10 June 2022 Morning Session Analysis

Euro slumped after ECB interest rate decision.

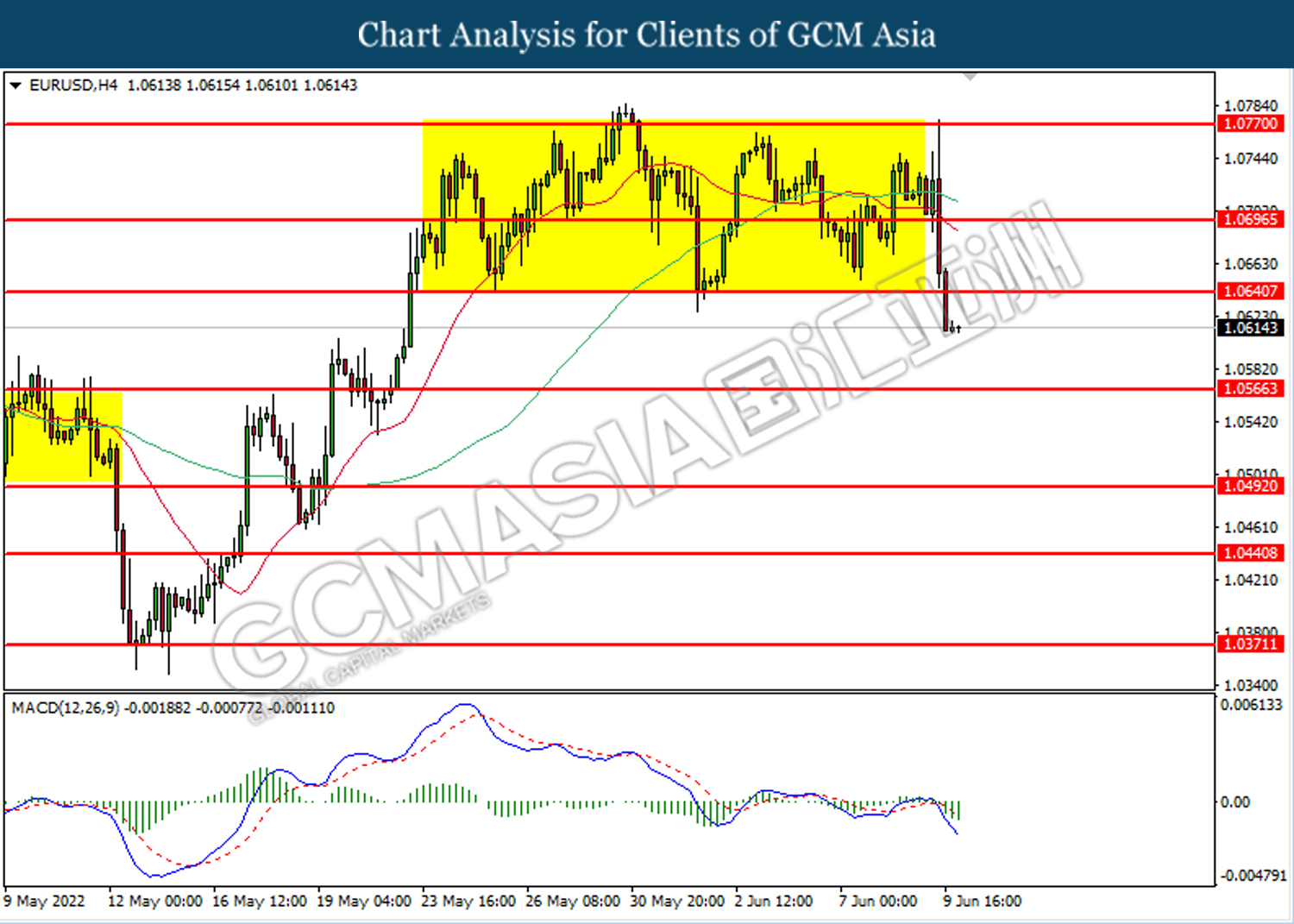

The Euro, which was widely traded by the global market participants slumped despite the European Central Bank (ECB) confirmed its intention to start its rate hike cycle at the policy meeting in July. Yesterday, the governing council of the ECB maintained the main refinancing operations, marginal lending facility and deposit facility as widely expected, which were 0.00%, 0.25% and -0.50%, respectively. Besides, ECB sent a message to the public that they intend to raise the key interest rates by 25 basis points at the July meeting, and a further hike could be possibly seen at the September meeting, but the increment scale would likely depend on the evolving trajectory of the inflation outlook. With that being said, the euro currency was still being threw off by the investors as ECB has downgraded its growth forecast significantly to 2.8% in 2022 and 2.1% in 2023, whereas the prior forecast at the ECB’s March meeting came in at 3.7% in 2022 and 2.8% in 2023. The revision of the growth forecast tampered with the sentiment in the euro market, dragging the Euro to the lowest level in 3 weeks’ time. As of writing, the pair of EUR/USD is down 0.02% to 1.0610.

