8 July 2022 Afternoon Session Analysis

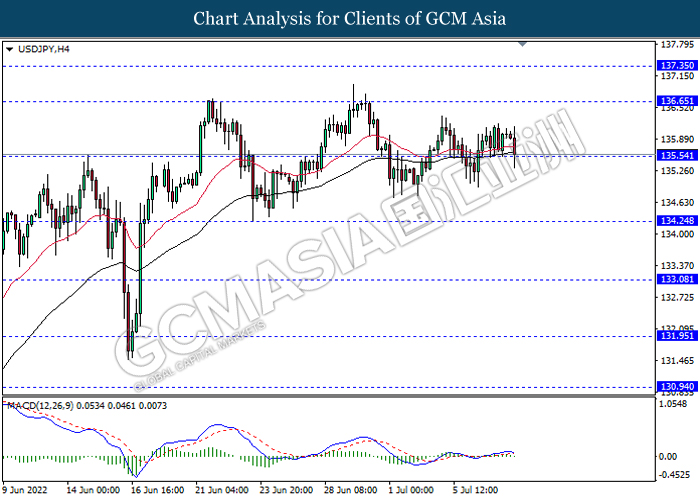

BoJ remained its dovish statement, USDJPY rose.

The USD/JPY edged up on yesterday amid the backdrop of dovish statement of Bank of Japan (BoJ). According to Reuters, BoJ was expected to raise its inflation forecast, which the core consumer inflation adjusted to 2% target in the current fiscal year ending in March 2023, up from the present forecast of 1.9% made in April. Nonetheless, the BoJ Governor Haruhiko Kuroda claimed that the central bank would remain its expansionary monetary policy as the inflation in Japan still lower than other western countries. Besides, BoJ also lowered its economic growth forecast from the current 2.9%. The bearish economic growth expectation might indicate that the diminishing of consumer spending in Japan, which reduced the odds of rate hike from BoJ. Though, the movement of USD/JPY is relatively slower throughout the overnight trading session as investors are eyeing on the NFP data which would be released tonight. As of writing, USD/JPY appreciated by 0.03% to 136.00.

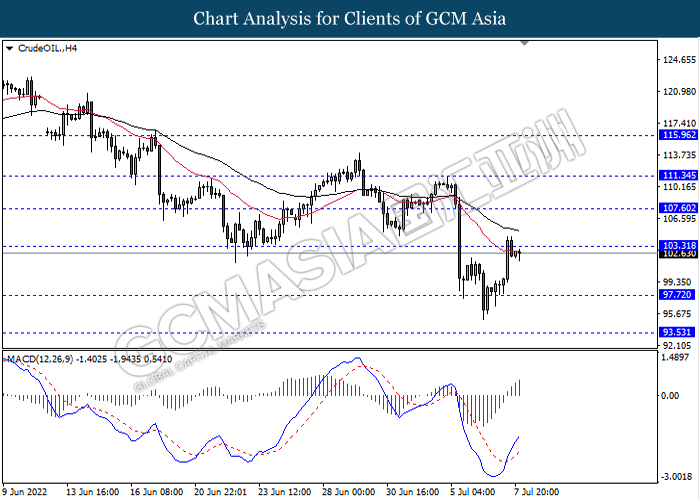

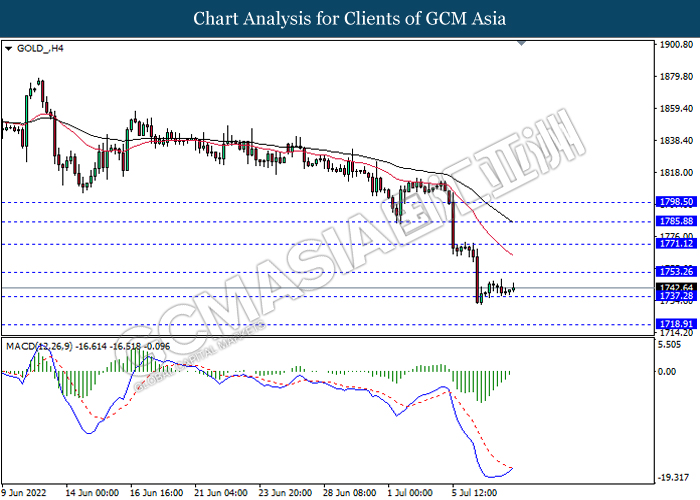

In the commodities market, crude oil price depreciated by 0.88% to $101.85 per barrel as of writing following the economy recession sentiment keep lingering in the market. On the other hand, gold price appreciated by 0.10% to $1741.55 per troy ounce as of writing. However, the overall trend of gold price remained bearish amid the rising of rate hike expectation from major central banks.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

