21 June 2022 Afternoon Session Analysis

Aussie surged following the governor Philip Lowe warned further rate hike.

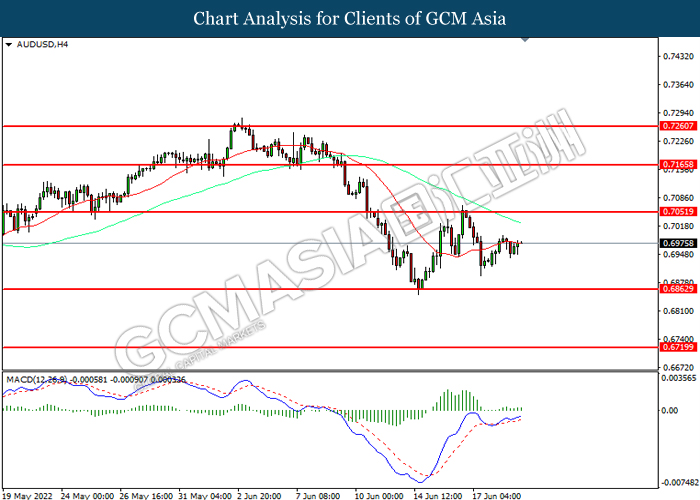

The Australia Dollar surged over the backdrop of hawkish tone from the Reserve Bank of Australia. According to the monetary policy statement from Reserve Bank of Australia, the Monetary Policy Committee (MPC) claimed that they are currently committed to implement necessary policy to ensure the inflation rate stabilize to 2-3% and household should prepare for further rate hike. Besides, he also reiterated that the possibility of recession in Australia Dollar remained low, claiming that the fundamentals of the economy in Australia remained strong. Besides, the Reserve Bank of Australia raised their inflation forecast to peak of around 7% in the December quarter, higher than the earlier predicted of 6%. As for now, they will still remain their footsteps of contractionary monetary policy while eyeing on global growth risk, more rate hike can be anticipated if the course of events urged the inflation growth goes against their expectation. As of writing, AUD/USD appreciated by 0.40% to 0.6975.

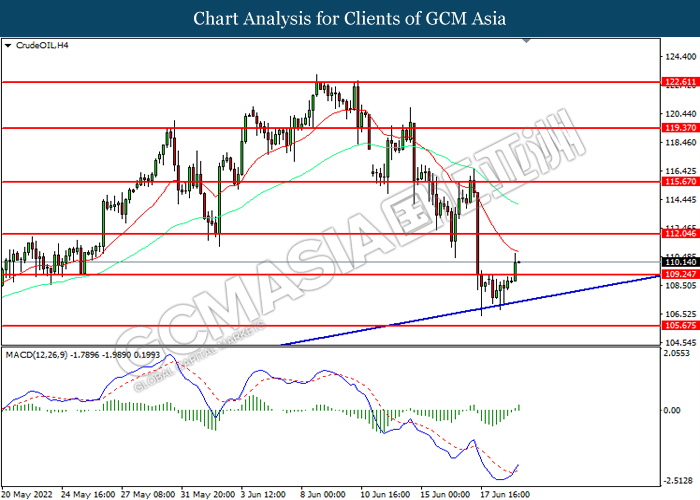

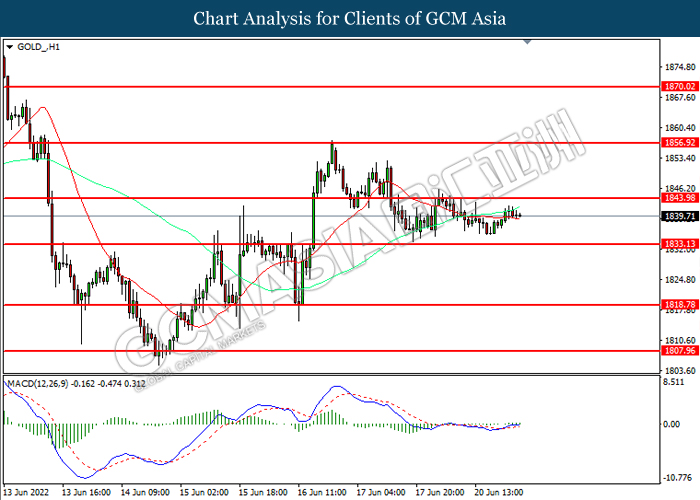

In the commodities market, the crude oil price surged 0.90% to $110.05 per barrel as of writing. The crude oil price was traded higher amid the rising tensions between US-Iran over the nuclear deal meeting had continued to spark further supply concerns, increasing the appeal for this black-commodity. On the other hand, the gold price appreciated by 0.01% to $1839.85 per troy ounces amid the fears upon the global recession risk had stoked a shift In sentiment toward safe-haven commodity.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | CAD – Core Retail Sales (MoM) (Apr) | 2.4% | 0.6% | – |

| 22:00 | USD – Existing Home Sales (May) | 5.61M | 5.39M | – |

Technical Analysis

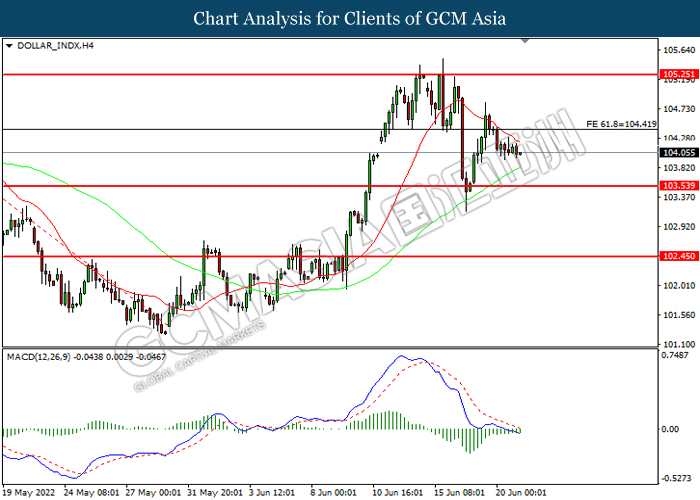

DOLLAR_INDX, H4: Dollar index was traded lower following prior retracement from the resistance level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 104.40, 105.25

