25 July 2022 Afternoon Session Analysis

A series of upbeat data ignited optimism in Pound market.

The British Pound, which was majorly traded by the global investors, jumped as a series of positive economic data showed that the economic condition in UK remains bright and resilient. According to the Office for National Statistics, UK Retail Sales data increased from the prior month reading of -0.8% to -0.1%, while stronger than the consensus forecast at -0.3%. It indicated that the deterioration of the consumer spending in UK has eased slightly. Besides, other data such as UK Composite PMI, Manufacturing PMI and Services PMI also came in at a reading which higher than the consensus forecast respectively, where it further cemented the view that UK economic condition has started to turn around from the worst. With such as backdrop, it has lit up the market expectation on aggressive rate hike by Bank of England in the upcoming meeting. As of writing, the pair of GBP/USD dropped -0.09% to 1.1991.

In the commodities market, the crude oil price up 1.75% to $93.75 a barrel after the European Union allow Russian state-owned companies to ship oil to third countries, which would help to ease the global oil supply tightness. Besides, the gold prices up 0.06% to $1726.80 a troy ounce amid weakening of dollar index.

Today’s Holiday Market Close

Time Market Event

N/A

Today’s Highlight Events

Time Market Event

N/A

Today’s Highlight Economic Data

| Time | Nation & Data | Previous | Forecast | Actual |

| 16:00 | EUR – German Ifo Business Climate Index (Jul) | 92.3 | 90.2 | – |

Technical Analysis

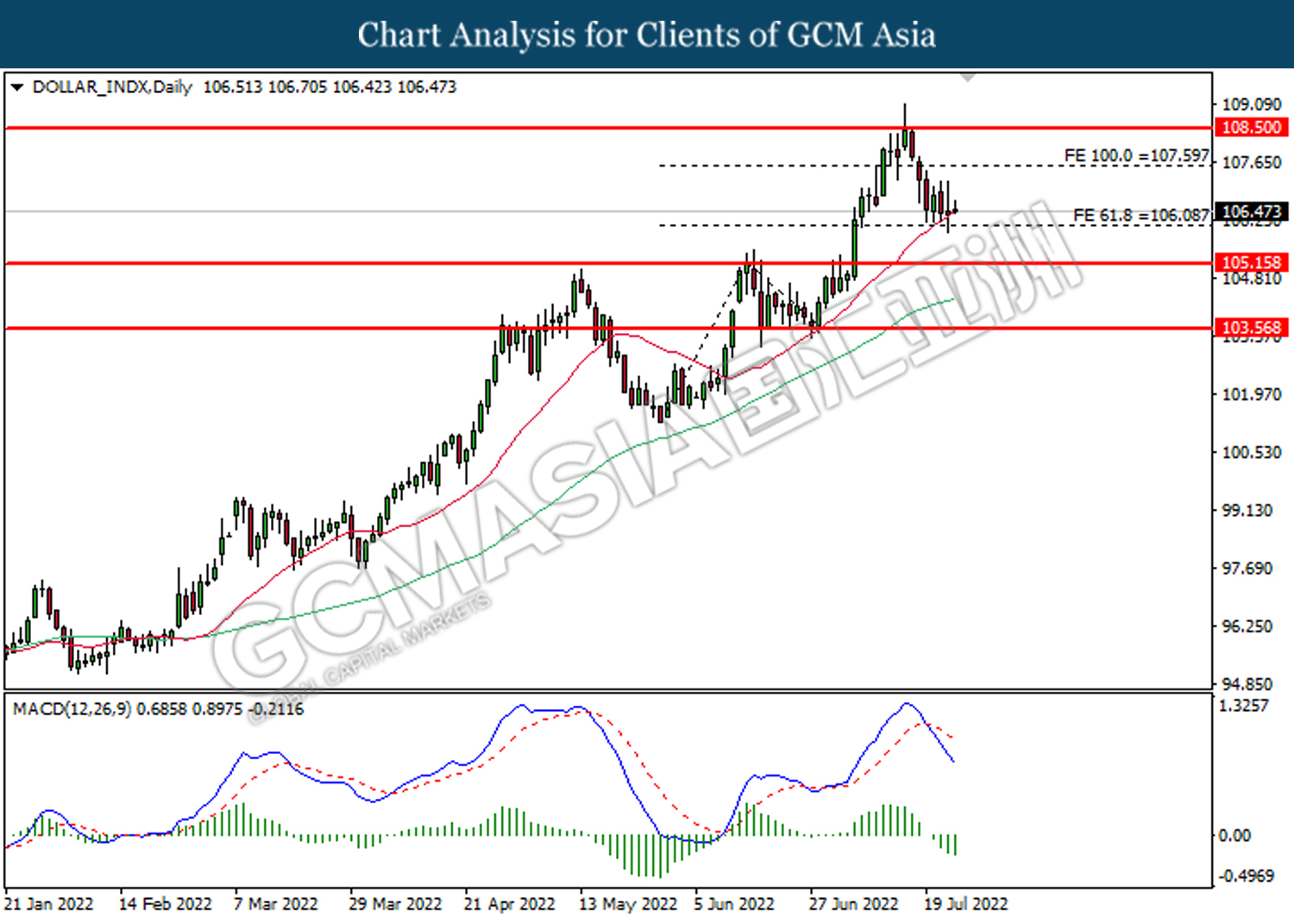

DOLLAR_INDX, Daily: Dollar index was traded lower while currently testing the support level at 106.10. MACD which illustrated increasing bearish momentum suggests the index to extend its losses after it successfully breakout below the support level.

Resistance level: 107.60, 108.50

Support level: 106.10, 105.15

GBPUSD, Daily: GBPUSD was traded lower following prior retracement from the resistance level at 1.2035. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 1.1900.