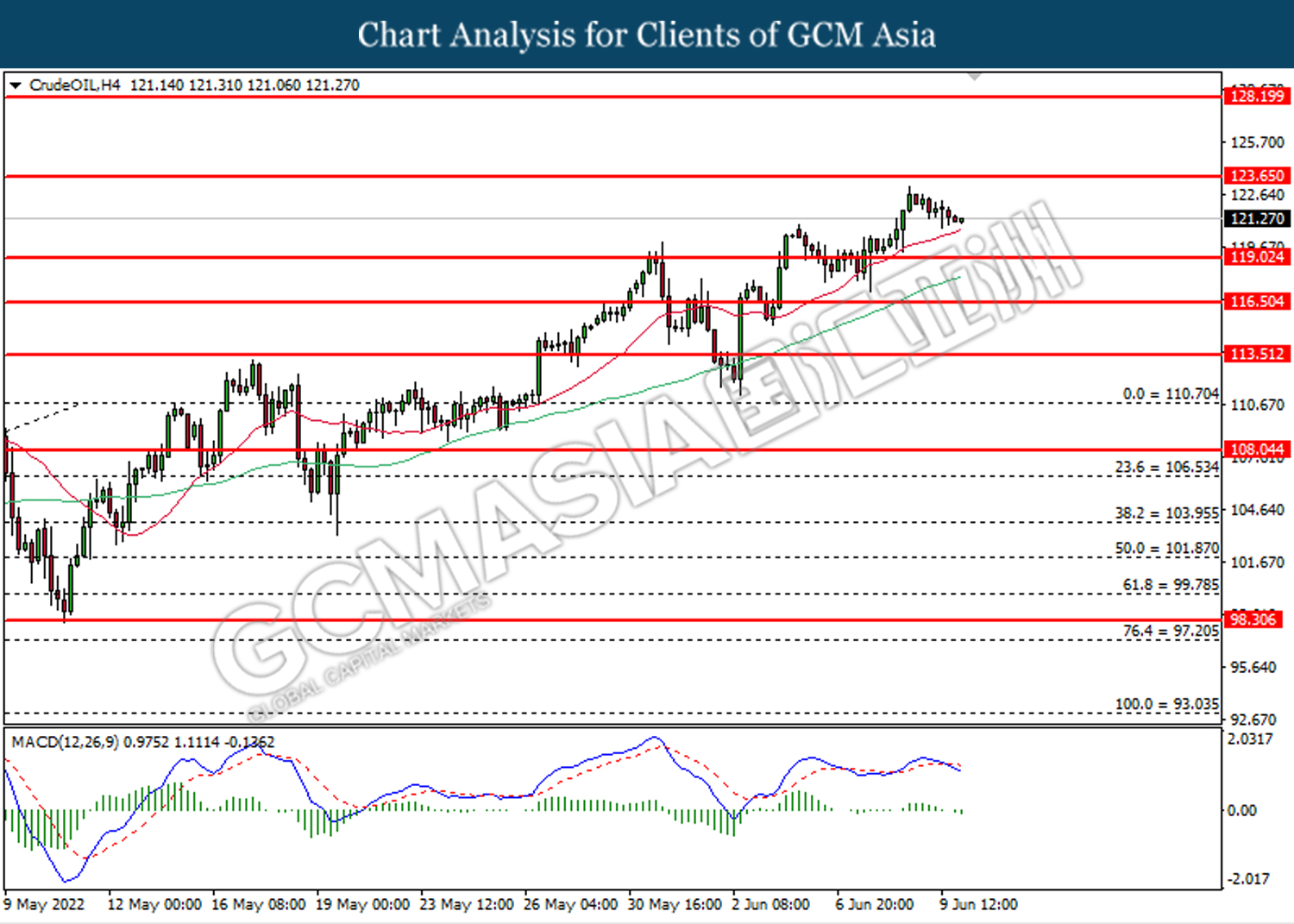

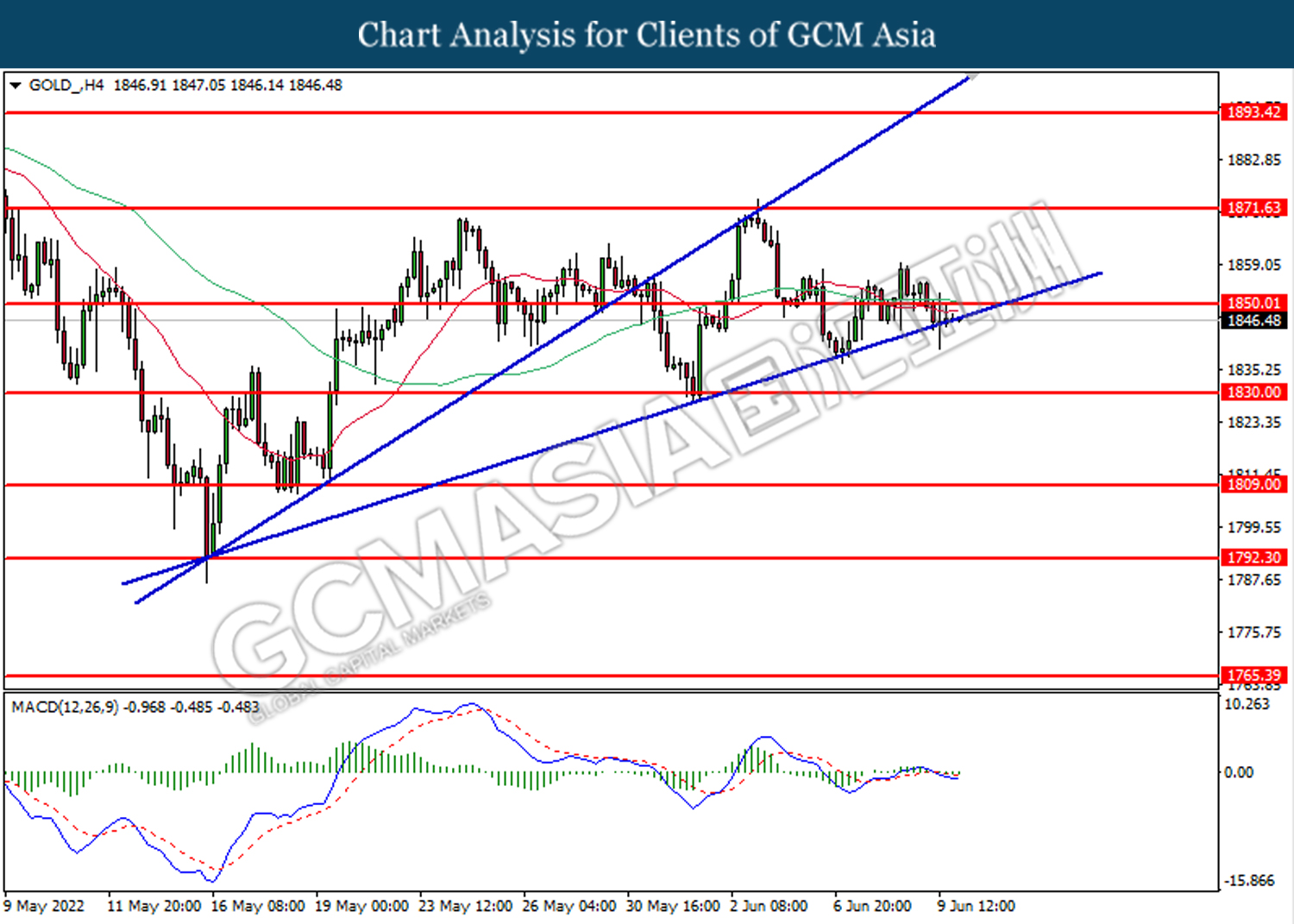

In the commodities market, crude oil prices were down by 0.25% to $121.15 as of writing as several big cities in China imposed new lockdown restrictions, putting the China economy at the edge of the hill again. Besides, gold prices were down 0.08% to $1846.50 per troy ounce amid the strengthening of the dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

21:45 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Employment Change (May) | 15.3K | 30.0K | – |

