20 July 2022 Morning Session Analysis

ECB signalled bigger rate hike expectation, Euro rebounded.

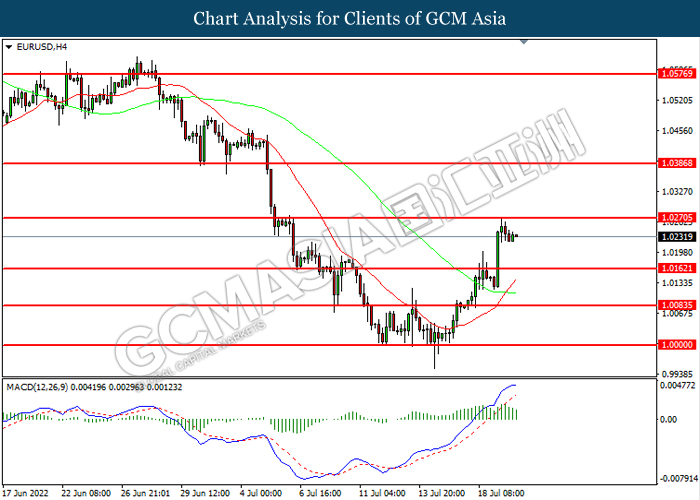

The Euro received significant bullish momentum yesterday following the European Central Bank signaled a bigger rate hike to stabilize the inflation risk for the European economy. According to Reuters, the European Central Bank policymakers are currently considering to increase their interest rate by bigger-than-expected 50 basis point during their monetary policy meting on Thursday. Besides, the policymakers also claimed that they would announce a deal to assist indebted countries like Italy on the bond market in order to cushion the impact of the higher borrowing cost. Nonetheless, the risk of a recession in the Euro zone continue to linger in the global financial market as the rising tensions between Russia-Ukraine issues would prompt the Russia to reduce natural gas supplies to Europe countries. Recently, the Euro zone inflation hit 8.6% last month and economist expected the inflation rate could keep rising until the autumn. The energy crisis in European region would add further tensions toward the living costs for the countries. As of writing, EUR/USD appreciated by 0.11% to 1.0235.

