17 June 2022 Morning Session Analysis

US Dollar eased after downbeat economic data was unleashed.

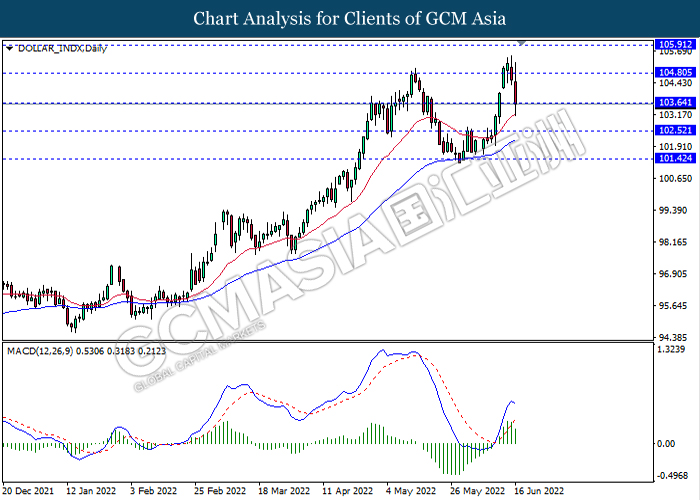

The Dollar Index which traded against a basket of six major currencies slumped on Thursday over the unleash of bearish economic data. According to Census Bureau, the US Building Permits notched down from the previous reading of 1.823M to 1.695M, which lower than the market forecast of 1.785M. In addition to this data, the US Philadelphia Fed Manufacturing Index and US Initial Jobless Claims had also released its downbeat reading, which are -3.3 and 229K, missing the economist expectation of 5.5 and 215K respectively. These bearish economic data were consistent with the projection of Federal Reserve on Thursday, which they mentioned that the economy growth was expected to be lower and unemployment rate would be higher. The growth forecast lowered to 1.7% for 2022 from 2.8%, and the unemployment rate forecast raised to 3.7% for 2022 from 3.5%. As the appeal of US Dollar has been dragged down, investors were prompted to look for other currencies which having better prospects. As of writing, the Dollar Index eased by 1.23% to 103.64.

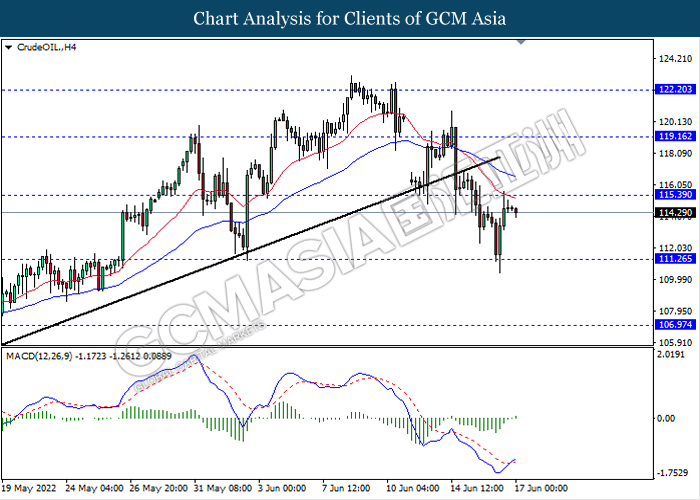

In the commodities market, crude oil price depreciated by 0.60% to $116.86 per barrel as of writing. Nonetheless, throughout the overnight trading session, oil price rose strongly amid the US announced new sanctions on Iran’s oil. On the other hand, gold price edged up by 0.16% to $1852.85 per troy ounce as of writing following the weakening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Monetary Policy Statement

TBC JPY BoJ Press Conference

20:45 USD Fed Chair Powell Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | – | – |

| 17:00 | EUR – CPI (YoY) (May) | 8.1% | 8.1% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 103.65, 104.80

