14 July 2022 Afternoon Session Analysis

Canada Dollar surged amid rate hike policy.

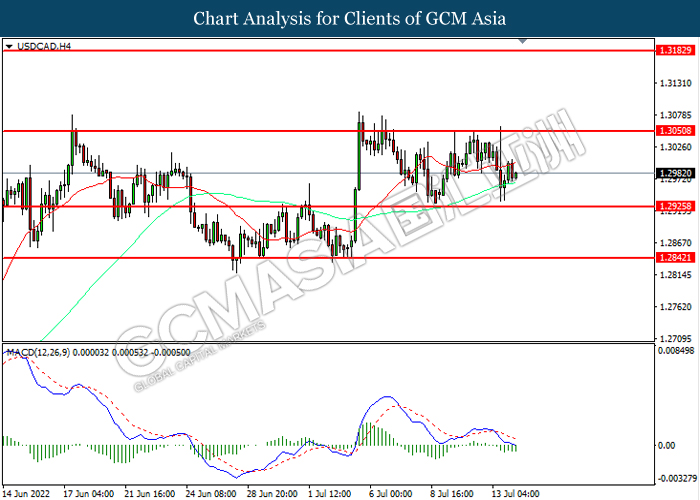

The Canada Dollar surged significantly following the Bank of Canada unleashed their aggressive contractionary monetary policy to stabilize the spiking inflation rate. Yesterday, the Bank of Canada on Wednesday increased their benchmark interest rate by 100 basis point to 2.5%, surprising the market expectation with its biggest rate hike since 1998. According to its monetary policy statement, the bank of Canada also raised it s near-term inflation forecast to an average 8% in the middle quarters of 2022. The rate hike decision from the central bank had spurred significant bullish momentum on the Canada Dollar. Though, the gains experienced by the Canada Dollar was limited following the central bank downgraded its economic projection, while predicting a sharp slowdown in Canada’s housing market, with that contraction expected to continue until 2023. As of writing, USD/CAD appreciated by 0.06% to 1.2980.

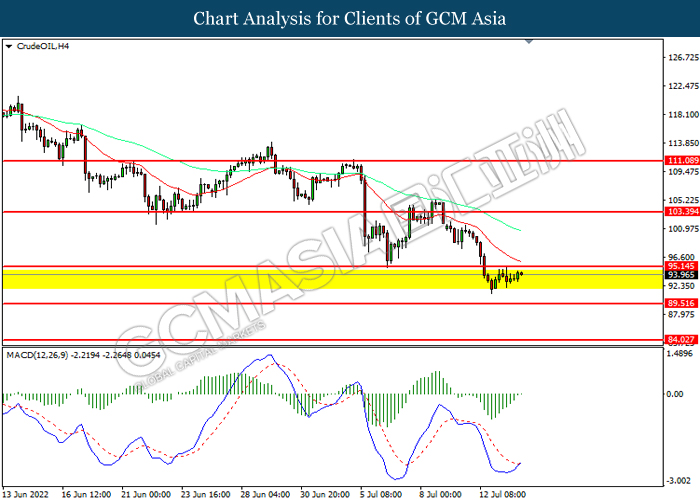

In the commodities market, the crude oil price surged 0.36% to $94.30 per barrel as of writing. The crude oil price rebounded amid technical correction. Though, the overall trend for the crude oil remained bearish amid fears upon recession risk continue to weigh down on this black-commodity. On the other hand, the gold price slumped 0.41% to $1728.55 per troy ounces as of writing amid strengthening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Initial Jobless Claims | 235K | 235K | – |

| 20:30 | USD – PPI (MoM) (Jun) | 0.80% | 0.80% | – |

Technical Analysis

DOLLAR_INDX, Daily: Dollar index was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.15, 112.45

