7 July 2022 Morning Session Analysis

Fed emphasized the needs of rate hike, US Dollar surged.

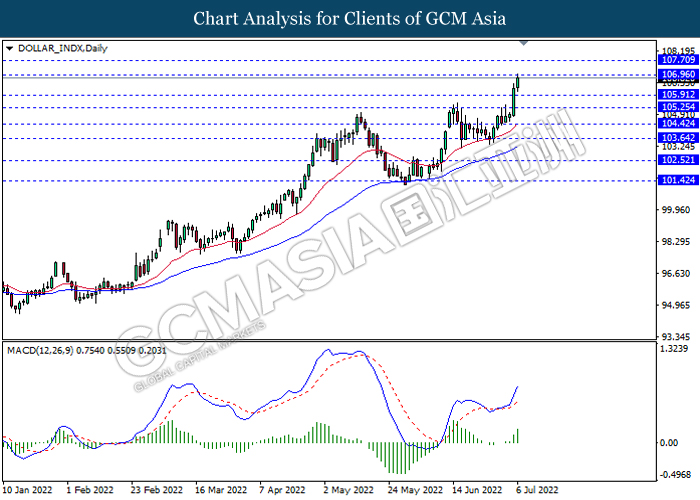

The Dollar index which traded against a basket of six major currencies extended its gains following the hawkish statement from Federal Reserve. According to the FOMC meeting minutes in the earlier day, Federal Reserve officials reiterated the needs of implementation of rate hike despite it would likely lead to the economy recession in the US. Besides, the officials also claimed that the 50 or 75 basis point increase is suitable in order to meet their objective, which controlling the inflation in 2% in long-run. Besides, the Dollar Index received further bullish momentum amid the upbeat economic data. The US ISM Non-Manufacturing Purchasing Managers Index (PMI) for June came in at the reading of 55.3 while higher than the market expectation of 54.3. In addition, the US JOLTs Job Openings for May recorded at the reading of 11.254M, exceeding the market forecast of 11.000M. The bullish economic data had brought positive prospects toward the economic progression in US. As of writing, the Dollar Index rose by 0.53% to 106.88.

In the commodities market, crude oil price depreciated by 0.20% to $98.33 per barrel as of writing as the API Weekly Crude Oil Stock increased while confounding expectations for a decline. On the other hand, gold price edged up by 0.07% to $1737.80 per troy ounce after a sharp decline throughout the overnight trading session following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:30 EUR ECB Publishes Account of Monetary Policy Meeting

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 231K | 230K | – |

| 22:00 | CAD – Ivey PMI (Jun) | 72.0 | – | – |

| 23:00 | USD – Crude Oil Inventories | -2.762M | -0.569M | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 106.95, 107.70

