20 June 2022 Morning Session Analysis

US dollar clawed back amid hawkish tone from Fed member.

The dollar index, which traded against a basket of six major currencies recovered from its prior losses after Federal Reserve (Fed) member gave a hawkish statement regarding to the pace of future rate hike. During an interview with President of the Fed Bank on Minneapolis, Neel Kashkari mentioned that he supported the U.S. central bank’s 0.75 percentage point interest-rate hike last week and could support another similar-sized one in July, but said the Fed should be “cautious” about doing too much or too fast. Such a hawkish titled statement boosted the market sentiment in the dollar market, as an aggressive rate hike is expected to be carried out by the Fed in the upcoming meeting. Besides, the catalyst that urged US dollar ended the Friday trading session with strong gains was after the Bank of Japan maintained its ultra-easy monetary policy in contrast to the aggressive tightening of its peers. With that, investors chose to move their capital away from the Japanese Yen to other market with higher risk-free return such as US dollar. As of writing, the dollar index up 0.02% to 104.75.

In the commodities market, the crude oil price was up by 0.25% to $111.70 after falling tremendously during the Friday late trading session amid the heightening of recession worries. Besides, the gold prices dropped 0.03% to $1838.90 a troy ounce after the US dollar climbed back to its recent high level.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Juneteenth

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

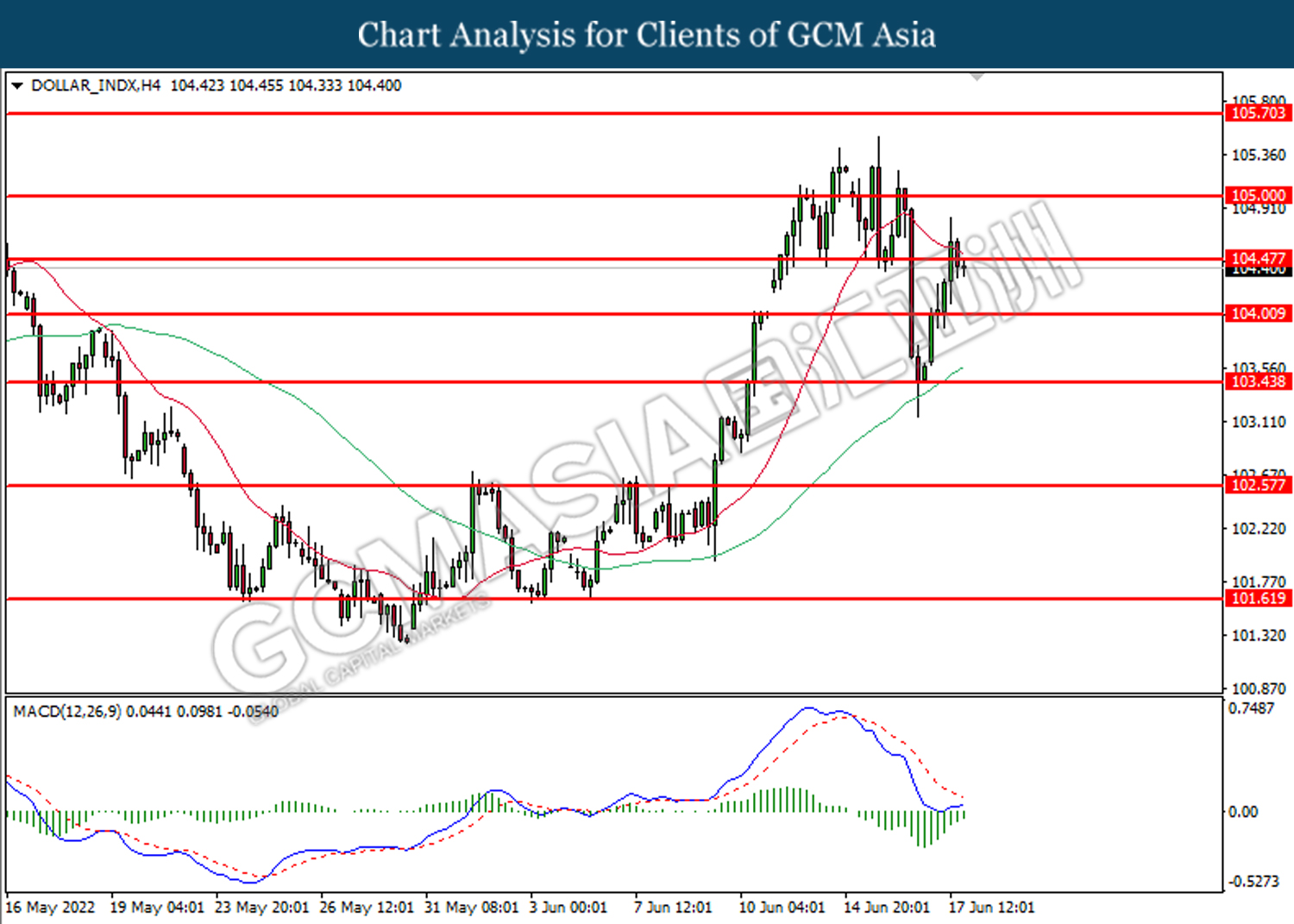

DOLLAR_INDX, H4: Dollar index was traded lower following prior breakout below the previous support level at 104.45. However, MACD which illustrated bullish bias momentum suggest the index to undergo technical correction in short term.

