20 June 2022 Afternoon Session Analysis

Euro surged after CPI data was unleashed.

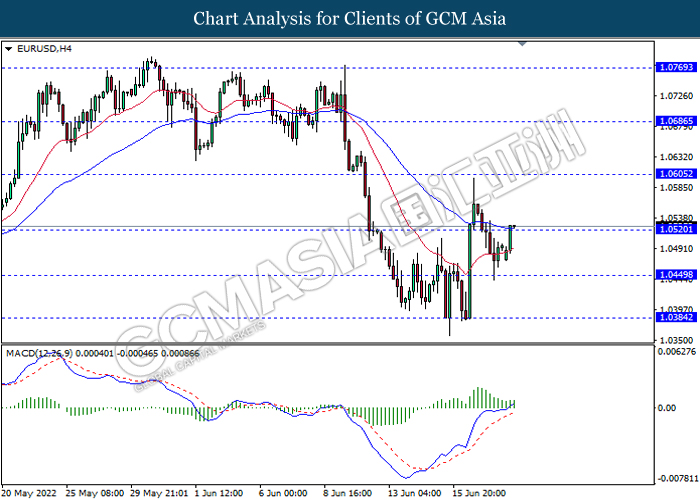

The EURUSD rebounded from its recent low after the Eurozone CPI data was released. According to Eurostat, the Eurozone Consumer Price Index (CPI) YoY notched up from the previous reading of 7.4% to 8.1% while it meet the market expectation. The CPI data had showed that the price of goods and services in Europe still remained in high level, which increased the odds of Bank of Europe (BoE) to implement tightening monetary policy in order to cool down the soaring price. Nonetheless, the overall trend of Euro remained bearish over the hawkish tone from Federal Reserve. According to Reuters, Fed member Neel Kashkari mentioned that he supported the US central bank’s 75 basic point rate hike last week and could support another similar-sized one in July, but said the Fed should be “cautious” about doing too much or too fast. Another aggressive rate hike is expected in the next FOMC meeting, which sparkling the appeal of US Dollar. As of writing, EURUSD appreciated by 0.27% to 1.0526.

In the commodities market, crude oil price depreciated by 0.15% to $107.83 per barrel as of writing following the US State Department sent letters to Eni and Spain’s Repsol in May authorizing them to resume taking Venezuelan crude oil, which cause the oil supply to increase. Besides, gold price rallied by 0.39% to $1847.85 per troy ounce as of writing. However, the gold price still under pressure amid the hawkish speech from Fed member.

Today’s Holiday Market Close

Time Market Event

All Day USD United States – Juneteenth

Today’s Highlight Events

Time Market Event

21:00 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

N/A

Technical Analysis

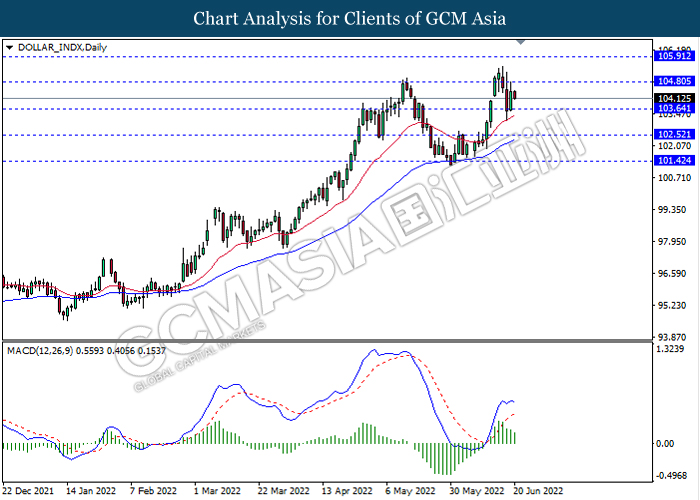

DOLLAR_INDX, Daily: Dollar index was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the index to extend its losses.