Resistance level: 1.2035, 1.2175

Support level: 1.1900, 1.1800

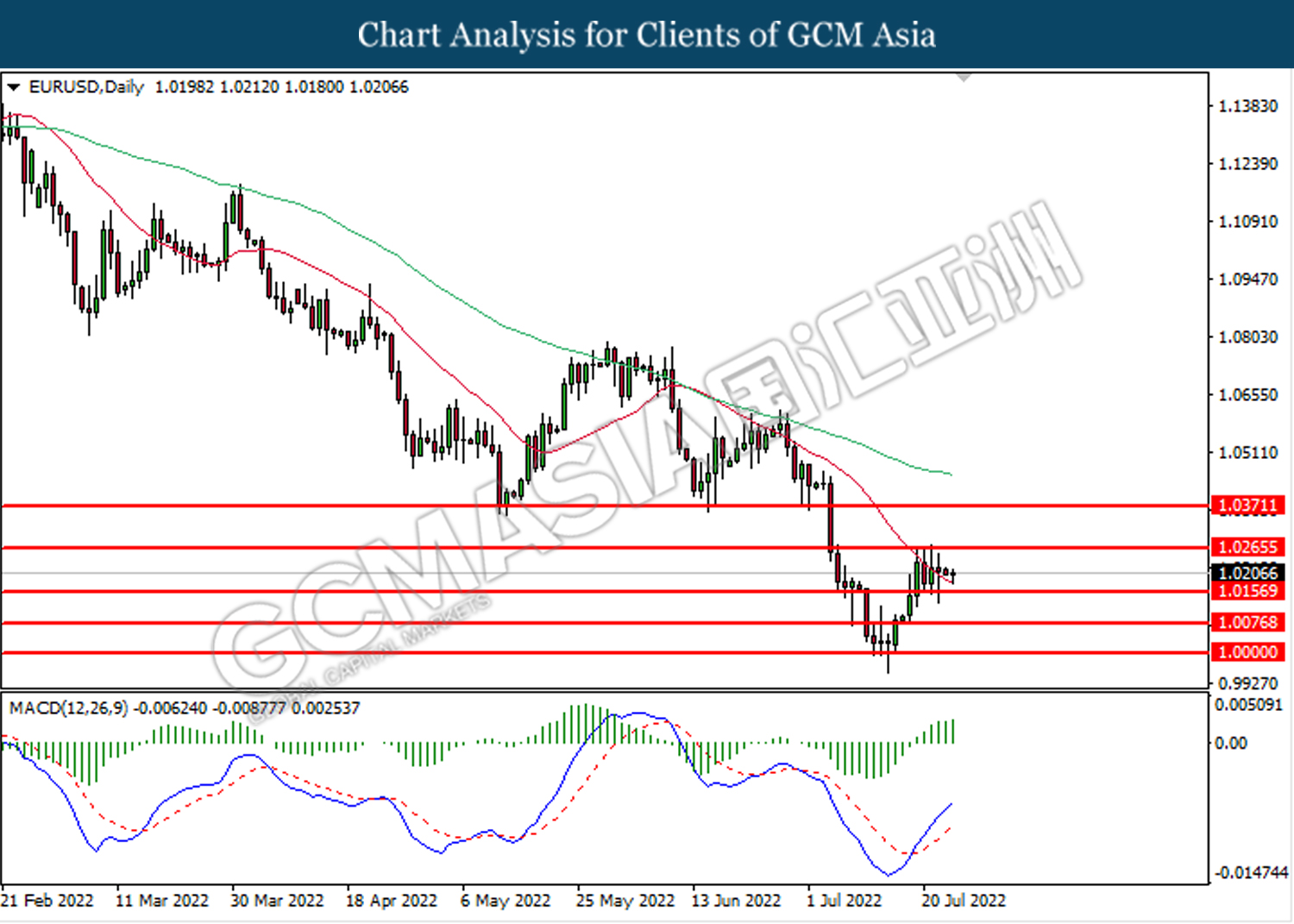

EURUSD, Daily: EURUSD was traded higher following prior rebound from the support level at 1.0155. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.0265.

