14 June 2022 Afternoon Session Analysis

US Dollar surged following the hawkish expectation from Fed.

The Dollar Index which traded against a basket of six major currencies spiked since yesterday over the backdrop of hawkish expectation from Fed. According to CNBC, Central bank policymakers are entertaining the idea of a 75 basis point increase to the Fed’s benchmark funds rate that banks charge each other for overnight financing, and the Wall Street firm’s economists now foresee consecutive 75 basis point rate hikes in June and July. The US Core Consumer Price Index (CPI) MoM for May which announced on June 10, has came in at the reading of 0.6% while exceeding the market forecast of 0.5%. Besides, the US CPI YoY had reached its 41-years highs, which is 8.6%. It increased the odds of Federal Reserve to implement aggressive tightening monetary policy in order to cool down the inflation, which sparkling the appeal of the US Dollar. At this juncture, investors would continue to focus on the latest updates with regards of interest rate decisions from Fed which will be announced on upcoming Thursday in order to receive further trading signals. As of writing, the Dollar Index appreciated by 0.11% to 105.08.

In the commodities market, crude oil price edged up by 0.12% to $121.08 per barrel as of writing despite recession fears and potential new COVID-19 curbs in China that could dampen demand as the market remains tightly supplied. Besides, gold price depreciated by 0.27% to $1827.10 per troy ounces as of writing amid the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Average Earnings Index +Bonus (Apr) | 7.0% | 7.6% | – |

| 14:00 | GBP – Claimant Count Change (May) | -56.9K | -42.5K | – |

| 17:00 | EUR – German ZEW Economic Sentiment (Jun) | -34.3 | -27.5 | – |

| 20:30 | USD – PPI (MoM) (May) | 0.5% | 0.8% | – |

Technical Analysis

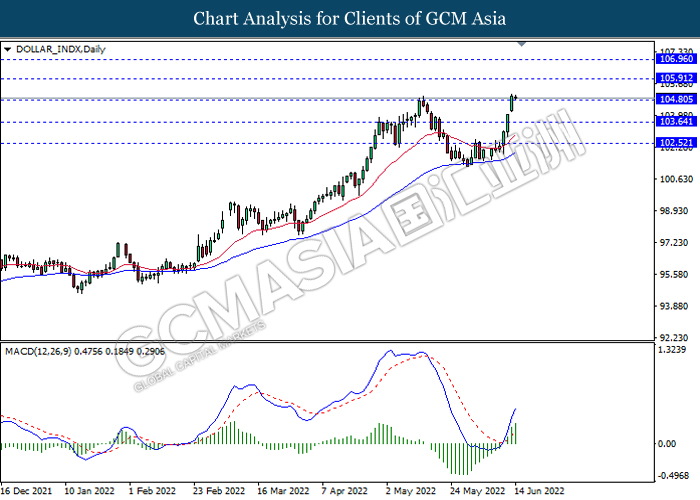

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains.

Resistance level: 105.90, 106.95

Support level: 104.80, 103.65

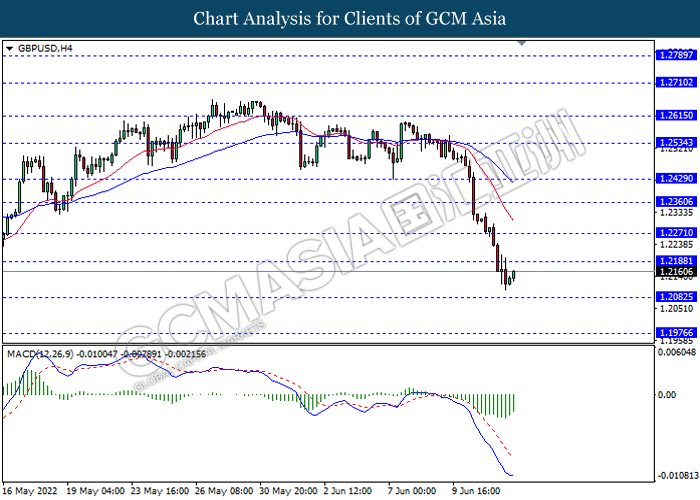

GBPUSD, H4: GBPUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2190, 1.2270

