15 July 2022 Morning Session Analysis

US PPI data given a bullish reading, US Dollar surged.

The Dollar Index which traded against a basket of six major currencies rose significantly on yesterday after the PPI data has been unleashed. According to the US Department of Labor, the US Producer Price Index (PPI) MoM for June notched up from the previous reading of 0.9% to 1.1%, exceeding the market forecast of 0.8%. The PPI data used to measure the changes of price from the perspective of producer, and was also a major indicator to determine the inflation rate in the US. As the PPI data had given a higher-than-expected reading, it hinted that the spiking inflation risk keep hovering in the US market. Federal Reserve would likely to implement aggressive rate hike in the upcoming meeting to stabilize soaring prices. Nonetheless, the gains experienced by the Dollar Index was limited over the downbeat employment data. The US Initial Jobless Claims came in at the reading of 244K, higher than the economist expectation of 235K. The fragile labor market in the US would likely drag down the economic progression, which spurred bearish momentum on the US Dollar. As of writing, the Dollar Index appreciated by 0.67% to 108.47.

In the commodities market, crude oil price appreciated by 0.58% to $96.35 per barrel after a sharp decline throughout the overnight session ahead of potential large US rate hike. Besides, gold price edged up by 0.20% to $1709.25 per troy ounce as of writing. However, gold price stayed under pressure following the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:30 | USD – Core Retail Sales (MoM) (Jun) | 0.50% | 0.60% | – |

| 20:30 | USD – Retail Sales (MoM) (Jun) | -0.30% | 0.80% | – |

Technical Analysis

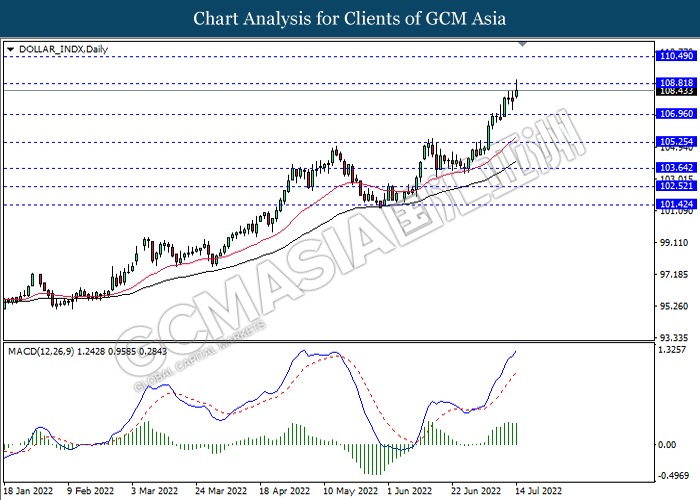

DOLLAR_INDX, Daily: Dollar index was traded higher following prior breakout the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the index to be traded lower as technical correction.

Resistance level: 108.80, 110.50

Support level: 106.95, 105.25

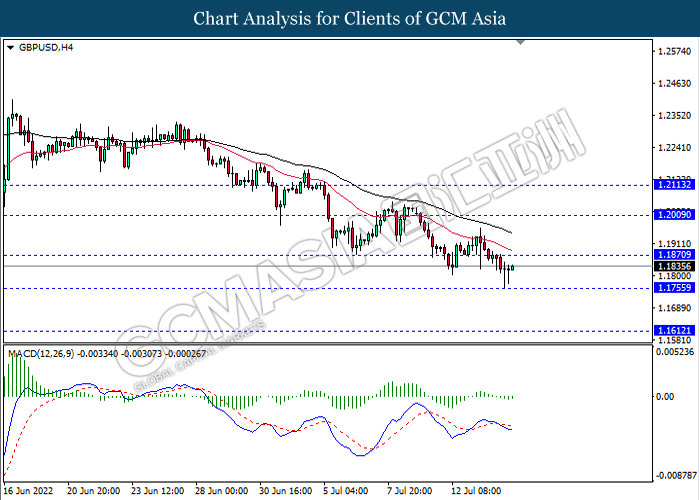

GBPUSD, H4: GBPUSD was traded higher following prior rebound from the support level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.1870, 1.2010