| 20:30 | USD – Core CPI (MoM)(May) | 0.6% | 0.5% | – |

Technical Analysis

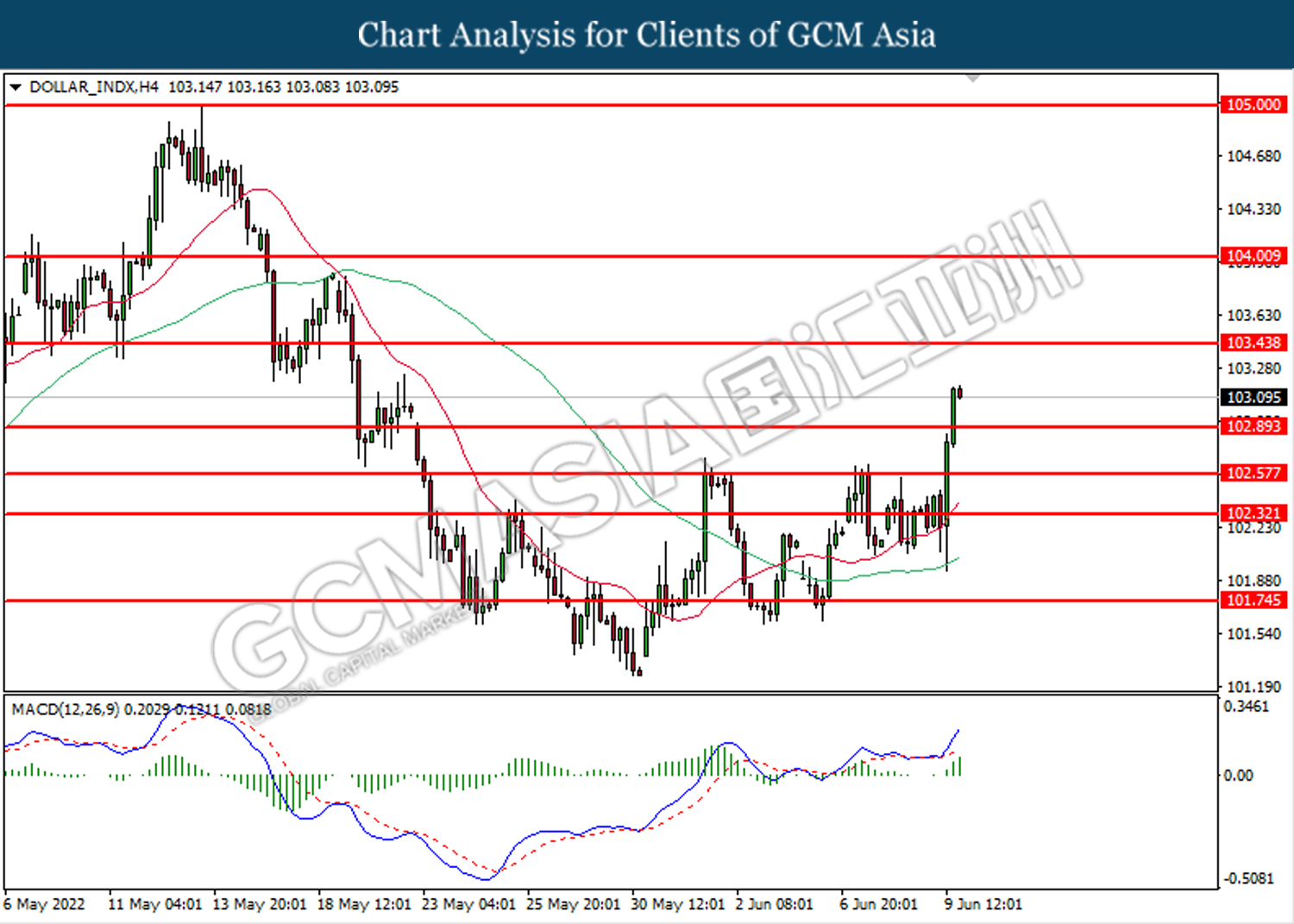

DOLLAR_INDX, H4: Dollar index was traded higher following prior breakout above the previous resistance level at 102.90. MACD which illustrated bullish bias momentum suggest the index