Resistance level: 104.80, 105.90

Support level: 103.65, 102.50

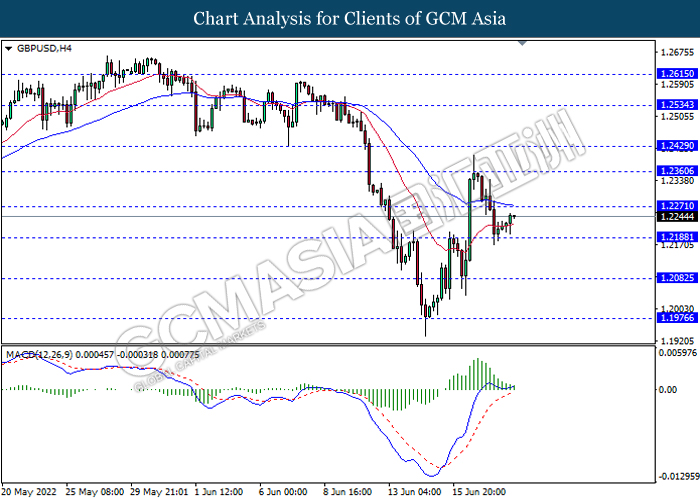

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2270, 1.2360

Support level: 1.2190, 1.2080

EURUSD, H4: EURUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.0605, 1.0685