19:55 EUR ECB President Lagarde Speaks

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Nonfarm Payrolls (Jun) | 390K | 270K | – |

| 20:30 | USD – Unemployment Rate (Jun) | 3.6% | 3.6% | – |

| 20:30 | CAD – Employment Change (Jun) | 39.8K | 22.5K | – |

Technical Analysis

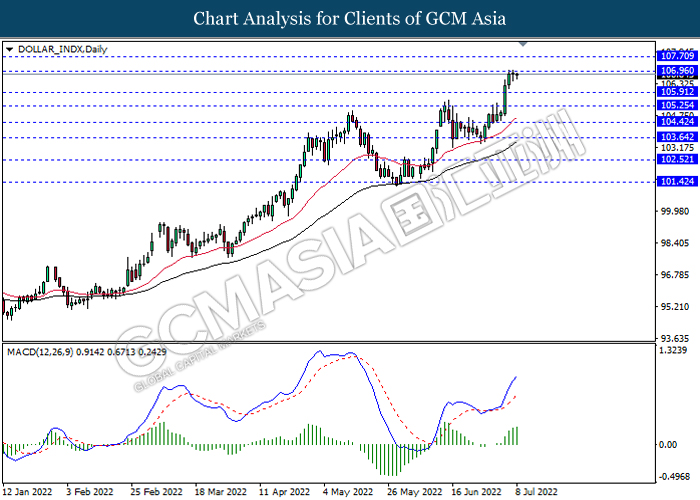

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the index to extend its gains if successfully breakout the resistance level.

Resistance level: 106.95, 107.70

Support level: 105.90, 105.25

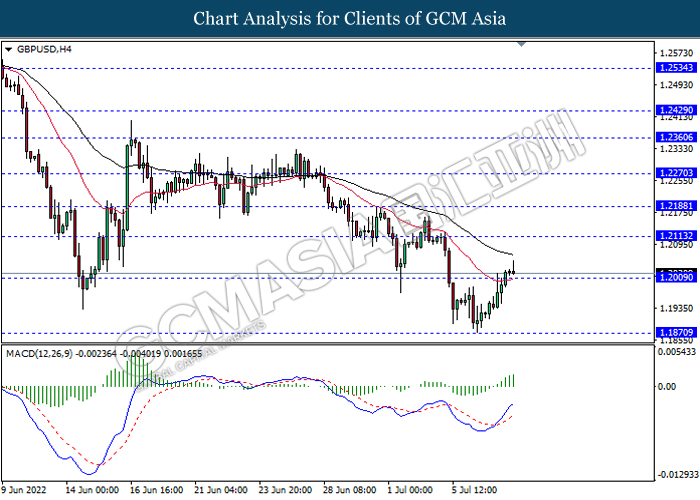

GBPUSD, H4: GBPUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 1.2115, 1.2190

Support level: 1.2010, 1.1870

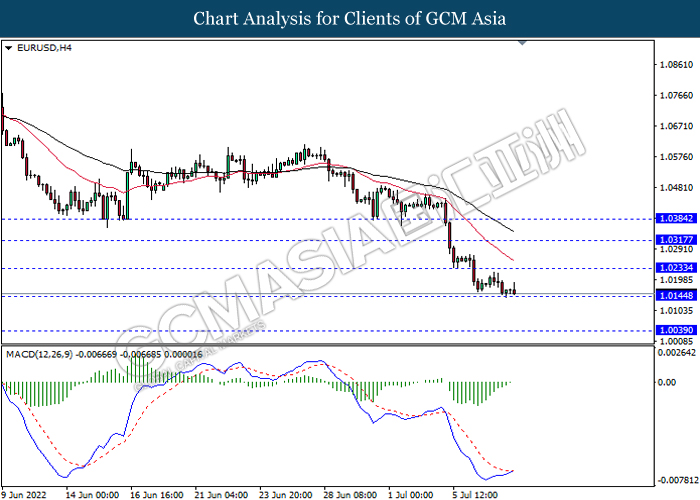

EURUSD, H4: EURUSD was traded lower while currently testing the support level. However, MACD which illustrated decreasing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0235, 1.0315

Support level: 1.0145, 1.0040

USDJPY, H4: USDJPY was traded lower while currently testing the support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 136.65, 137.35