Resistance level: 1.0265, 1.0370

Support level: 1.0155, 1.0075

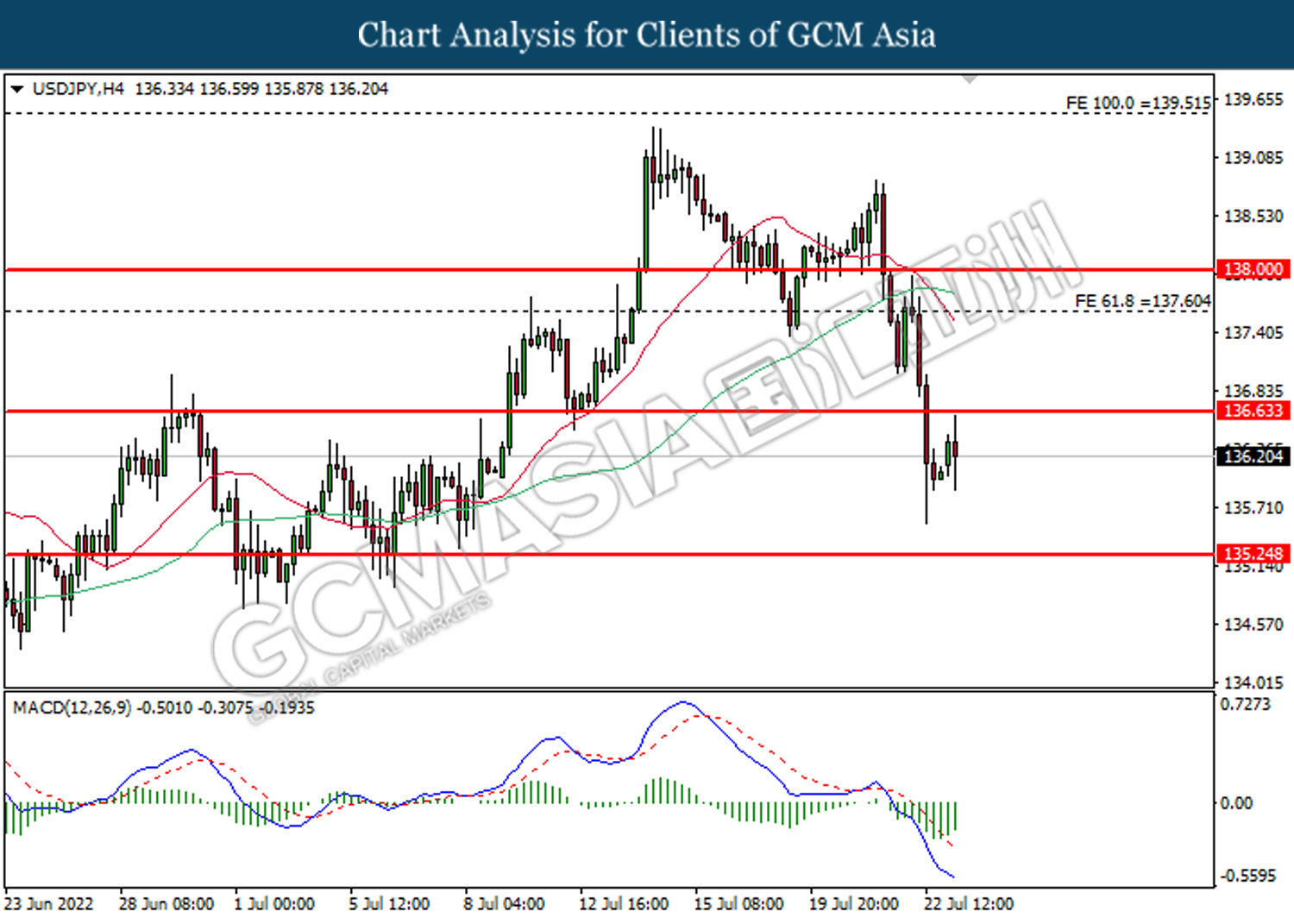

USDJPY, H4: USDJPY was traded higher while currently testing the resistance level at 136.65. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains after it successfully breakout above the resistance level.