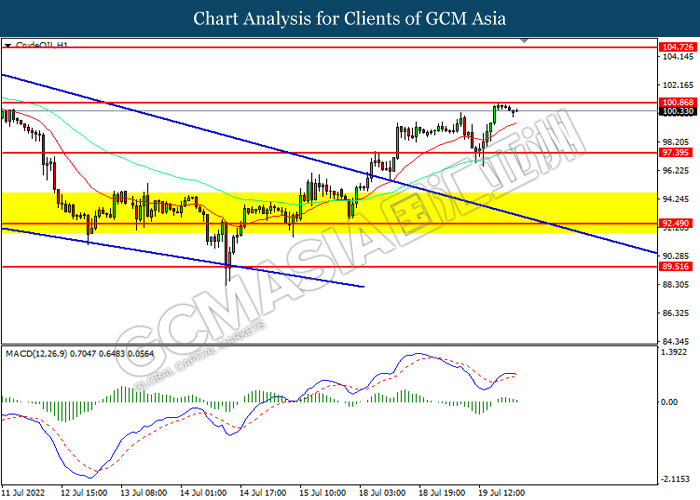

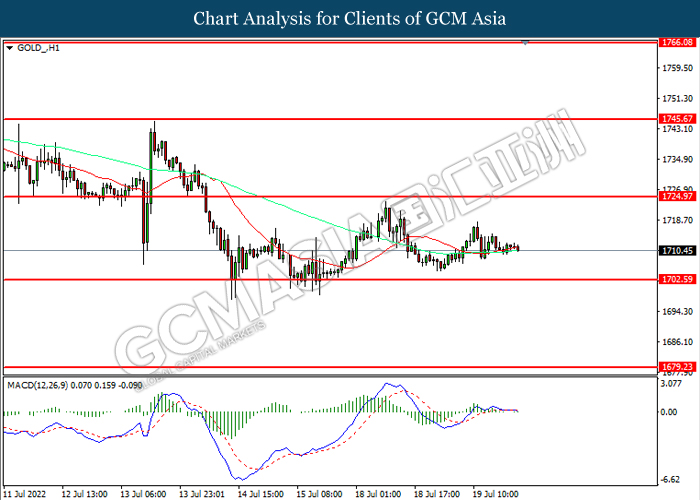

In the commodities market, the crude oil price appreciated by 0.02% to $100.45 per barrel as of writing following the US Dollar retreats into two-week low, making oil less expensive for buyers using other currencies. On the other hand, the gold price was traded flat at $1712.05 per troy ounces as of writing as market participants waited for crucial monetary policy meeting from Federal Reserve before entering the gold market.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – CPI (YoY) (Jun) | 9.1% | 9.2% | – |

| 20:30 | CAD – Core CPI (MoM) (Jun) | 0.8% | – | – |

| 22:00 | USD – Existing Home Sales (Jun) | 5.41M | 5.38M | – |

| 22:30 | CrudeOIL – Crude Oil Inventories | 8.235M | -1.933M | – |

Technical Analysis

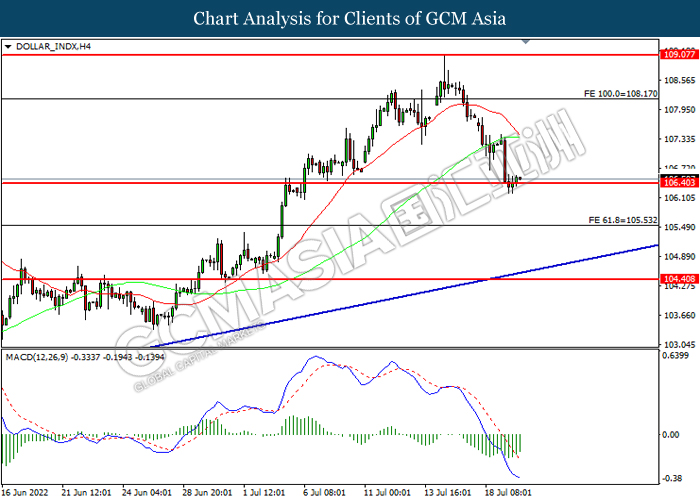

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the index to be traded higher as technical correction.