Support level: 1.1755, 1.1610

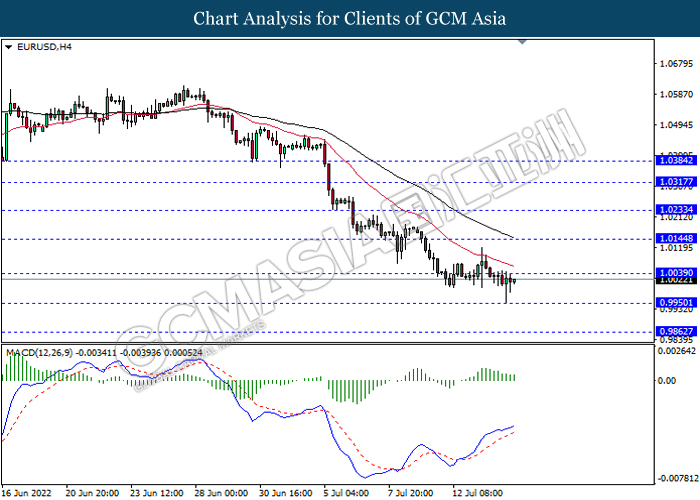

EURUSD, H4: EURUSD was traded lower following prior breakout below the previous support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.0040, 1.0145

Support level: 0.9950, 0.9860

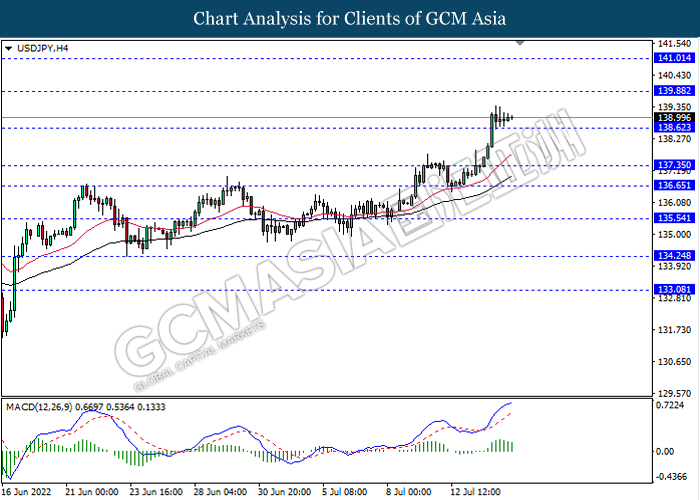

USDJPY, H4: USDJPY was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 139.90, 141.00

Support level: 138.60, 137.35

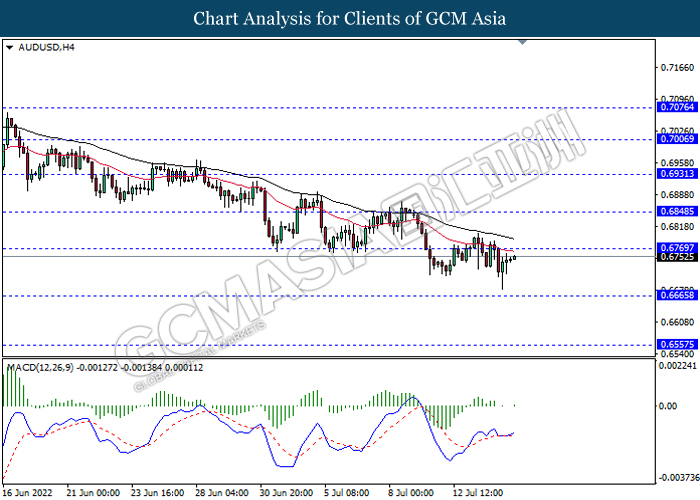

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 0.6770, 0.6850

Support level: 0.6665, 0.6555

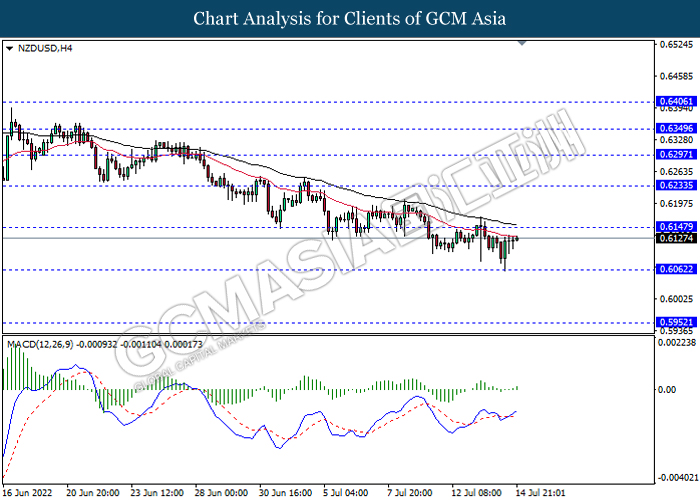

NZDUSD, H4: NZDUSD was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.6145, 0.6235

