25 July 2022 Morning Session Analysis

US Dollar slumped amid concerns upon the recession risk.

The Dollar Index which traded against a basket of six major currencies extend its losses on last Friday over the backdrop of bearish economic data as well as the pessimistic statement from Janet Yellen. On the economic data front, US Services Purchasing Managers Index (PMI) notched down significantly from the previous reading of 52.7 to 47.0, missing the market forecast at 52.6. Such downbeat reading had indicated that currently the US business activity had contracted for the first time in nearly two years as the high inflation risk, rising interest rates as well as deteriorating consumer confidence continue to jeopardize the economic growth in the United States. Besides that, US Treasury Secretary Janet Yellen warned that the US economic growth is slowing down while she acknowledged the risk of a recession continue to linger in the global financial market. In addition, the data last week suggested the labor market was softening with new claims for the unemployment benefits hitting the highest reading in eight months. Besides, she also reiterated that the inflation rate is way too high and she hoped the Federal Reserve could stabilize the further inflation risk in future without triggering a broad economic downturn. As of writing, the Dollar Index depreciated by 0.13% to 106.60.

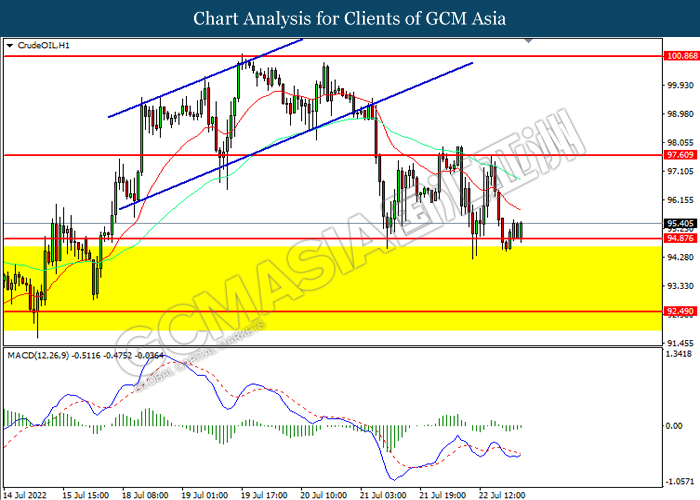

In the commodities market, the crude oil price slumped 0.03% to $95.35 per barrel as of writing amid the global recession risk continue to weigh down the market demand on this black-commodity. On the other hand, the gold price appreciated by 0.02% to $1725.30 per troy ounces as of writing amid weakening US Dollar.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

20:15 EUR ECB Monetary Policy Statement

20:45 EUR ECB Press Conference

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 20:15 | EUR – Deposit Facility Rate (Jul) | -0.50% | -0.25% | – |

| 20:15 | EUR – ECB Marginal Lending Facility | 0.25% | – | – |

| 20:15 | EUR – ECB Interest Rate Decision (Jul) | – | 0.25% | – |

| 20:30 | USD – Initial Jobless Claims | 244K | 240K | – |

| 20:30 | USD – Philadelphia Fed Manufacturing Index (Jul) | -3.3 | -2.5 | – |

Technical Analysis

DOLLAR_INDX, H4: Dollar index was traded lower while currently testing the support level. However, MACD which illustrated increasing bullish momentum suggest the pair to be traded higher as technical correction.

Resistance level: 108.15, 109.05

Support level: 106.40, 105.55

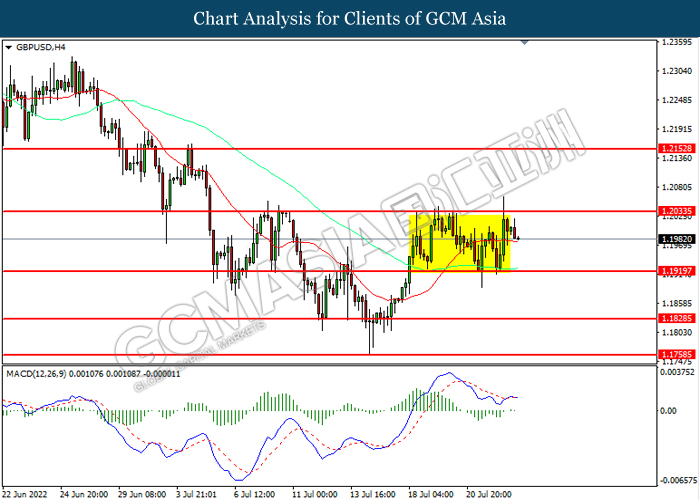

GBPUSD, H4: GBPUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward resistance level.