Support level: 105.55, 101.30

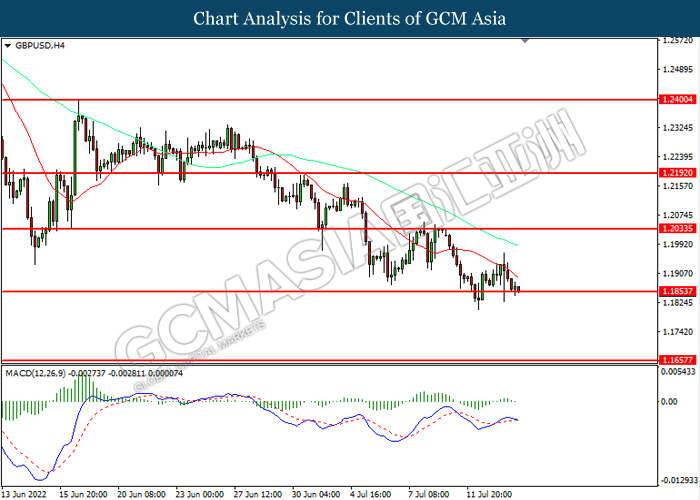

GBPUSD, H4: GBPUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2035, 1.2190

Support level: 1.1855, 1.1655

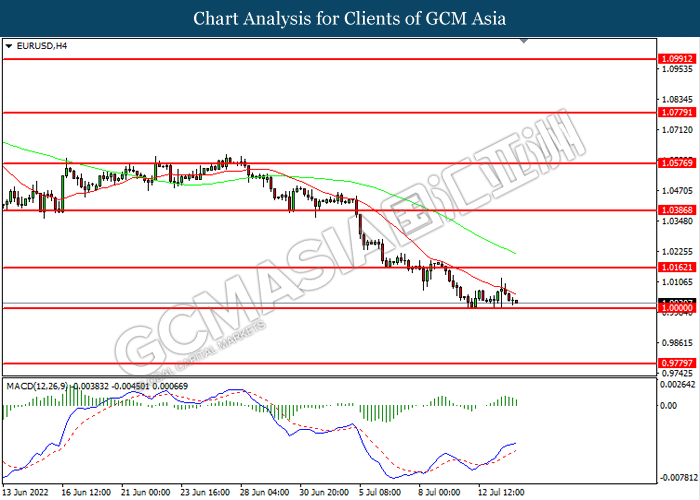

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout the support level.