to extend its gains toward the resistance level at 103.45.

Resistance level: 103.45, 104.00

Support level: 102.90, 102.55

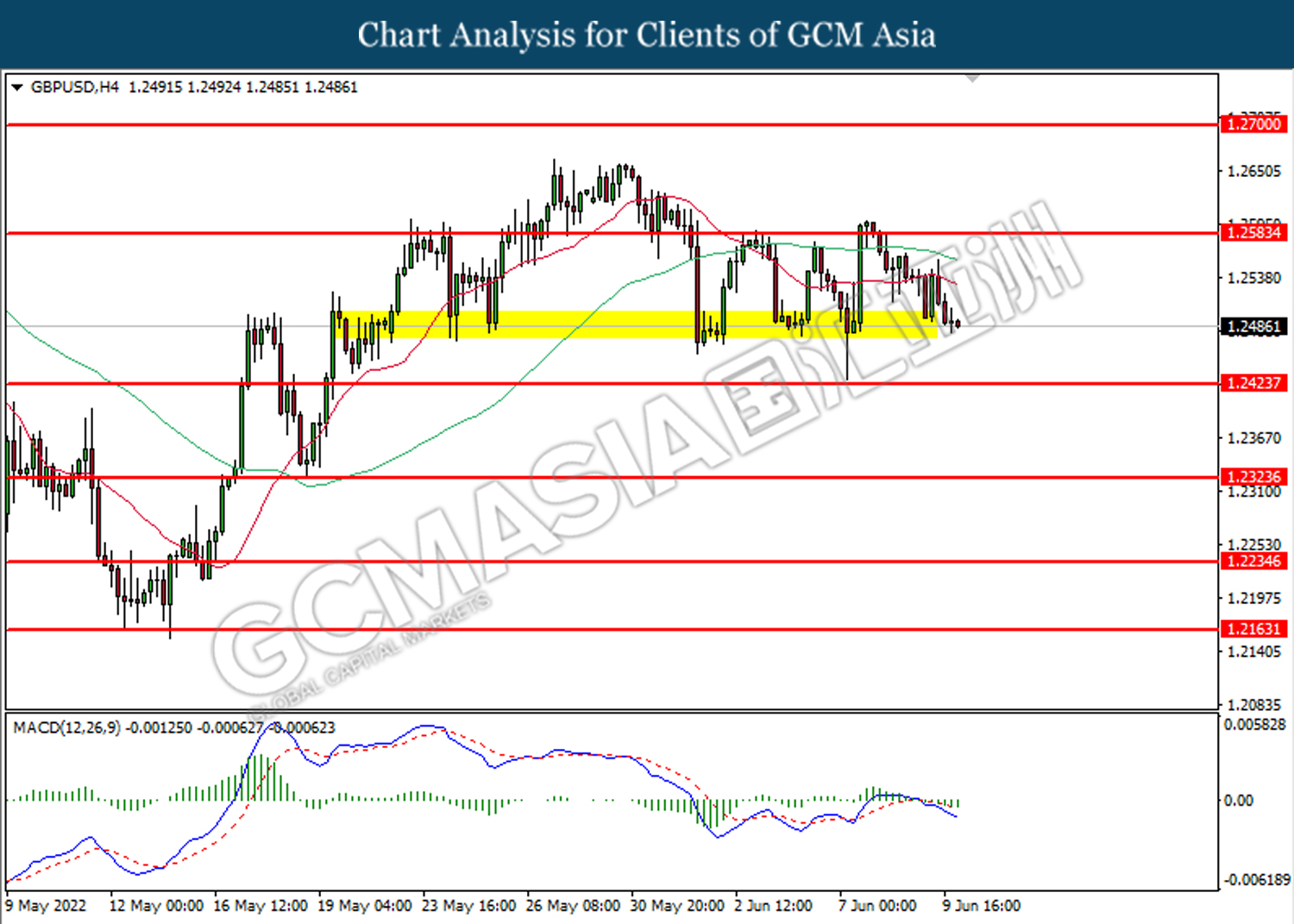

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level at 1.2585. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.2425.