Support level: 102.50, 101.40

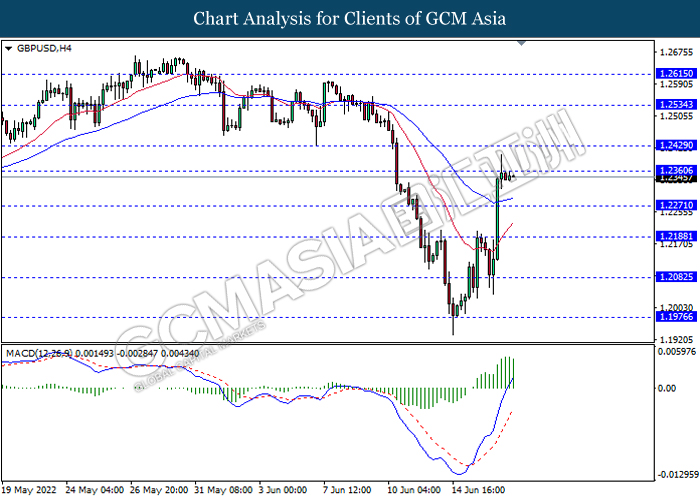

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2360, 1.2430

Support level: 1.2270, 1.2190

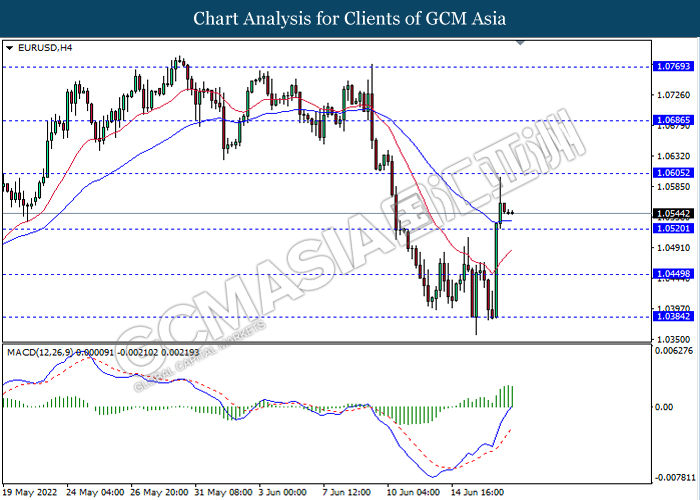

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0605, 1.0685

Support level: 1.0520, 1.0450

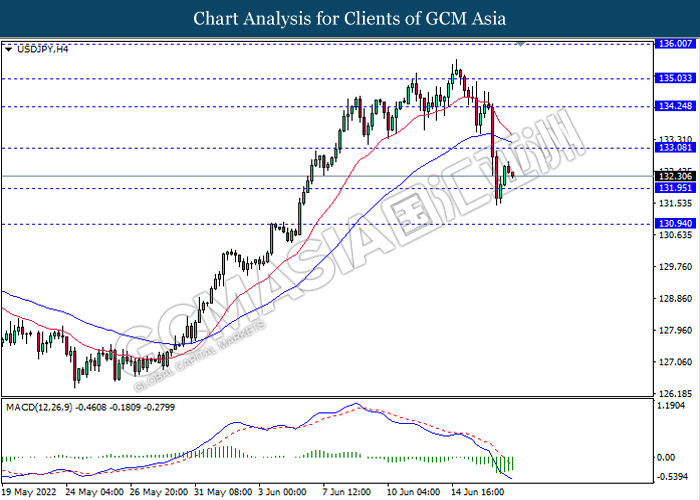

USDJPY, H4: USDJPY was traded higher following prior breakout above the previousresistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 133.10, 134.25