Resistance level: 104.45, 105.00

Support level: 104.00, 103.45

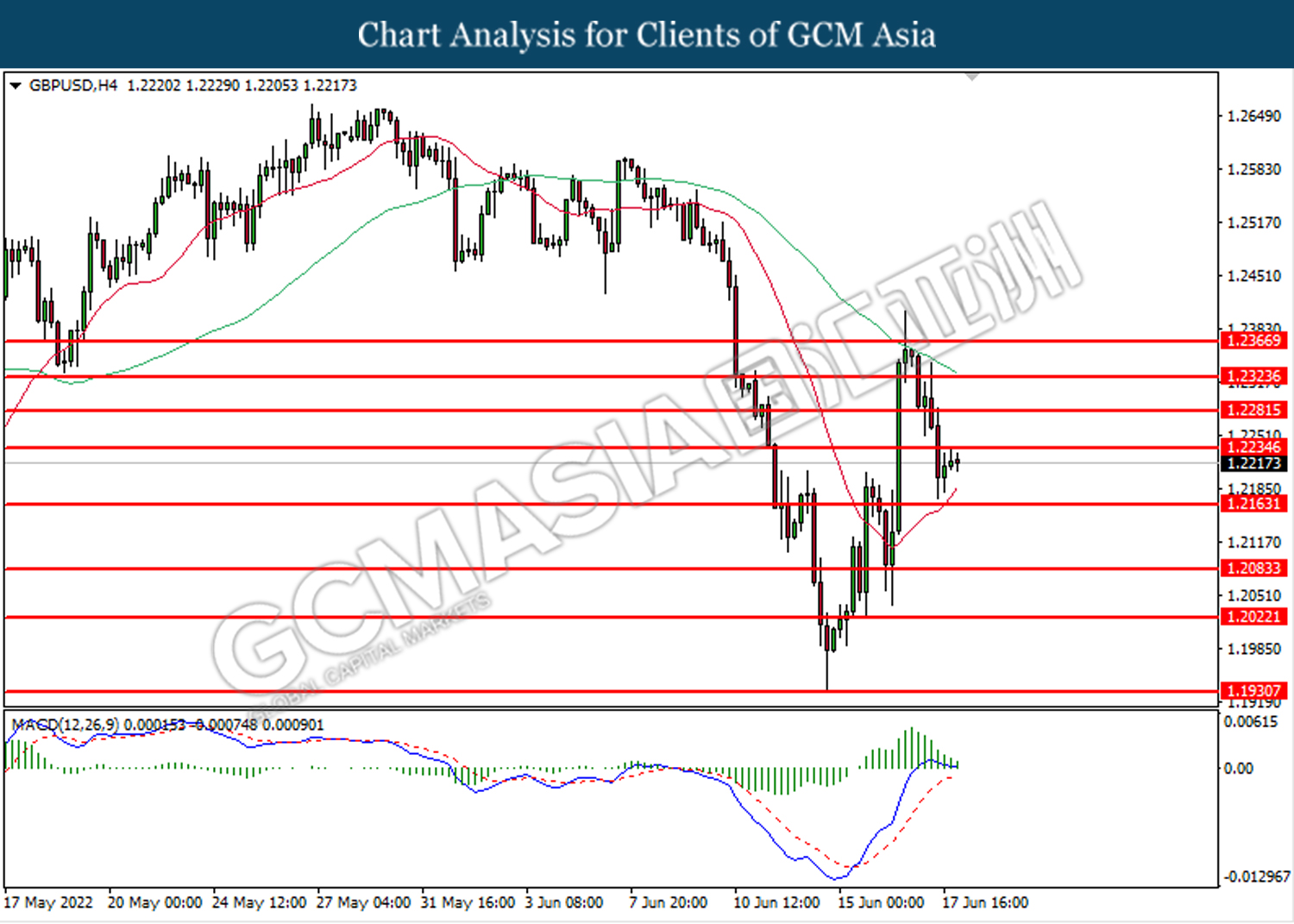

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level at 1.2235. However, MACD which illustrated diminishing bearish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.2235, 1.2280

