16 June 2022 Afternoon Session Analysis

Yen rebounded following BoJ unleashed their concern over sharp drop in Yen.

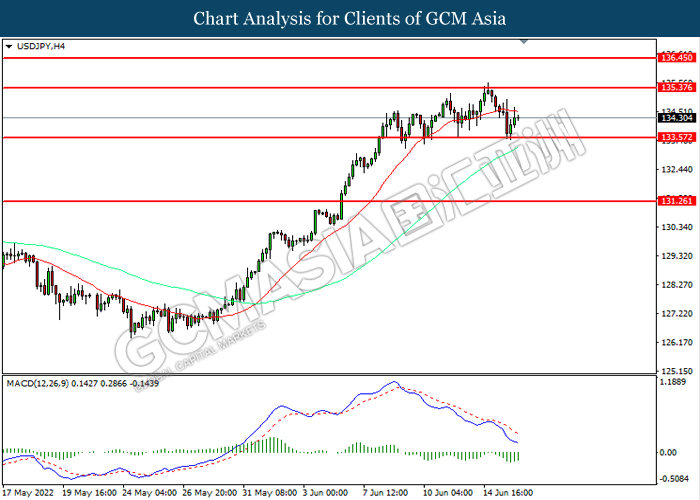

The Japanese Yen rebounded yesterday following the Japan’s top government claimed that they will “respond appropriately” by manipulating the Yen market if needed, issuing a fresh warning to market. In earlier, the overall trend for the Japanese Yen remained bearish following the Bank of Japan (BOJ) has repeatedly committed to keeping interest rate low, in contrast with other major central banks, which are flagging aggressive interest hikes to tackle inflation. The Central bank chief Haruhiko Kuroda also warned the significant depreciation of Japanese Yen would likely to create further tensions for the economic growth in Japanese. Though, Kuroda repeated his pledged to maintain ultra-loose monetary policy while communicating closely with government. On the other hand, the US Dollar retreated yesterday following the Federal Reserve unleashed their downbeat tone toward the economic prospect in United States despite rate hike decision from Fed. As of writing, USD/JPY depreciated by 0.03% to 134.30.

In the commodities market, the crude oil price depreciated by 0.03% to $113.70 per barrel as of writing over the backdrop of bearish inventory data. According to Energy Information Administration (EIA), US Crude Oil Inventories came in at 1.956M, exceeding the market forecast at -1.314M. On the other hand, the gold price surged 0.03% to $1831.00 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

15:30 CHF SNB Monetary Policy Assessment

16:30 CHF SNB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 15:30 | CHF – SNB Interest Rate Decision (Q2) | -0.75% | – | – |

| 19:00 | GBP – BoE Interest Rate Decision (Jun) | 1.00% | 1.25% | – |

| 20:30 | USD – Building Permits (May) | 1.823M | 1.787M | – |

| 20:30 | USD – Initial Jobless Claims | 229K | 215K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jun) | 2.6 | 5.3 | – |

Technical Analysis

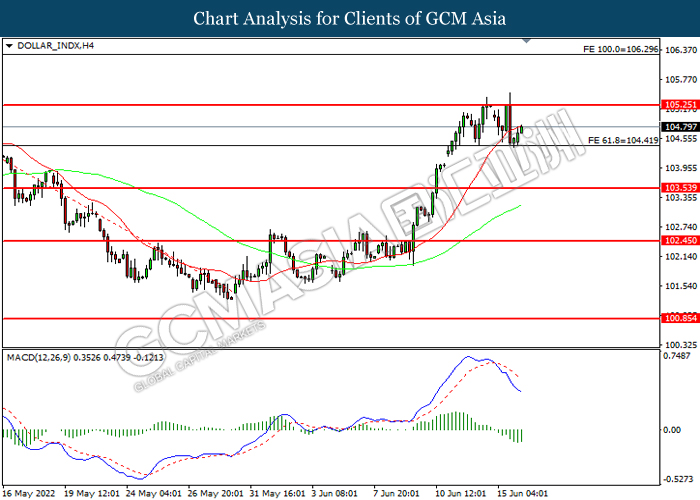

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses after breakout.

