22 July 2022 Morning Session Analysis

Euro surged upon aggressive rate hikes from ECB.

The EUR/USD, which traded by majority of investors rose significantly on yesterday after European Central Bank (ECB) announced its interest rate decision. According to the meeting last night, ECB decided to raise its interest rate for the first time in 11 years by 50 basis point, which exceeding the market forecast of 0.25% rate hikes. The current rate hikes has ended negative rates era in Eurozone. Besides, the ECB claimed that it was a proper way to take more forcefully rate hikes in order to tame the soaring inflation, which sparkling the appeal of Euro. The ECB also reiterated that this move in interest rates will support the return of inflation to the Governing Council’s medium-term target by strengthening the anchoring of inflation expectations and ensuring that demand conditions adjust to meet the medium-term inflation target. The central bank’s inflation target is 2%. As of writing, EUR/USD edged down by 0.01% to 1.0227.

In the commodities market, crude oil price depreciated by 0.02% to $96.33 per barrel as of writing following the returning oil supply from Libya and the resumption of Russia’s gas flow to Europe eased supply concerns. On the other hand, gold price appreciated by 0.23% to $1717.30 per troy ounce as of writing amid the slump of US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 14:00 | GBP – Retail Sales (MoM) (Jun) | -0.5% | -0.4% | – |

| 15:30 | EUR – German Manufacturing PMI (Jul | 52.0 | 51.0 | – |

| 16:30 | GBP – Composite PMI | 53.7 | – | – |

| 16:30 | GBP – Manufacturing PMI | 52.8 | – | – |

| 16:30 | GBP – Services PMI | 54.3 | – | – |

| 20:30 | CAD – Core Retail Sales (MoM) (May) | 1.3% | 0.6% | – |

Technical Analysis

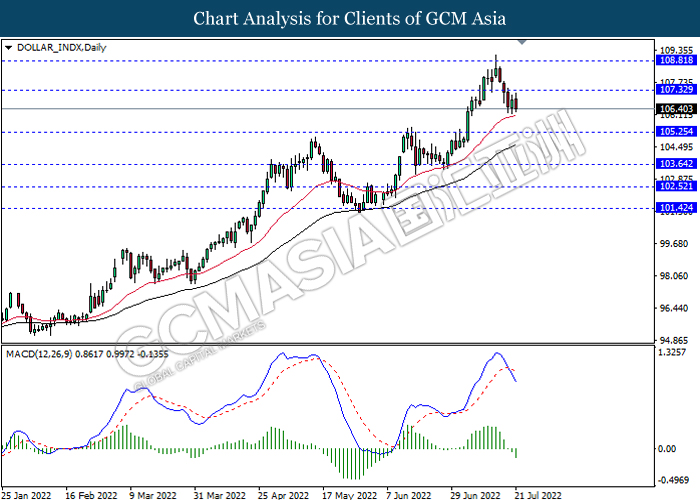

DOLLAR_INDX, Daily: Dollar index was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the index to extend its losses.

Resistance level: 107.30, 108.80

Support level: 105.25, 103.65

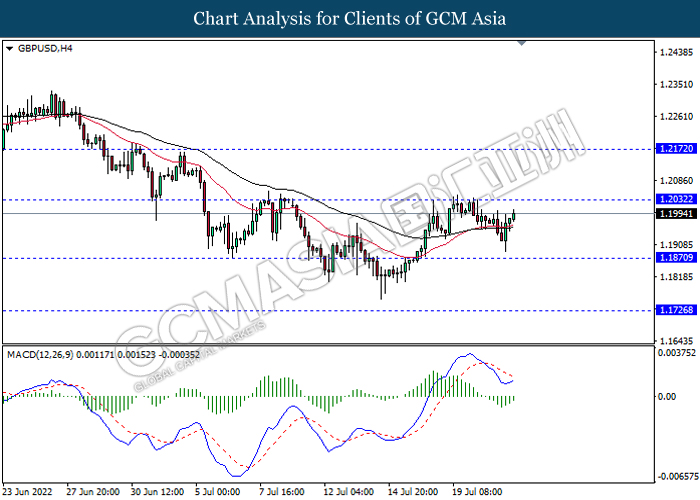

GBPUSD, H4: GBPUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.2030, 1.2170

Support level: 1.1870, 1.1725

EURUSD, H4: EURUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains if successfully breakout the resistance level.

