21 July 2022 Morning Session Analysis

Euro beaten down amid the raising risk of energy crisis.

The Euro which was traded by majority of investors eased on yesterday amid the rising odds of diminishing gas supply. According to Reuters, the Russia President Vladimir Putin had warned that Russian’s gas supplies sent via the Nord Stream 1 pipeline to Europe could be reduced further and might even stop. Thus, the European Commission proposed to reduce gas usage by 15% until next spring as an emergency step. The disruptions have hampered Europe’s efforts to refill gas storage before winter, raising the risk of rationing and another hit to fragile economic growth if Moscow further restricts flows in retaliation for Western sanctions over the war in Ukraine. The move from Russia had dialed down the market optimism toward economic progression in Europe. Besides, investors would continue to scrutinize the latest updates with regards of interest rate decision from ECB which will be released tonight in order to receive further trading signals. As of writing, EUR/USD edged down by 0.01% to 1.0177.

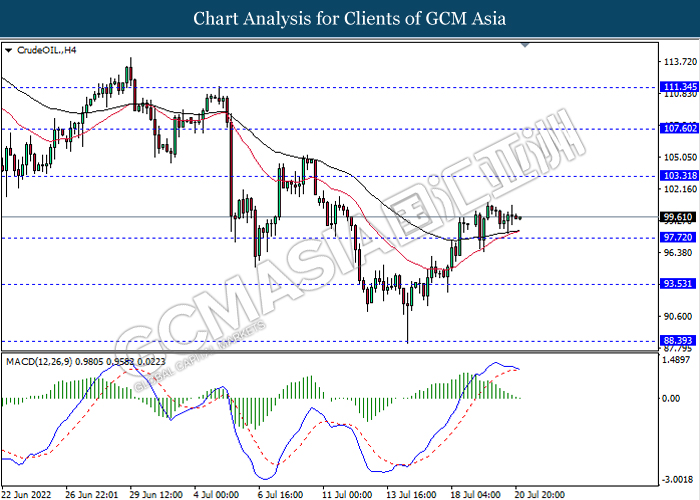

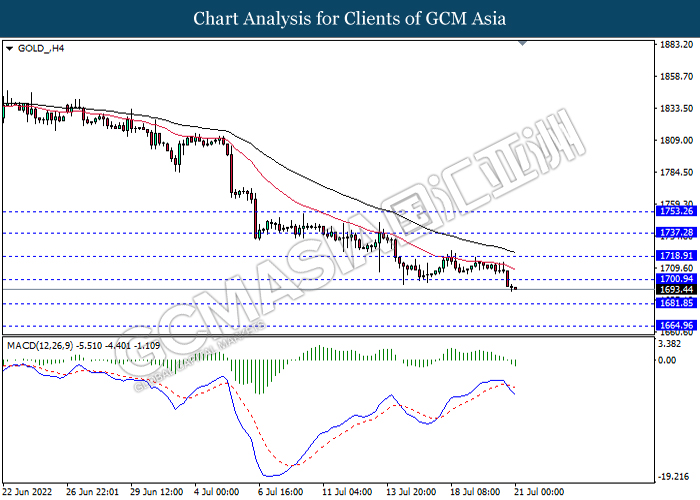

In the commodities market, crude oil price depreciated by 0.24% to $99.64 per barrel as of writing after the US government data showed lower gasoline demand during the peak summer driving season. On the other hand, gold price depreciated by 0.44% to $1692.65 per troy ounce as of writing over the strengthening of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

11:00 JPY BoJ Outlook Report (YoY)

TBC JPY BoJ Press Conference

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 11:00 | JPY – BoJ Interest Rate Decision | -0.10% | -0.10% | – |

| 20:15 | EUR – Deposit Facility Rate (Jul) | -0.50% | -0.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | – | 0.25% | – |

| 20:30 | USD – Initial Jobless Claims | 244K | 240K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -3.3 | -2.5 | – |