Support level: 131.95, 130.95

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7075, 0.7165

Support level: 0.7005, 0.6930

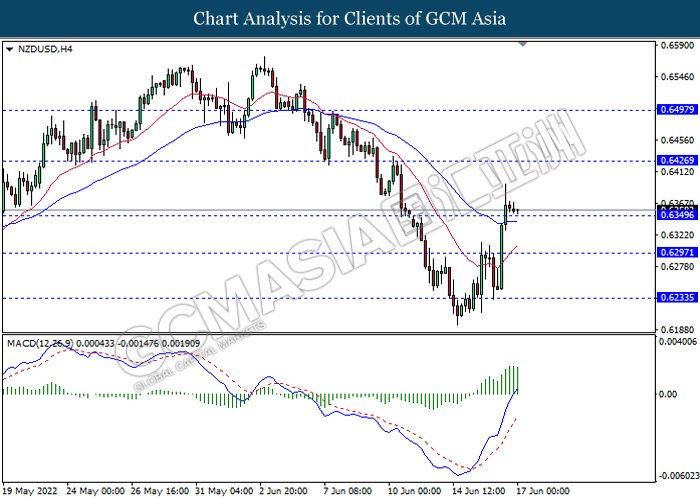

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.6425, 0.6495

Support level: 0.6350, 0.6295

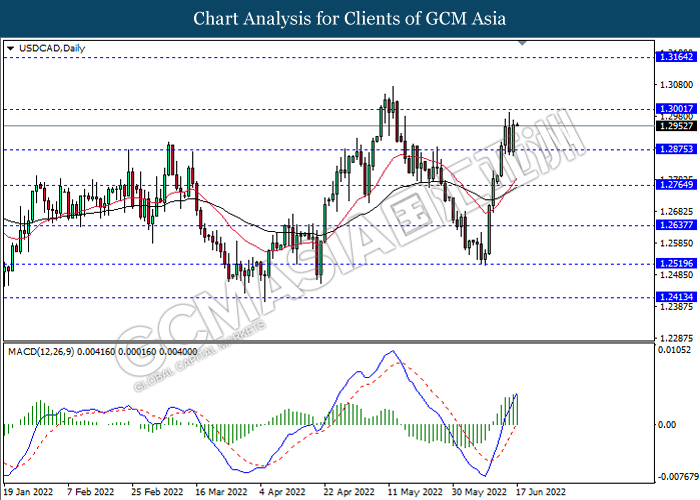

USDCAD, Daily: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.3000, 1.3165

Support level: 1.2875, 1.2765

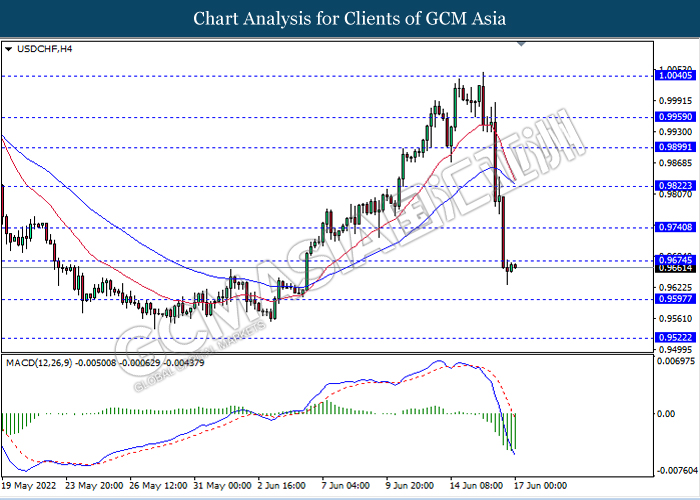

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

CrudeOIL, H4: Crude oil price was traded lower following prior retracement from the resistance level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 115.40, 119.15

Support level: 111.25, 106.95

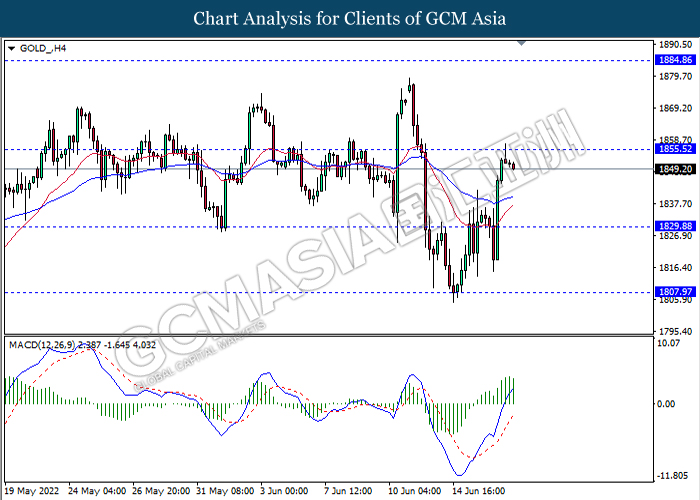

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the commodity to extend its losses.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95