Resistance level: 136.65, 137.60

Support level: 135.25, 133.15

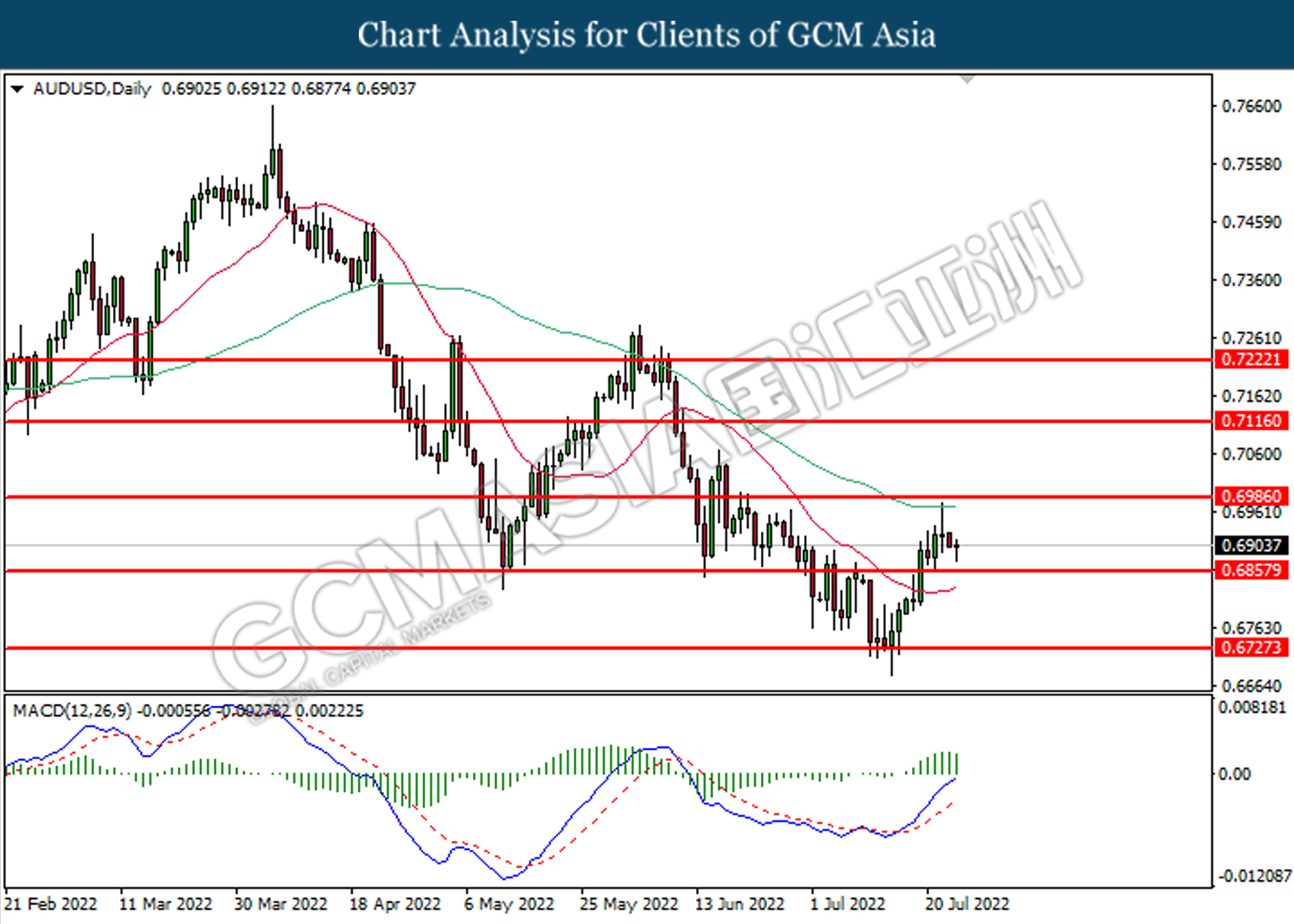

AUDUSD, Daily: AUDUSD was traded lower following prior retracement from the resistance level at 0.6985. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6855.