Support level: 1.2165, 1.2085

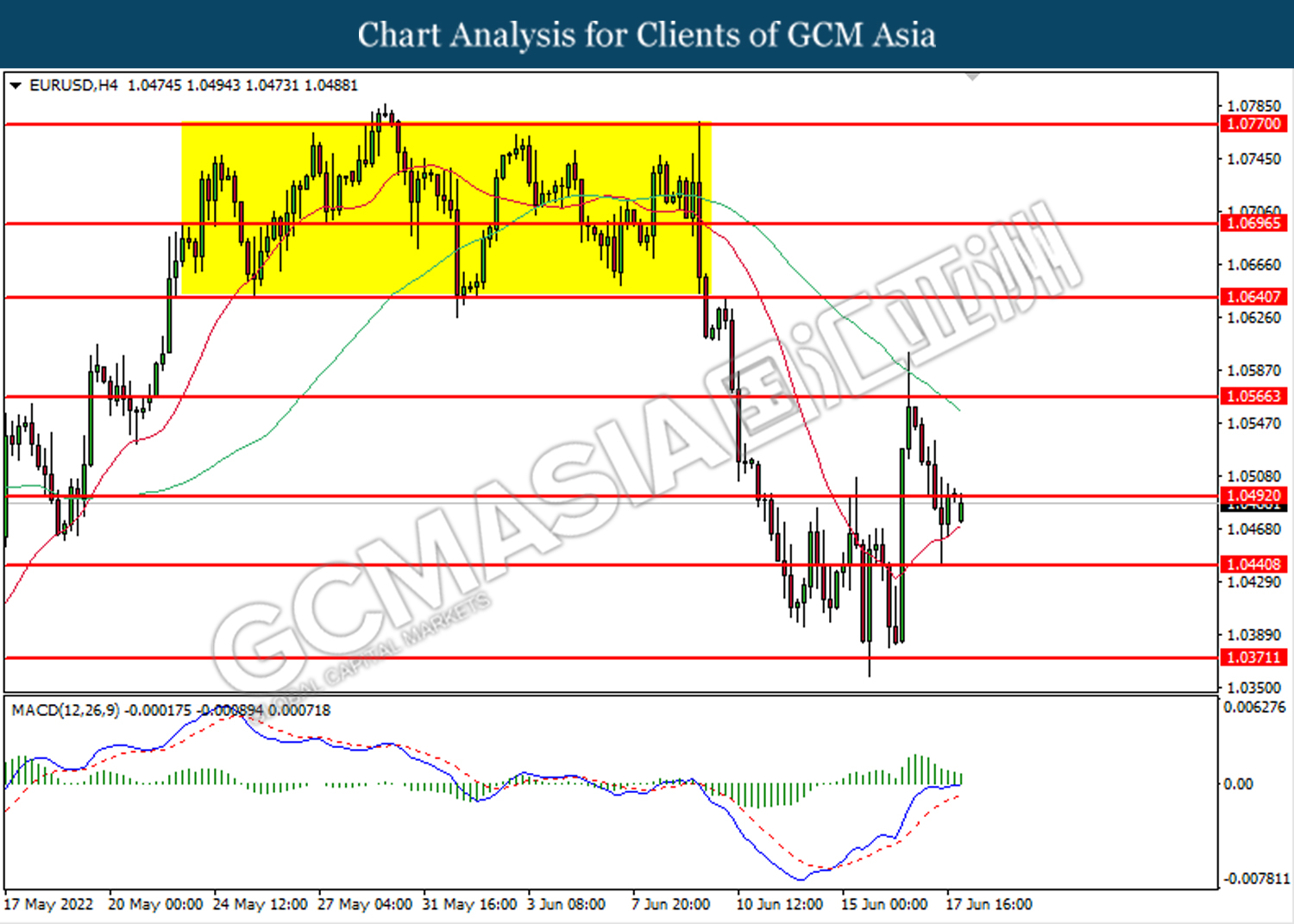

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level at 1.0490. However, MACD which illustrated diminishing bullish momentum suggest the pair to undergo technical correction in short term.