Support level: 1.0520, 1.0450

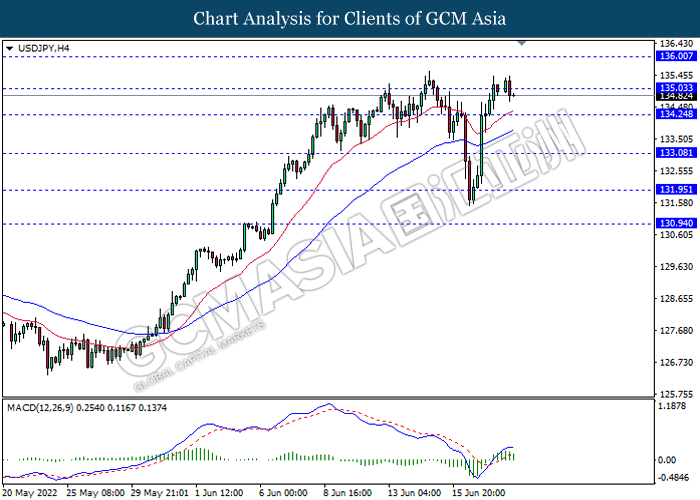

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 135.05, 136.00

Support level: 134.25, 133.10

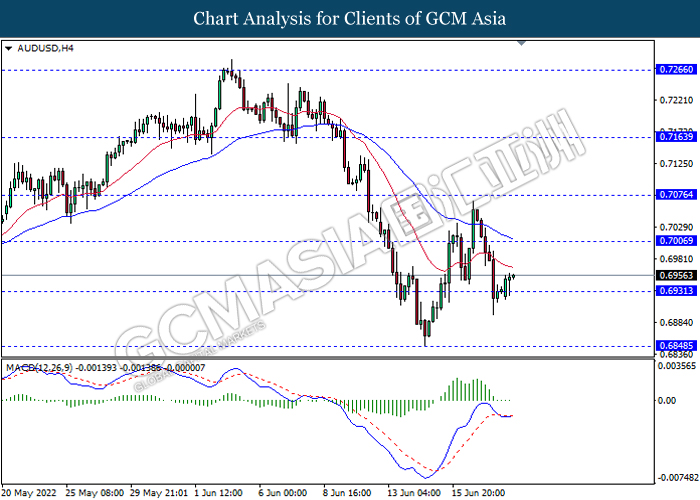

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.7005, 0.7075

Support level: 0.6930, 0.6850

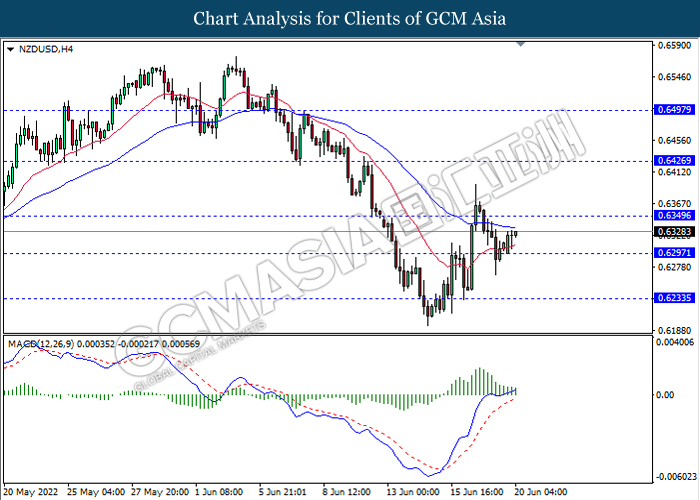

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6350, 0.6425

Support level: 0.6295, 0.6235

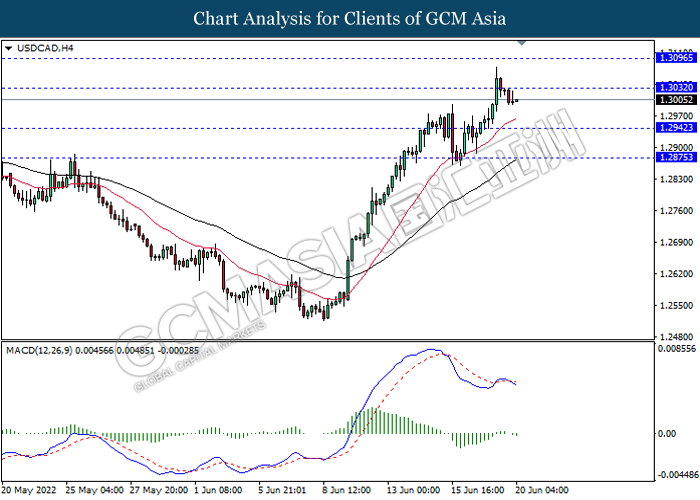

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.3030, 1.3095

Support level: 1.2940, 1.2875

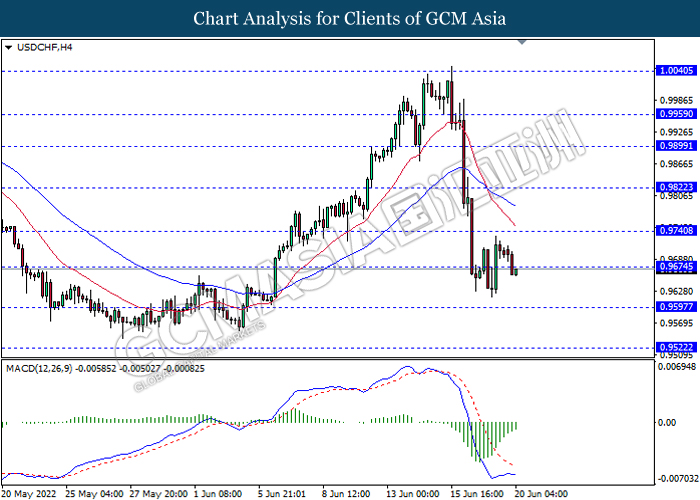

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

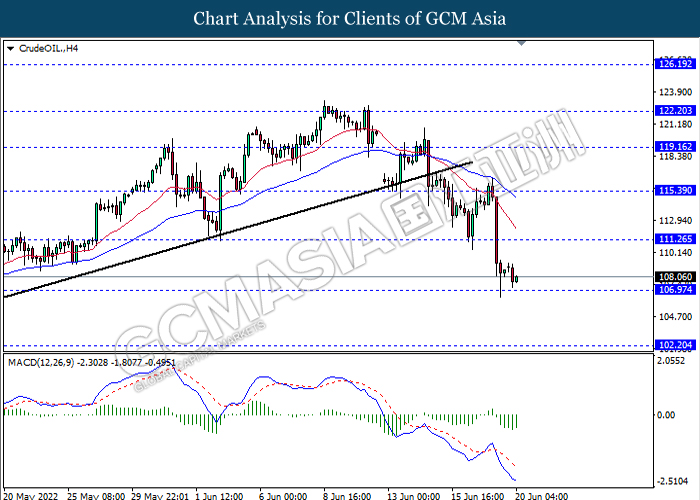

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 111.25, 115.40

Support level: 106.95, 102.20

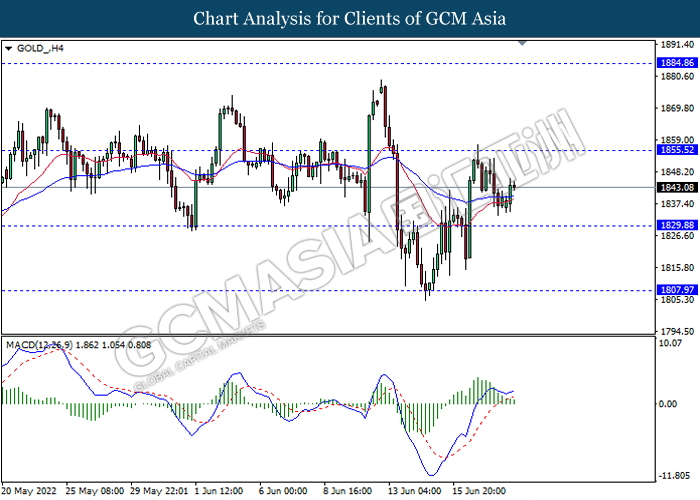

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 1855.50, 1884.85

Support level: 1829.90, 1807.95