Resistance level: 1.2585, 1.2700

Support level: 1.2425, 1.2325

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level at 1.0640. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 1.0565.

Resistance level: 1.0640, 1.0695

Support level: 1.0565, 1.0490

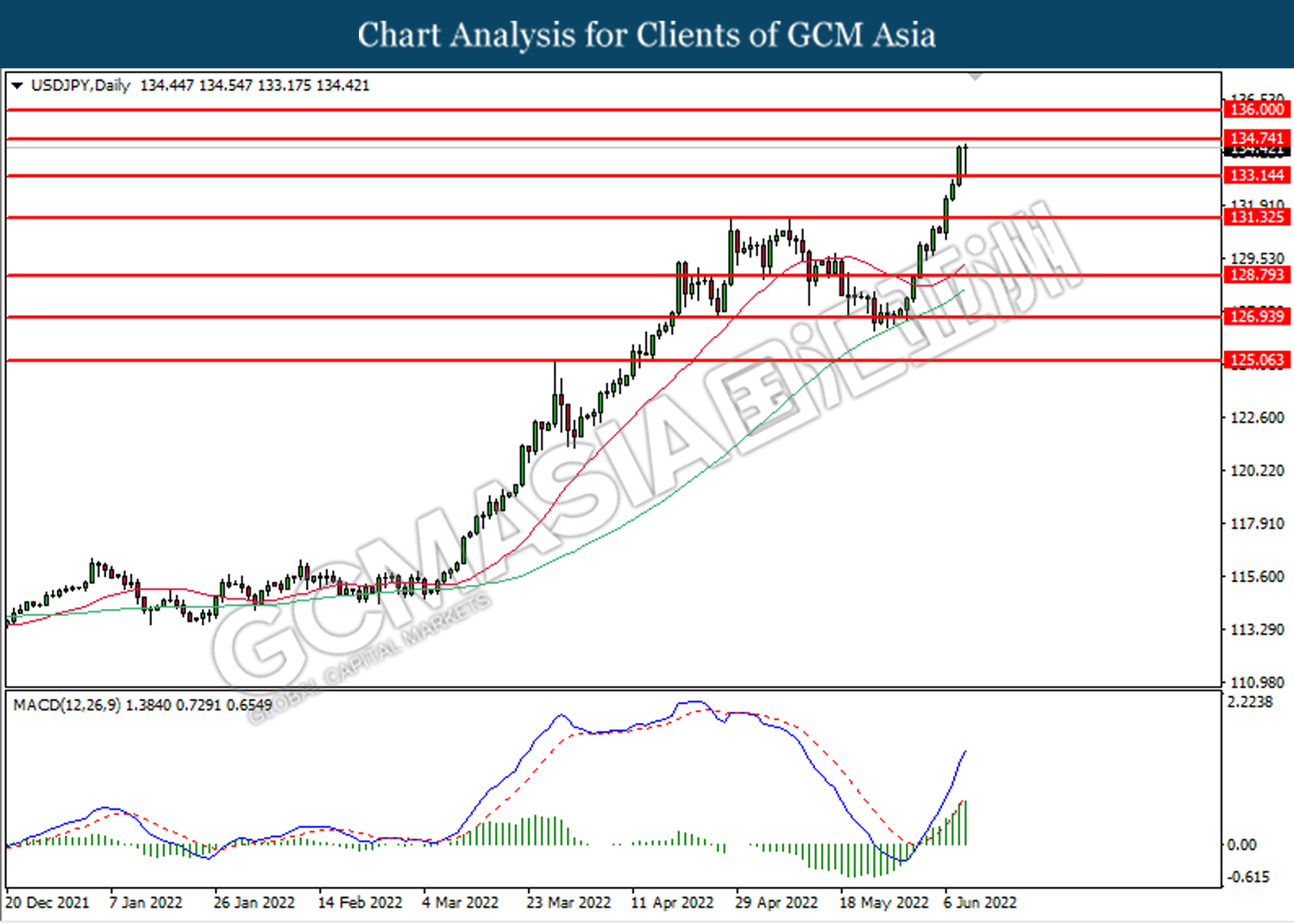

USDJPY, Daily: USDJPY was traded higher following prior breakout above the previous resistance level at 133.15. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the next resistance level.