Support level: 1.2080, 1.1975

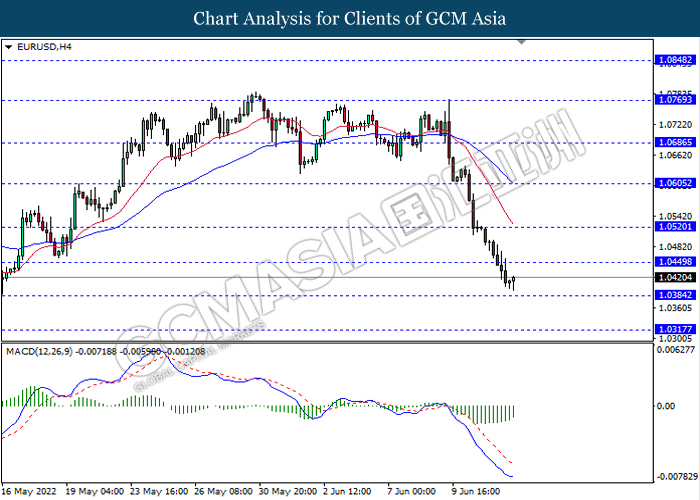

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0450, 1.0520

Support level: 1.0385, 1.0315

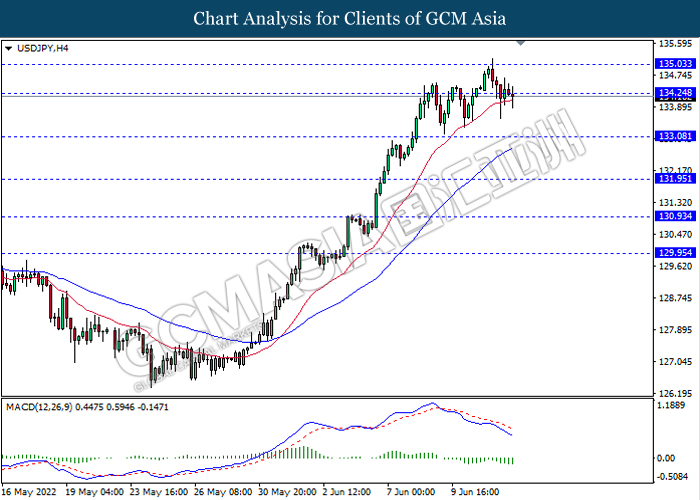

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 134.25, 135.05

Support level: 133.10, 131.95

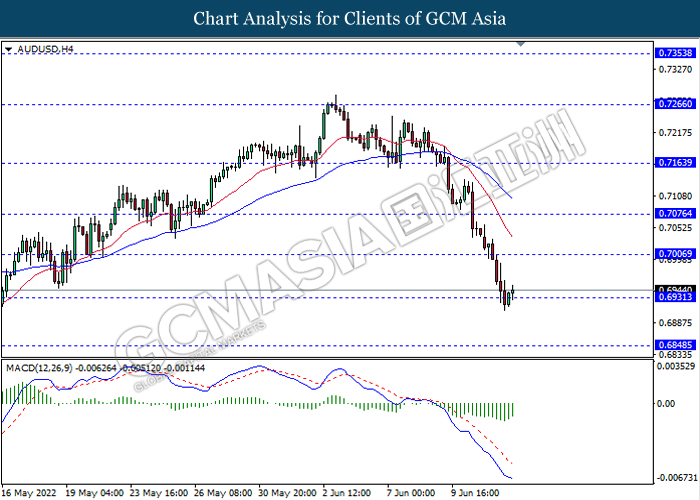

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

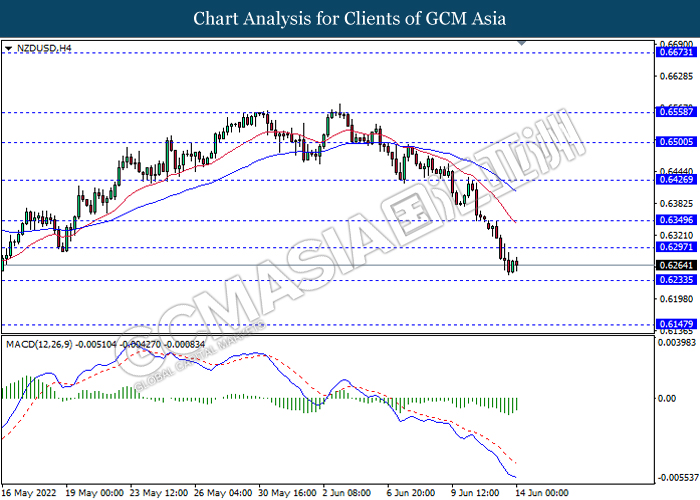

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

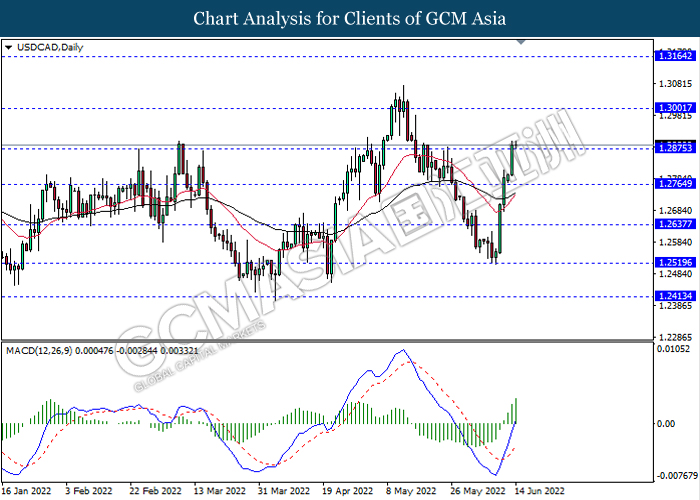