Resistance level: 1.0490, 1.0565

Support level: 1.0440, 1.0370

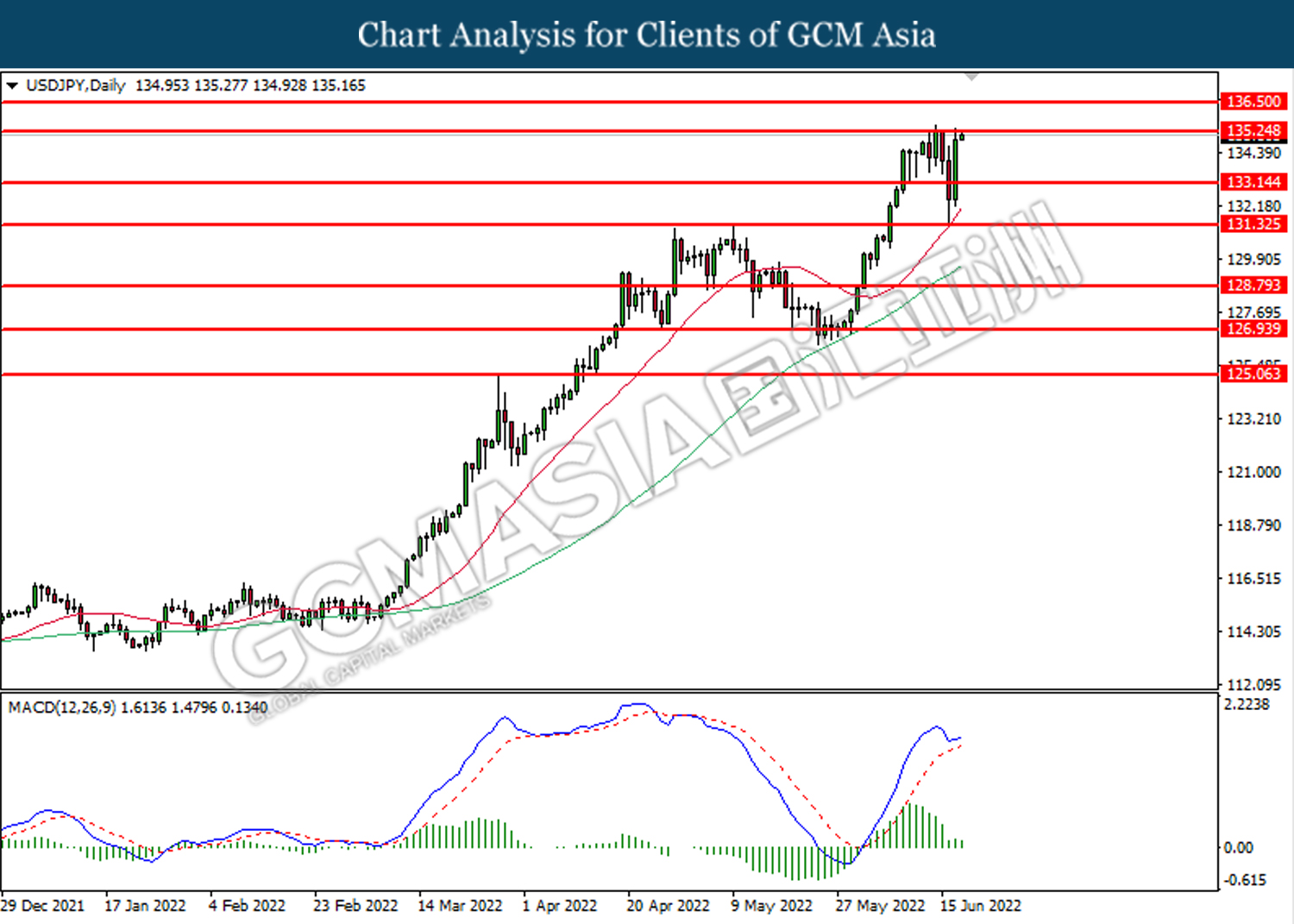

USDJPY, Daily: USDJPY was traded higher while currently testing the resistance level at 135.25. MACD which illustrated bullish bias momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 135.25, 136.50

Support level: 133.15, 131.35

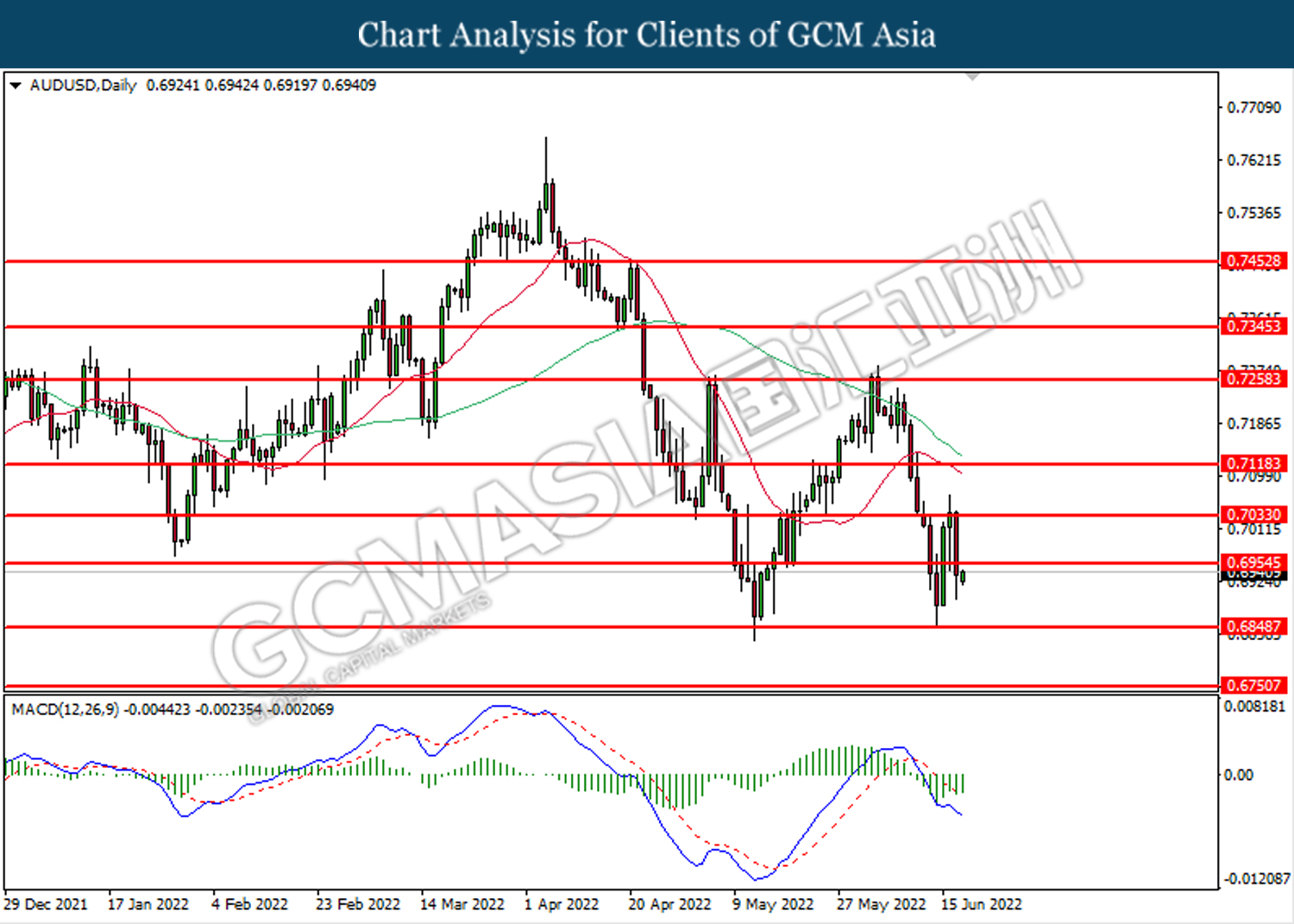

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level at 0.6955. MACD which illustrated bearish bias momentum suggest the pair to extend its losses toward the support level at 0.6850.