Resistance level: 134.75, 136.00

Support level: 133.15, 131.35

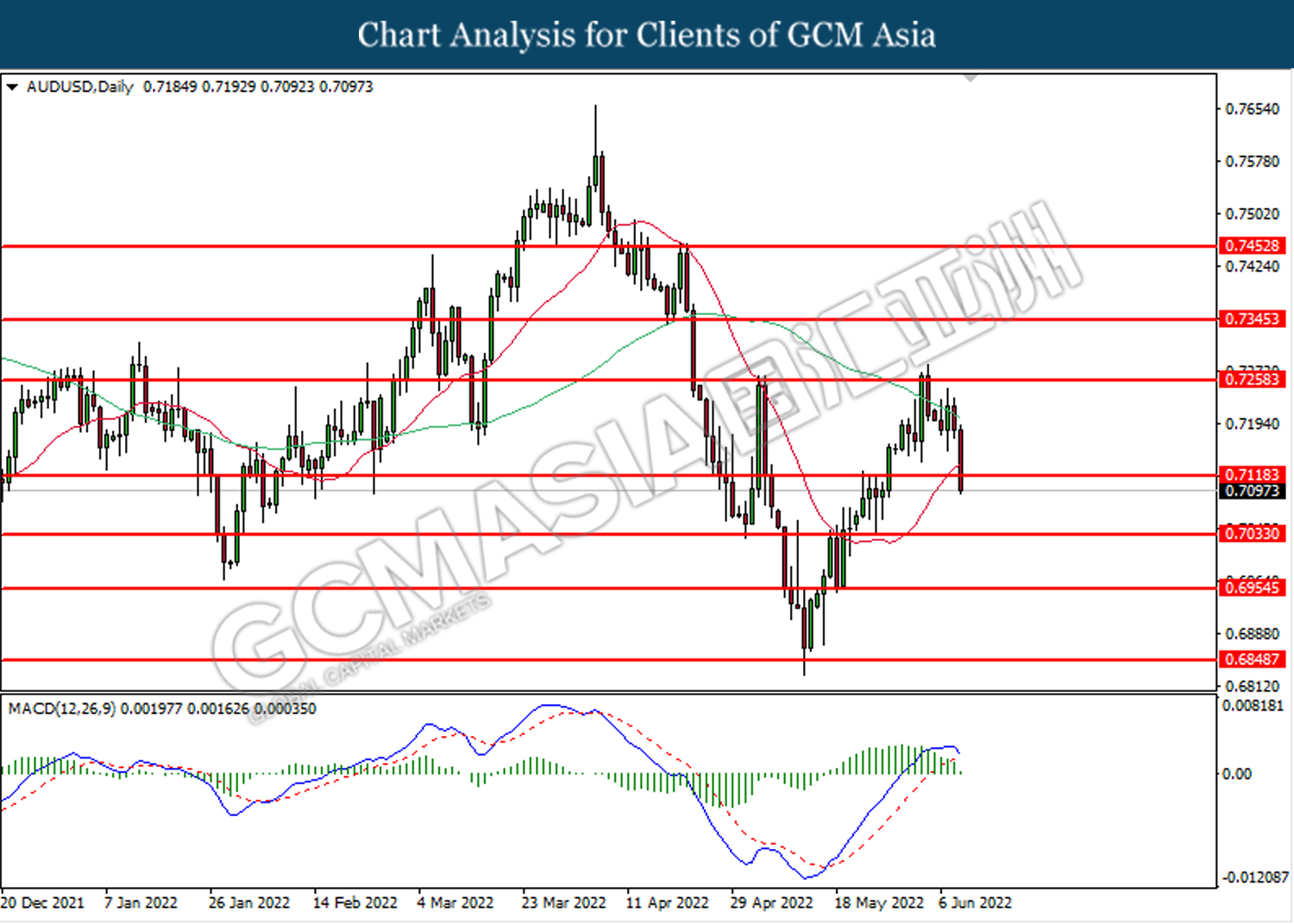

AUDUSD, Daily: AUDUSD was traded lower while currently testing the support level at 0.7120. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.7260, 0.7345