Support level: 0.6060, 0.5950

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.3165, 1.3240

Support level: 1.3095, 1.3035

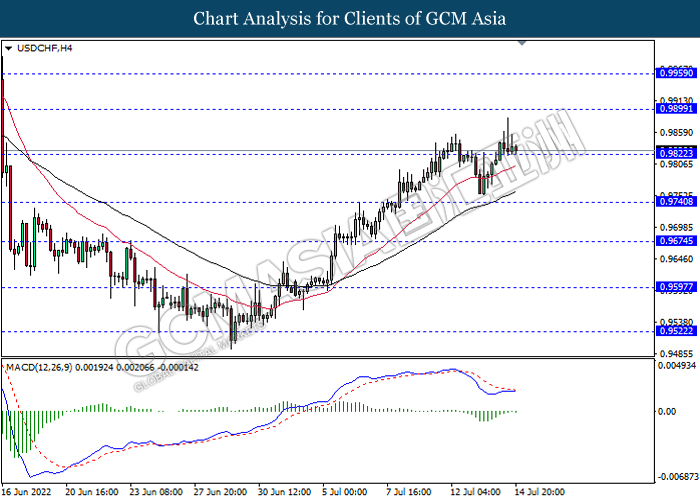

USDCHF, H4: USDCHF was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 0.9900, 0.9960

Support level: 0.9820, 0.9740

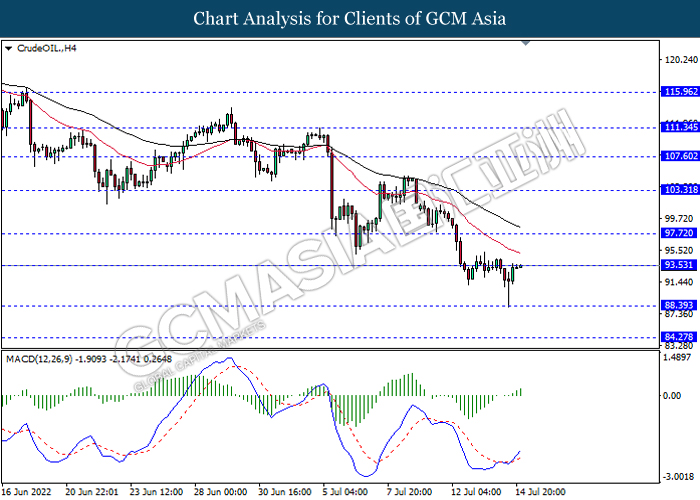

CrudeOIL, H4: Crude oil price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 93.55, 97.70

Support level: 88.40, 84.25

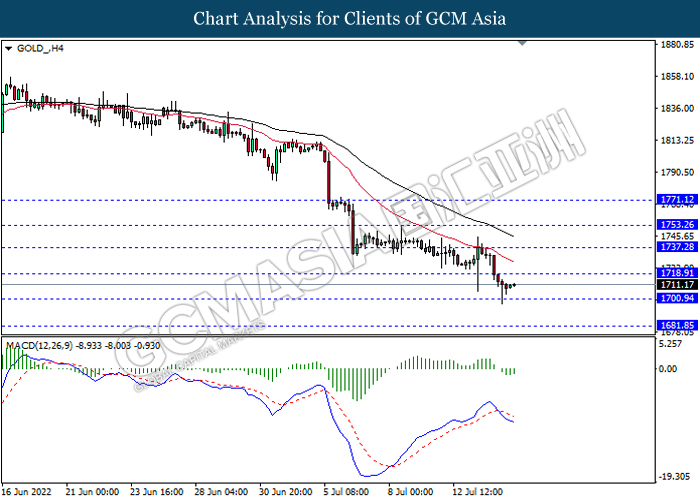

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. However, MACD which illustrated decreasing bearish momentum suggest the commodity to be trade higher as technical correction.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85