Resistance level: 0.6955, 0.7035

Support level: 0.6850, 0.6750

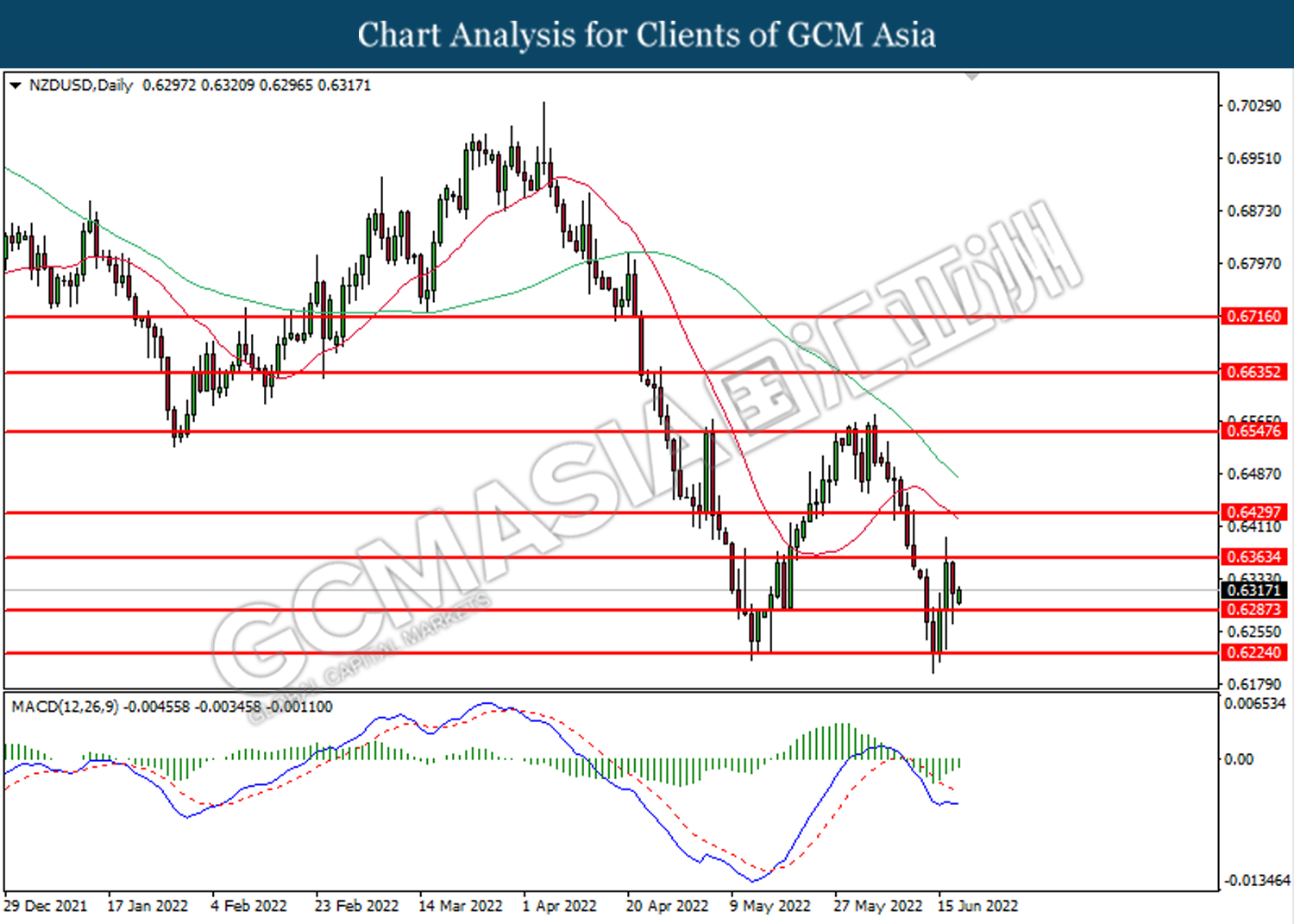

NZDUSD, Daily: NZDUSD was traded higher following prior rebound from the support level at 0.6285. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.6365.