Resistance level: 1.2035, 1.2155

Support level: 1.1920, 1.1830

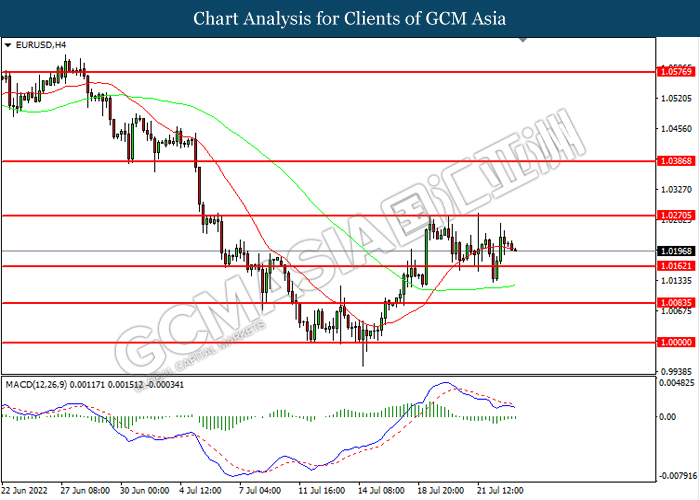

EURUSD, H4: EURUSD was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its toward resistance level.

Resistance level: 1.0270, 1.0385

Support level: 1.0160, 1.0085

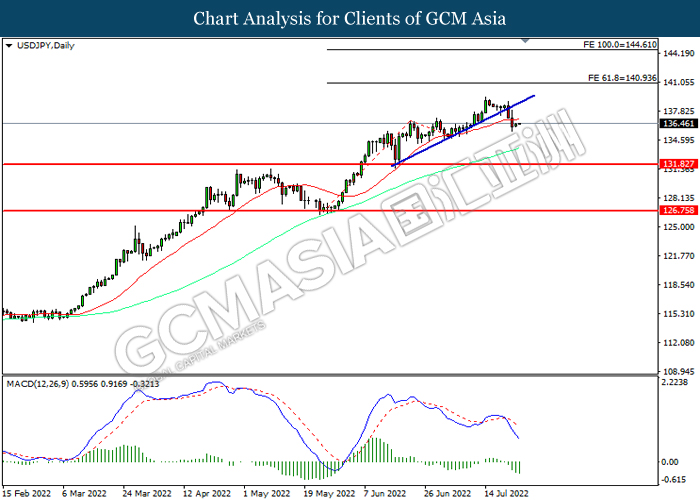

USDJPY, Daily: USDJPY was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 140.95, 144.60

Support level: 131.85, 126.75

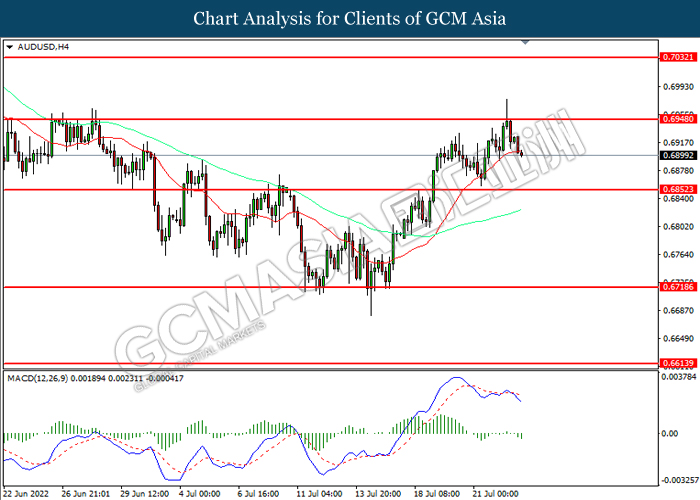

AUDUSD, H4: AUDUSD was traded lower following prior retracement from the resistance level. MACD which illustrated increasing bearish momentum suggest the pair to extend its losses.

Resistance level: 0.6950, 0.7030

Support level: 0.6850, 0.6720

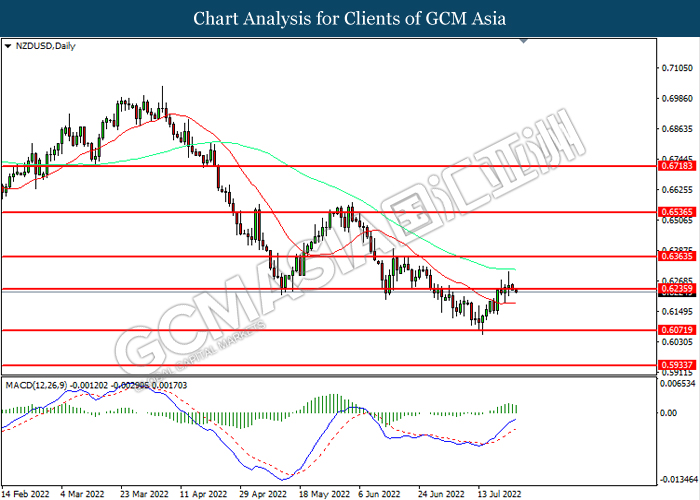

NZDUSD, Daily: NZDUSD was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the pair to be traded lower as technical correction.