Resistance level: 0.6985, 0.7115

Support level: 0.6855, 0.6725

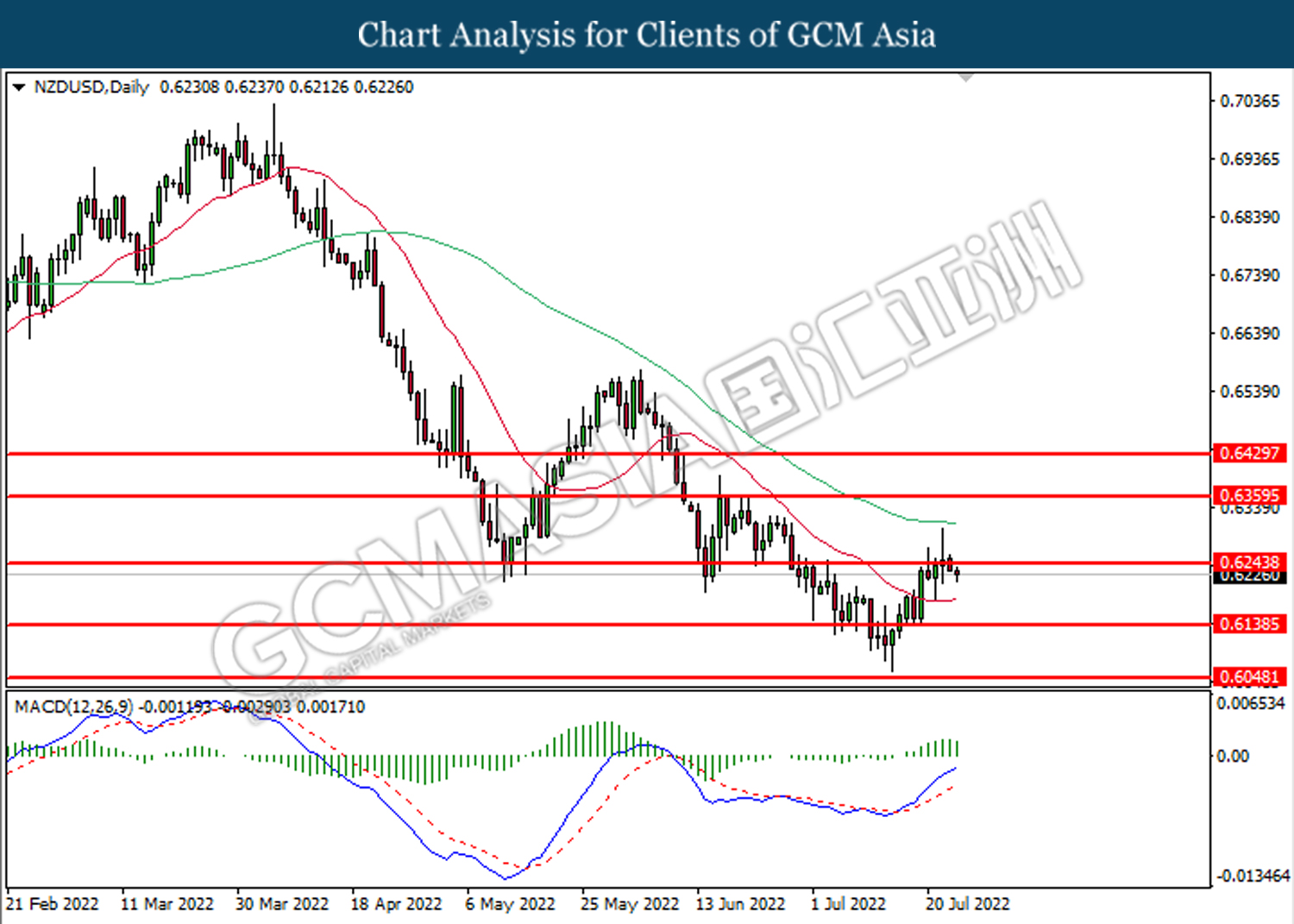

NZDUSD, Daily: NZDUSD was traded lower following prior retracement from the resistance level at 0.6245. MACD which illustrated diminishing bullish momentum suggest the pair to extend its losses toward the support level at 0.6140.