Support level: 0.7120, 0.7035

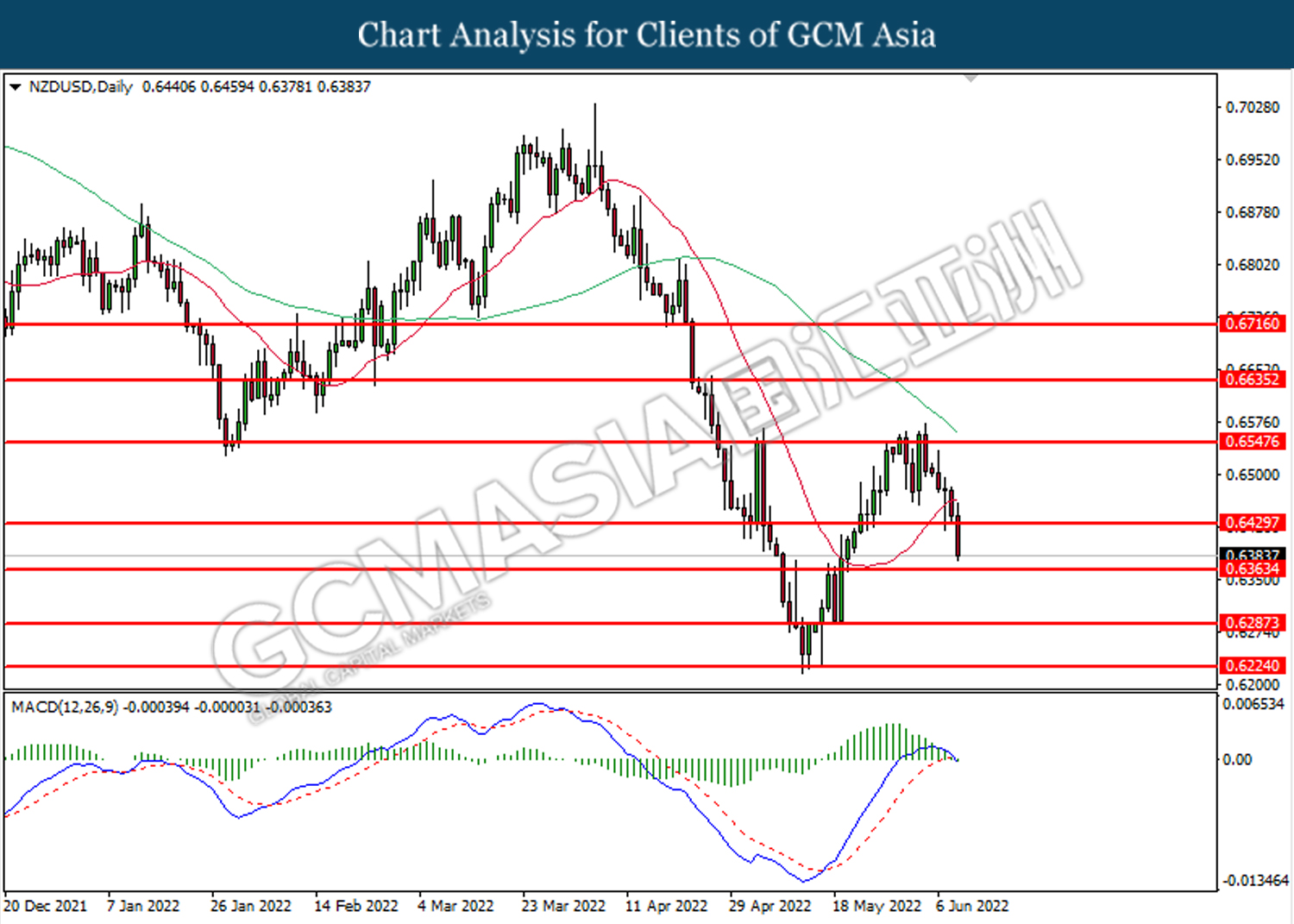

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level at 0.6430. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after its candle successfully closed below the support level.

Resistance level: 0.6545, 0.6635

Support level: 0.6430, 0.6365

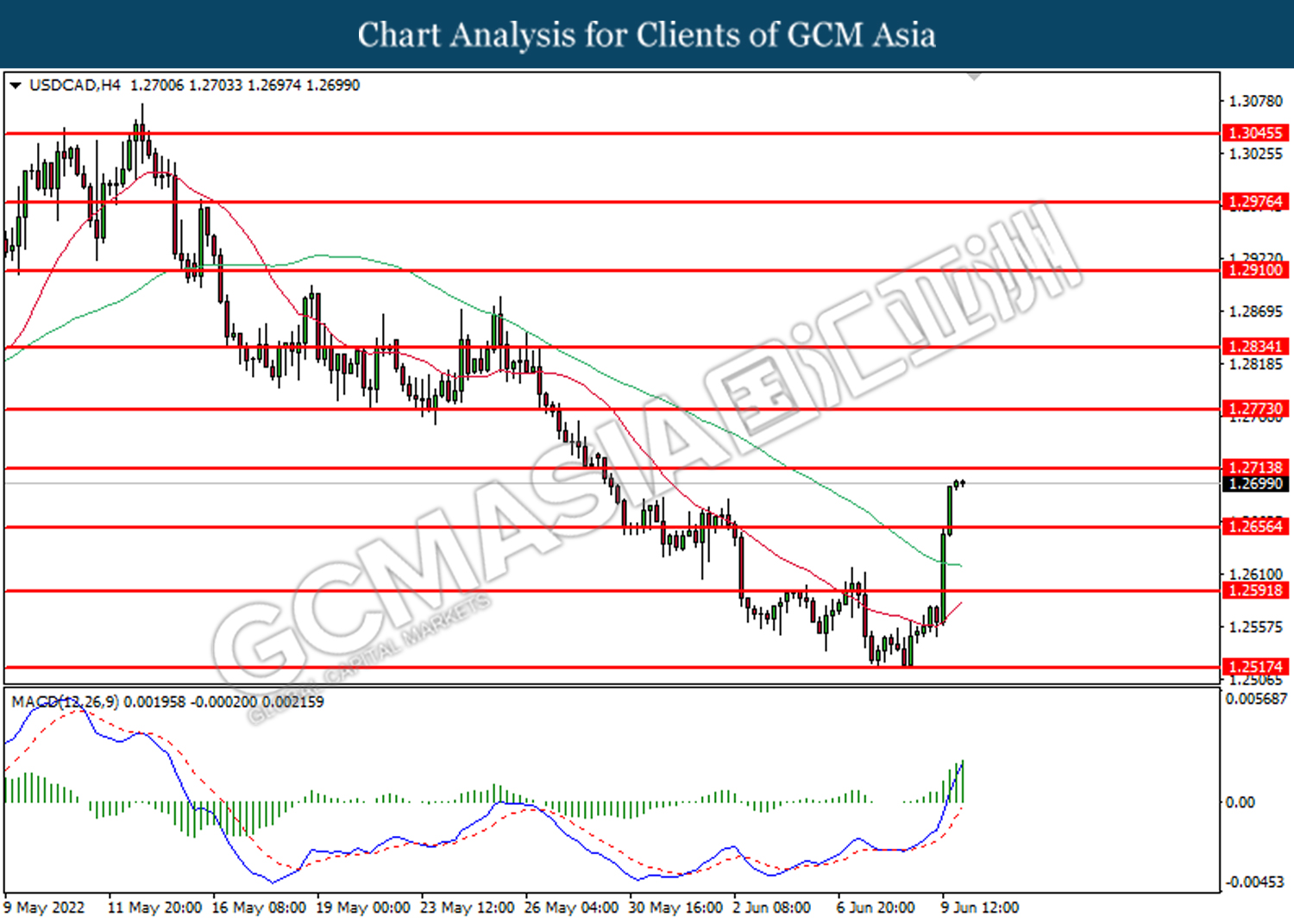

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2655. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2715.