Resistance level: 0.6365, 0.6430

Support level: 0.6285, 0.6225

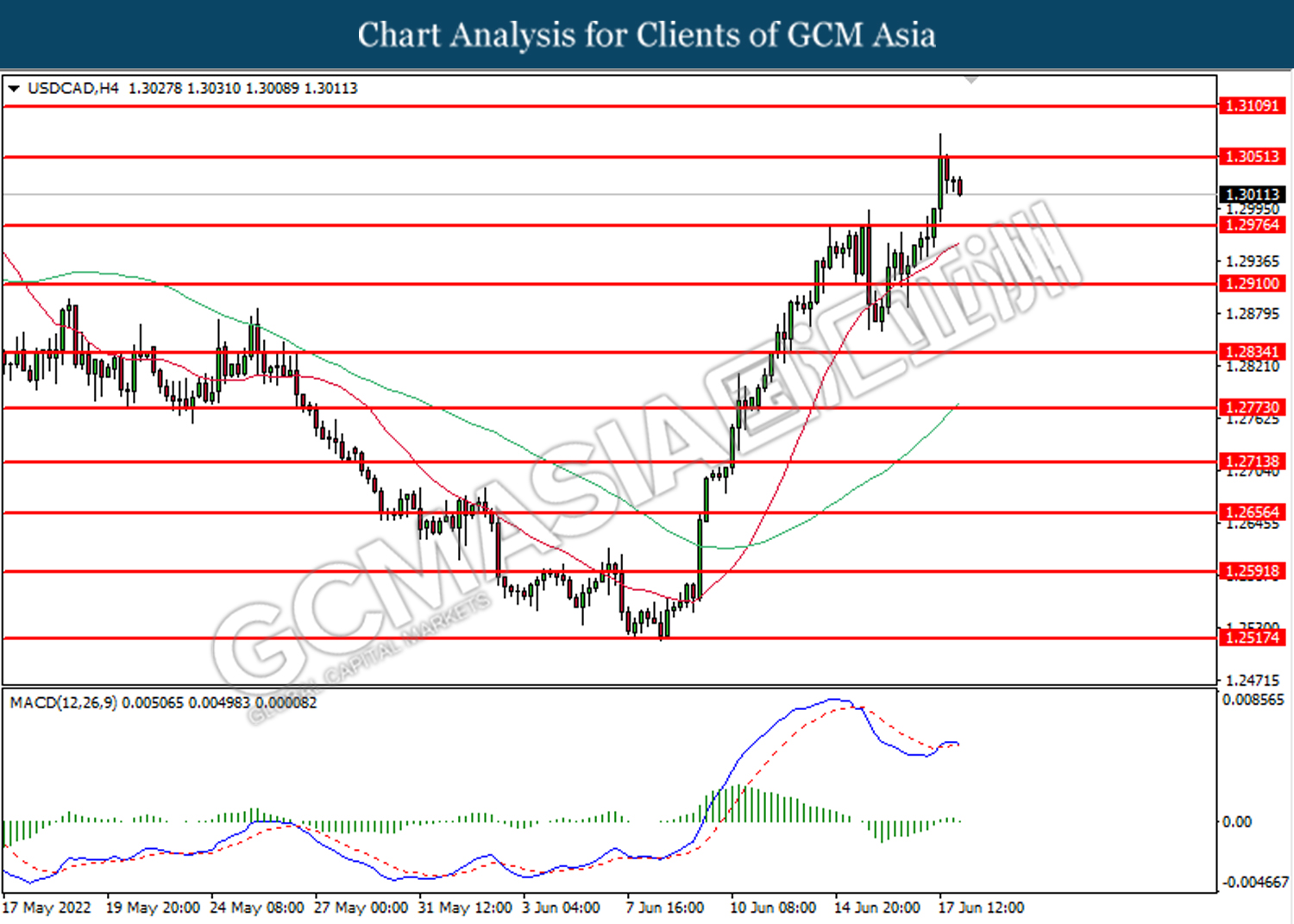

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level at 1.3050. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.2975.

