08 July 2022 Morning Session Analysis

US Dollar seesawed ahead of Nonfarm Payroll.

The Dollar Index which traded against a basket of six major currencies was traded flat ahead of the released of crucial economic data from US region. Recently, fears upon the recession risk continue to linger in the global financial market, the retail Sales and real spending in the United States were indicated pessimism reading in May. The Federal Open Market Committee (FOMC) are expected to add another 75-basis point during the 27th July meeting, bringing the target interest rate to 2.50% in order to stabilize the significant inflation risk. The Nonfarm Payroll. which would be releasing tonight is crucial as the labor market is the crucial factor which would affect the decision making of the monetary policy. When hiring process began to fade, the odds toward the recession risk would be higher. The earlier statistic had indicated that the Nonfarm Payrolls data have seen the three-month average decrease from the previous reading of 602,000 in February to 408,000 in May, and the economists forecasted that the data would continue its downward trend into 270,000 job creation in June. Indeed, the Atlanta Fed’s GDPNow model predicted the second-quarter growth in United States would fall into further contraction. As of writing, the Dollar Index depreciated by 0.06% to 107.05.

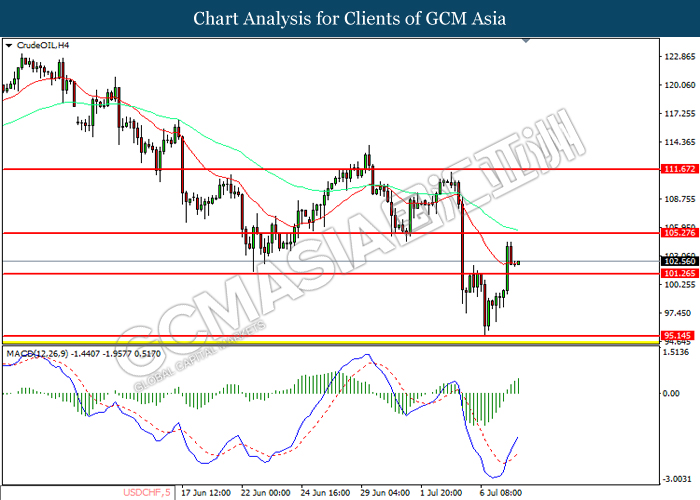

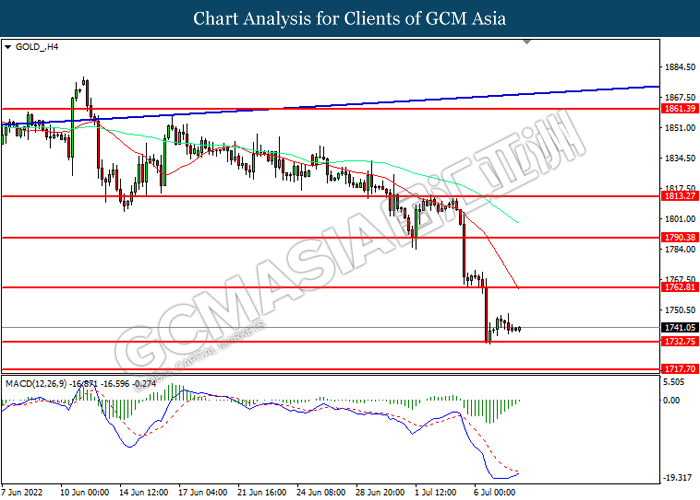

In the commodities market, the crude oil price appreciated by 0.10% to $102.25 per barrel as of writing amid technical correction. Though, the gains experienced by the crude oil was still limited by bearish inventory data. According to Energy Information Administration (EIA), Crude Oil Inventories came in at 8.235M, exceeding the market forecast at -1.043M. On the other hand, gold price was traded flat at $1739.30 while investors continue to scrutinize the latest job data tonight.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:55 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 390K | 270K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jun) | 39.8K | 22.5K | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

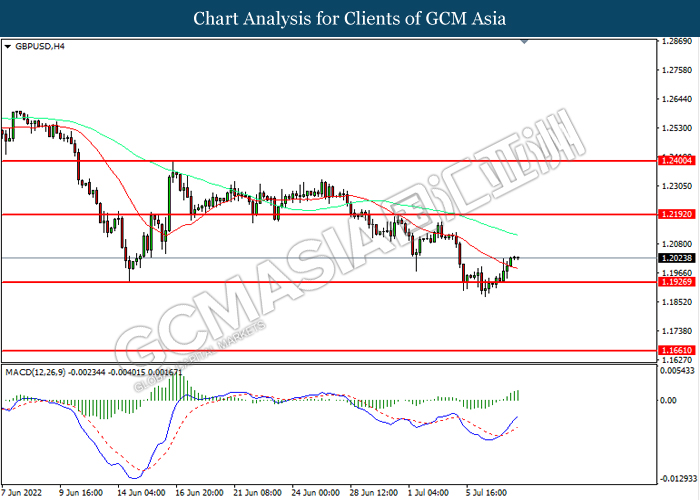

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2190, 1.2400

Support level: 1.1925, 1.1660

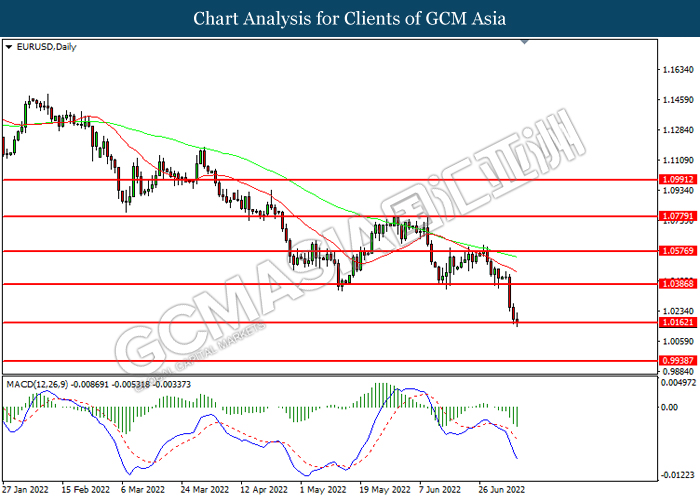

EURUSD, Daily: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0385, 1.0575

Support level: 1.0185, 1.0060

USDJPY, H4: USDJPY was traded lower higher while currently near the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 136.60, 137.70