Support level: 103.55, 102.45

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2320, 1.2400

Support level: 1.2240, 1.2140

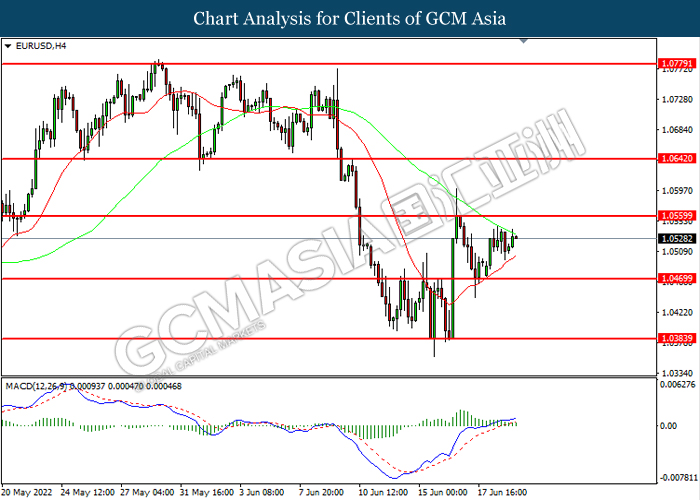

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0560, 1.0640

Support level: 1.0470, 1.0385

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 135.40, 136.45

Support level: 133.55, 131.25

AUDUSD, H4: AUDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.7050, 0.7165

Support level: 0.6865, 0.6720

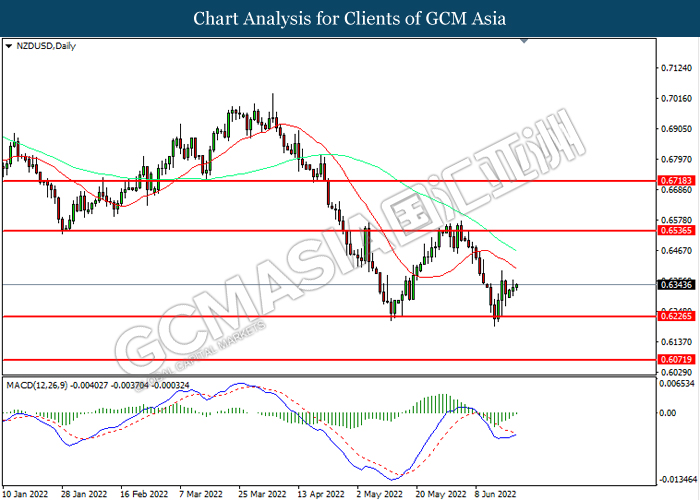

NZDUSD, Daily: NZDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6535, 0.6720

Support level: 0.6225, 0.6070

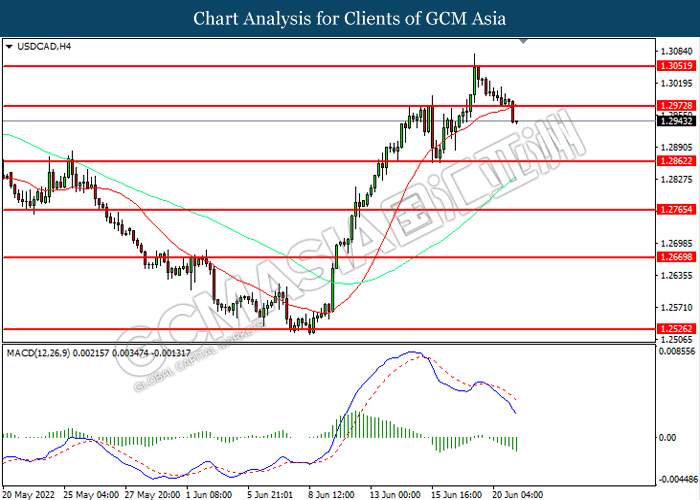

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2975, 1.3050

Support level: 1.2860, 1.2765

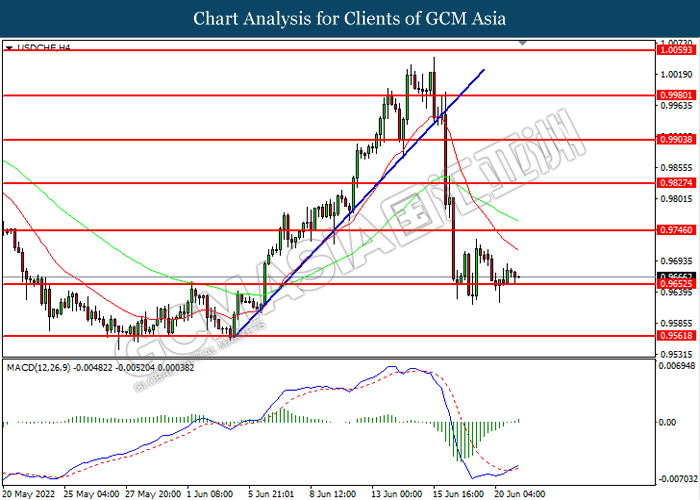

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9745, 0.9825

Support level: 0.9655, 0.9560

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains.

Resistance level: 112.05, 115.65

Support level: 109.25, 105.65

GOLD_, H1: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1844.00, 1856.90

Support level: 1833.15, 1818.80