Resistance level: 0.6235, 0.6365

Support level: 0.6070, 0.5935

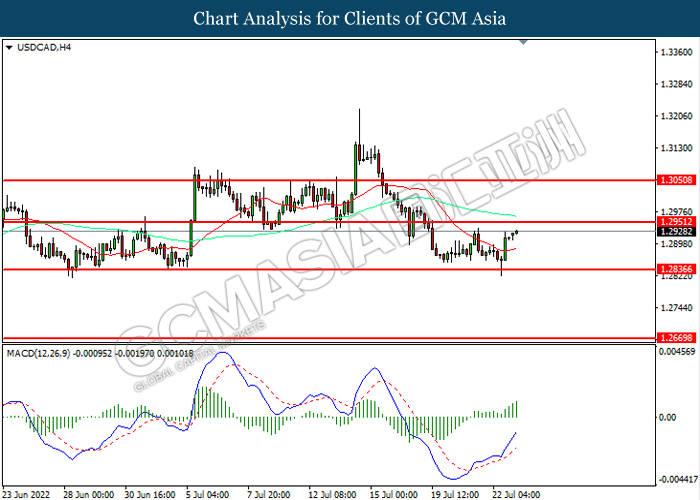

USDCAD, H4: USDCAD was traded higher while currently testing the resistance level. MACD which illustrated increasing bullish momentum suggest the pair to extend its gains after breakout.

Resistance level: 1.2950, 1.3050

Support level: 1.2835, 1.2670

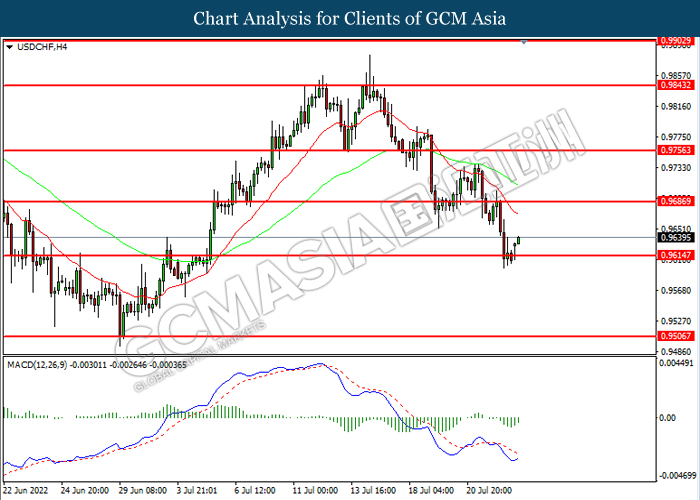

USDCHF, H4: USDCHF was traded higher following prior rebounded from the support level. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains.

Resistance level: 0.9685, 0.9755

Support level: 0.9615, 0.9505

CrudeOIL, H1: Crude oil price was traded lower while currently testing the support level. However, MACD which illustrated diminishing bearish momentum suggest the commodity to be traded higher as technical correction.

Resistance level: 97.60, 100.85

Support level: 94.85, 92.50

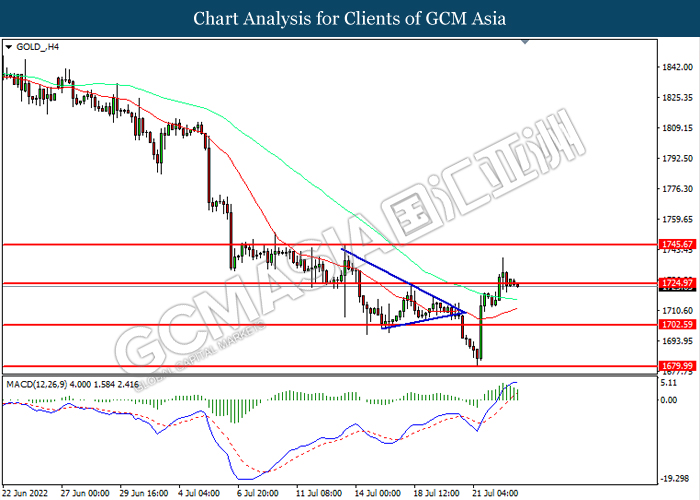

GOLD_, H4: Gold price was traded higher while currently testing the resistance level. However, MACD which illustrated diminishing bullish momentum suggest the commodity to be traded lower as technical correction

Resistance level: 1725.00, 1745.65

Support level: 1702.60, 1680.00