Support level: 134.45, 131.40

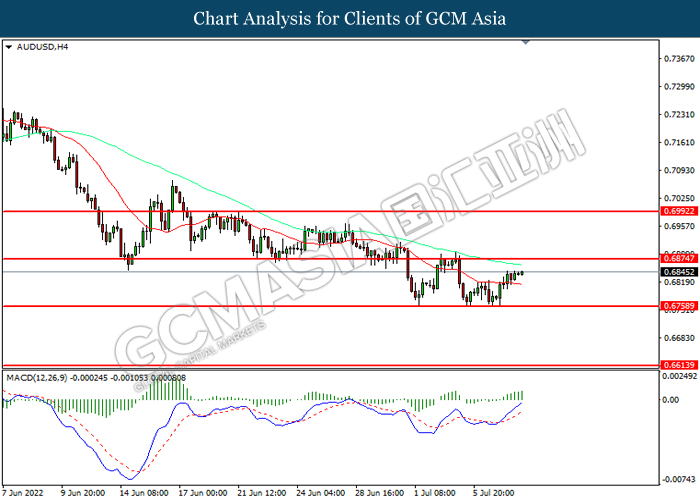

AUDUSD, H4: AUDUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 0.6875, 0.6990

Support level: 0.6760, 0.6615

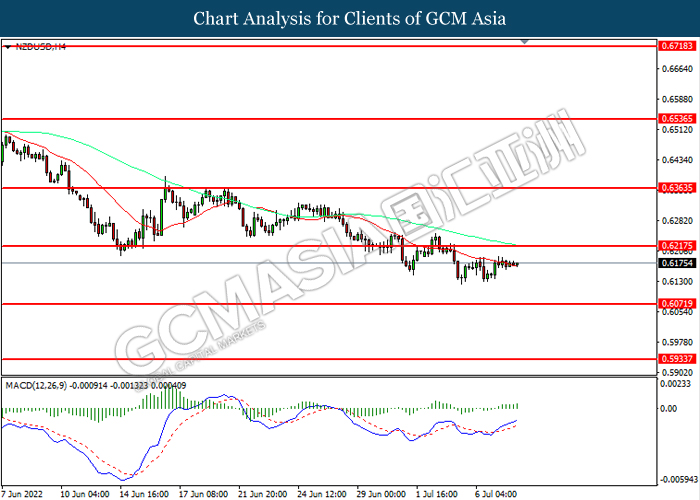

NZDUSD, H4: NZDUSD was traded within a range while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

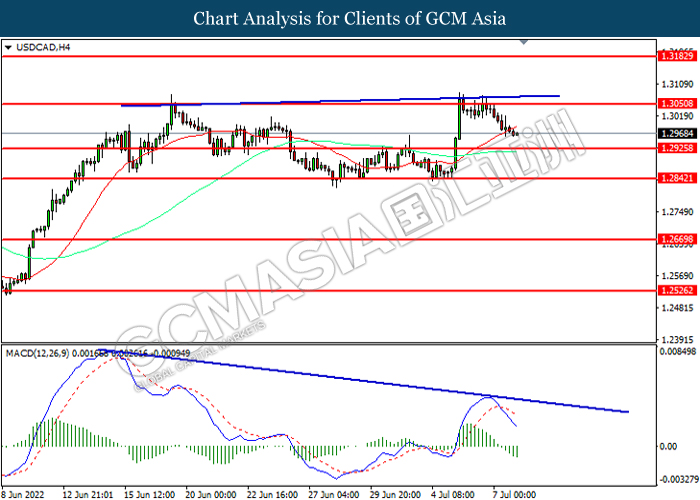

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

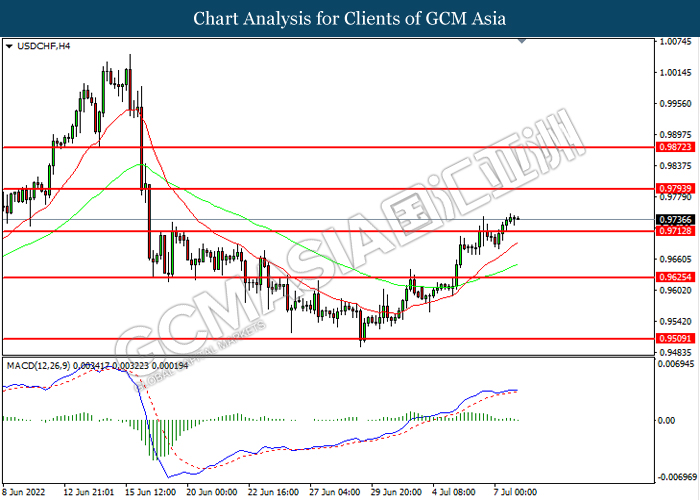

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower in short-term as technical correction.

Resistance level: 0.9715, 0.9780

Support level: 0.9625, 0.9510

CrudeOIL, H4: Crude oil price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 103.40, 111.65

Support level: 95.15, 84.55

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1790.40, 1861.40

Support level: 1721.25, 1622.40