Resistance level: 1.0160, 1.0385

Support level: 1.000, 0.9780

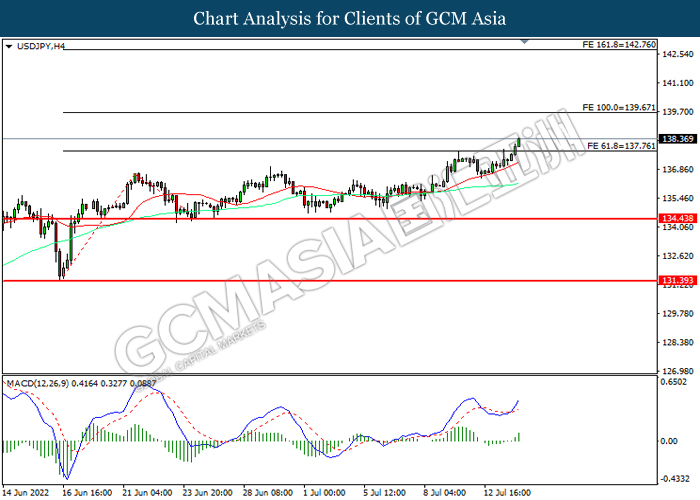

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 139.65, 142.75

Support level: 137.75, 134.45

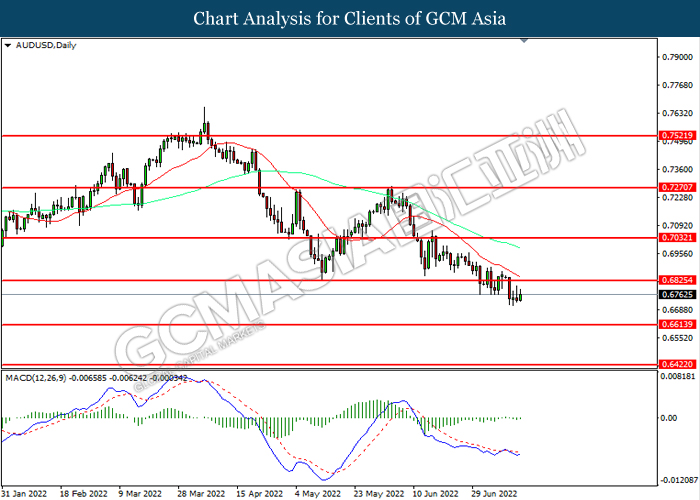

AUDUSD, Daily: AUDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6825, 0.7030

Support level: 0.6615, 0.6420

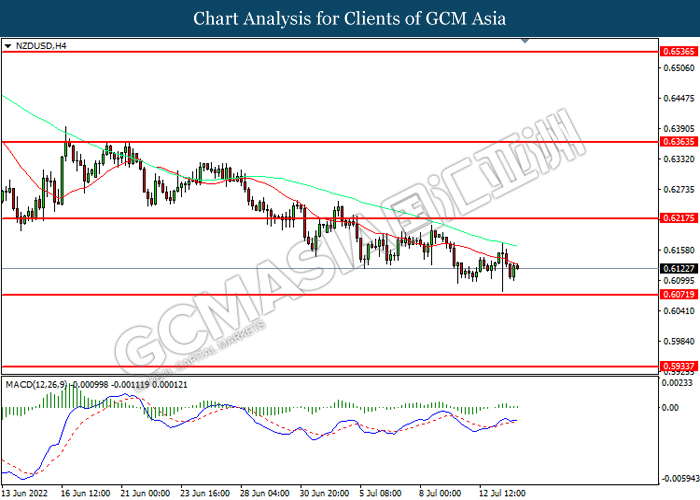

NZDUSD, H4: NZDUSD was traded within a range while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses after breakout.

Resistance level: 0.6215, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses toward support level.

Resistance level: 1.3050, 1.3185

Support level: 1.2925, 1.2840

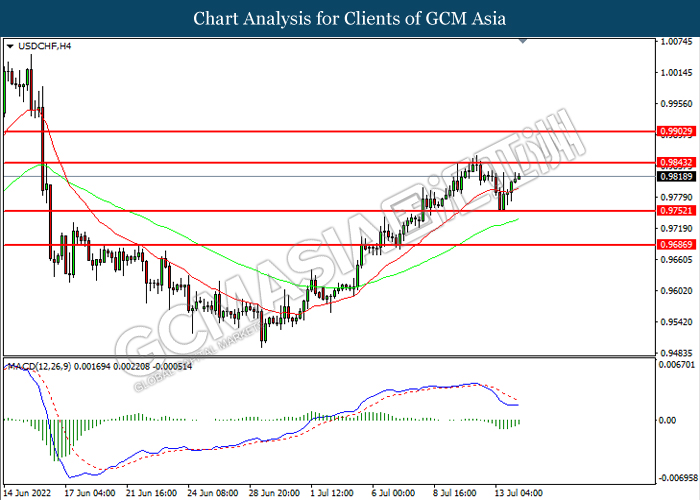

USDCHF, H4: USDCHF was traded higher while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after breakout.

Resistance level: 0.9845, 0.9905

Support level: 0.9750, 0.9685

CrudeOIL, H4: Crude oil price was traded within a range while currently testing the resistance level. MACD which illustrated diminishing bearish momentum suggest the commodity to extend its gains after it breakout the resistance level.

Resistance level: 95.15, 103.40

Support level: 89.50, 84.05

GOLD_, H4: Gold price was traded lower while currently testing the support level. MACD which illustrated diminishing bullish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1747.10, 1766.10

Support level: 1723.85, 1704.75