Resistance level: 1.3050, 1.3110

Support level: 1.2975, 1.2910

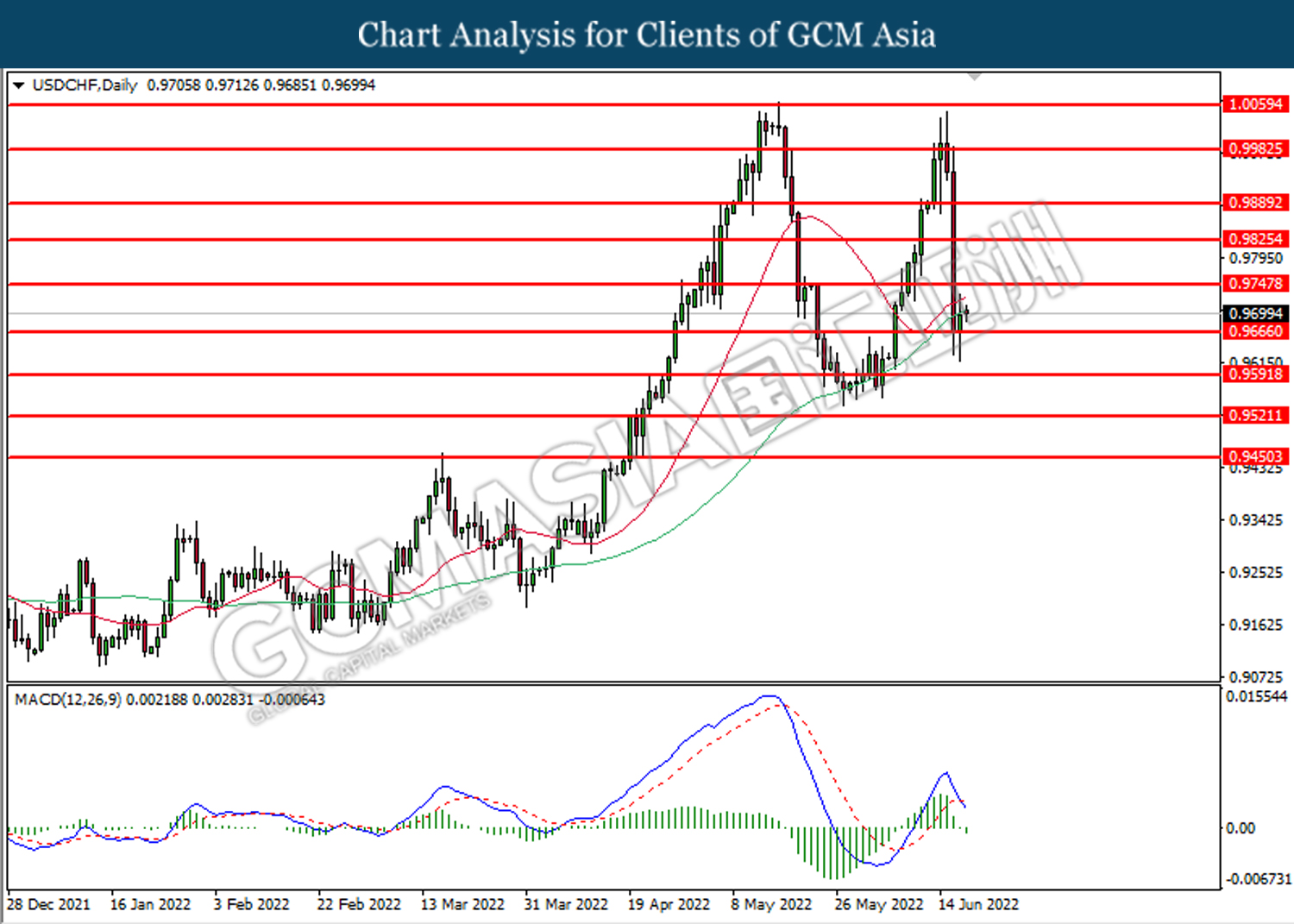

USDCHF, Daily: USDCHF was traded higher following prior rebound from the support level at 0.9665. However, MACD which illustrated bearish bias momentum suggest the pair to undergo technical correction in short term.