Support level: 135.55, 134.25

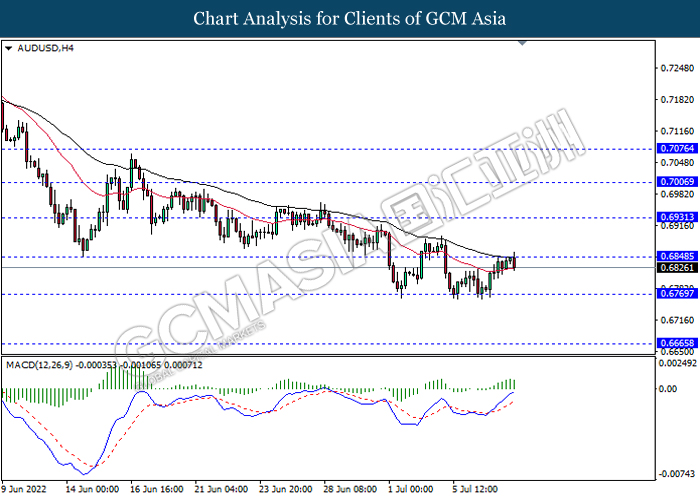

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6850, 0.6930

Support level: 0.6770, 0.6665

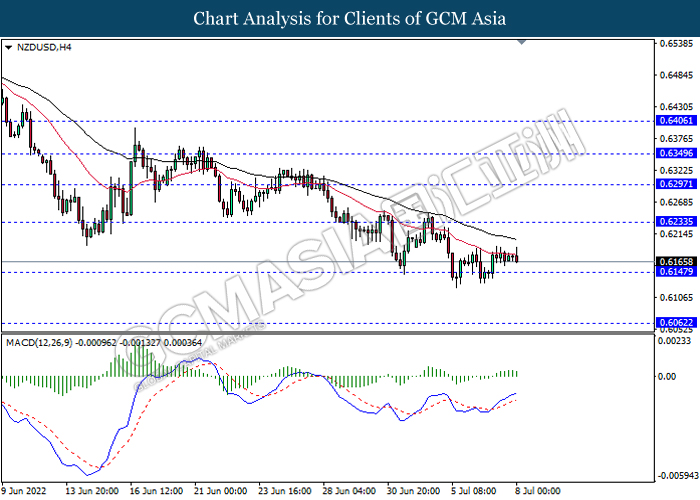

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

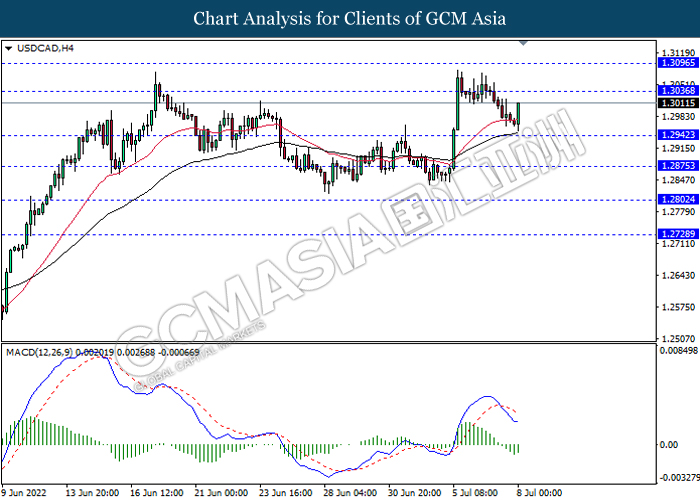

USDCAD, H4: USDCAD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.3035, 1.3095

Support level: 1.2940, 1.2875

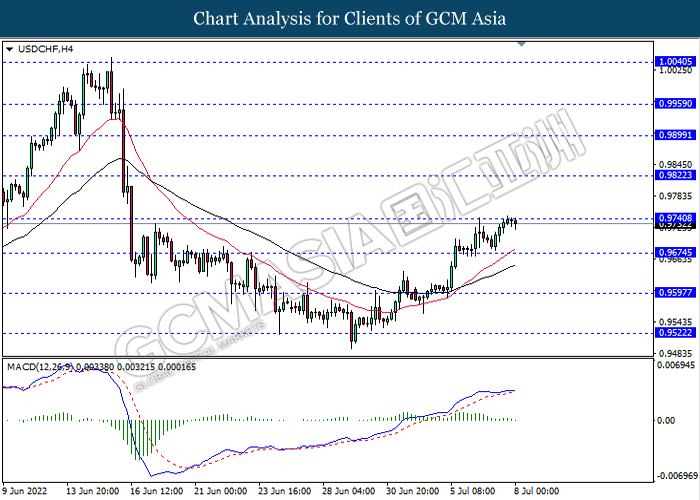

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be trade lower as technical correction.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the commodity to extend its gains.

Resistance level: 1753.25, 1771.10

Support level: 1737.30, 1718.90