Resistance level: 1.0230, 1.0315

Support level: 1.0160, 1.0075

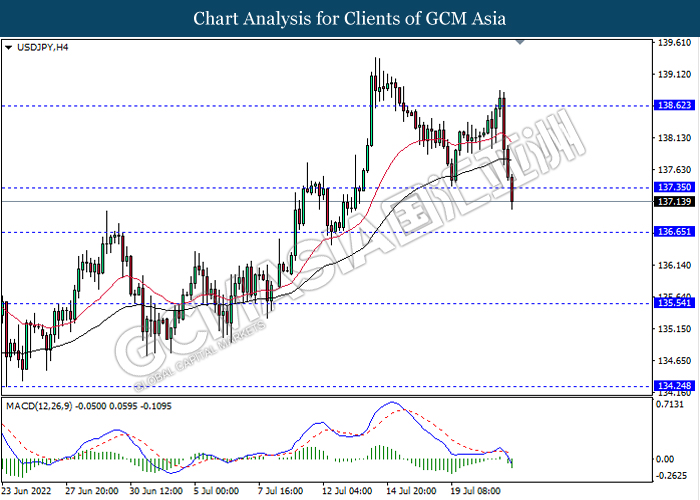

USDJPY, H4: USDJPY was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 137.35, 138.60

Support level: 136.65, 135.55

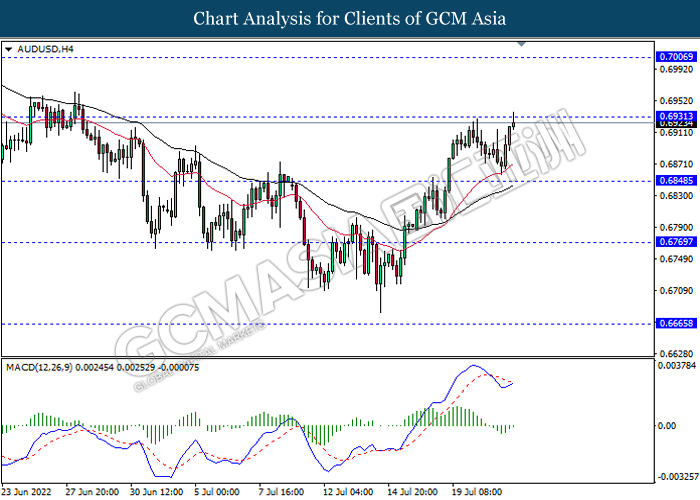

AUDUSD, H4: AUDUSD was traded higher while currently testing the resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6930, 0.7005

Support level: 0.6850, 0.6770

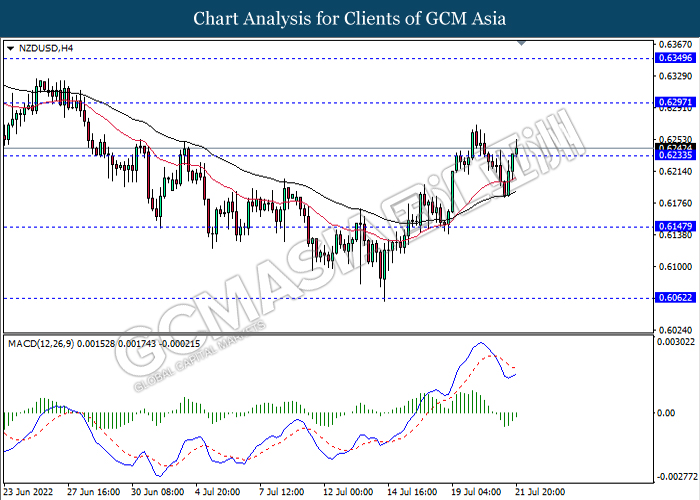

NZDUSD, H4: NZDUSD was traded higher following prior breakout above the previous resistance level. MACD which illustrated decreasing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.6295, 0.6350

Support level: 0.6235, 0.6145

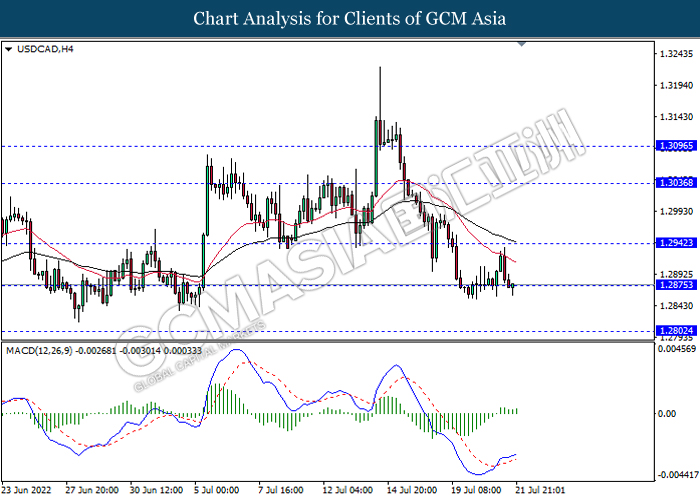

USDCAD, H4: USDCAD was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 1.2940, 1.3035

