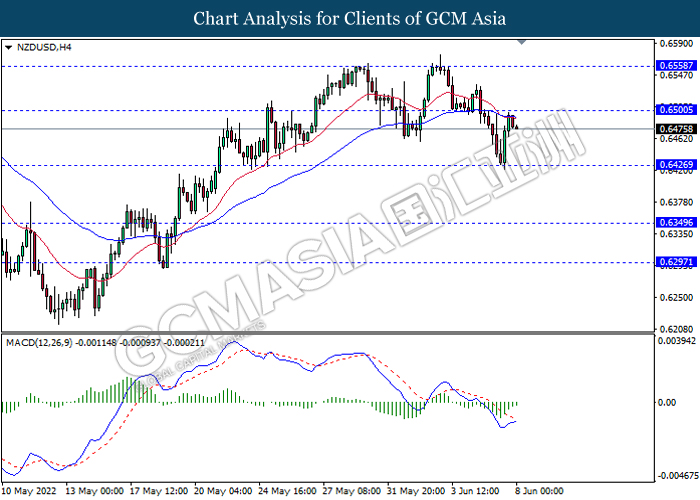

NZDUSD, H4: NZDUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6500, 0.6560

Support level: 0.6425, 0.6350

USDCAD, Daily: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2635, 1.2765

Support level: 1.2520, 1.2415

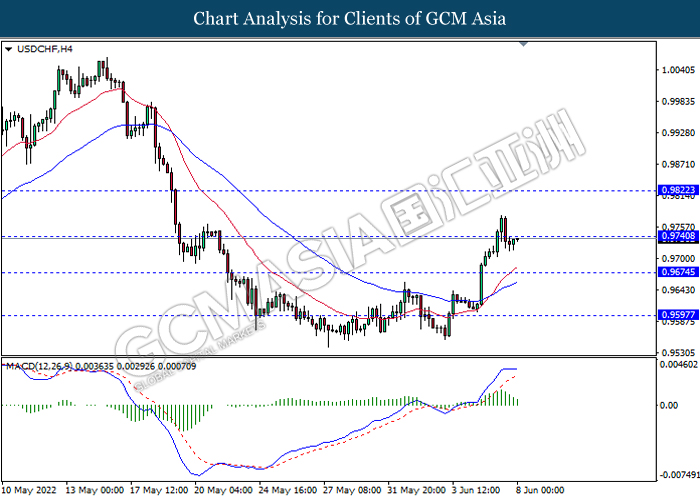

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.9820, 0.9740

Support level: 0.9675, 0.9595

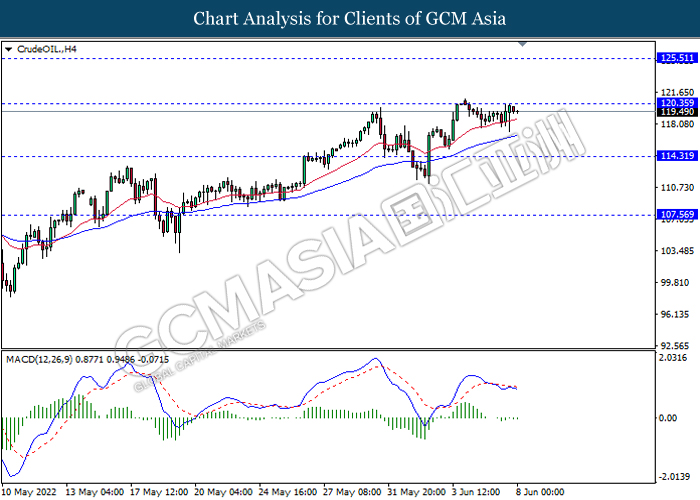

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 120.35, 125.50

Support level: 114.30, 107.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1895.15, 1870.00

Support level: 1846.20, 1823.35