Technical Analysis

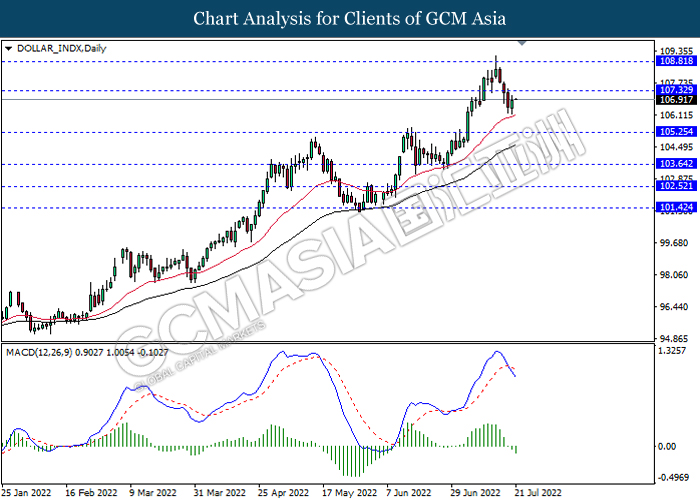

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.80

Support level: 105.25, 103.65

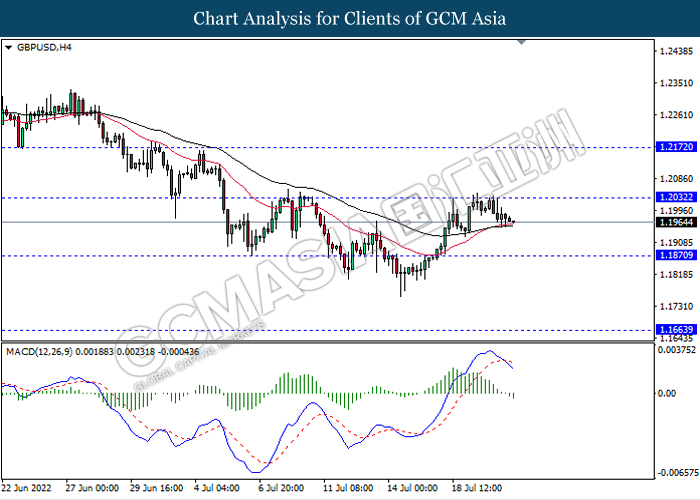

GBPUSD, H4: GBPUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 1.2030, 1.2170

Support level: 1.1870, 1.1665

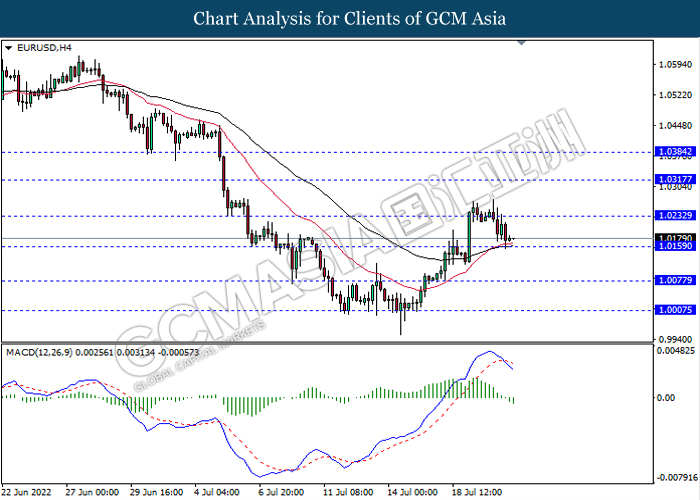

EURUSD, H4: EURUSD was traded lower while currently testing the support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses if successfully breakout the support level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

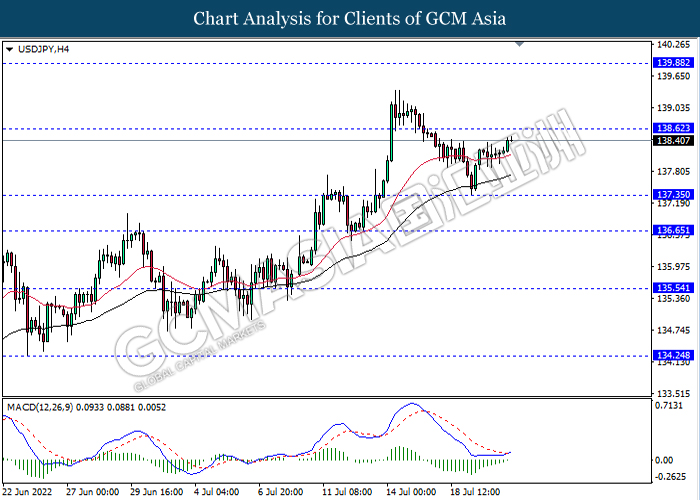

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 138.60, 139.90

Support level: 137.35, 136.65

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

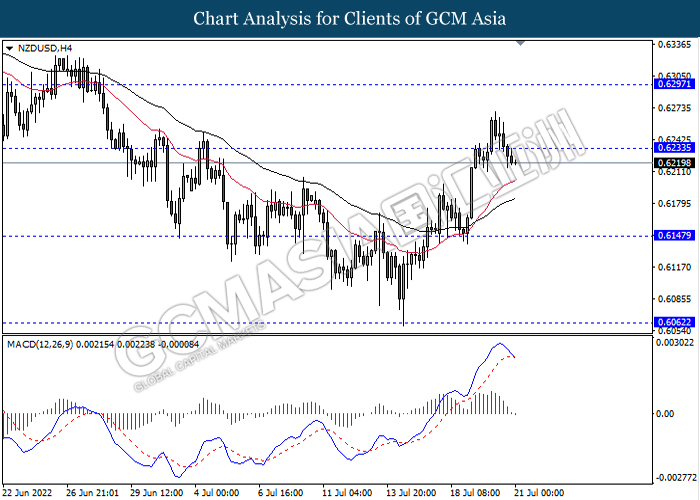

NZDUSD, H4: NZDUSD was traded lower following prior breakout below the previous support level. MACD which illustrated decreasing bullish momentum suggest the pair to extend its losses.

Resistance level: 0.6235, 0.6295

Support level: 0.6145, 0.6060

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 1.2940, 1.3035

Support level: 1.2875, 1.2800

USDCHF, H4: USDCHF was traded higher following prior rebound from the support level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains.

Resistance level: 0.9740, 0.9820

Support level: 0.9675, 0.9595

CrudeOIL, H4: Crude oil price was traded higher following prior breakout above the previous resistance level. However, MACD which illustrated decreasing bullish momentum suggest the commodity to be traded lower as technical correction.

Resistance level: 103.30, 107.60

Support level: 97.70, 93.55

GOLD_, H4: Gold price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 1700.95, 1718.90

Support level: 1681.85, 1664.95