Resistance level: 0.6245, 0.6360

Support level: 0.6140, 0.6050

USDCAD, H4: USDCAD was traded higher following prior breakout above the previous resistance level at 1.2910. MACD which illustrated bullish bias momentum suggest the pair to extend its gains toward the resistance level at 1.2975.

Resistance level: 1.2975, 1.3050

Support level: 1.2910, 1.2835

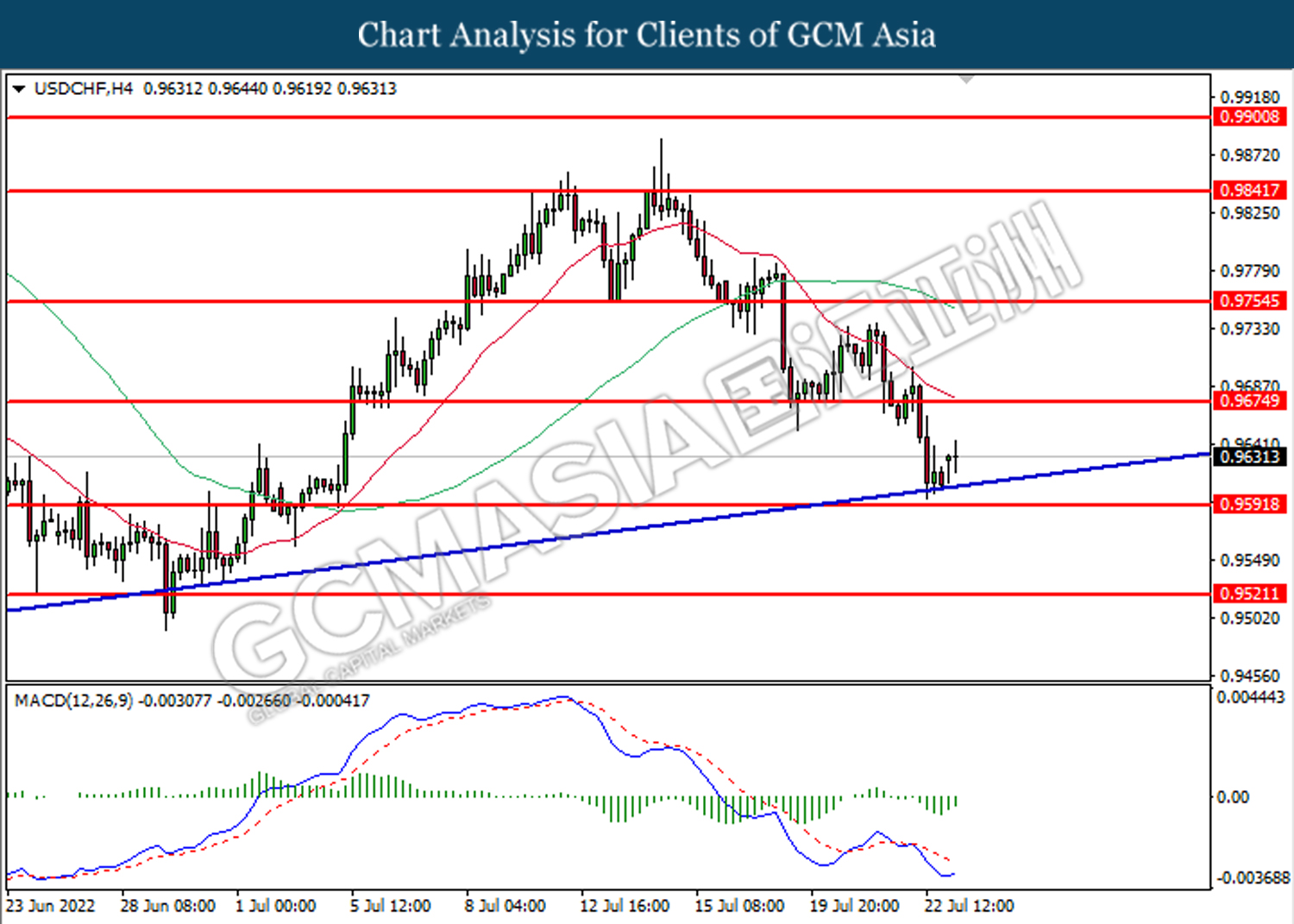

USDCHF, H4: USDCHF was traded higher following prior rebound from the upward trendline. MACD which illustrated diminishing bearish momentum suggest the pair to extend its gains toward the resistance level at 0.9675.