Resistance level: 105.25, 106.20

Support level: 104.40, 103.55

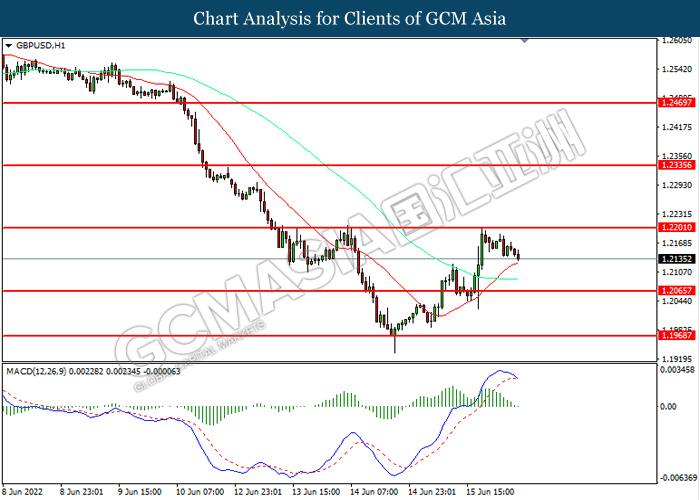

GBPUSD, H1: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.2200, 1.2335

Support level: 1.2065, 1.1970

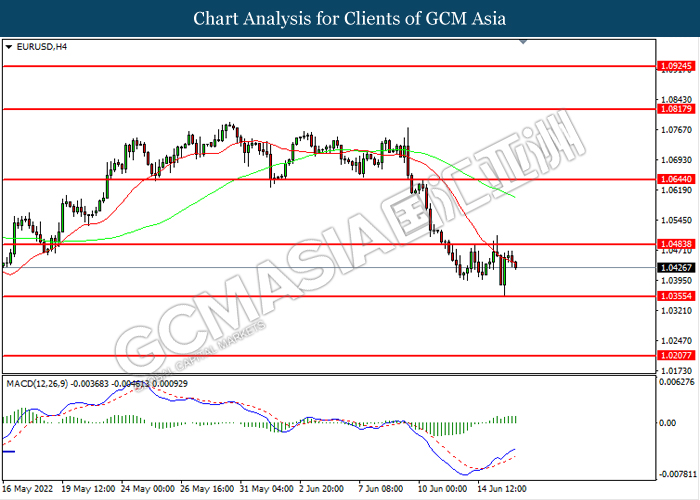

EURUSD, H4: EURUSD was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0485, 1.0600

Support level: 1.0355, 1.0205

USDJPY, H4: USDJPY was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 135.40, 136.45

Support level: 133.55, 131.25

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.7015, 0.7125

Support level: 0.6865, 0.6720

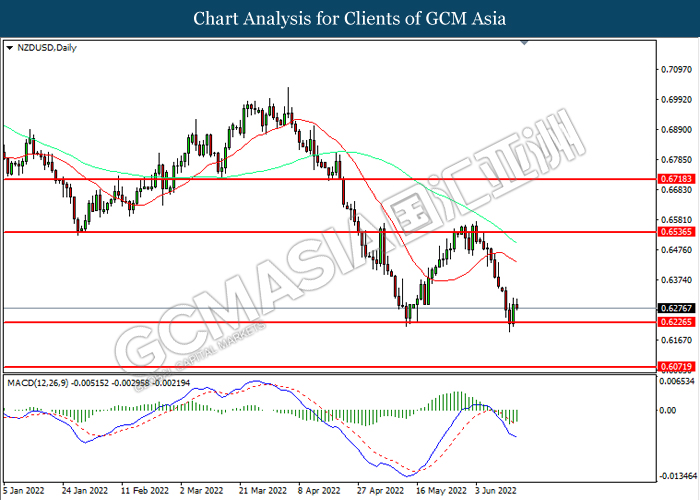

NZDUSD, Daily: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

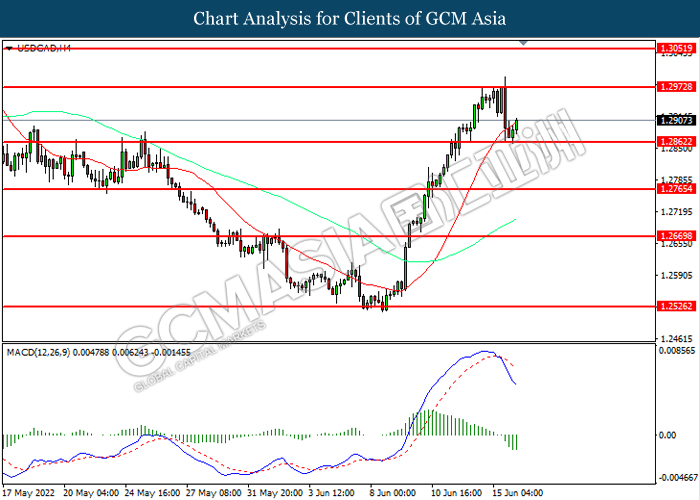

USDCAD, H4: USDCAD was traded higher following prior rebounded from the support level. However, MACD which illustrated increasing bearish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