Resistance level: 0.9750, 0.9825

Support level: 0.9665, 0.9590

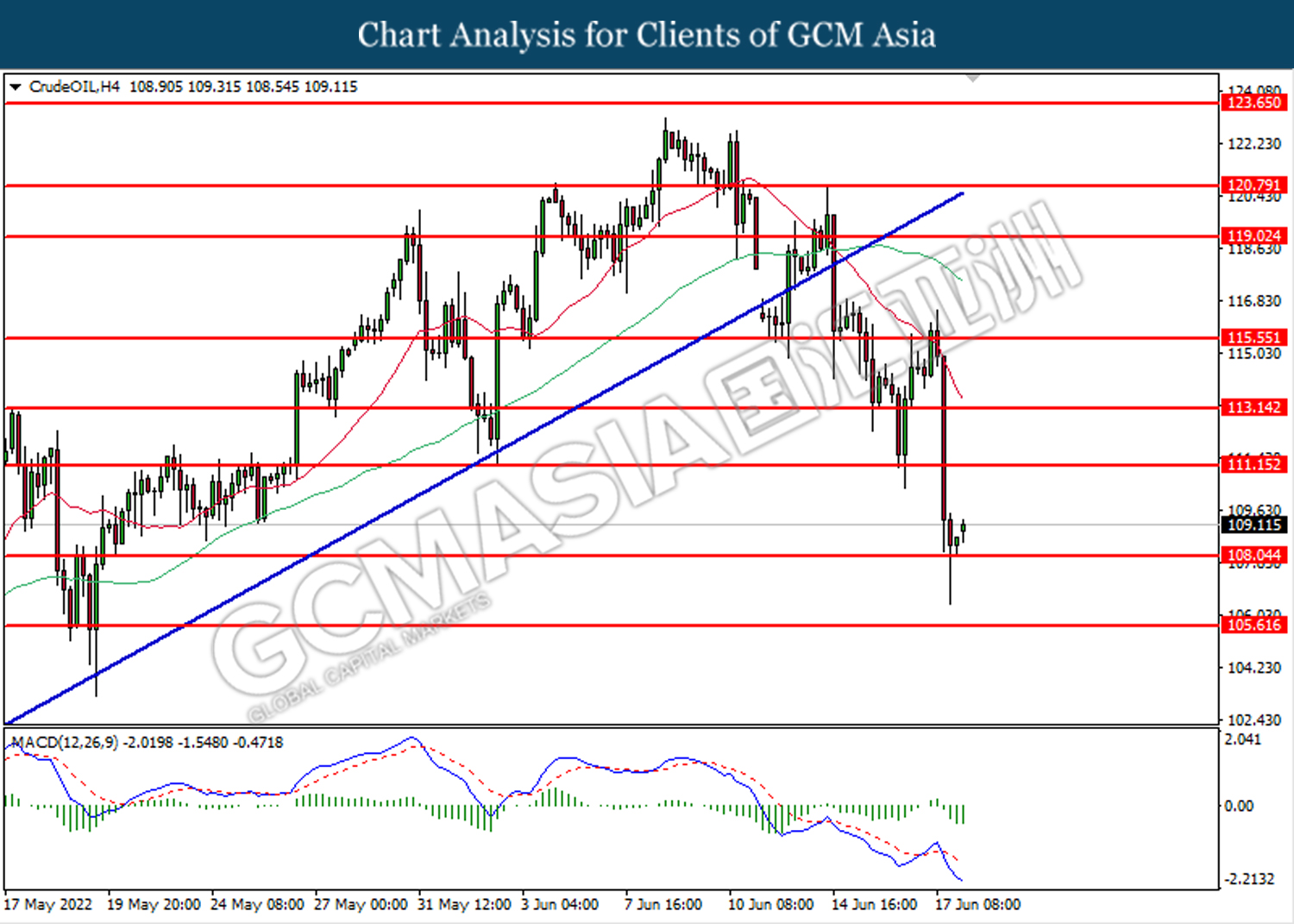

CrudeOIL, H4: Crude oil price was traded higher following prior rebound from the support level at 108.00. However, MACD which illustrated bearish bias momentum suggest the commodity to undergo technical correction in short term.

Resistance level: 111.15, 113.15

Support level: 108.00, 105.60

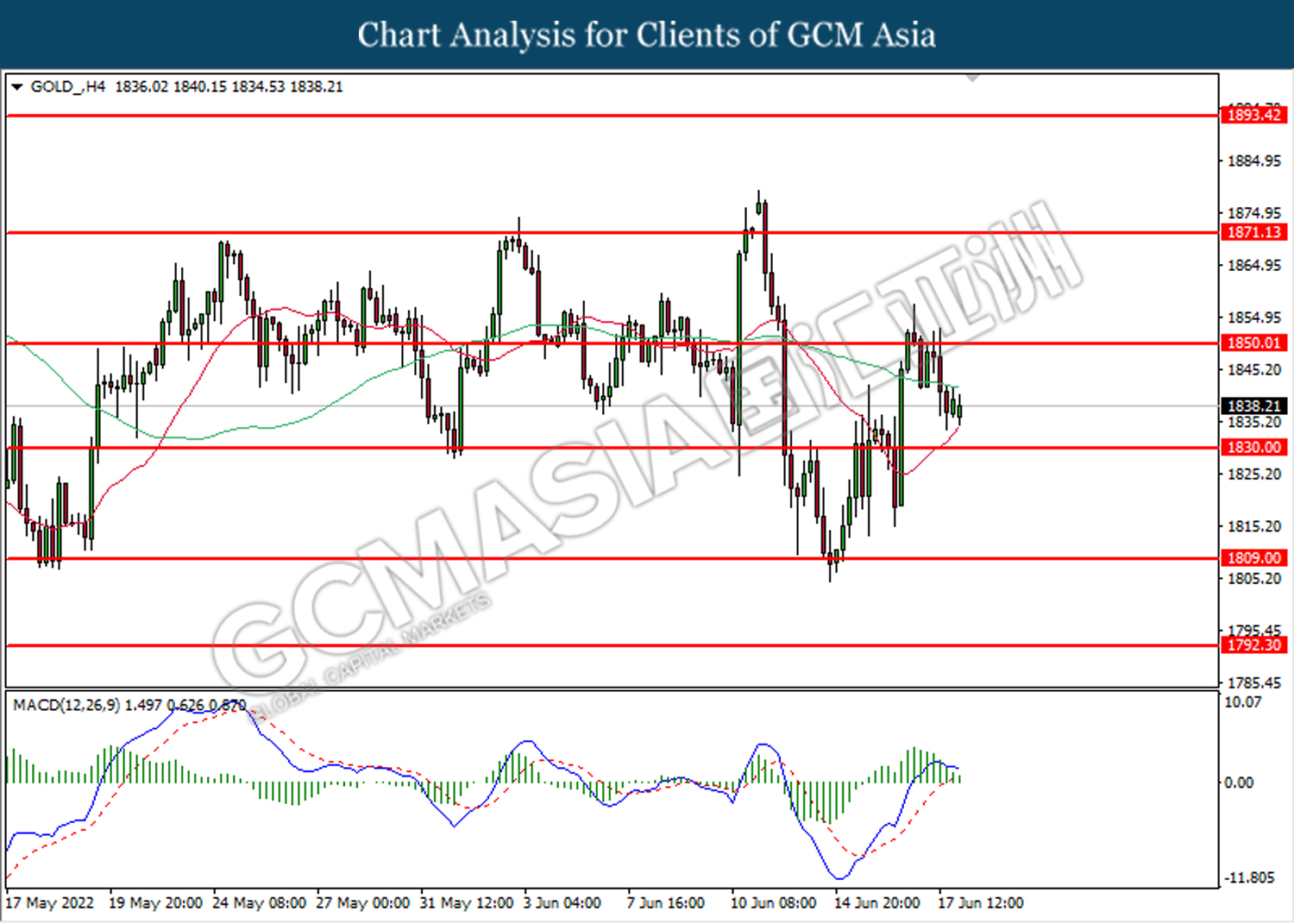

GOLD_, H4: Gold price was traded lower following prior retracement from the resistance level at 1850.00. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses toward the support level at 1830.00.

Resistance level: 1850.00, 1871.15

Support level: 1830.00, 1809.00