Resistance level: 0.9675, 0.9755

Support level: 0.9590, 0.9520

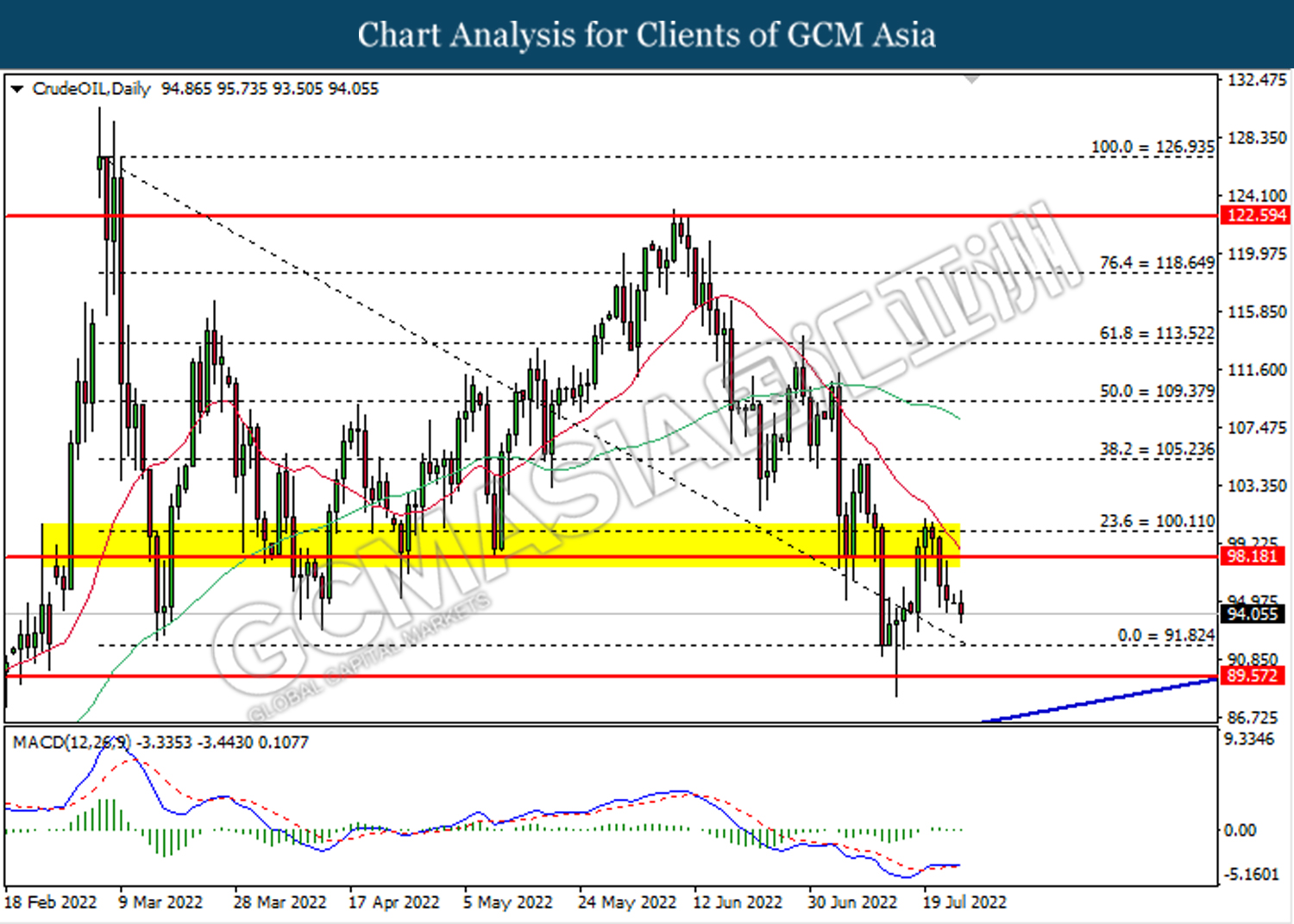

CrudeOIL, Daily: Crude oil price was traded lower following prior retracement from the resistance level at 98.20. MACD which illustrated bearish bias momentum suggests the commodity to extend its losses toward the support level at 91.80.