Resistance level: 1.2715, 1.2775

Support level: 1.2655, 1.2590

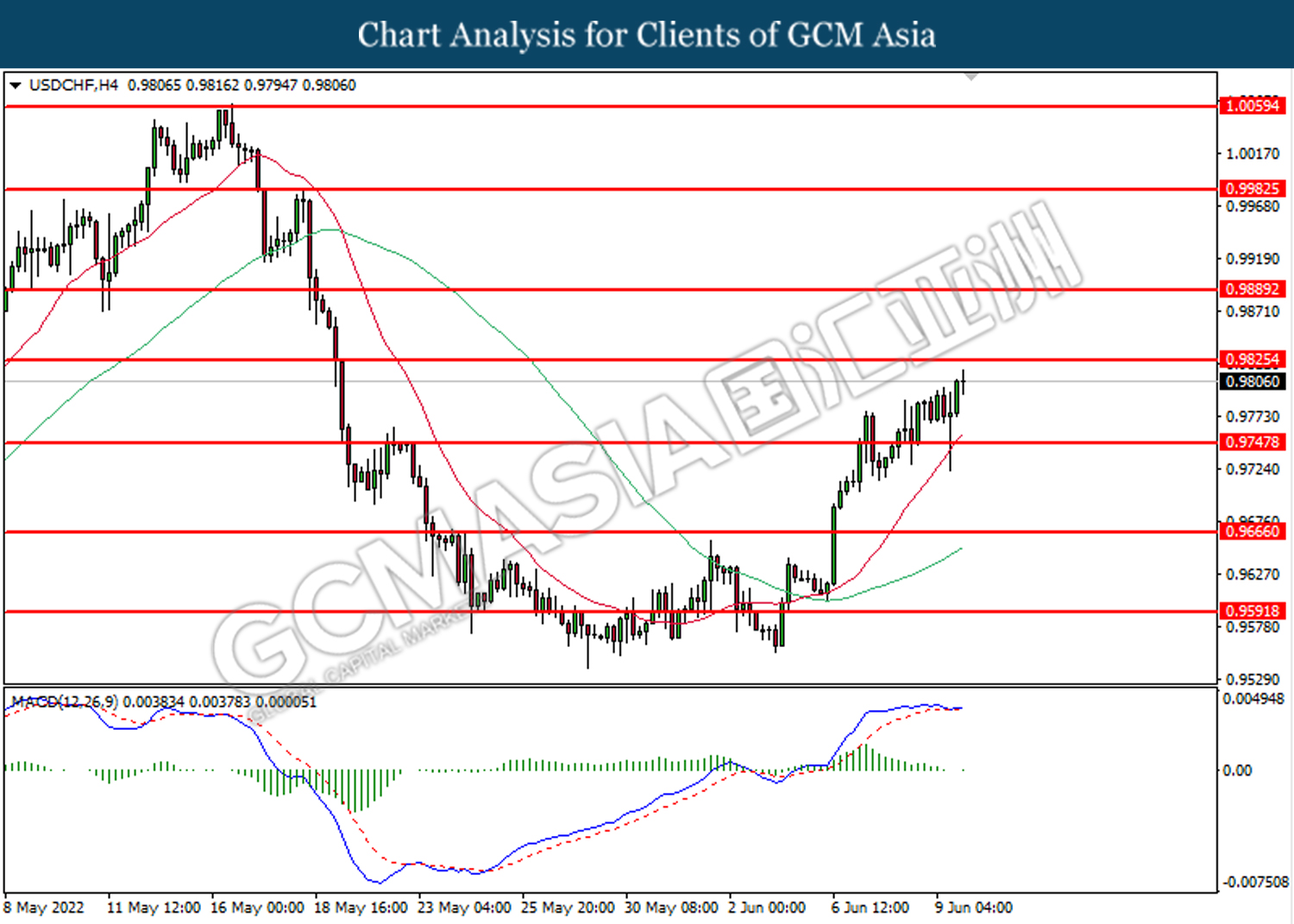

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level at 0.9825. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo short term technical correction toward the support level at 0.9750.

Resistance level: 0.9825, 0.9890

Support level: 0.9750, 0.9665

CrudeOIL, H4: Crude oil price was traded lower following prior retracement near the resistance level at 123.65. MACD which illustrated bearish bias momentum suggest the commodity to extend its losses in short term toward the support level at 119.00.

Resistance level: 123.65, 128.20

Support level: 119.00, 116.50

GOLD_, H4: Gold price was traded lower while currently testing the upward trendline. Due to lack of signal from MACD, it is suggested to wait for further confirmation such as breakout below the trendline happened before entering into the market.

Resistance level: 1850.00, 1871.65

Support level: 1830.00, 1809.00