Support level: 105.90, 105.25

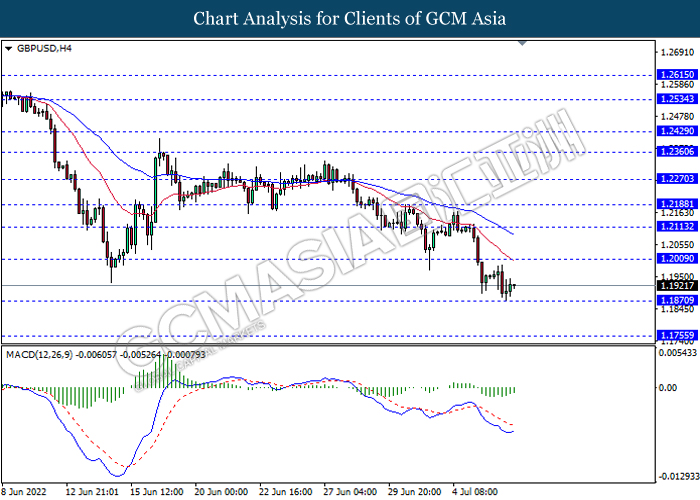

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2010, 1.2115

Support level: 1.1870, 1.1755

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0235, 1.0315

Support level: 1.0145, 1.0040

USDJPY, H4: USDJPY was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

AUDUSD, H4: AUDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

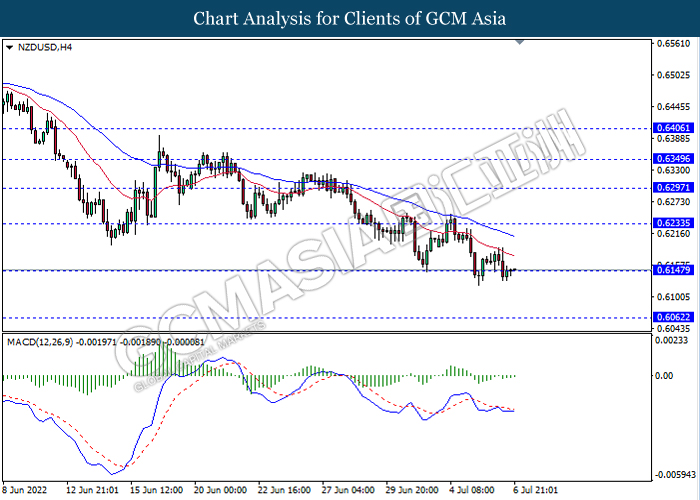

NZDUSD, H4: NZDUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

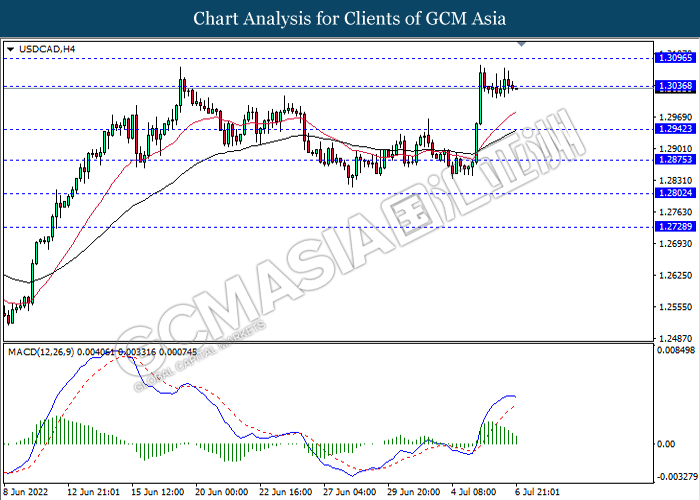

USDCAD, H4: USDCAD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

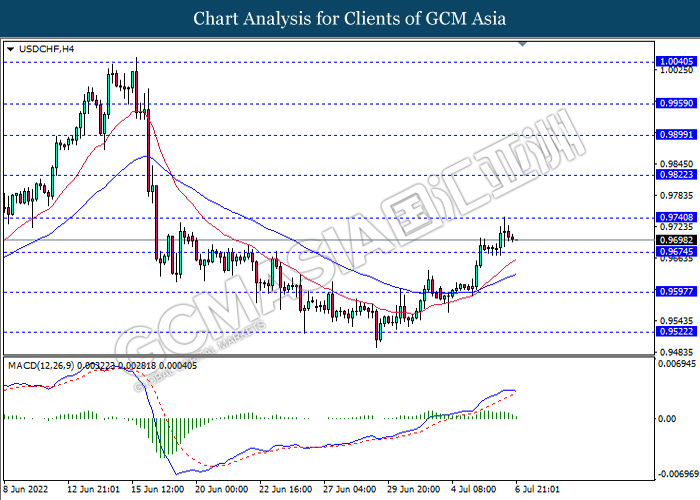

USDCHF, H4: USDCHF was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

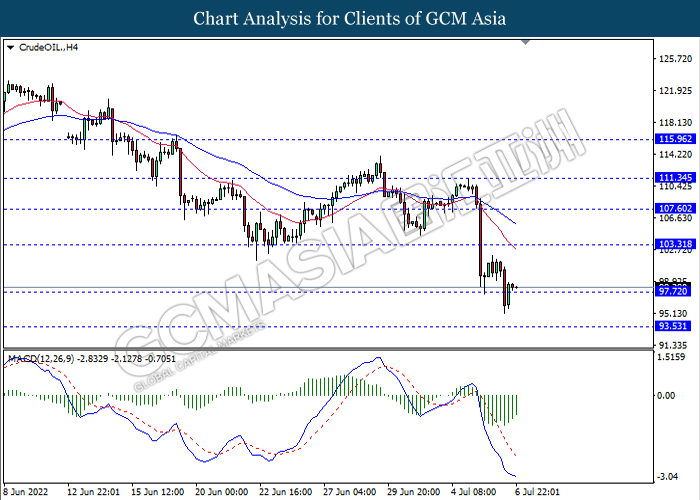

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1753.25, 1771.10

Support level: 1737.30, 1718.90