Resistance level: 98.20, 100.10

Support level: 91.80, 89.55

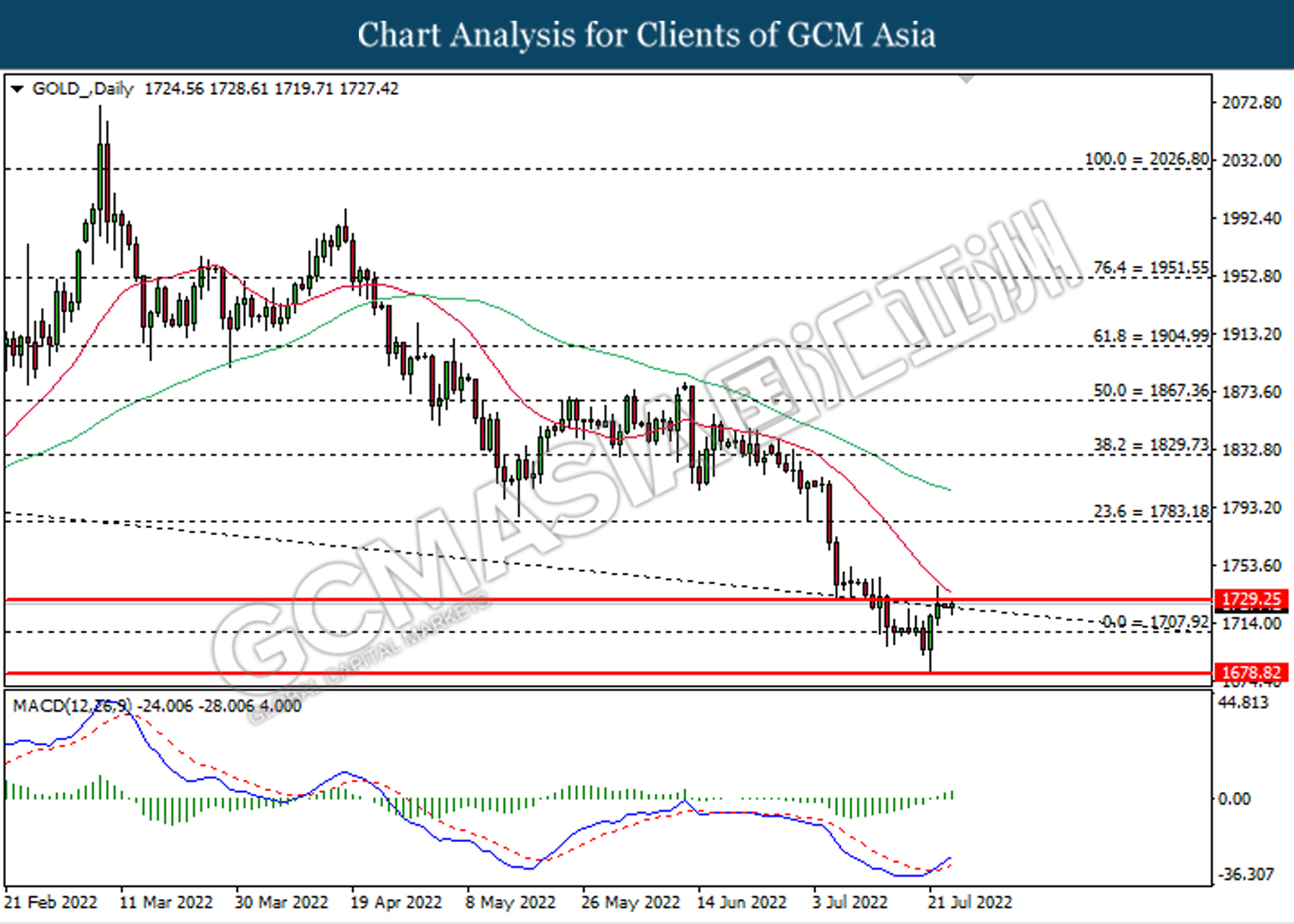

GOLD_, Daily: Gold price was traded higher while currently testing the resistance level at 1729.25. MACD which illustrated bullish bias momentum suggest the commodity to extend its gains after it successfully breakout above the resistance level.

Resistance level: 1729.25, 1783.20

Support level: 1707.90, 1678.80