Resistance level: 108.15, 109.05

Support level: 106.40, 105.55

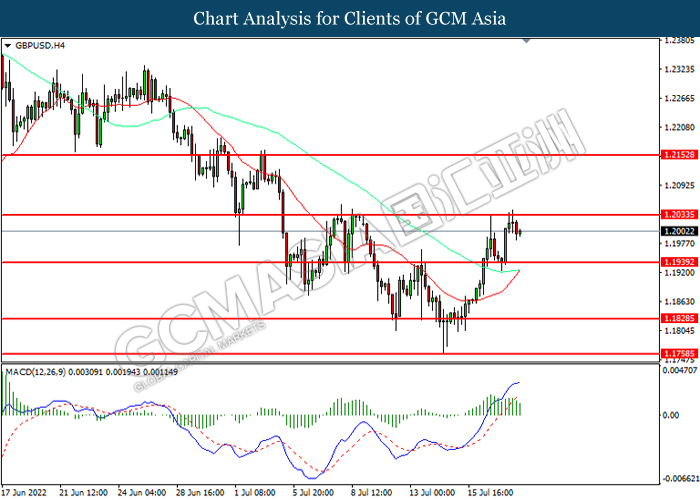

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.2035, 1.2155

Support level: 1.1940, 1.1830

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 1.0270, 1.0385

Support level: 1.0160, 1.0085

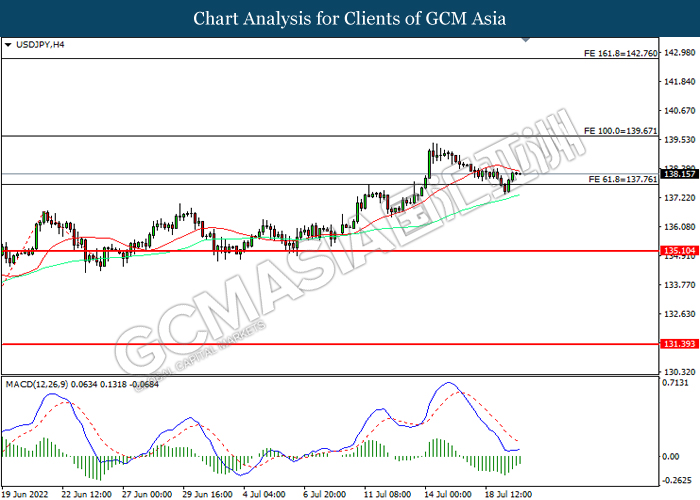

USDJPY, H4: USDJPY was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 139.65, 142.75

Support level: 137.75, 135.10

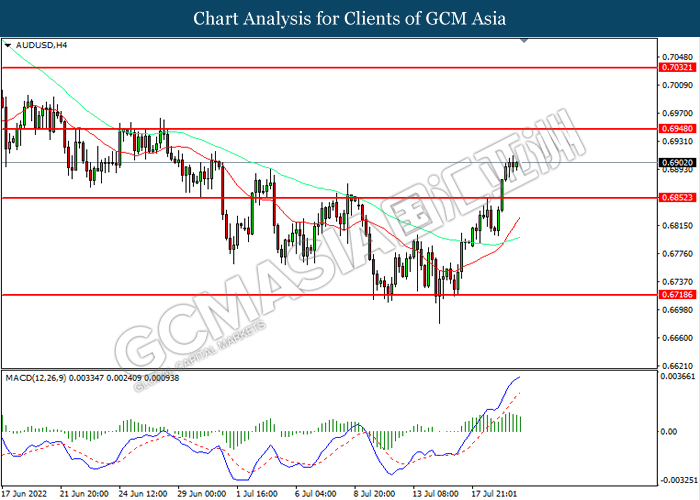

AUDUSD, H4: AUDUSD was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6950, 0.7030

Support level: 0.6850, 0.6720

NZDUSD, H4: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6365

Support level: 0.6070, 0.5935

USDCAD, H4: USDCAD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses after breakout.

Resistance level: 1.2950, 1.3050

Support level: 1.2835, 1.2670

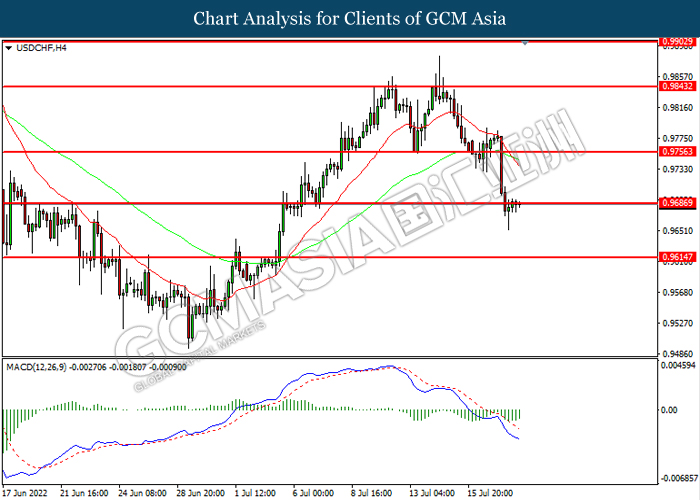

USDCHF, H4: USDCHF was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 0.9755, 0.9845

Support level: 0.9685, 0.9615

CrudeOIL, H1: Crude oil price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 100.85, 104.75

Support level: 97.40, 92.50

GOLD_, H1: Gold price was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses after breakout.

Resistance level: 1724.95, 1745.65

Support level: 1702.60, 1679.25