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3000, 1.3165

Support level: 1.2875, 1.2765

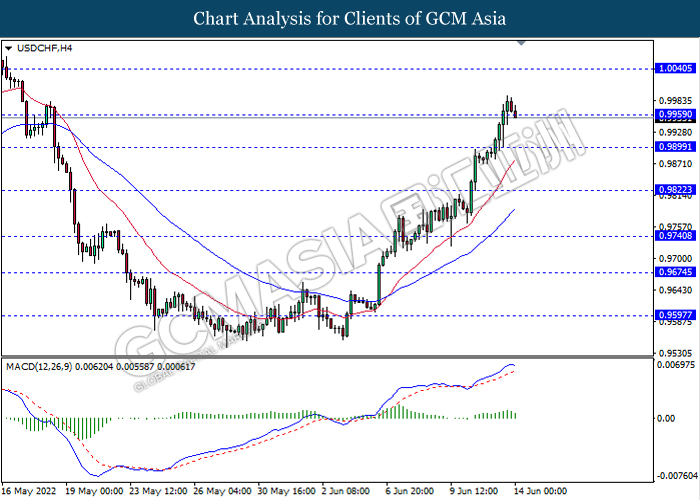

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9960, 1.0040

Support level: 0.9900, 0.9820

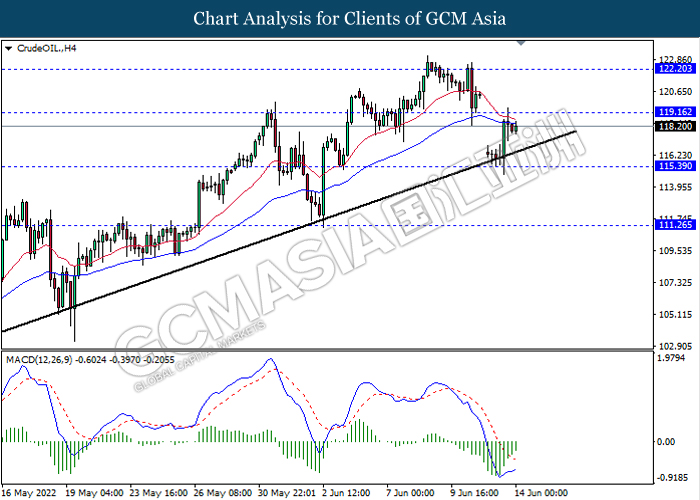

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 119.05, 122.20

Support level: 115.40, 111.25

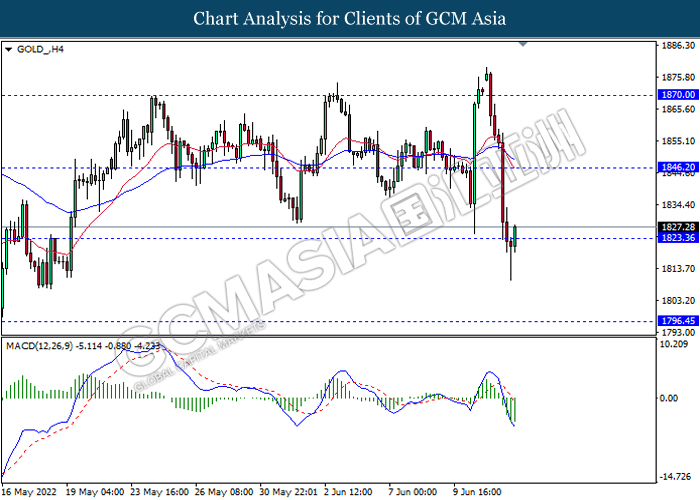

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated increasing bearish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1846.20, 1870.00

Support level: 1823.35, 1796.45