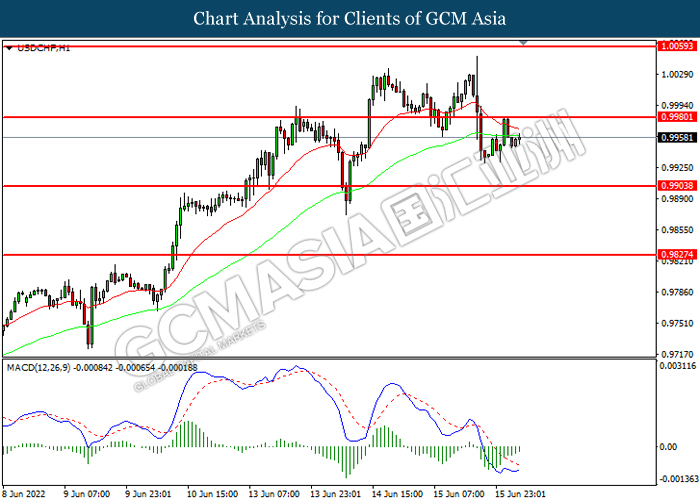

USDCHF, H1: USDCHF was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be trade higher as technical correction.

Resistance level: 0.9980, 1.0060

Support level: 0.9905, 0.9825

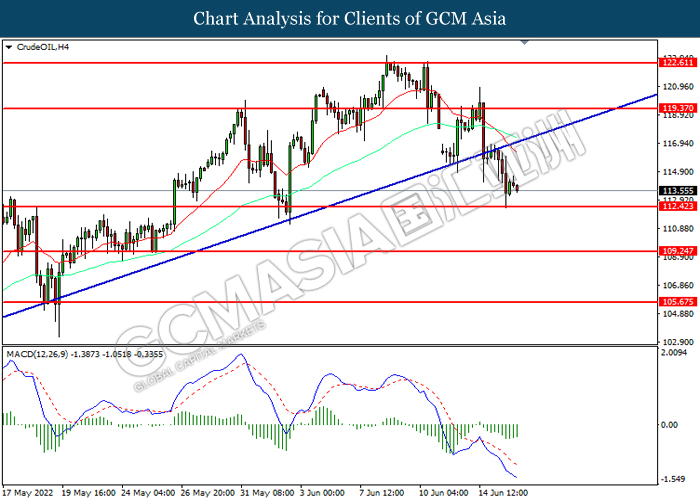

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 119.35, 112.60

Support level: 112.40, 109.25

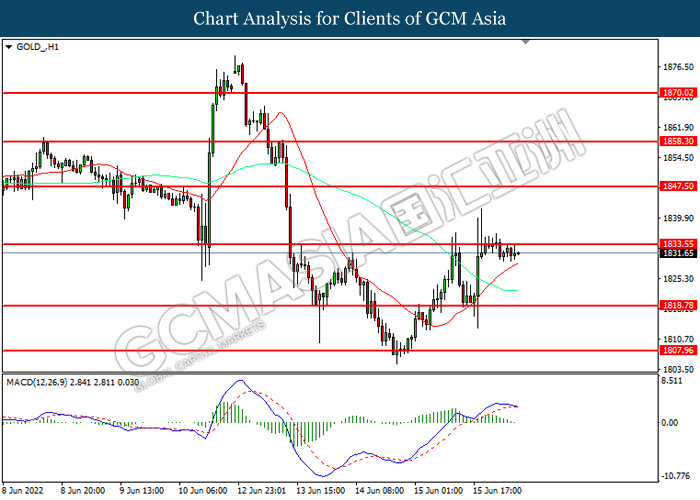

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1833.55, 1847.50

Support level: 1818.80, 1807.95