Support level: 1.2875, 1.2800

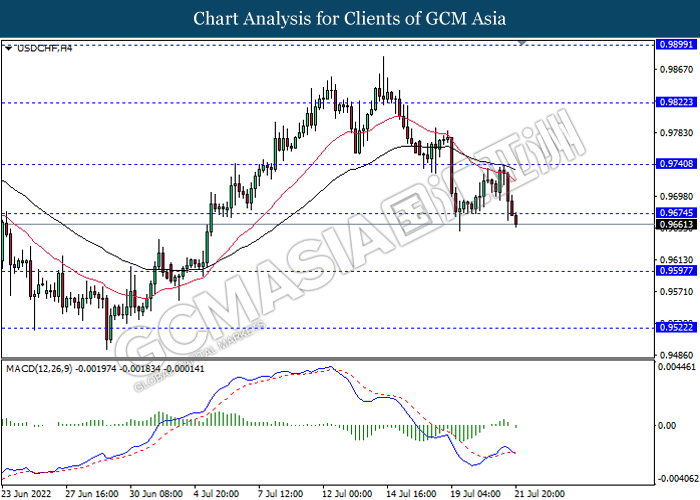

USDCHF, H4: USDCHF was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.9675, 0.9740

Support level: 0.9595, 0.9520

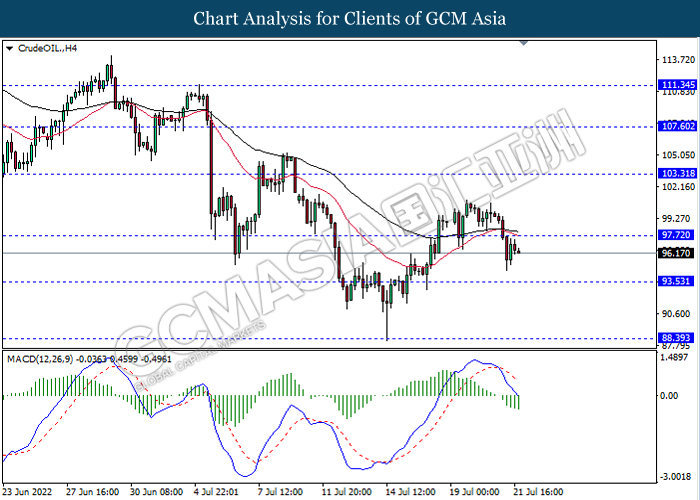

CrudeOIL, H4: Crude oil price was traded lower following prior breakout below the previous support level. MACD which illustrated increasing bearish momentum suggest the commodity to extend its losses.

Resistance level: 97.70, 103.30

Support level: 93.55, 88.40

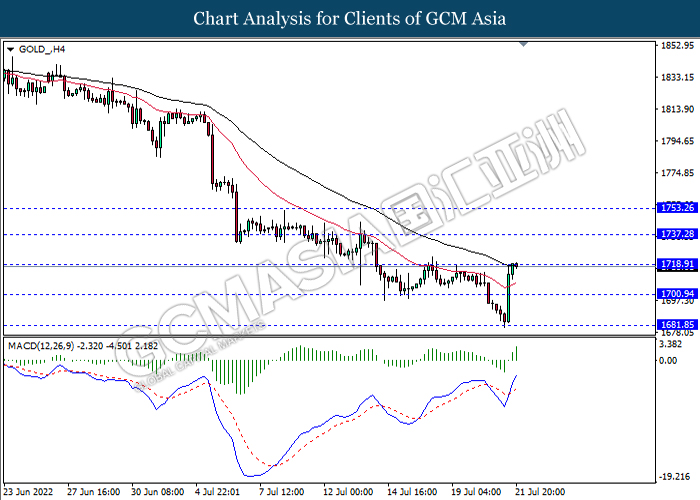

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the commodity to extend its gains if successfully breakout the resistance level.

Resistance level: 1718.90, 1737.30

Support level: 1700.95, 1681.85